Daniel Kahneman on Life and Investing (Interview)

http://www.forbes.com/sites/steveforbes/2013/01/24/nobel-prize-winner-daniel-kahneman-lessons-from-hitlers-ss-and-the-danger-in-trusting-your-gut/

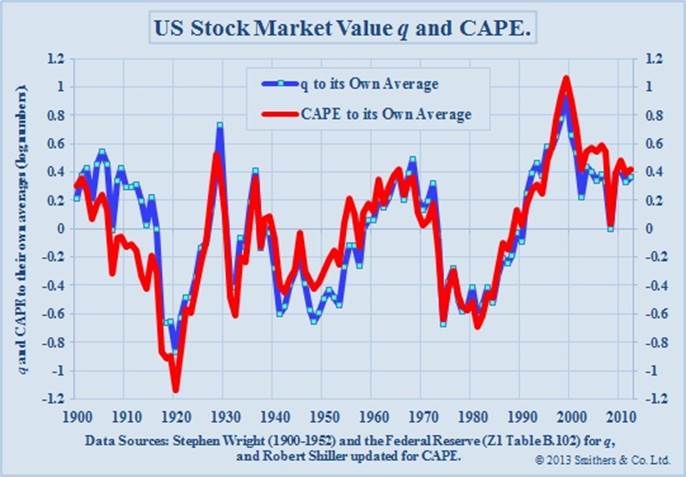

Buffett’s Favorite Valuation Metric:

http://pragcap.com/buffetts-favorite-valuation-metric-surges-over-the-100-level

Quant. Value: http://abnormalreturns.com/qa-with-wesley-gray-co-author-of-quantitative-value/

What is Inside Banks? What is inside Americas Banks

An excellent article by The Atlantic. The article explains why some banks trade under tangible book value. Investors do not trust the balance sheets of the banks and therefore do not trust the reported earnings. If the banks had truly cleansed themselves of rotten loans and assets, our economy would be growing faster but thanks to intervention, we slog on.

Yet, don’t let that stop you from studying WFC: Wells Fargo Notes

and visit The Brooklyn Investor

Legendary Jim Rogers: Brokers Going Broke, Farmers Will Become Rich – Very Rich!

Jim Rogers is a renowned international investor. In 1973, he co-founded the Quantum Fund with George Soros. After a fantastically successful decade, he retired to travel the world. He is the author of Investment Biker: On The Road With Jim Rogers and A Bull in China: Investing Profitably in the World’s Greatest Market, among other books. He also runs the Rogers Global Resources Equity Index. Recently Rogers sat down with Steve Forbes to talk about why the global economy is moving to Asia, where he’s putting his money and what the U.S. can do to right the ship. Video and a transcript of their conversation follows.

Steve Forbes: Jim Rogers, thank you for joining us.

CSInvesting Editor: I like his cantankerous, contrary nature.

Jim Rogers: My pleasure.

Forbes: Let’s go through a little bit of history. You teamed up in the early 1970s with George Soros. Had a great fund, got out in the early 1980s. Quickly recapture what you did and how you did it at such a young age.

Rogers: Well, we had a successful ten years. I didn’t want to wake up at 75 and still be looking at a computer screen. I’d always wanted to have more than one life, so off I set to have more than one life. And I’ve had more than one life. I retired. I was 37. And set off to have more than one life.

Forbes: Any motorcycle trips in the offing? Any more books on the exotic places of the world?

Rogers: No. I went around the world in a car, 1999 to 2001, and I really haven’t been on a motorcycle much since then. It grieves me that you ask, because some of the finest times of my life were on motorcycles, including the trip around the world on the motorcycle. But now I’m doing other things. I’ve got two little girls. I’m living in Singapore, which is not a great motorcycle place. Now I’m doing other things.

Forbes: I can’t imagine you speeding there.

Rogers: No, no. I mean, the speed limit is 90 kilometers an hour! It’s not a great motorcycle place.

Forbes: Not to be negotiated.

Rogers: Right, and not negotiable. You’re right. Exactly.

