In the second decade of the twenty-first century, America is faltering under the weight of a dual crisis. Its public sector teeters on the ragged edge of political dysfunction and fiscal collapse. At the same time, its private enterprise foundation has morphed into a speculative casino which swindles the masses and enriches the few. These lamentable conditions are the Janus-faces of crony capitalism–a mutant regime which now threatens to cripple the nation’s bedrock institutions of political democracy and the free market economy.

….Once the Fed plunged into the prosperity management business under Greenspan and Bernanke, however, the subordination of public policy to the pecuniary needs of Wall Street became inexorable. No other outcome was logically possible given Wall Street’s crucial role as a policy transmission mechanism and the predicate that rising stock prices would generate a wealth effect and thereby levitate the national economy. — David A. Stockman (former Budget Director under Reagan and a former Partner of Blackstone Group) from The Great Deformation, The Corruption of Capitalism in America.

READERS QUESTIONS

Reader Question #1: What Accounting Books Do You Suggest? I want to improve my intermediate level of understanding so I am ready for my investment analyst internship.

My reply: http://www.barnesandnoble.com/s/?category_id=394924

Buy and work through the problem sets. Accounting problems must be done rather than reading texts because then the concepts will sink in.

Also, to combine that with analyzing financial statements, read http://seekingalpha.com/article/1019951-book-review-what-s-behind-the-numbers

Interview of the writer: http://www.businessinsider.com/whats-behind-the-numbers-a-chat-with-john-del-vecchio-2012-10

Companion website for the book: http://deljacobs.com/

Also, look at: http://www.footnoted.com/report

http://www.accountingobserver.com/PublicBlog/tabid/54/Default.aspx

http://www.offwallstreet.com/research.html Go download several research reports then obtain the particular annual report and study the numbers. Do you agree with the analyst’s report on the company? Study cases.

Financial Shenanigans by Schillit. His books are great for practicing your financial statement skills to undercover weaknesses and strengths.

Also, view short seller blogs like www.brontecapital.com

Reader Question #2: How to begin?

My reply: Investing for beginners:

Obtain a few of these books on the cheap to get a perspective. Then find an industry like beer, soda or trash hauling (one that you can easily understand) and order the annual reports, then pick a company and go through the numbers with your books at your side to look up what you don’t understand. Go back and forth and note your questions. Try to find answers for those questions.

http://www.fwallstreet.com/intro/

http://www.classicvalueinvestors.com/

Wall Street on Sale by Timothy Vick (A good book but perhaps out of print?)

The Little Book of Value Investing by Christopher Browne

The Little Book that Builds Wealth by Pat Dorsey (A good intro to franchises)

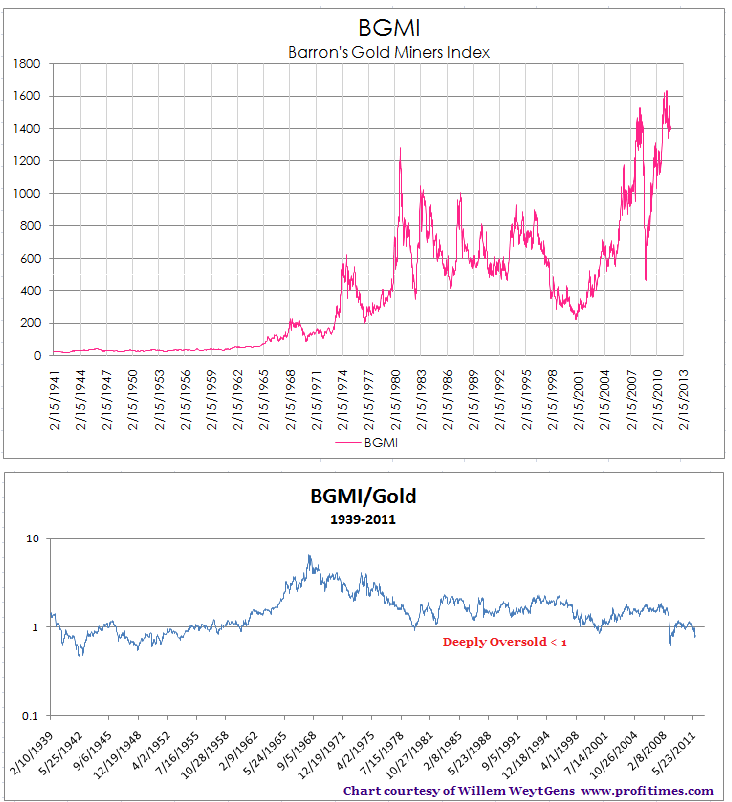

Reader’s Question #3: How Do you Invest in Gold Mining Stocks?

