A LETTER TO THE US FROM JOHN CLEESE

To the citizens of the United States of America, in light of your failure to elect a competent President of the USA and thus to govern yourselves, we hereby give notice of the revocation of your independence, effective today.

Her Sovereign Majesty Queen Elizabeth II resumes monarchical duties over all states, commonwealths and other territories. Except Utah, which she does not fancy.

Your new prime minister (The Right Honourable Theresa May, MP for the 97.8% of you who have, until now, been unaware there’s a world outside your borders) will appoint a minister for America. Congress and the Senate are disbanded. A questionnaire circulated next year will determine whether any of you noticed.

To aid your transition to a British Crown Dependency, the following rules are introduced with immediate effect:

1. Look up “revocation” in the Oxford English Dictionary. Check “aluminium” in the pronunciation guide. You will be amazed at just how wrongly you pronounce it. The letter ‘U’ will be reinstated in words such as ‘favour’ and ‘neighbour’. Likewise you will learn to spell ‘doughnut’ without skipping half the letters. Generally, you should raise your vocabulary to acceptable levels. Look up “vocabulary.” Using the same twenty seven words interspersed with filler noises such as “like” and “you know” is an unacceptable and inefficient form of communication. Look up “interspersed.” There will be no more ‘bleeps’ in the Jerry Springer show. If you’re not old enough to cope with bad language then you should not have chat shows.

2. There is no such thing as “US English.” We’ll let Microsoft know on your behalf. The Microsoft spell-checker will be adjusted to take account of the reinstated letter ‘u’.

3. You should learn to distinguish English and Australian accents. It really isn’t that hard. English accents are not limited to cockney, upper-class twit or Mancunian (Daphne in Frasier). Scottish dramas such as ‘Taggart’ will no longer be broadcast with subtitles.You must learn that there is no such place as Devonshire in England. The name of the county is “Devon.” If you persist in calling it Devonshire, all American States will become “shires” e.g. Texasshire Floridashire, Louisianashire.

4. You should relearn your original national anthem, “God Save The Queen”, but only after fully carrying out task 1.

5. You should stop playing American “football.” There’s only one kind of football. What you call American “football” is not a very good game. The 2.1% of you aware there is a world outside your borders may have noticed no one else plays “American” football. You should instead play proper football. Initially, it would be best if you played with the girls. Those of you brave enough will, in time, be allowed to play rugby (which is similar to American “football”, but does not involve stopping for a rest every two seconds or wearing full kevlar body armour like nancies) You should stop playing baseball. It’s not reasonable to host event called the ‘World Series’ for a game which is not played outside of America. Instead of baseball, you will be allowed to play a girls’ game called “rounders,” which is baseball without fancy team stripe, oversized gloves, collector cards or hotdogs.

6. You will no longer be allowed to own or carry guns, or anything more dangerous in public than a vegetable peeler. Because you are not sensible enough to handle potentially dangerous items, you need a permit to carry a vegetable peeler.

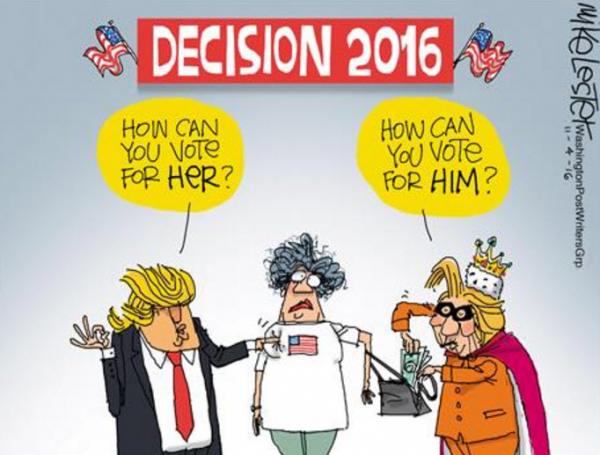

7. July 4th is no longer a public holiday. November 2nd will be a new national holiday. It will be called “Indecisive Day.”