Forbes: Talking about Singapore, when you moved there you decided to have three dates: 1807, you’d move to London. 1907, you’ve got to go to New York. 2007, you’re in Asia, specifically Singapore. Why?

Rogers: Well, the 20th century was the century of the U.S. The 19th century was the century of the U.K. The 21st century will be the century of Asia, and it’s becoming more and more evident. And especially of China. I wanted my children to grow up knowing Asia and speaking Mandarin. I think the best skills that I can give two girls born in 2003 and 2008 is to know Asia and to know Mandarin. So there we are. I couldn’t do it in New York. I tried. I tried doing it in New York. But it was not possible. So there we are.

Forbes: What do you see as the problem with the U.S.?

Rogers: The main problem is the staggering debt. We are the largest debtor nation in the history of the world, Steve, as you undoubtedly know, because you probably read Forbes. It’s amazing how high the debt is, and it’s going up by leaps and bounds. It’s just mind boggling how fast it’s going up. Nobody seems to understand or care what the significance and the consequences will be. It’s not good. It’s not good news.

Forbes: In the past, we’ve had some rough periods – I remember the malaise of the 1970s – and the U.S. has come back. You don’t see that happening again? Are we just digging the hole so deep we’re not going to be able to get ourselves out?

Rogers: There will be rallies. The U.K. in 1918 was the richest, most powerful country in the world. There was no number two. In three generations, they were bankrupt. Now in that period of time, they had some rallies, as you well know. They won the Second World War, for instance. So they had some big rallies. But basically, they were in decline.

I would like to think that there’s something which is going to save us. I can think of some things which will give us rallies. But I cannot see anything – I mean, look at Japan. Japan has staggering internal debt. They still are externally a creditor nation. They still have a balance of trade surplus. We’re the largest external debtor nation in history and the largest internal debtor nation in history. We’ll have rallies. But Steve, I don’t see what can cause us to repeat, perhaps, the ’70s. We’re in relative decline. Maybe you would like to debate that. I don’t think so. I don’t see that that relative decline will stop.

Forbes: Now in terms of investing, commodities. You have the Rogers Global Resources Equity Index. You don’t see the dollar eventually getting strong again? Do you think commodities replace –

Rogers: I actually own the dollar. I actually own the dollar, as we stand here. I bought the dollar 15-16 months ago. 17.

Forbes: That’s just a bear market rally?

Rogers: It’s a bear market rally, yes, in my view. Although when I walk out of here, I may buy more. No, I don’t see it as anything more than a bear market rally. But I own several currencies around the world. There may be a time, Steve, in the foreseeable future, when all of us are going to be getting rid of our paper money, because it’s being debased all over the world. One reason I own the dollar is because everybody’s panicked about the debasement of these other currencies. Paper money is suspect.

Forbes: So it’s just the best house in a bad neighborhood?

Rogers: I’m not even sure it’s the best house in a bad neighborhood. But it’s a good house in the bad neighborhood, for the moment.

Forbes: Getting back to commodities, what makes you bullish on commodities?

Rogers: Well, there’s been a huge dearth of investment in productive capacity for 30 years now. The last lead smelter built in America was built in 1969. No gigantic elephant oil fields discovered since the 1960s. I could go to agriculture. Steve, you should start an agriculture magazine. Because the profits in agriculture –

Forbes: Share with us the observation you made about somebody majoring in public relations and agriculture.

Rogers: Well done. More people in America study public relations than study farming. We have no farmers. You went to Princeton; nobody you went to school with became a farmer. I went to Yale; nobody I went to Yale with became a farmer. The average age of farmers in America is 58 years old. In Japan, the average age is 66. In Australia, it’s 58. Hundreds of thousands of Indian farmers commit suicide every year. It’s a disastrous business. In the U.K., the highest rate of suicide is in agriculture. It’s been a horrible business for 30 years. Prices have to go up – have go to up a lot – or we’re not going to have any food at any price.

Unless you’re going to become a farmer.

Forbes: Then we truly starve. But you pointed out we have 200,000 PR graduates, 20,000 farmers coming out of our schools. And you have a wonderful phrase, “You can’t eat press releases.”

