A reader (the ONLY one) presented his valuation below:

The analysis is in response to http://csinvesting.org/2017/10/27/sandstorm-gold-so-whats-it-worth/

Business Model

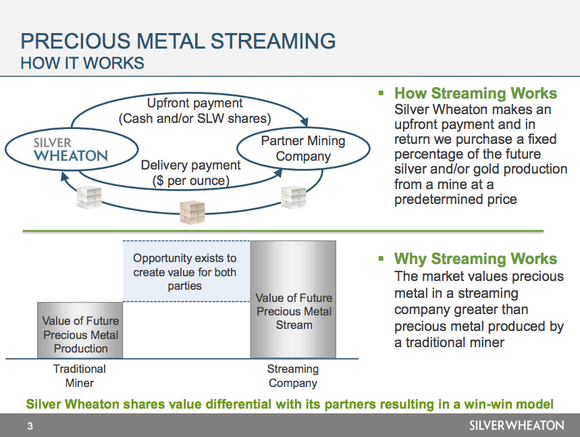

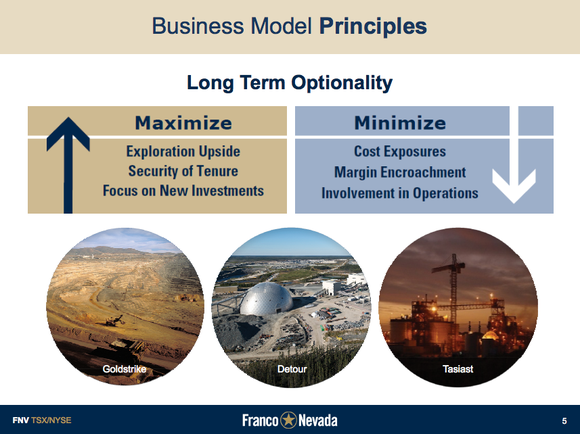

Sandstorm provides financing for other junior, mid-tiers and major gold producers. In exchange for a principal amount provided by Sandstorm, gold producers exchange a royalty stream on their gold production. This royalty stream can take different forms, the most common being a percentage of Net Smelter Revenue (“NSR”) or by offering an off-take agreement at discounted prices. In addition, Sandstorm may receive warrants or other traded securities.

Sandstorm offers their shareholders a diversified portfolio of royalty streams, which offers some benefits over investing in a gold exploration/producing company: 1) predictable cash flows, 2) very low cost structure, 3) replacement capex (investment in new projects) typically much lower than for a gold producer.

In my view, this kind of investment should benefit from a lower cost of capital because of its lower risk, so therefore investors would be willing to pay more for this cash flow stream vs. a cash flow stream coming out directly from a mine.

Valuation

I’m looking at 3 main buckets of value here.

1) Producing assets – currently generate ~US$50mm of cash flows each year. My rough assumption here is that these cash flows should be relatively stable over the next 10 years. I assume no terminal value as these mines are winded-down over time. Discounting this at a cost of equity of ~8% yields ~US$335mm

2) Advanced exploration / explo / investment portfolio – I’m assuming no value to the exploration projects and assuming a 10% discount to the FMV of the investment portfolio. This yields ~US$70mm.

3) Development projects – this one is certainly tougher to ascribe value. If we look at the SSL presentation, we see that the majority of future cash flows will come out from Hot Maden which was paid US$175mm. Assuming there was a market check done on the sale of the stream, we can assume this is market value. Other projects from the development portfolio will also yield future cash flows, but it can be assume to be somewhat captured in the above DCF.

So overall, I compute US$335mm + US$70mm + US$175mm = US$580 which is far from the current market cap of the company.

One needs to believe that the development portfolio will materialize into sustainable cash flows (which would essentially translate into the addition of a terminal value in my DCF) before investing in this business.

Let me know your thoughts and feel free to share my response on your website!

CSInvesting: I will be posting my thoughts soon.

Interesting readings

- https://wiserdaily.wordpress.com/category/investment-analysis/

- https://www.moaf.org/publications-collections/financial-history-magazine

- https://youtu.be/C2eMawa7smE A video on why reading the Intelligent Investor is a great start.

https://thefelderreport.com/2017/10/31/tobias-carlisle-on-beating-the-little-book-that-beats-the-market/ Worth a listen!