Having trouble understanding what I am illustrating, then go here:

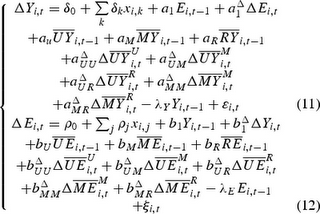

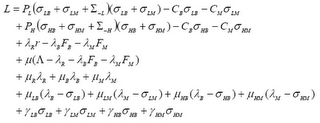

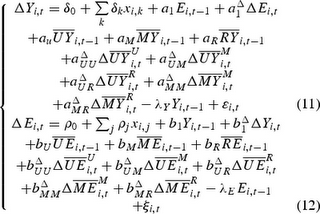

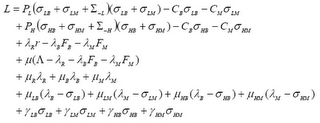

My perfect mathematical proofs on where the market will be in eighteen months.

My perfect mathematical proofs on where the market will be in eighteen months.

What, are you ignorant? http://youtu.be/OUvKIubY6OY?t=1m40s

Mathematics vs. Economic Logic:

http://mises.org/daily/3540 and Rothbard’s note on mathematical economics http://mises.org/daily/3638

and Chapter_XVI

Readings

Is Romney intentionally trying to lose? http://www.economicpolicyjournal.com/2012/09/five-possible-reasons-for-romney-being.html

Learning through deliberate practice: A good investment blog! http://www.whopperinvestments.com/category/deliberate-practice

Major Debt will be defaulted on: http://www.economicpolicyjournal.com/2012/09/major-insider-vast-majority-of-global.html

Bernanke’s QE3 defies common sense.

Bernanke’s QE3 defies common sense.

In order to boost the demand for goods and services, one must boost the production of goods and services. For instance, an individual can exercise his demand for bread by producing shirts; or a butcher can exercise a demand for potatoes by first producing meat that he can exchange for potatoes.

Furthermore, producers of final goods can also exchange them for various other goods such as tools and machinery in order to expand and enhance the existent infrastructure, which will permit an expansion of final consumer goods that promotes people’s lives and well-being.

The Bernanke-Woodford plan, which is based on relentless monetary pumping, will lead to a weakening of the economy’s ability to generate final goods and services in line with consumers’ preferences. This will diminish rather than strengthen effective demand for goods and services. Read more: https://mises.org/daily/6200/QE3-Sowing-the-Wind

Learn how to negotiate: http://youtu.be/xT5iqTgypVs (Please, women and children, ignore this clip).

Reader’s Question: What is it like to write a blog?

My reply: http://youtu.be/ozDSk9XUkrc