subscription

Categories

Do you want the keys to the Value Vault?

Simply send an email to aldridge56@aol.comTag Cloud

AAPL ABCT Ackman Austrian Economics bitcoin Blogs books Bubbles Buffett business Case Study Competition Demystified Contrarian Cuba Deep Value Economies of Scale economy Federal Reserve Franchises Gold Gold Stocks Graham Greenwald History inflation James Grant Klarman Learning Lectures miners Mises money Munger Politics Risk ROIC Rothbard Strategic Logic Strategy The Fed valuation Value Investing Resources Value Vault Videos WMT-

Recent Posts

Category Archives: Investing Careers

A Reader Seeks Guidance

A Reader Asks for Guidance (edited for brevity)

I’m writing this e-mail to ask for advice, as I value your opinion.

I’m 22 and graduated in Psychology. I moved to New York back in March as everyone said this was the place to be to get a job in finance. Since then I’ve been networking a lot, learning, and pretty much bugging every fund manager I’ve managed to get a hold on.

Attached you can find my current security analysis template; in Word and Excel (tables). I’d appreciate any feedback on anything to add.

I’m writing to you as I’m almost down to the penny (excluding my investing capital which is untouchable) and I need actionable advice. I’ve been crashing at a girl’s place in Brooklyn for the last 2 months and down to $400.

For write-up purposes, looking at equities, I still believe ESV and CLD are among the best plays.

ESV is currently the only driller making a profit and management has proven wise. It’s a good play for both safety and capital gains. The same could be said about CLD.

Looking at bonds, I haven’t analyzed them quite as much as equity opportunities since I can’t invest there yet. However, from a glance at the BTU bonds trading at around 34 cents and maturing on Nov. 15 18, they seem as potentially worth a closer look. BTU’s dominant size, presence and assets makes it unlikely to go through a disastrous formal chapter 11, so if it goes through an out of court restructuring or simply plows through, you’re seeing either full recovery or getting new equity in the restructured entity. It seems as a similar play to the equities I’ve looked at, albeit less secure. Can’t say the same on the BTU equity.

I would really appreciate any actionable advice you have for me. At this point I’m even willing to mow the lawn of whoever takes me in (funny, but true).

Thanks for reading such a long message, and thanks again for sharing your knowledge. Your advice and the Deep-Value group’s really helped me both intellectually and psychologically as I was feeling a bit bummed out.

John Chew:

Dear D (name withheld)

I am not quite sure what you are asking advice on:

Your investing templates, stocks, and/or job/career advice.

First, I did not post your templates here for others to see and comment on because of privacy, but I do think you put alot of effort and thought into constructing them. Just remember John Templeton’s advice to his analysts, “We want our analysts to adopt whatever approaches are appropriate to a particular situation.” Use your templates as a guide but don’t cut and paste.

There are many in the Deep-Value group with varied experiences who could give you their thoughts. I find it is hard to give advice not knowing the person well. The key is knowing yourself which can be difficult for a young person starting out. You seem to have a passion to learn and become an investor, so you are part way on your journey, but you have much to learn (as we all do). You have met other money managers and what has been the response? I can promise two things:

No one trains you on Wall Street and you have to show what you can do. In your case, that would be a well-written research report on a company or an industry to show an employer your through process and skills. You need time to develop your skills–about five years.

Do you need to be in an expensive city like New York or even work on “Wall Street?” I place Wall Street in quotes because I mean the investment business. Could you work as an assistant to a CFO at a small growing company? Would you think of working as a broker or back office clerk to get your foot in the door. You could work in a job to keep food on the table while you constantly build your skills and a track record no matter how small and keep networking. Francis Chou did this while he worked at a telephone lineman (Francis Chou) But again, easy to give advice while not knowing all your alternatives.

Perhaps think through EXACTLY what advice you want, but other people reading this can also provide their thoughts.

Cheer up, I remember being broke and staring up at the ceiling in an Indian brothel and wondering how the hell would I ever survive?

