To Get Big Think Small

I am having difficulty finding value, so now I gotta go small. More on micro-cap investing…..Liquidity as an Investing Style and Microcap_Investing and then More_on_Microcap_Investing. If you can accurately value a business while the company’s stock price is volatile, then you have a gold mine. Smaller companies tend to be more OVER and UNDER-VALUED than larger, well-known names.

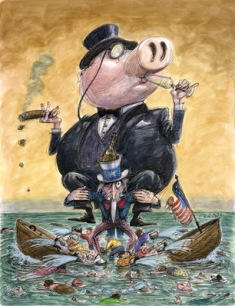

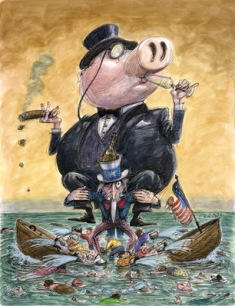

Secrets and Lies of the Bailout

Secrets and Lies of the Bailout

The federal rescue of Wall Street didn’t fix the economy – it created a permanent bailout state based on a Ponzi-like confidence scheme. And the worst may be yet to come

So what exactly did the bailout accomplish? It built a banking system that discriminates against community banks, makes Too Big to Fail banks even Too Bigger to Failier, increases risk, discourages sound business lending and punishes savings by making it even easier and more profitable to chase high-yield investments than to compete for small depositors. The bailout has also made lying on behalf of our biggest and most corrupt banks the official policy of the United States government. And if any one of those banks fails, it will cause another financial crisis, meaning we’re essentially wedded to that policy for the rest of eternity – or at least until the markets call our bluff, which could happen any minute now.

An excellent article that shows what has happened to our centrally-controlled, socialist, Ponzi financial system. Of course, the author does not point out the causes or remedies, but he does show the results of the bailout.

My favorite line:

We thought we were just letting a friend crash at the house for a few days; we ended up with a family of hillbillies who moved in forever, sleeping nine to a bed and building a meth lab on the front lawn.

http://www.rollingstone.com/politics/news/secret-and-lies-of-the-bailout-20130104?print=trueor Crony_Finance_Rolling_Stone.

View these films: http://thebubblefilm.com/cast/jim-rogers/

Conventional Wisdom on Booms and Busts from a Value Guru

Ask yourself what have you learned from reading this article. What can you apply from his thoughts? Read here: Ditto.

PS:I didn’t learn much. 50 seconds to the trash bin.

HAVE A GREAT WEEKEND.