Johnson spoke well when he said that life is hard enough to swallow without squeezing in the bitter rind of resentment. Charlie Munger

“Invert, always invert,” Jacobi said. He knew that it is in the nature of things that many hard problems are best solved when they are addressed backward. –Charlie Munger

How to Guarantee Misery in Your Life

Below are tips from the great and the not-so-great on how to guarantee misery and second-rate achievement in your life.

Johnny Carson says,

- Ingesting chemicals in an effort to alter mood or perception;

- Envy, and

- Resentment.

John Chew pleads: Meet my Ex. http://www.youtube.com/watch?v=i5OlolbLXvw. Not to be watched if squeamish.

Charlie Munger intones:

- Be unreliable. Do not faithfully do what you have engaged to do.

- Learn everything you possibly can from your own experience, minimizing what you learn vicariously from the good and bad experience of others, living and dead.

- Go down and stay down when you get your first, second, or third severe reverse in the battle of life.

- Avoid thinking creatively about problems. Never invert.

First Solar

Now to put our lessons to the test…

I read the news this morning…Oh boy. –The Beatles.

This morning I read a Bloomberg story discussing First Solar’s attractive valuation following its recent selloff. Also analysts have rekindled takeover chatter. “First Solar is still profitable,” a Kaufman analyst explains. “So you are buying the best in the industry at a discount price. Certainly for both GE and Siemens (SI), it would diversify their energy platform.” FSLR trades at 60% of book value and 5 or 6 times trailing earnings.

If the Kaufman analyst said that to me, this is exactly how I would respond. http://www.youtube.com/watch?v=6eXFxttxeaA

Why? What is the strategic thinking you would need to do before considering this as an investment?

How could you have avoided this house of pain before the price drop?

Subsidy Orgy Ending, First Solar’s Hangover is Just Beginning By Jeff Bailey

Ever been to a sporting event where, during a break in the action, they wheel out that clear booth, stick some poor sucker from the crowd inside, and cash is blown into the enclosure for a brief period of shameless money-grabbing?

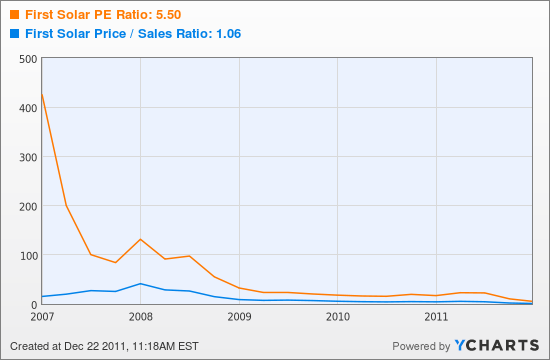

The global boom in government subsidies to the solar panel industry went something like that, and one can see the brief and frenzied joy of that period in First Solar’s (FSLR) up-and-down stock chart, with today’s price a steep 90% or so below the peak.

The good times were good. Malaysia was handing out huge tax holidays for manufacturers, so First Solar built plants there. Germany seemed intent on covering every roof with solar panels, paid for in part by government subsidy, so First Solar sales were huge there. And not to be left out, the U.S., during its giddy economic stimulus days, offered cash grants for solar installations. Party on.

But, as with past alternative-energy orgies, the good times must come to an end. Goodbye to First Solar’s market cap of $20 billion. Jimmy Carter’s Public Utility Regulatory Policies Act of 1978, known as PURPA, led to tens of billions of dollars of alternative energy projects, including some early and costly solar. But paying above-market electricity rates to subsidize the projects became so costly that PURPA was eventually curtailed.

Poor politicians can’t help themselves. They love stuff like solar and wind, which generate manufacturing and construction jobs and makes everyone involved seem so with it. More efficient energy projects – like ones that reduce consumption – are by comparison so boring, even if they make more sense.

Last week, in announcing reduced earnings projections for 2011 and 2012, First Solar’s CEO Mike Ahearn said, “we are recalibrating our business to focus on building and serving sustainable markets rather than pursuing subsidized markets.” Investors can count on thinner margins and all the hassles and expenses that go with building and operating huge energy projects. And solar remains a relatively expensive way to make power. Unless the brent crude oil price chart goes to $200 a barrel.

In the meantime, the stock is bound to look super cheap by some measures. A trailing PE of 5, of course, suggests some big adjustments ahead to the E.

But it won’t be until 2014, Ahearn said in a statement, that First Solar’s will “earn substantially all” of its revenues from non-subsidized markets. So the results until then are nothing to make long-term bets on. The last of the party is still winding down. End.

Thoughts on First Solar and Competitive Advantage

OK, I am not saying First Solar is not a buy at any price, but what did the Wall Street “analysts” not analyze.

Studying competitive advantage will help us as much in avoiding a house of pain as in finding profitable investments.