If you are seeking ways to becoming a master investor/analyst, the road is a long but rewarding one:

Pavel Datsyuk https://youtu.be/gpDdaC1_UGg

Jordan on fire: https://youtu.be/hYntar_qeVk?t=41s

Keith Moon: https://youtu.be/NJH8DmPfVmU

Capitulation Selling-A Real-Time Case Study

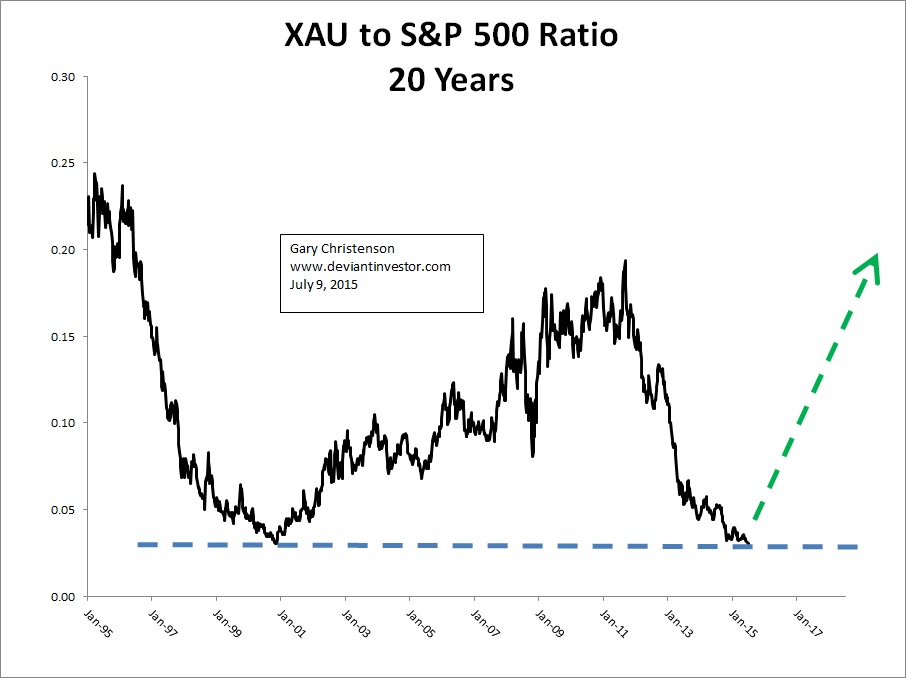

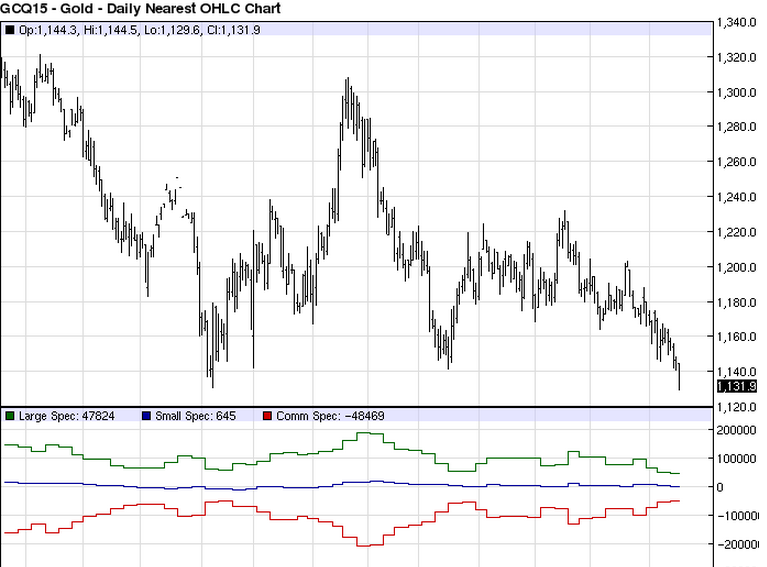

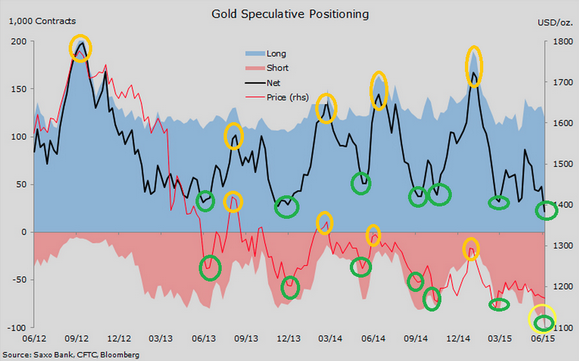

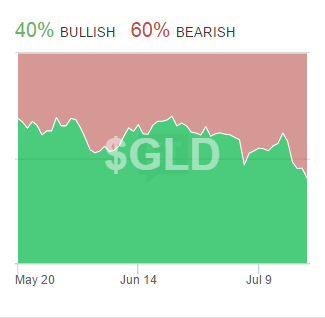

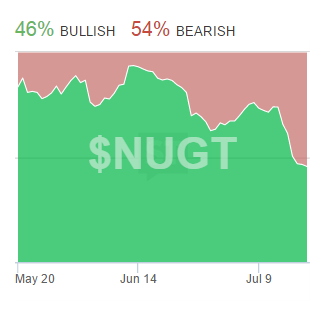

The chart above shows an index of gold and silver miners relative to the S&P 500, breaking now to a new extreme. Will the world need to produce and find more minerals and metals or will the world just need health care and bio-tech?