Rogers: That’s exactly right. You cannot eat press releases. It was actually 200,000 M.B.A.’s we have coming out. That’s even worse. We have more people doing M.B.A.’s than doing PR.

There’s going to be a huge shift in American society, American culture, in the places where one is going to get rich. The stock brokers are going to be driving taxis. The smart ones will learn to drive tractors so they can work for the smart farmers. The farmers are going to be driving Lamborghinis. I’m telling you. You should start Forbes Farming.

Forbes: In the 1970s, we heard the same thing, and it didn’t happen. Why?

Rogers: Well, farmers did make a lot of money in the 1970s.

Forbes: And then lost it all in the ’80s.

Rogers: Yeah, but it actually started before. That’s my point. These things go in cycles. There has never been any bull market which has lasted forever. No bull market in the history of the world has lasted forever. These commodity cycles come and go. On average, they’ve lasted 18 to 20 years in the past. I have no idea how long this will last. But it’s not over yet.

Forbes: Thoughts on gold? You were suspicious in the late 2011, not without reason. Where does that go from here?

Rogers: Well, I own gold. I’m not selling my gold. I’m not even hedging my gold, at the moment, although I’m thinking about it. Gold’s up 11 years in a row, which is extremely unusual, as you know, for any asset class. It’s correcting right now. I would suspect it’s going to continue to correct.

There are some things going on in the world. The Indians are coming down hard on gold, and they’re the largest consumer of gold in the world. So it may continue to correct. If so – if it goes down further – I hope I’m smart enough to buy more. To buy a lot more. The bull market in gold is not over yet, Steve.

Forbes: Now going back to Asia, China. You have not been a big fan of stocks. You are of the currency. How do you play China now?

Rogers: The best way to play China is commodities, because they have to buy commodities. If you’ve got cotton, they will take you to dinner, they will pay for your dinner and they’ll pay you on time. You don’t have to worry about corporate governance or any of that kind of stuff. They don’t care who the head of The Federal Reserve is if you have cotton. Because cotton is its own world. And many other commodities, as well.

I own the Renminbi, as well. It’s a good way to play China. I don’t buy Chinese shares, except when they collapse. They collapsed last in November of 2008. I bought more Chinese shares. If and when they collapse again, I’ll buy more. My Chinese shares are for my children. They’re not for me.

Forbes: Now looking at China itself, can they become (as the U.S. has been) an innovative economy instead of a catch up economy? Are they going to do the real value added stuff? Do you see the changes coming on that?

Rogers: The first time I went to China, 25 or 30 years ago, there was one radio, one TV, one newspaper, one way to dress, one everything. That’s changed dramatically, as you know. In China now, they produce something like, I don’t know, 20 times as many engineers every year as we do. They didn’t in the past. It was a very closed and traumatic society and autocratic society. That’s changing rapidly.

I suspect, yes, some of these engineers are going to turn out to be hotshot engineers. I don’t know when. I don’t know where. But China has a long history of entrepreneurship and capitalism. They’ve been disastrous, at times, in their history. But they’ve also been spectacularly successful, at some times in their history. So teach your children Mandarin, teach your grandchildren Mandarin.

Forbes: You’re not a fan of India?

Rogers: No, no, no. I’m short India as a matter of fact. I love to go there. If you can only visit one country in your life, Steve, for whatever reason, I would urge you to go to India. There’s nothing quite like it from a tourist point of view. But as far as a bureaucratic maze, it’s the worst bureaucracy in the world. They don’t like foreigners. They don’t like capitalists. They don’t like people making money. It’s a fabulous country to visit, but I wouldn’t try to do business there.

Forbes: So what’s happening in high tech is just an outlier?

Rogers: Yeah, very much so. You can probably name four or five companies – I doubt if you could name four or five, I could probably name two or three high technology companies. Steve, there are a billion people in India. We hope that somebody’s successful. And most of the outlying outliers that are the successful Indians that you know live in Europe or America. There are very few great success stories in India itself. There are. They exist. Out of a billion people, of course.

