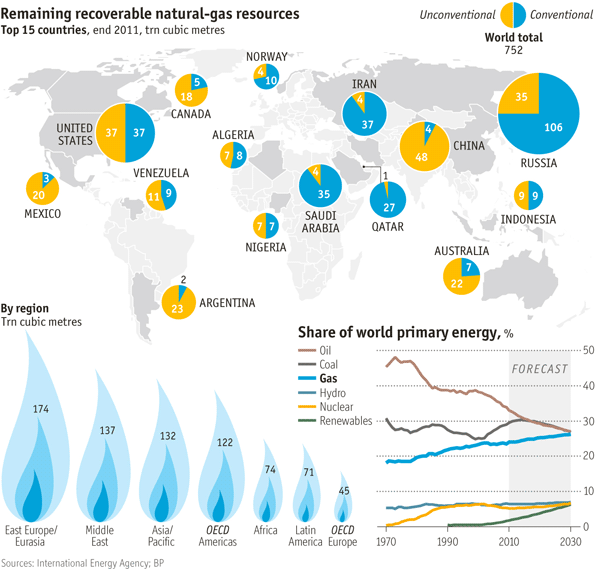

A good article on Natural Gas in the Economist: http://www.economist.com/node/21558432

Southeastern Asset Management (Mason Hawkins) 2nd Qtr. Longleaf Partners Fund Longleaf 06_30_12 Shareholder Letter

In the letter, the portfolio team speaks of their controversial holding Chesapeake Energy (“CHK”). Clients obviously are anxiously calling them about the falling price and controversial news. There is one important lesson for all who invest in cyclical commodity based companies.

Lessons learned:

Longleaf 2nd Qtr. Letter: “Our conviction about CHK does not mean we are complacent about our path of ownership. We have learned two important lessons as our investment has unfolded.

First, we recognize that in commodity businesses, being a low cost provider is not enough of an advantage for an overweight position since the commodity price is subject to going below the cost of production for an unpredictable period of time.

Second, we learned a lesson that reinforces the importance of being a long-term investor who tries to work productively with management when change is warranted. We had much more influence in the tremendous governance transformation than we would have otherwise had if we had initiated our investment with guns blazing. The board and management listened to, trusted, and addressed our views knowing that our only agenda was to benefit long-term shareholders.”

John Chew: Ideally, you want to buy commodity companies when the price of the commodity is UNDER the marginal cost of production. Certainly when natural gas was trading near $2.00, almost no producer could generate a return above their cost of capital. Why were companies producing? The natural gas market is unusual in that there is limited storage (for now) so all gas produced must be sold immediately into the market and Hold-by-Production (“HBP”)means companies will hold leases by having to drill.

Exxon-Mobil on Natural Gas Market: http://www.forbes.com/sites/cfainstitute/2012/01/30/exxon-and-the-natural-gas-revolution/

Exxon CEO says low U.S. natgas prices not sustainable

(Reuters) – U.S. natural gas prices are too low to allow the energy industry to cover the cost of finding and producing new supplies, the head of top producer Exxon Mobil said on Wednesday.

Record production, thanks to new technologies that tap natural gas trapped in shale rock formations, pushed U.S. natural gas prices to 10-year lows below $2 per million British thermal units (mmBtu) in April, though prices have since rebounded.

“The cost of supply is not $2.50. We are all losing our shirts today,” Rex Tillerson, chief executive officer of Exxon Mobil, said in a presentation at the Council on Foreign Relations.

Gas prices have risen over 50 percent since April’s lows, and were up more than 5 percent on Wednesday to nearly $2.95 per mmBtu.

Still, prices remain well below the $4-$5 level that makes drilling in pure natural gas fields profitable. Most producers have moved over to more lucrative oil and liquids-based plays to fetch higher prices, which has begun to put a slight dent in U.S. gas production.

Tillerson also said the recent decline in oil prices appeared to be linked to rising crude oil inventories, economic worries in Europe and a slowdown in China’s growth, as well as a more stable political situation in the Middle East.

DEVON ENERGY (“DVN”)

For those who want more balance sheet strength and conservative management–Devon Energy (DVN) might be of interest to explore. (Let’s check back in two years).