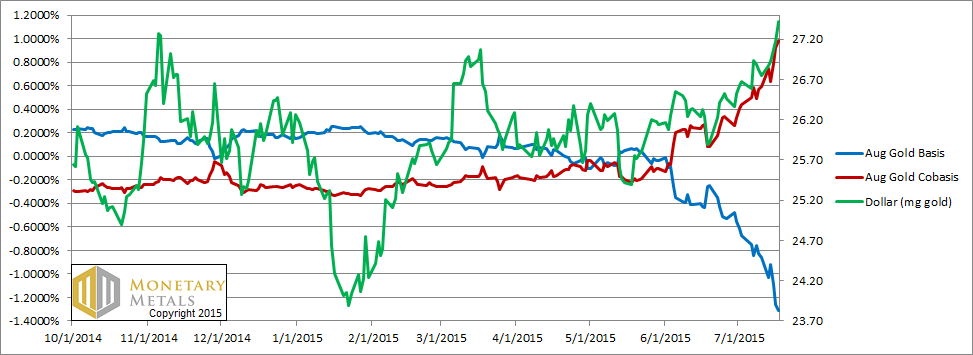

The read line is the co-basis that is rising as the dollar rises relative to gold. This indicates rising demand for physical and more futures selling. Bullish.

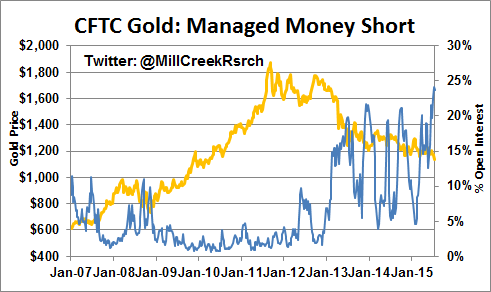

So who is selling?

The Fed’s decision to restock the rate toolkit has got the gold market very nervous,” George Zivic, a New York-based portfolio manager at OppenheimerFunds Inc., which oversees $235 billion, said by phone. “We have already seen that gold did not perform as a safe-haven investment. There is not a single motivating reason to own gold.”

Who knows, perhaps money managers are funding their long equity positions with short gold positions.

“It looks like the end of an era for gold,” said Howie Lee, analyst at Phillip Securities in Singapore, adding that China had been grappling with oversupply after importing a record volume in 2013.

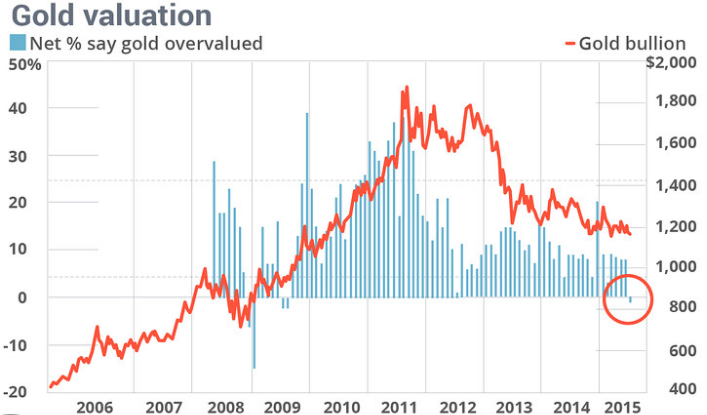

Money managers (a few of them) finally see gold as undervalued.

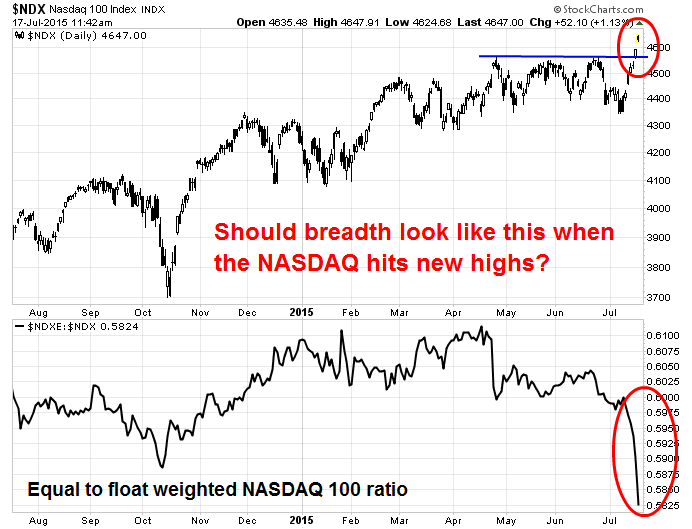

I am posting this so as to have a record of certain market events. I seek out where the most marginal or urgent seller is operating AFTER a long decline (four years).