My reply: Very carefully………….

GOLD

Dr. Ron Paul was interviewed by Fox after the U.S. Federal Reserve confirmed it will continue its QE program highlights the importance of gold as money.

On July 13, 2011, when Dr. Paul was a U.S. Congressman he asked U.S. Fed Chairman, Ben Bernanke, “Do you think gold is money?” and Bernanke replied, “No, it’s a precious metal.”

Dr. Paul countered, “Even though it’s been used for 6,000 years?” But Bernanke denied gold was money and said, “No, it’s an asset. Just like T-Bill’s are not money.”

The Fox News interviewer then commented, “Cyprus has taught us that governments can confiscate money that you’ve earned or even paid taxes on. Rampant quantitative easing and price fixing by governments may prop up the stock markets but it doesn’t keep unemployment down. The U.S. Fed is going to continue its QE program which is good for gold.”

—

First, I do not want this subsection to be more than 35% of my portfolio, then I want 12 to 15 companies for maximum specific company risk diversification, then I have a range of low cost producers like Yumana, Eldorado then Streamers (Royalty Companies) like Royal Gold and Silver Wheaton, then more obscure, smaller companies that are beginning their production.

I suggest visiting www.goldstockanalyst.com Listen to all the audios and videos. Read: GSA_2012_User_Guide and GSA_sanfranpresentation

Also, a book, Investing in Resources: How to Profit from the Outsized Potential and Avoid the Risks by Adrian Day

Go to www.kitco.com and listen to the investors, miners and analysts of the mining industry.

From GSA:

Investors must choose from two major groups: Explorers, of which probably 1,000 are publicly owned and Producers, of which only about 50 trade in North American stock markets.

To this latter group, we can add near-Producers, miners that have taken a deposit through the bankable feasibility stage and an independent engineering firm’s analysis has shown that:

1) drill holes are close-enough spaced to have high confidence about the ore grades in-between the holes and thus justify the Proven and Probable Reserves (P+P) classification, and

2) that the capital investment required to put the site into production will yield a profit, or economic return. Just as an independent auditor’s sign-off on a company’s financial statement is critical for investors, so too is an independent engineering firm’s sign-off on the deposit’s economics, and it’s required by the US SEC for a miner to be able to call its ounces in the ground P+P Reserves.

Gold Stock Analyst only follows producers and near-producers as they are the only miners with data confirmed by 3rd parties and thus have solid numbers that can be analyzed.

The Gold mining industry is unique. All the miners produce exactly the same final output, ounces of Gold. Unlike Coke and Pepsi, they spend nothing trying to tell consumers that their Gold is the best. The miners simply accept the current Gold price when they sell. With all ounces the same, and selling for the same price, one might think the stock prices would reflect similar valuations for Miner A’s ounces versus Miner B’s ounces. But, in fact, the stock market is not efficient and the valuations can vary widely. This gives an opportunity for investors.

The gold stock analyst uses three filters:

- Market Cap/oz P + P Reserves

- Mkt.. Cap/Oz Production

- Operating Cash Flow Multiple

Essentially, you can use his filters to pick your own gold and silver stocks. I monitor some of the well-known gold and value investors like Sprott, First Eagle Fund, Van Eck, Tocqueville and note some of their holdings, then I run the numbers and compare. I want to buy the cheapest ozs of gold (producing or in the ground) that I can with management that has been successful before and with a decent balance sheet or highly probably access to the capital markets. Many junior gold mining companies are going to go bust due to the prior boom creating over-capacity (too many mining promoters or two guys and a mule with pick and shovel) and to tight financing conditions today. Great conditions for those companies that survive.

By the way, here is one gold bug who will not hire MBAs:

http://www.kitco.com/news/video/show/on-the-spot/55/2012-10-25/There-Will-Be-Panic-Into-Gold-Casey-Research (see 4 minute 30 second mark)

Interviewer: Do they need a good degree to work at your shop (www.caseyresearch.com)?

Doug Casey, “We don’t care if someone has an MBA or college. We don’t care whether they went to college. We ask, “Do they have good character, intelligence, diligence, are they hard working and do they want to improve themselves? I don’t see how a college degree has anything to do with that, especially what they are teaching today—gender studies, etc. If someone comes to work for us today with an MBA, we look at them and say, What’s going on in your head that you allocated $100,000 and two years of your life to get more theory instead of doing in the real world.

….be careful.