* * *

Ms. Bennett: Seth Lipsky is the author of a book titled “The Floating Kilogram and Other Editorials on Money from The New York Sun.” Before the Sun, he spent 20 years at the Wall Street Journal where he served on the editorial board and helped launch the Asian Wall Street Journal as well as the Wall Street Journal Europe. Recently, Seth authored a column in the New York Post titled “Why does the Federal Reserve Fear a Real Audit,” which is a question much on my mind. Seth, welcome.

Mr. Lipsky: Thanks, Dawn. It’s nice to be with you.

Ms. Bennett: To put it charitably, Janet Yellen appears to be very alarmed that some members of Congress want to conduct a comprehensive audit of the Federal Reserve for the first time since it was created. If the Federal Reserve is doing everything correctly, why should Mrs. Yellen be alarmed and what does she have to hide?

Mr. Lipsky: Well, that’s a great question. The Federal Reserve is already audited, in the sense that an accountant comes in and goes over its books. But what the Congress is talking about is a much broader look by the Governmental Accountability Office of how the central bank forms our monetary policy and what its relations are with foreign banks. The Fed has been fighting this tooth and nail as an intrusion on its independence. What Congress knows is that the Constitution gave the monetary power precisely to Congress.

Congress has a constitutional obligation and power to establish the American monetary system and regulate it, to coin money, regulate its value and that of foreign coinage. This has become a big issue where we have not taken a really systematic look at how the Fed operates in the hundred years that it’s been in existence. We’re starting the second century, and there is growing sentiment in the Congress to take a look at this. The audit of the Fed measure passed the House as recently as of September by a vote of 333 to 92, with 109 Democrats joining the Republicans. So the Fed is certainly growing concerned.

Ms. Bennett: The only reason Janet Yellen has the power to coin money is because Congress delegated its own power to the Federal Reserve in 1913. Isn’t congressional oversight of that power something that should be considered commonsensical by the Federal Reserve?

Mr. Lipsky: The Fed was created in 1913. The Coinage power was first acted on in 1792, and coinage was given not to any Federal Reserve but to the United States Mint. When the second central bank came up to the Supreme Court it was really the tax and the borrowing power that the courts were looking at when they okayed the authority of the central bank.

Ms. Bennett: We are all accountable to someone or something, so what is wrong about the Federal Reserve being accountable to Congress?

Mr. Lipsky: Nothing whatsoever. Even Chairman Yellen acknowledges that Congress has the power. She’s just pleading and warning that it not interfere. Why is Congress growing concerned about this in the first place? It’s because the Great Recession has lasted six years and we still do not feel like we’ve recovered. What is the Fed’s role in this? Could the reason that the Great Recession lasted so long be attributable to monetary policy? The value of the dollar has been allowed to collapse below one 1,100th of an ounce of gold. It was a 265th of an ounce of gold when George W. Bush was sworn in. These are huge questions, and somebody needs to ask them.

Ms. Bennett: It is quite clear to me that the Federal Reserve doesn’t want the rest of us to actually be able to see what they really up to. If we did know what they’re doing, do you think most Americans would just want it shut down? To your point, since 1913, the dollar has actually lost over 97% of its purchasing power. And of course, the economy has been subjected to one painful depression and a series of what I call Fed-created recessions. Despite the poor track record, we continue to support them. At the end of the day, does it matter if we even have a Federal Reserve?

Mr. Lipsky: I think the monetary questions do matter to every American in all positions. My favorite statistic is that between 1947 and 1971 the average unemployment rate was below 5%. From 1971 until today it was above 6%. What happened in 1971, when the unemployment rate began souring? What happened is we abandoned the Bretton Woods Gold Exchange System, under which the dollar was linked to gold, and the money began flowing not in the productive enterprises, but into the money markets and hedge funds and all these sorts of things and not so much into the kind of investment that created the great industrial base in America.