Posted in Investing Careers, Investor Psychology, Valuation Techniques, YOU

Tagged co-basis, Nasdaq, xau to gold

Buffett’s 2014 Letter to Shareholders

Decades ago, Ben Graham pinpointed the blame for investment failure, using a quote from Shakespeare: “The fault, dear Brutus, is not in our stars, but in ourselves.”

Comments on the Berkshire Hathaway 2014 letter, Part 1

Note the plug (page 6) for Where Are the Customers’ Yachts by Fred Schwed. That along with the Money Game by Adam Smith will teach you the ways of Wall Street. Also, see:

Intrinsic Value: Buffett reiterates that it is not a precise number for Berkshire nor, in fact for ANY stock.

GEICO delivers savings to its customers because it is a low-cost operation (source of structural competitive advantage). The company’s low costs create a moat—an enduring one—that competitors are unable to cross. Note Buffett’s comment on the animated gecko, a LOW-COST spokesperson.

TESCO

Here’s how he explained it:

“In 2013, I soured somewhat on the company’s then-management and sold 114 million shares, realizing a profit of $43 million. My leisurely pace in making sales would prove expensive. Charlie calls this sort of behavior “thumb-sucking.” (Considering what my delay cost us, he is being kind.)

“During 2014, Tesco’s problems worsened by the month. The company’s market share fell, its margins contracted and accounting problems surfaced. In the world of business, bad news often surfaces serially: You see a cockroach in your kitchen; as the days go by, you meet his relatives.”

Buffett said the dawdling resulted in an after-tax loss of $444 million by the time Berkshire was no longer a Tesco shareholder. That, he added, is about 0.2% of Berkshire’s net worth. Only three times in 50 years has Berkshire recorded losses from a sale equal to more than 1% of its net worth.

Unfortunately, we don’t learn what exactly caused the loss. How did Buffett miscalculate intrinsic value? Did management worsen, but if so, then how can an investor sidestep that? I believe the economics changed as customers had more in-home deliveries and other choices coupled with poor store execution from Tesco. I was disappointed with this explanation of the Tesco loss, but Buffett would reply that it was only 1/5 of 1%.

Nominal vs. Real Returns

During the 1964-2014 period, the S&P 500 rose from 84 to 2,059, which, with reinvested dividends, generated the overall return of 11,196% shown on page 2. Concurrently, the purchasing power of the dollar declined a staggering 87%. That decrease means that it now takes $1 to buy what could be bought for 13 cents in 1965 as measured by the CPI (Flawed or whats wrong with cpi)

I prefer measuring in gold grams, because gold is a store of value and market-based rather than concocted by Federal bureaucrats.

There is an important message for investors in that disparate performance between stocks and dollars. Think back to our 2011 annual report, in which we defined investing as the transfer to others of purchasing power now with reasoned expectation of receiving more purchasing power–after taxes have been paid on nominal gains—in the future.” (I wonder why Mr. Buffett makes no mention of the financial repression of ZIRP and NIRP? It is the elephant in the room because of the devastating effect it has on savers and on calculating discount rates for investment.)

The unconventional, but inescapable, conclusion to be drawn from the past fifty years is that it has been far safer to invest in a diversified collection of American businesses than to invest in securities—Treasuries, for example—whose values have been tied to American currency. That was also true in the preceding half century, a period including the Great Depression and two world wars. Investors should heed this history. To one degree or another it is almost certain to be repeated during the next century. Buffett’s comments are backed up by history as shown here: and triumph_of_the_optimists

and triumph_of_the_optimists

Stock prices will always be far more volatile than cash equivalent holdings. Over the long term, however, currency-denominated instruments are riskier investments—far riskier investments. Than widely –diversified stock portfolios that are bought over time and that are owned in a manner invoking only token fees and commissions. That lesson has not customarily been taught in business schools, where volatility is almost universally used as a proxy for risk. Though this pedagogic assumption makes for easy teaching, it is dead wrong. Volatility is far from synonymous with risk. Popular formulas that equate the two terms lead students, investors and CEOs astray.