Forbes: Japan? Are they ever going to get out of this rut?

Rogers: I own the currency. And when they had the tsunami, I bought shares, as a matter of fact, as they collapsed. It’s always been a good thing to do when there’s a huge natural disaster. It’s usually a good thing to do, to buy into the market. I doubt in five years I will own them. I doubt if I’ll own the currency or the shares. Japan’s got staggering problems. They’ve got the highest internal debt in the world and they’ve got a declining population. They’ve got serious problems.

Forbes: Talking about debt, India’s piling on debt, too.

Rogers: I know. That’s why I’m short India. That’s one reason I’m short India – because they’ve got this huge debt. For some reason there are all these bulls walking around that don’t seem to understand that India has a debt to GDP ratio of 90%. They’re still bullish. They don’t do their homework.

Forbes: You going into Myanmar?

Rogers: I’m extremely optimistic. If I could put all of my money into Myanmar, I would. I cannot, because you and I are citizens of the land of the free. In the land of the free, we cannot invest in Myanmar. Everybody else can. The Japanese, everybody’s pouring into Myanmar, except all of us from the land of the free.

It is so exciting. It is like going to China in 1978; it’s exactly the same place. It might be more exciting, because it’s been such a disaster for 50 years and now they’re opening up. They’re right between India on the left, China on the right – huge natural resources, 60 million people, disciplined, hard work, educated. Oh my gosh, it’s such an exciting opportunity. But all you and I can do is I can read about it in Forbes. I can’t do anything.

Forbes: Where else are you doing things?

Rogers: Well, the other place that I see wildly exciting things is North Korea, but we can’t do anything there. There’s no market in North Korea either. But there’s going to be a merger soon of North and South Korea and that’s going to be a very, very exciting place. Then you’ll have a country of 75 million people, right on the border of China, huge labor pool, lots of natural resources in North Korea. They’re going to run circles around the Japanese. The reasons the Japanese don’t want it to happen is because they don’t want a huge new competitor. They got their own problems.

North Korea, I wish I could find – I’m looking for ways to invest. I have a couple of ways. But they’re not of great interest. These are the places that I find the most exciting. But as far as stocks, for the most part I’m short stocks. I don’t own many stocks in the world. I own commodities. I own currencies.

Forbes: Vineyards?

Rogers: Not in vineyards. No, that’s a good idea. I don’t own any. No, I don’t own any vineyards. No, I drink the stuff, I don’t grow it. It takes too long to grow it, so I’d rather drink it.

Forbes: So to sum up, the U.S. – long term, secular decline.

Rogers: Certainly relative secular decline. There’s no question about that. We may have a lot of oil. When the U.K. had a big rally, went bankrupt in the ’70s, it had a big rally because the North Sea oil started flowing. I know Margaret Thatcher takes credit for it – it was the North Sea. North Sea oil started flowing in 1979, the same year Margaret Thatcher came to power.

If you give me the largest oil field in the world, I’ll show you an extremely good time, as you can imagine. We may have the largest oilfield in the world, with all this oil shale and natural gas, shale gas if they can solve the environmental problems. That would cause a huge rally in the U.S. We’re very good at agriculture or have been. That could cause a big rally in the U.S.

So don’t give up on the U.S. I own the dollar. I’m a U.S. taxpayer, U.S. citizen. So don’t give up on the U.S. But I’m afraid it’s nothing more than a secular rally, because we’re the largest debtor nation in the world and nobody cares, except me and you. I know you care. But other than the two of us, nobody seems to care.

Forbes: So why aren’t you running for president?

Rogers: No, no, no.

Forbes: Might do better than I did.

Rogers: No, that’s why I’m not. Because I know I wouldn’t. And second of all, you think I want to spend my time being nice to people I don’t want to be nice to? You tried that. I can’t imagine it’s a lot of fun, going out day to day being nice to people you don’t want to be nice to. I don’t want to do that.

Forbes: Jimmy, thank you.

Rogers: Thank you, Steve. Good fun, as usual.