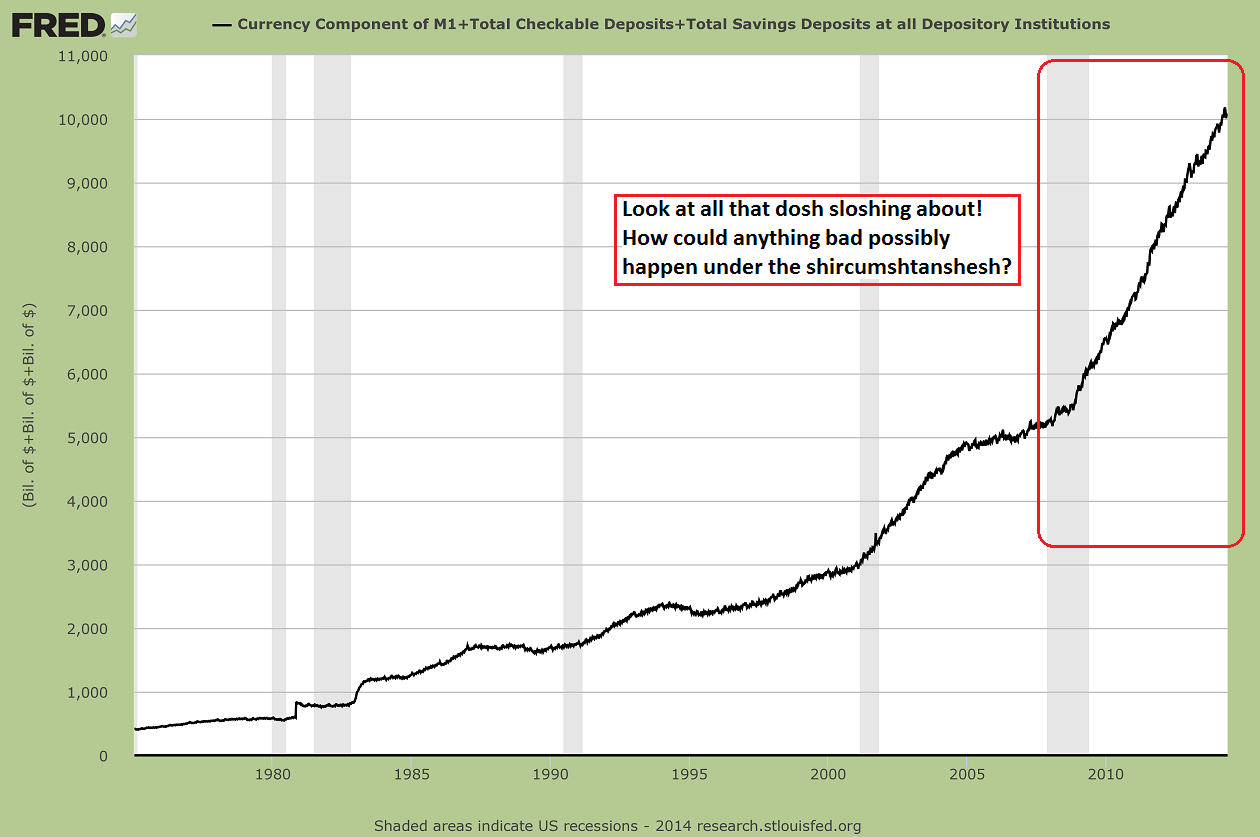

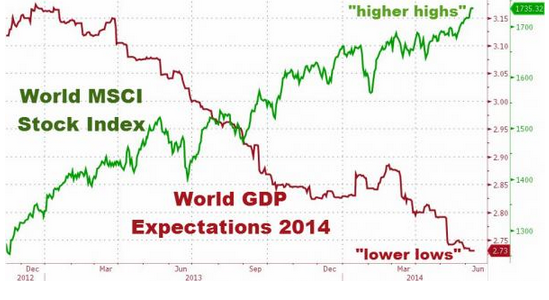

Ms. Bennett: Let’s talk about that type of investment. According to a government report I’ve read, the Federal Reserve made $16.1 trillion in loans to big banks during that financial crisis. In my opinion, [it once] created the dotcom bubble and the housing bubble. Now, I think it has created the financial bubble that our markets are experiencing.

Mr. Lipsky: Asset inflation. The debate over inflation is one of the most important debates in the country. The left wing likes to say there is no inflation, but the dollar is worth only a tiny amount of the constitutional specie, which is gold and silver, compared to what it used to be worth. This is what people feel when they hear the government say there’s no inflation but they try to go to the grocery store and they spend $50 or $100 on a tiny plastic bag with a few items in it.

Ms. Bennett: Yes, I know shelf inflation is huge, but I want to talk about commodities for a bit. The Department of Justice has recently said again that they’re going after the big banks that have been, on an ongoing and continuous basis, manipulating gold and silver. What are your thoughts on that? Will it work this time? And, if so, is there a simple solution to stop them from doing this? They seem to get their hands slapped, apologize, and then come back and do it again, and again.

Mr. Lipsky: The news that the Justice Department is looking at something like ten or twelve major banks for possibly rigging the price of gold broke the same week that Mrs. Yellen was up on Capitol Hill testifying against an audit of the Fed.