8. All American cars are hereby banned. They are crap and it is for your own good. When we show you German cars, you will understand what we mean. All road intersections will be replaced with roundabouts, and you will start driving on the left. At the same time, you will go metric without the benefit of conversion tables. Roundabouts and metrication will help you understand the British sense of humour.

9. Learn to make real chips. Those things you call French fries are not real chips. Fries aren’t French, they’re Belgian though 97.8% of you (including the guy who discovered fries while in Europe) are not aware of a country called Belgium. Potato chips are properly called “crisps.” Real chips are thick cut and fried in animal fat. The traditional accompaniment to chips is beer which should be served warm and flat.

10. The cold tasteless stuff you call beer is actually lager. Only proper British Bitter will be referred to as “beer.” Substances once known as “American Beer” will henceforth be referred to as “Near-Frozen Gnat’s Urine,” except for the product of the American Budweiser company which will be called “Weak Near-Frozen Gnat’s Urine.” This will allow true Budweiser (as manufactured for the last 1000 years in Pilsen, Czech Republic) to be sold without risk of confusion.

11. The UK will harmonise petrol prices (or “Gasoline,” as you will be permitted to keep calling it) for those of the former USA, adopting UK petrol prices (roughly $6/US gallon, get used to it).

12. Learn to resolve personal issues without guns, lawyers or therapists. That you need many lawyers and therapists shows you’re not adult enough to be independent. If you’re not adult enough to sort things out without suing someone or speaking to a therapist, you’re not grown up enough to handle a gun.

13. Please tell us who killed JFK. It’s been driving us crazy.

14. Tax collectors from Her Majesty’s Government will be with you shortly to ensure the acquisition of all revenues due (backdated to 1776).

Thank you for your co-operation.

* John Cleese [Basil Fawlty, Fawlty Towers, Sir Lancelot of Camelot (Monty Python & The Quest for the Holy Grail), Torquay, Devon, England]

—

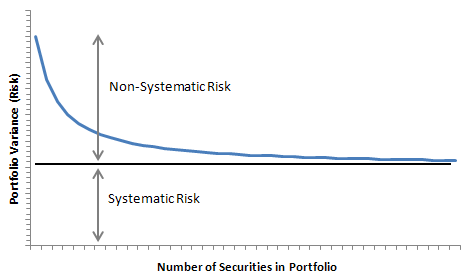

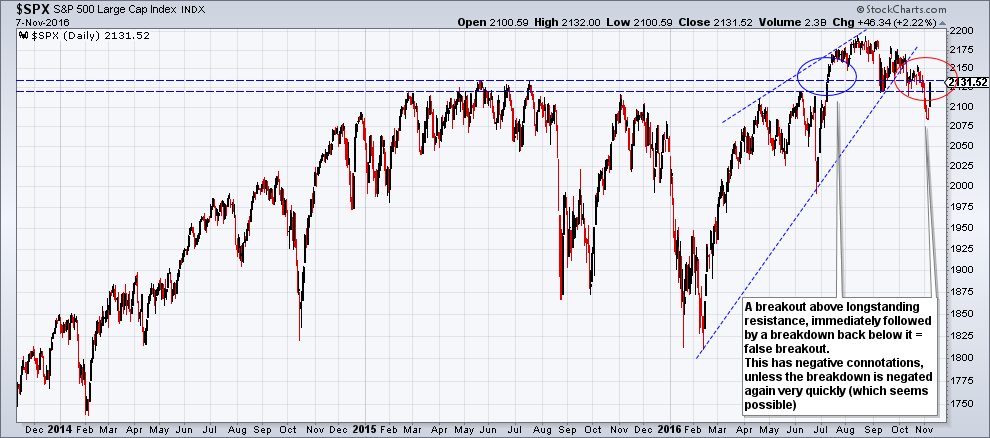

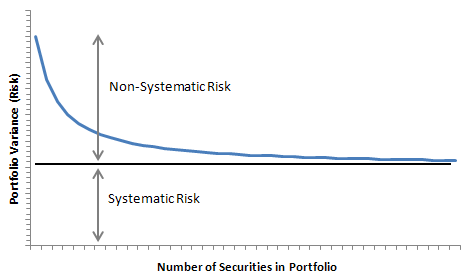

What is Risk? A Great Post on Risk