This freakish central bank accumulation of dollar liabilities, in turn, was the result of the greatest money printing spree in world history. In essence, we printed and then they printed, and the cycle never stopped repeating. In this manner, the massive excess of dollar liabilities generated by the Fed were absorbed by its currency pegging counterparts, and then recycled into swelling domestic money supplies of yuan, yen, won, ringgit, and Hong Kong dollars.

As the US debt-based global monetary system became increasingly more unstable in recent years, central bank absorption of incremental Treasury debt reached stunning proportions. Thus, US publicly held debt rose by $6 trillion between 2004 and 2012, but upward of $4 trillion, or 70 percent, of this was taken down by central banks.

I could be truly said, therefore, that the worlds’ central banks have morphed into a global chain of monetary roach motels. The bonds went in, but they never came out. And therein lays the secret of “deficits without tears.”

David Stockman from The Great Deformation (2013)

Read an interesting article on crony capitalism: Sundown_in_America

Comments on the article: http://www.zerohedge.com/news/2013-04-01/guest-post-stockman-liquidation

Current Conditions

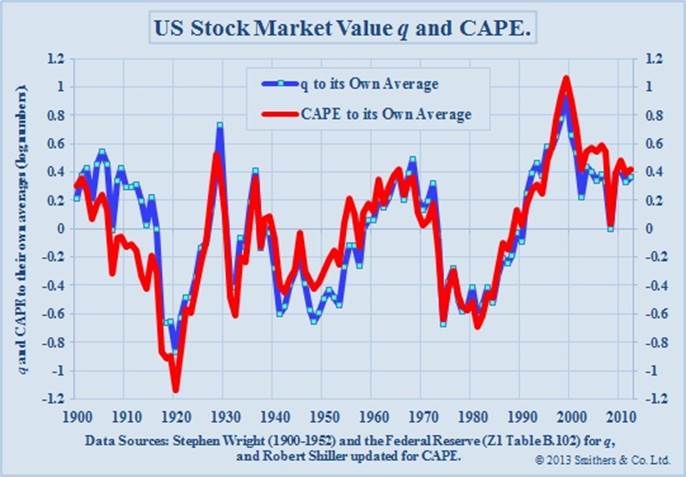

The chart is based on data through the end of 2012. Smithers notes “At that date the S&P 500 was at 1426 and US non-financials were overvalued by 44% according to q and quoted shares, including financials, were overvalued by 52% according to CAPE. With the S&P 500 at 1552 the overvaluation was 57% for non-financials and 65% for quoted shares.”

Unfortunately, that seems about right. Let’s translate this into an estimate of prospective 10-year total returns, assuming underlying nominal economic growth rate of about 6.3% (which may be optimistic, but is a robust peak-to-peak norm across economic cycles, and is unlikely to be pessimistic), and a dividend yield of about 2.2% on the S&P 500. With that, a 65% overvaluation in quoted shares, reverting to fair valuation a decade from now, would imply a 10-year annual nominal total return on the S&P 500 of 1.063*(1/1.65)^(1/10) + .022 – 1 = 3.3% annually. That’s right in line with the estimates we obtain from a wide range of other historically reliable approaches (historically reliable in italics, because the “Fed Model” is not).

Notice that in 1982, the -0.7 reading on Smithers’ log-scale chart implied that stocks were undervalued by exp(-0.7)-1 = -50%. At that point, with the dividend yield on the S&P 500 about 6.7%, one would have estimated a 10-year prospective total return for the S&P 500 of 1.063*(1/0.5)^(1/10)+.067 – 1 = 20.6% annually. One would have been correct.

In contrast, note that in 2000, the 1.0 reading implied that stocks were overvalued by exp(1.0)-1 = 172%. At that point, with the dividend yield on the S&P 500 at just 1.2%, one would have estimated a 10-year prospective total return for the S&P 500 of 1.063*(1/2.72)^(1/10)+.012 = -2.6% annually. Again, one would have been correct.

With due respect to Howard Marks and Warren Buffett

At present, we estimate a 10-year total return on the S&P 500 over the coming decade averaging just 3.5% annually, with zero total returns over a horizon of about 7 years, and expected losses for the S&P 500, including dividends, over shorter horizons.

…..The last four years of market advance have reduced FUTURE retruns.