It is true, of course, that owning equities for a day or a week or a year is far riskier (in both nominal and purchasing power terms) than leaving funds in cash-equivalents. That is relevant to certain investors-say, investment banks—whose viability can be threatened by declines in asset prices and which might be forced to sell securities during depressed markets. Additionally, any party that might have meaningful near-term needs for funds should keep appropriate sums in Treasuries or insured bank deposits.

For the great majority of investors, however, who can—and should—invest with a multi-decade horizon, quotational declines are unimportant. Their focus should remain fixed on attaining significant gains in purchasing power over their investing lifetime. For them, a diversified equity portfolio, bought over time, will prove far less risky than dollar-based securities.

Note the multi-decade horizon. Stocks were unchanged from 1964-1981, please see page 79: A Study of Market History through Graham Babson Buffett and Others. Read what Buffett has to say about stock markets. Some say it is Time to exit because of high valuations for big-cap stocks in the U.S. market. So even if stocks decline for a decade but your holding period is MULTI-Decade, then hold tight. Tough to do, but history seems to bear his thesis out: valuing-growth-stocks-revisiting-the-nifty-fifty. I prefer to act like the pig farmer in A Study of Market History (see link above).

If the investor, instead, fears price volatility, erroneously viewing it as a measure of risk, he may, ironically, end up doing some very risk things. Recall, if you will, the pundits who six years ago bemoaned falling stock prices and advised investing in “safe” Treasury bills or bank certificates of deposit. People who heeded this sermon (to panic) are now earning a pittance on sums they had previously expected would finance a pleasant retirement. (The S&P 500 was then below 700; now it is about 2,100.) If not for their fear of meaningless price volatility, these investors could have assured themselves of a good income for life by simply buying a very low-cost index fund whose dividends would trend upward over the years and whose principal would grow as well (with many ups and downs, to be sure).

Investors, of course, can, by their own behavior, make stock ownership highly risky. And many do. Active trading, attempts to “time” market movements, inadequate diversification, the payment of high and unnecessary to managers and advisors and the use of borrowed money can destroy the decent returns that a life-long owner of equities would otherwise enjoy. ….Anything can happen anytime in markets. And no advisor, economist, or TV commentator–and definitely not Charlie nor I–can tell you when chaos will occur. Market forecasters will fill your ear but will never fill your wallet.

A plug for Jack Bogle’s The Little Book of Common Sense Investing. Basically, Buffett is saying keep it simple, think and hold L O N G – T E R M, avoid high fees and commissions, and don’t use leverage.

Next, let’s look at Berkshire–Past, Present and Future in Part II

Posted in Investing Careers, Investing Gurus, Investor Psychology

Tagged 2014 Letter, Berkshire, Buffett, GEICO, Nominal vs Real Returns, Real Returns, Tesco

A Deep Value Investor in Cyclical Companies

David Iben is a deep value investor currently focused on highly cyclical industries like coal, uranium, and gold mining. He has a mandate to go anywhere to invest in big or small companies. He seeks out value. The world is now bifurcated between a highly valued U.S. stock market and the cheaper emerging markets. Social media and Biotech stocks trade at rich valuations while depressed cyclical resource companies languish.

David Iben is a deep value investor currently focused on highly cyclical industries like coal, uranium, and gold mining. He has a mandate to go anywhere to invest in big or small companies. He seeks out value. The world is now bifurcated between a highly valued U.S. stock market and the cheaper emerging markets. Social media and Biotech stocks trade at rich valuations while depressed cyclical resource companies languish.

VALUATION

Value to us is a pre-requisite and thus we never pay more than a company’s estimated risk-adjusted intrinsic value. But, failing to think deeply and independently about what constitutes value and how best to derive it, can be harmful. Following in the footsteps of growth investors who had allowed themselves to become too formulaic or put in a box in the late 90s, some value investors were hurt by overly restrictive definitions of value in 2007 and 2008 (Price/Book and Price/Earnings, etc). We find it valuable to use many valuation metrics. Additionally, emphasis is placed on those metrics that are most appropriate to a certain industry. For example, asset heavy and/or cyclical companies often are tough to appraise using Price/Earnings or Price-to-Cash Flow. Price to book value, liquidation value, replacement value, land value, etc. usually prove helpful. These metrics often are not helpful for asset light companies, where Discounted Cash Flow scenario analysis is more useful. Applying these metrics across industries, countries, and regions helps illuminate mispricing. Looking at different industries through different lenses, through focused lenses, using industry appropriate metrics and qualitative factors is important. Barriers to entry are an important factor. Potential winners possess different key attributes. Supply and demand are extremely important detriments of margin sustainability. The investor herd has a strong tendency to use trend line analysis, assuming that past growth will lead to future growth. A more reasoned, independent assessment will often foretell margin collapses as industries overdo it, thereby sowing the seeds of their own self-destruction.

