Don’t Invest until you see the money lying there on the floor–Jim Rogers, Investor.

From the 1997 Berkshire Hathaway (BRKa) Shareholder Letter:

In his book The Science of Hitting, Ted explains that he carved the strike zone into 77 cells, each the size of a baseball. Swinging only at balls in his “best” cell, he knew, would allow him to bat .400; reaching for balls in his “worst” spot, the low outside corner of the strike zone, would reduce him to .230. In other words, waiting for the fat pitch would mean a trip to the Hall of Fame; swinging indiscriminately would mean a ticket to the minors.

If they are in the strike zone at all, the business “pitches” we now see are just catching the lower outside corner. If we swing, we will be locked into low returns. But if we let all of today’s balls go by, therecan be no assurance that the next ones we see will be more to our liking. Perhaps the attractive prices of the past were the aberrations, not the full prices of today. Unlike Ted, we can’t be called out if we resist three pitches that are barely in the strike zone; nevertheless,just standing there, day after day, with my bat on my shoulder is not my idea of fun.

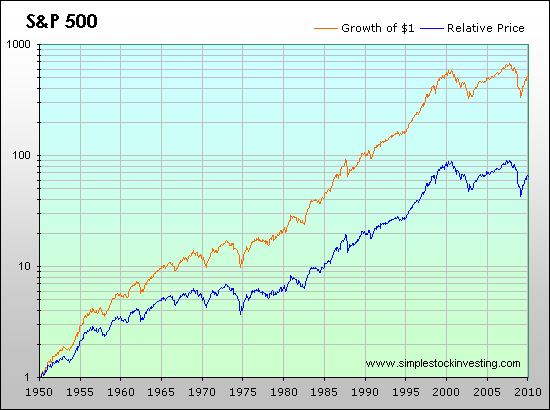

When the above was written, the party that ultimately led to the tech bubble era valuations* had already begun in the equity markets.

http://theinvestmentsblog.blogspot.com/2011/06/fat-pitch-ted-williams-science-of.html

And check out: www.theinvestmentsblog.blogspot.com/

Case Study on Earnings Qualithy

Our last case on earnings quality was National Electric found by going into the case study value vault found in the blog post in the following link: http://wp.me/p2OaYY-1ub I promised to provide an answer. Before submitting my write-up on that case, perhaps the following case would be a good supplement to learn more about uncovering earnings quality. This case should be pretty obvious. Don’t cheat! Just use the material provided in the link below and answer the three questions in the HBS Case Study.

John Chew shared a folder with you via YouSendIt. |

|||||

|

Another Case Study Dec 2012 |

|

|||

|

|

|||||

If you get stuck, here is a hint: (don’t look until you have tried to solve the case on your own! http://youtu.be/l-O5IHVhWj0 With practice, certain figures and phrases in the notes to the financials should SCREAM OUT at you. Whatever happened to the CFO?

A Christmas Vault with goodies for all will be posted if someone posts their solution.

Free Behavioral Finance Course! (Coursera)

I have signed up!

https://www.coursera.org/course/behavioralecon

Workload: 7-10 hours/week

About the Course

Behavioral economics and the closely related field of behavioral finance couple scientific research on the psychology of decision making with economic theory to better understand what motivates investors, employees, and consumers. This course will be based heavily on my own research. We will examine topics such as how emotion rather than cognition determines economic decisions, “irrational” patterns of thinking about money and investments, how expectations shape perceptions, economic and psychological analyses of dishonesty by presumably honest people, and how social and financial incentives combine to motivate labor by everyday workers and CEOs alike. This highly interdisciplinary course will be relevant to students with interests in General Management, Behavioral Finance, Entrepreneurship, Social Entrepreneurship, and Marketing.

This class has two main goals:

- To introduce you to the range of cases where people (consumers, investors, managers, and significant others) make decisions that are inconsistent with standard economic theory and the assumptions of rational decision making. This is the lens of behavioral economics.

- To help you think creatively about the applications of behavioral economic principles for the development of new products, technology based products, public policies, and to understand how business and social policy strategies could be modified with a deeper understanding of the effects these principles have on employees and customers.

About the Instructor(s)

Dan Ariely is the James B. Duke Professor of Psychology and Behavioral Economics at Duke University, with appointments in the Fuqua School of Business, the Center for Cognitive Neuroscience, and the department of Economics. As one of the foremost leaders in psychology and behavioral economics, Dr. Ariely has published his research in top economic, medical and psychology journals and is the author of Predictably Irrational (2008), The Upside of Irrationality (2010), and The (Honest) Truth About Dishonesty (2012), three bestselling general audience books about research in behavioral economics. In addition, he is the founding member of The Center For Advanced Hindsight. More information about Dan can be found at: www.danariely.com

Take an MBA course on Buffett: http://cba.unomaha.edu/execmgmt/buffettgenius/

The Difference Between Mainstream Economics and Austrian Economics

BOOK LISTS

The 2012 Holiday Book Survey has been tallied and the results can be found here. I want to thank everyone who participated in the survey.

The biography & memoir genre continues to lead the survey (Steve Jobs – Walter Isaacson & new comer The Passage of Power – Robert Caro) with social science still having a strong showing (The Signal and the Noise – Nate Silver & Thinking, Fast and Slow – Daniel Kahneman). Atlas Shrugged continues to breach the top 5 although falling from its #2 spot in the last two years to #5. Overall, biography & memoir and business & finance showed the strongest growth.

I hope you enjoy this years’ book list and find something of interest to read or gift. If you have any suggestions on how to improve on the survey, please let me know.

All the best and happy holidays.

—

Barry Pasikov, Managing Member of HazeltonCapital Partners in Highland Park, IL 60035 Tel: 312-970-9202