While our estimates for 10-year total returns exceeded 10% annually near the 2009 market lows, the recent advance has, in effect, “eaten” most of those prospective returns. The well-admired bond manager Howard Marks is very correct when he notes “appreciation at a rate in excess of the cash flow accelerates into the present some appreciation that otherwise might have happened in the future.”

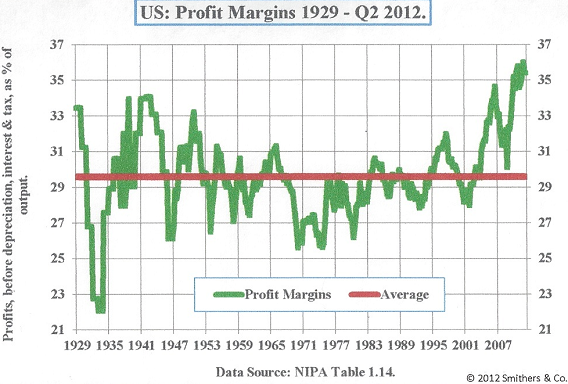

Where I differ from even Howard Marks and Warren Buffet here, is that if you are going to rely on a summary measure in order to value long-lived assets like stocks (both Marks and Buffett point to “forward operating earnings” today), that summary measure must be representative of the long-term stream of cash that investors can expect to receive over time. The hook today is that investors are using analyst estimates of next year’s operating earnings as if they are representative of the entire long-term stream, and that this one number can be used as a “sufficient statistic” for long-term corporate profitability.

Read More: http://www.hussmanfunds.com/wmc/wmc130401.htm

Jim Rogers on when he was wiped out

Is Bitcoin money?

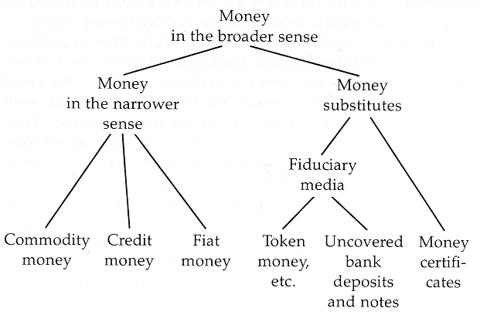

No! Summary:

» Bitcoins can be hyperinflated in substance

» Bitcoins can never be the most saleable good

» Bitcoins cannot account for the regression theorem

» Bitcoins are the equivalent of token money

» Bitcoins are the opposite of anonymous

For context, Bitcoin is a newly formed digital currency which has rapidly grown in popularity (as well as in price) following the Cyprus banking system collapse. The chart below is the price performance of Bitcoins, which have seen a market cap expansion of almost 20x—from about $50mm to roughly $1B where it stands today—in less than one year.

Watch the balance sheet: Never ignore the balance sheet (Videos).

http://www.youtube.com/watch?NR=1&v=X-b62ZYXAyw&feature=endscreen

What is a balance sheet: http://youtu.be/DuKEcxVplnY

Signs a company is in trouble: http://youtu.be/lwp6i4Kd4RA

Why does a profitable company go bust? http://youtu.be/d0FY4xRT_yo

A Ponzi on top of a Ponzi: http://video.cnbc.com/gallery/?play=1&video=3000148493 This story is unbelievable. A young guy decides to create fake boat titles from fake invoices that he then obtains loans on from his local banker. The banker doesn’t have the brains nor the energy to make a 90 second call to the boat manufacturer to verify the make and model. Nor does the banker even wonder how his customer obtained the money to have 53 yachts.

As the court documents reveal, the con man said it was in the interests of the banker to believe the con! (This I believe). As a plea for leniency, the conman’s lawyer stated that his client ONLY defrauded FDIC INSURED banks! Expect many more ponzis to be revealed. See: MichaelVorce_AmericanGreedStatement and Vorce_PleaTranscript

Another $600 million Ponzi: http://www.huffingtonpost.com/2013/03/30/zeekrewards-ponzi-scheme-north-carolina_n_2984347.html?utm_hp_ref=business

SOUND MONEY

Prof Selgin on sound money http://youtu.be/U_0CNwgL8Rw

Dr. Judy Sheldon on the origins of our money: http://youtu.be/hdlZi2KPXhU

Money in crisis part 1: http://youtu.be/TQ4PGr0WBBc

Money in crisis, part 2: http://youtu.be/1mI8Lek60_w