Ms. Bennett: That’s right.

Mr. Lipsky: One of the questions that The New York Sun raised is what is she afraid of then? Is it the danger that the Fed has been meddling in the gold market the way the Justice Department is alleging commercial banks have been doing it? It’s the Fed that regulates commercial banks after all. I don’t want to carry that argument too far. I asked it then in an editorial more in the nature of a question. But there is a movement in Congress to open up what is called a Centennial Monetary Commission that after the first hundred years of the Fed, would just take a look at how the whole system is working.

We’ve been in a period of fiat money, meaning dollars that have no connection in law to any gold or silver or other constitutional money. We’ve been in a fiat system since 1971. Previously, our dollars were always defined in terms of gold and silver, suddenly they’re not. The unemployment average is much higher; the bankruptcy rate is much higher; the inequality rate has been much higher since the mid 1970’s. Could this be related to the fact that we abandoned sound money in the mid 1970s?

Ms. Bennett: De-dollarization has been going on now for the last few years, and I think it’s because the dollar is continuing to get weaker. Our political system and economic system aren’t what they used to be. Do you think it’s possible that if China, for example, standardizes the renminbi it will start taking power away from the U.S. dollar?

Mr. Lipsky: The abandonment of sound money by the U.S. has brought forth a whole chain of foreign governments that are alarmed and wonder whether a new system should be set up. China. There is talk of Russia going on a gold standard; the European Union is having its own catastrophe with the Euro, and it’s wondering whether the dollar ought to be replaced as the international reserve. The United Nations, for crying out loud, has gotten involved in this.

One of my favorite moments happened in 1965, when the President of France, Charles de Gaulle, called a thousand reporters into the presidential palace sat them down and addressed them on the importance of restoring gold as the international standard. His argument was that it puts all countries on the same basis: America, France, England, China, little countries, and it takes a lot of the partisanship out of the monetary question internationally, or it takes the politics out of money. It’s ironic that Fed loves to talk about how we shouldn’t politicize the monetary system. If one really wants to de-politicize the monetary system, restoring a gold standard or something like it is exactly the way to do it.

Ms. Bennett: Mrs. Yellen claims that opening the Fed to an outside audit would “politicize” — her word — monetary policy.

Mr. Lipsky: Right.

Ms. Bennett: Isn’t it political when Senator Schumer, for example, tells her to keep rates low every time she testifies before the Senate Banking Committee? Isn’t it already happening?

Mr. Lipsky: You’re exactly right. Why is it always the conservatives that are doing the politicizing and not the liberals? The big politicization of monetary policy happened in 1978 with the passage of Humphrey-Hawkins, which said that the Fed has to have a second mandate of increasing the employment rate or decreasing unemployment, in addition to affecting the value of our dollar. That opened the door to an enormous political interference in monetary policy.

Ms. Bennett: I know you’re not a gold trader or silver trader…

Mr. Lipsky: I’m a newspaperman.

Ms. Bennett: There you go. But I’m certain you follow the markets. What do you think would be a simple solution to fix the ongoing and continuous manipulation of gold and silver so that we can get more stability? It does seem, whether it’s a Federal Reserve or some other central bank, that they’re interfering with it in order to make the fiat currency look stronger than it really is.

Mr. Lipsky: I favor a definition by law, enacted by Congress under its constitutional powers to coin money and regulate its value, and fix the standards of weights and measures — a law passed by Congress defining the dollar as a fixed amount of gold or silver. Silver was the main specie used in early years of our republic. The debate over whether gold or silver was better went on through the 19th century, and we basically decided in 1900, with the passage of the Gold Standard Act, to make gold the true national money. I think that would go a long way toward solving this problem. There are a lot of questions as to exactly how to do it, whether there should be a system like Bretton Woods, which said dollars had to be redeemed in gold if they were held by foreign governments.

Ms. Bennett: In physical gold, not paper gold. In physical gold.

Mr. Lipsky: Right.

Ms. Bennett: There’s a big difference there.

Mr. Lipsky: Therefore the price at which one fixes the dollar, the value, the amount of gold, has to be carefully worked out. But the gold standard is not some flaky thing. This was believed in by George Washington, Thomas Jefferson, James Madison, Alexander Hamilton, and almost every president since, up until Richard Nixon. John Kennedy, Woodrow Wilson, Grover Cleveland — they all believed in it.

