“First They Came for the Jews” By Pastor Niemoller

First they came for the Jews and I did not speak out because I was not a Jew.

Then they came for the Communists and I did not speak out because I was not a Communist.

Then they came for the trade unionists and I did not speak out because I was not a trade unionist.

Then they came for me and there was no one left to speak out for me.

America’s Slide into Tyranny

Or the “Patriot” Act’s stomping on the 4th, 5th and 6th Amendments to the US Constitution. Who has ever heard of the Bill of Rights? http://www.archives.gov/exhibits/charters/bill_of_rights_transcript.html

When I read this, I puked on new suede shoes. http://lewrockwell.com/goyette/goyette22.1.htmlay

Pay close attention. This is how it happens…

President Obama found a moment of reduced visibility, in an unwatched hour on New Year’s Eve, to sign the latest assault on the Fifth Amendment. In signing the National Defense Authorization Act of 2012 on New Year’s Eve, Obama knew the nation’s attention would be elsewhere, diverted by revelry, football, New Year’s Day, and a Monday national holiday.

In case you haven’t heard, the National Defense Authorization Act allows the government to detain people indefinitely – yes, it includes American citizens who can be taken even on our native soil and imprisoned – merely on the basis of accusations.

The measure is “so radical,” says Human Rights Watch, “that it would have been considered crazy had it been pushed by the Bush administration.” And although Obama appended a signing statement as he put his name to the act, solemnly assuring the nation that the power he insisted on having won’t be used recklessly, it is a political gesture that has no more force of a law than attaching a little yellow sticky note to the bill. If the clear language of the Constitution itself cannot bind the governing classes, it is hard to imagine a post-it note having much effect on the current or future presidents now that the indefinite detention of Americans without trial has been legislatively countenanced.

There you have it in a nutshell, the new American way: Guilty until proven innocent. This is how once-free people slip into state tyranny and slide into martial law.

I ask if any here feel safer?

So Where Does the Federal Reserve Earn the Money?

http://www.economicpolicyjournal.com/2012/01/nutty-77-billion-dollar-profit.html

The Federal Reserve turned $76.9 billion over to the U.S. Treasury last year, close to the record amount transferred to the government’s coffers in 2010, amid a strong profit generated from its expanding portfolio of securities.

Preliminary unaudited results released by the central bank Tuesday showed the Fed had net income of $78.9 billion in 2011 mainly thanks to higher earnings on securities it bought to counter the recession and promote recovery….the Fed’s crisis-lending programs have produced profits. The increase in 2011 income was primarily a result of $83.6 billion in interest earnings from holdings of U.S. Treasurys, federal agency debt and securities held by government-run mortgage finance firms Fannie Mae and Freddie Mac, the Fed said.

Got that? The Fed printed billions of new dollars and earned a profit after all this nonsense. For the record the money supply (M2) grew in 2011 by nearly $ 850 billion. The total monetary base came in at aprox. $8.5 trillion.

Note: Don’t try this at home. You would get arrested for counterfitting. But do you think you could “earn” a profit of $77 billion, if you printed, over-time, some $8.5 trillion to buy Treasury securities and the like, which means, as part of the circus, you could give the Treasury the money to pay you the interest that you then give back to them and release a press release about your financial acumen?

Quiz: Any guess as to where this money actually comes from? Who loses?

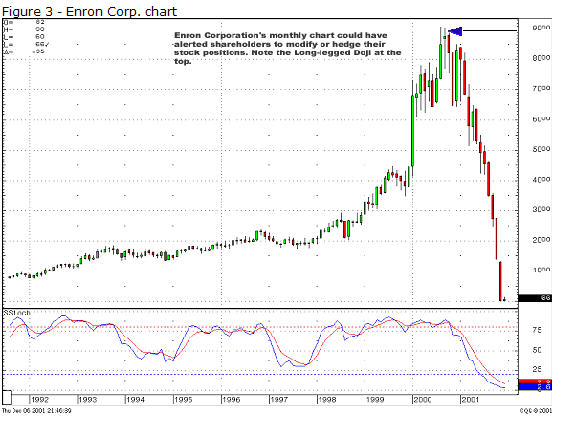

Enron Case Study Addition

We have discussed Enron in prior posts here:

http://wp.me/p1PgpH-1R Enron so What is it Worth?

http://wp.me/p1PgpH-2U Analysis of Enron Case Study

http://wp.me/p1PgpH-34 Video of Enron Collapse

An alert reader gave me a heads up to add this to the Enron Case Study:

Full Hearing Testimonies on the Enron Scandal: http://republicans.energycommerce.house.gov/107/action/107-83.pdf

Chanos Testimony: http://energycommerce.house.gov/107/hearings/02062002Hearing483/Chanos782print.htm

Please stop me before I post again…..but I had to alert you to the above. Most will enjoy reading the Chanos testimony. Note how he FOUND the idea. From our prior study of this case we know that great businesses do not need to layer on complicated debt to grow. Complexity in financial statments is a RED FLAG.