Currently, opportunities are being created when the establishment pays too little heed to supply growth. This fallacy extends to money. Many seem to believe that the Federal Reserve has succeeded in quintupling the supply of dollars without a loss of intrinsic value. That is impossible. Evidence of the loss of value is abundantly clear. Gold supply held by the U. S. Treasury has not increased. As economic theory would predict, the price of gold went up. Following 12 straight years of advance and apparently overshooting, the price has since corrected 40%. The trend followers have their rulers out again, confusing a correction in a supply/demand induced uptrend with a new counter-trend.

We view this as opportunity. At the same time, bonds are priced as if they were scarce rather than too abundant to be managed. It is no secret that this is due to open, market manipulation by the central banks. Intrinsic value must eventually be reflected in market prices. These are abnormally challenging times. Fortunately, we believe markets aren’t fully efficient.

—

If you listen to his conference calls and read his insights, you will have a great education in counter-cyclical investing. It is easy to know what to do but hard to do!

Value Investor Insight_3.31.14 Kopernik (Interview)

July 2014 The Contrarian Iben of Kopernik (Interview)

Kopernik Annual Report 10 31 14 – Web Ready

Kopernik Semi-Annual Report _4.30.2014_FINAL

2014 – 4th Q Call with DI – Transcript FINAL

A tutorial of Deep Value Investing in Highly Cyclical Assets/Companies

The trials, tribulations, and need for consistent approach.

http://kopernikglobal.com/content/news-and-views-iben-insights

http://kopernikglobal.com/content/news-and-views-news

—

I will be asking for your suggestions for the deep value course. I am collating one reader’s suggestions which I will post next. Some of you may be quite experienced and advanced investors who tire of the theoretical course materials as well as the mechanical aspect of quantitative investing. We will discuss this next………….Thanks for your patience.

Posted in Free Courses, Investing Careers, Risk Management, Search Strategies, Valuation Techniques

Tagged David Iben, Kopernik

More on Buffett’s Investments

Buffett_Lecture_Fla_Univ_Sch_of_Business_1998 (transcript of above lecture–see page 7 for See’s Candies)

329_Buffett_Seminar_1978 to a value investment class at Stanford University.

Buffett_Case Study on Investment Filters Tabulating Company

The Essays Of Warren Buffett – Lessons For Corporate America (Please read pages 82 to 97, especially the section on cigar-butt investing).

Valuation of Western Insurance_2 (A reader, WAPO mentioned in the comments section of the Dempster Mill Post that Chapter 3 of Deep Value didn’t include Buffett’s other early investments like Western Insurance, Genesee Valley, Union Street Railway, American Fire Insurance, and Rockwood. Does anyone wish to dig these investments up from somewhere? Just post in the comments section and/or I can post your work for the readers.

In the Dempster Mill Post we learned that Buffett succeeded in this investment because he:

- Most importantly and in deference to Graham, he bought well--he started paying $18 in 1956 for Dempster with its $70 per share of book value and $50 of net working capital per share. He bought right. Note in the video lecture above, Buffett mentions that he paid 1/3 of working capital for a windmill company (probably Dempster).

- Then he was patient. This investment was held for at least seven years.

- Finally, he had Harry Bottle to turn the business around.

Thanks for the intelligent and thoughtful comments on Dempster. We learn from the questions and thoughts of others.

Perhaps his success in Dempster Mills lured him to buy Berkshire Hathaway?(considered by Buffett to be his worst investment)

Next we will review See’s Candies, Sanborn Map. We will focus on Buffett’s writings in his shareholder letters on valuation. See the Essays of Warren Buffett above.

For new investors you may feel frustrated by the lack of clear rules. Net/nets depend upon reversion to the mean before total value destruction, but franchises manage to repel the forces of competitive entry for longer than investors expect. Early, fast growing franchise companies like Wal-Mart (in the 1970s) or Costco trade at what appear to be sky-high multiples of earnings (30+) yet the market is UNDER-pricing the profitable growth of those companies. There seem to be grey areas. Congratulations, we are making progress. And for experienced investors, we can never reread the writings of investment greats like Graham and Buffett as many times as we should, but it may seem like

Have a Great Weekend!

Posted in Investing Careers, Investing Gurus, Valuation Techniques

Tagged Dempster, Letters to Shareholders

The Superinvestors of Graham and Doddesville

Effective money managers do not go with the flow. They are loners, by and large. They are not joiners; they’re skeptics, cynics even. Whatever label you want to put on them, they trait they all share is that they don ‘t automatically trust that what the majority of people–especially the experts–are doing is necessarily correct or wise. If anything, they move in the opposite direction of the majority, or they at least seek out their own course.