Ms. Bennett: Seth, “The Floating Kilogram and other Essays on Money from The New York Sun.” For any listeners not familiar with the Sun, can you bring them up to speed?

Mr. Lipsky: The New York Sun is an online newspaper that I edit. We published in print until several years ago. It’s a leading voice in journalism for a sound dollar. It supports a sound dollar, limited government, and a restoration of constitutional dollar based on gold or silver. This is the first radio interview about the book.

Ms. Bennett: Thank you.

Mr. Lipsky: This book contains on this issue 130 editorials that have been issued in the Sun in recent years. Steve Forbes calls them “brilliant,” “irrefutable,” and “the Federalist Papers for the gold standard.” James Grant calls the book both “persuasive” and “unfailingly entertaining.” It’s a book for every person, not just the experts, and it’s available on Amazon.com, the online bookstore, and you’ll have a copy in a day or two if you place your order. “Pure gold” is the way the economist Judy Shelton described this book. The title, Dawn, comes from the discovery that the kilogram, which is the last metric weight measure based on a physical object, has been losing mass — atom by atom. The Sun in one of its editorials said, “Why don’t we float the kilogram just like we float the dollar?” That’s from where the title of the book comes.

Ms. Bennett: If President Obama, or our next president, were to become motivated to make reforms, what do you think the takeaway from this book would to be? Definitely a gold standard?

Mr. Lipsky: So I think the takeaway is going to be that in our monetary system at some point, the dollar has to be defined in terms of something real rather than just another dollar. At the moment, if you take your dollar to the central bank to redeem it, they’ll give you another dollar. There’s no reference to anything real and no classical measure of value. We have what Jim Grant likes to call the Ph.D. standard, and I think we need to move away from that to the kind of standard that sustained our country during its periods of greatest growth and strongest employment.

Ms. Bennett: We always seem to make changes in the United States when things break down, but not beforehand. What is going to be the instigator to standardize our currency?

Mr. Lipsky: People say things could become a disaster. The last six years have been a disaster.

Ms. Bennett: Exactly.

Mr. Lipsky: Huge amounts of unemployment, not just for a short period, but for six years. It’s consumed almost the entire Obama presidency. People are still trying to figure out their homes, still trying to figure out how the price of college got more than halfway to $100,000 a year — you know, all these things. We’ve been living through this, and I think events have energized Congress to start looking at this. The Sound Dollar Act, or Centennial Monetary Commission Act, or Audit the Fed Act, or Free Competition in Currency Act. This is why Janet Yellen — to bring it back to where we came in — is fighting so hard against the Congress doing this. We’re in a constitutional moment here where Congress is going to take a look at this, I predict.

Ms. Bennett: Do you think they’re going to have the guts to do it?

Mr. Lipsky: I think the American people have a lot of guts.

Ms. Bennett: Me, too.

Mr. Lipsky: And at the end of the day, the Congress has to listen to the American people.

Lawrence H. White is Professor of Economics at George Mason University. He specializes in the theory and history of banking and money, and is best known for his work on free banking. He received his A.B. from Harvard and his M. A. and Ph.D. from the University of California, Los Angeles. He previously taught at New York University, the University of Georgia, and the University of Missouri – St. Louis.

Lawrence H. White is Professor of Economics at George Mason University. He specializes in the theory and history of banking and money, and is best known for his work on free banking. He received his A.B. from Harvard and his M. A. and Ph.D. from the University of California, Los Angeles. He previously taught at New York University, the University of Georgia, and the University of Missouri – St. Louis. Gonzalo Schwarz (moderator) manages the Awards and Grants program at the Atlas Network that include the prestigious Fisher Memorial Award and Templeton Freedom Awards. Additionally he manages the Latin American Program. He currently holds an MA in Economics from George Mason University and is looking to pursue other graduate studies. He is originally from Uruguay and has lived in four other countries throughout his life. In the past he worked in academics and other non profits. He enjoys participating in academic seminars and was also part of the Koch Foundation Fall internship in 2009. His main hobbies are sports, reading and spending time with his family.

Gonzalo Schwarz (moderator) manages the Awards and Grants program at the Atlas Network that include the prestigious Fisher Memorial Award and Templeton Freedom Awards. Additionally he manages the Latin American Program. He currently holds an MA in Economics from George Mason University and is looking to pursue other graduate studies. He is originally from Uruguay and has lived in four other countries throughout his life. In the past he worked in academics and other non profits. He enjoys participating in academic seminars and was also part of the Koch Foundation Fall internship in 2009. His main hobbies are sports, reading and spending time with his family.