A Reader’s Question

Hey John,

Thanks for sharing and giving advice on my previous query. I am interning in a fund that practices value investing philosophy now and learning at a much faster pace than as a retail investor. Institutional investors certainly have more firepower when it comes to gathering more information. Had me pointlessly worrying why my knowledge of industries was so shallow as a retail investor ha ha ha. But no excuses for not read up broadly and extensively!

Came across these slides.

One of them is on Jae Jun’s site. Not sure whether you have came across it. The reunion presentation slides contained some workings which I think is Greenwald’s? (Downloaded it off Columbia’s site)

I believe they could shed some light on how Prof. Greenwald measures business returns. (You audited his classes before, maybe you would know better)

Some questions that I have:

From EPV slide:

1) Slide 35& 42: I don’t quite really understand the steps. For slide 42, I think this might be the workings for slide 35. Don’t quite really understand them either. How did he get cash and the growth rate. And what is option.

2) Slide 36: Why does he use 2 methods to calculate the expected return for each respective market?

From the reunion presentation slides: It is largely similar to the EPV slides except the last few slides that are handwritten. For Gannett, I can’t decipher the workings without any context. No idea how to get distribution, organic growth or reinvestment. Needless to say, clueless for the Walmart and Amex returns as well.

I think a more quantitative approach to calculate the expected rate of return would be more useful in determining intrinsic value and Greenwald presents us his way of doing it.

How I would value a company is for instance, Company W earns $50million for FY 2012. By determining the expected return (X), we can take 50/X to determine the value of the business. Reading the way how Buffett valued Mid Continent Tab, he seems to approach valuation this way. But of course, he has a deep understanding of the industry such that he is able to project an accurate return.

Not sure if you or your readers could help out.

My reply: Ok, CSInvesting readers are the smartest in the world, so I will let them have first crack at your questions before I chime in. …I will be back later to answer.

—

Pump and Dump Alert: Pump and Dump_SEC

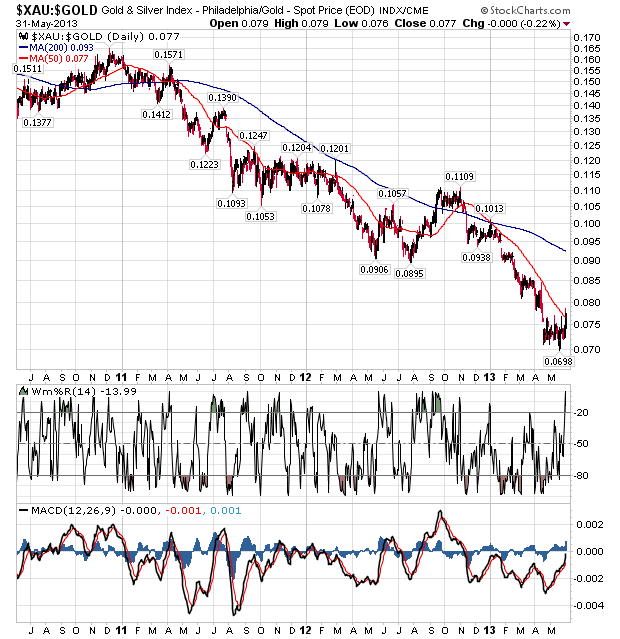

The End of the Gold Bubble: http://www.project-syndicate.org/commentary/the-end-of-the-gold-bubble-by-nouriel-roubini

VENICE – The run-up in gold prices in recent years – from $800 per ounce in early 2009 to above $1,900 in the fall of 2011 – had all the features of a bubble. And now, like all asset-price surges that are divorced from the fundamentals of supply and demand, the gold bubble is deflating.

15 responses to “A Reader’s Question on Greenwald’s Valuation Slides”