Warren Buffett is the best example of this contrarian impulse. In the 1960s, when Buffett started out (An excellent recounting of that era is The Go-Go Years, The Drama and Crashing Finale of Wall Street’s Bullish 1960s by John Brookes, Good review of the book, the Go-Go Years) most money managers were investing in highly cyclical, heavily indebted and capital-intensive industrial giants like U.S. Steel (X). As a consequence, stock in those kinds of companies were overpriced in Buffett’s view, especially when compared to their earnings. Instead of following the majority and buying into that mini-bubble, he consciously sought out companies on the other end of the spectrum–businesses with lower capital expenditures and higher profit margins–and he wound up buying relatively cheap stocks in ad agencies and regional media companies like Capital Cities, Gannett, and the Washington Post. This was a complete departure from the consensus of the time, and it made Buffett a ridiculous amount of money. (Scott Rearon, Dead Companies Walking, 2015)

most money managers were investing in highly cyclical, heavily indebted and capital-intensive industrial giants like U.S. Steel (X). As a consequence, stock in those kinds of companies were overpriced in Buffett’s view, especially when compared to their earnings. Instead of following the majority and buying into that mini-bubble, he consciously sought out companies on the other end of the spectrum–businesses with lower capital expenditures and higher profit margins–and he wound up buying relatively cheap stocks in ad agencies and regional media companies like Capital Cities, Gannett, and the Washington Post. This was a complete departure from the consensus of the time, and it made Buffett a ridiculous amount of money. (Scott Rearon, Dead Companies Walking, 2015)

—

As we study Chapter 3 in Deep Value and Buffett’s early career, we should learn more about this tribe called value investors. Have they had success and why?

Below are four (4) articles you should read in sequence. Watch for what these investors do differently than the majority of institutional investors. Lessons we can use?

- The Superinvestors of Graham and Doddsville by Warren Buffett

- Graham Dodd Revisted by Lowenstein

- Searching for rational investors in a perfect storm

- KLARMAN in response to Lwenstein Article on Rational Investors

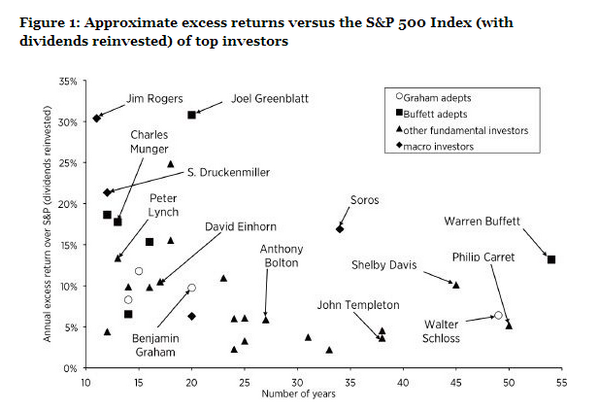

This Friday/Weekend I will review our readings. By the way, I don’t know if the graph above is accurate, but it might stimulate our reading of the articles.

How to join Deep-Value group at Google I ask enrollees to join to make communication and emailings easier.

DEEP VALUE Videos on Net/Nets and Investing

How is it possible that an issue with the splendid records of Tonopah Mining should sell at less than the company’s cash assets alone? Three explanations of this strange situation may be given. The company’s rich mines at Tonopah are known to be virtually exhausted. At the same time the strenuous efforts of the Exploration Department to develop new properties have met with but indifferent success. Finally, the drop in the price of silver last year has provided another bearish argument. It is this combination of unfavorable factors which has carried the price down from $7 1/8 in 1917 to its present low of $1 3/8 in 1923.

Granting that the operating outlook is uncertain, one must still marvel at the triumph of pessimism which refused to value the issue at even the amount of its cash and marketable investments; particularly since there is every reason to believe that the company’s holdings in the Tonopah and Goldfield railroad, are themselves intrinsically worth the present selling price. (Ben Graham on Investing)

VIDEOS

Marty Whitman criticizes Graham and Net Nets (3 minutes Must see!)

Marty Whitman: They Just Don’t Get it. (23 minutes) Marty says many analysts on Wall Street do not understand credit analysis. We will explore later in this course whether the quality of credit provides a better assessment of the true cost of capital for a firm rather than “beta.”

One investor’s experience investing in Net/Nets (3 minutes)

Net/nets as value traps (5 minutes)

Good advice on behavioral investing (3.5 minutes)

Prof. Greenwald on UGLY and Cheap or Graham’s Search Strategy (8 minutes)

Greenwald on the Balance Sheet (risk of financials) (10 minutes)

Posted in Free Courses, History, Investing Careers, Investor Psychology, Risk Management, Search Strategies

Tagged Deep Value, Graham, Greenwald, NEt Nets, Search Strategy

The Education of a Value Investor: Part 1: The Good

The Education of a Value Investor: The Good, the “Bad,” and the “Ugly.”

Editor: In full disclosure I received this book from the publicist, and I actually read the book.

The title of this review has the words bad and ugly in quotes because I will define those words in part II and III of this review.

Part I: The Good

Here is a story of a young hedge fund manager on a Hero’s Journey (Joseph Campbell) to become a more integrated human being—to become, as the author says, authentic. Though managing money is the author’s profession there isn’t much in the way of investing strategy or techniques. The author writes with honesty and humility about his journey through life starting as a young investment banker. The author provides an example for investors and non-investors alike by taking responsibility for his failures and setbacks, understanding his weaknesses and then designing workarounds to improve his investing and life. A person must develop self-understanding and go where his or her strengths can benefit.

Perhaps Nassim Taleb, author of Fooled by Randomness describes the main investing lesson I took away from the book, “We are faulty and there is no need to bother trying to correct our flaws. We are so defective and so mismatched to our environment that we can just work around these flaws. I am convinced of that after spending almost all my adult and professional years in a fierce fight between my brain (not Fooled by Randomness) and my emotions (completely Fooled by Randomness) in which the only success I’ve had is going around my emotions rather than rationalizing them. Perhaps ridding ourselves of our humanity is not in the works; we need wily tricks, not some grandiose moralizing help. As an empiricist I despise the moralizers beyond anything on this planet: I wonder why they blindly believe in ineffectual methods. Delivering advice assumes that our cognitive apparatus rather than our emotional machinery exerts some meaningful control over our actions. We will see how modern behavioral science shows this to be completely untrue.

For example, the only way for a chocaholic like me to avoid temptation is not to stop loving chocolate but to be kept here in a padded cell: http://youtu.be/pjProtBm4Dc.

Along the way, Mr. Spier shares life lessons such as:

- The real goal, perhaps, is not acceptance by others, but acceptance of oneself.

- Avoid groupthink—get out of the New York hedge fund vortex.

- Environment trumps intellect—move to Switzerland

- Turn off Bloomberg and check prices infrequently on Nestle, Berkshire and other global franchises.

- Write thank you notes.

- Surround yourself with people better than yourself.

- It helps to know thyself—and to adapt thy setting accordingly.

- If you don’t know your inner reality, you are likely to be mugged by reality.

- Become more aware, strip away your facades, and listen to the interior.

- Take a sincere interest in people. Value people as an end in themselves, not as a means to our own ends.

- Try Tony Robbins fire walk—put your mind to it and unleash the power. https://www.youtube.com/watch?v=a2c8PMmQxJs (disturbing content, so children should not watch).

- Play bridge because it is a game based on insufficient information like investing.

- Try for a state of quiet contentment.

- Think about your own investment processes in a structured, systematic way. For example, gather investment research in the right order. Hint: start with the 10-Ks. Less biased.

- And finally, the greatest lesson Buffett taught Mr. Spier: “ The more you give love away, the more you get.”

Certainly, the above are excellent lessons, but information is not knowledge and wisdom may not translate into action. How to go from here to there? The author suggests the Nike commercial, “Just Do It!” If only action were so easy. But remember the author battles his own flaws and vulnerabilities not the readers’. You may be better off reading Dante’s pilgrimage in the The Devine Comedy. Perhaps Plato’s Dialogues or Nicomachean Ethics by Aristotle. My favorite: Watch Groundhog Day over and over. See: http://youtu.be/6VF5P7qLaEQ (I’m serious).

There are flashes of good writing: “In hindsight, I can see with clarity that the real value to the firm of my Oxford degree and my Harvard MBA was to adorn its (D.H. Blair, an investment bank bucket shop) deals and documents with my pristine credentials. I thereby provided a kind of Ivy League fig leaf.”

But there are spots of overwrought description: “This book is about my journey from that dark place toward the Nirvana where I now live.” Nirvana? A tad over the top.

This is Mr. Spier’s particular journey and a beginning investor or those who need inspiration may learn how honesty and self-knowledge helped transform a hedgie into a better human being. Mr. Spier continues on that journey. Part II and III will describe a few of this reviewer’s disappointments.

More on Mr. Spier here:

https://www.youtube.com/results?search_query=mr+guy+spier