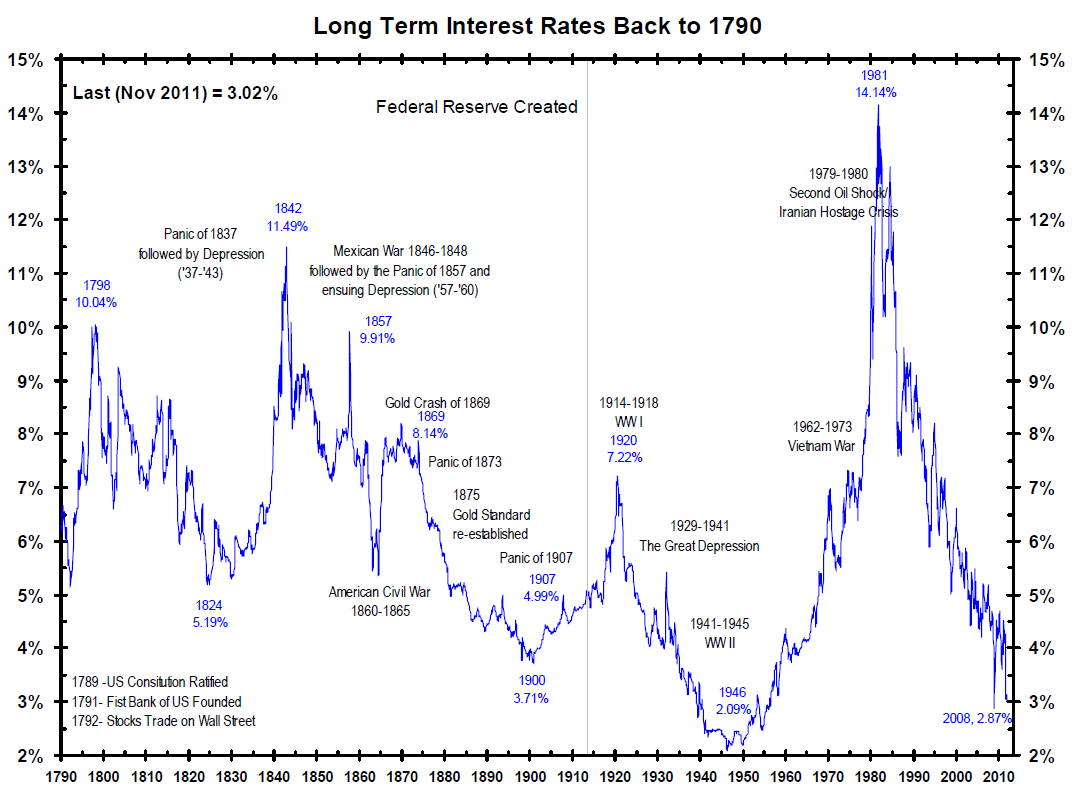

The view from Grant’s (Mar. 20th, 2015) is that risk can usually be found where you aren’t looking for it. You get to thinking, for example, that government bonds are perfectly and unconditionally safe. You would so conclude after 33.5 years of a bond bull market. Yet, the same asset struck many as perfectly and unconditionally unsafe at the 33.5 year point in the preceding 1946-81 bond bear market. Nothing in investing is for certain or forever, “Many shall be restored that now are fallen, and many shall fall that are now in honor,” wrote Horace (65 B.C. to 8 B.C.).

A reader asked about the

sharpe_ratio.asp. I think any metric that uses volatility as risk is absurd. The video below will give you a better understanding of what REAL risk is–permanent loss of life! I know some may disagree–see: FAJ My Top 10 Peeves and a value investor’s view: Risk Revisited

A Reader’s Question

I’m a value investor from Italy, and I’ve been following your blog since a few months ago. I appreciate a lot your work and the way you share your knowledge with the others. I’ve been doing my own research in American stocks, and create a portfolio that I think is doing well.

I’m a retail small value investor with no MBA, or any especial degree in accounting.

How can a “middle class working hero” approach the world of finance? Do you think any money manager be interested in my research, or I’m only wasting my time?

My advice: First, you can post this to the deep-value@googlegroups.com because there are many smart, experienced investors who may offer another perspective.

First, why American stocks (especially now since many are high-priced?) versus Italian or Greek stocks? Can you develop an area of expertise NEAR where you are? In other words, what makes YOU unique where you can add unique value? Where can you find the biggest edge. Do you have expertise or experience in a particular industry? Have you spoken to or research Italian Money Managers? Send your write-up to a few of them. The worst that can happen is they give you a thumbs down but you obtain feedback/and learn.

Not having an MBA is no big deal, but you should learn accounting up to the intermediate level so you can translate the financial information into information useful for an investor. GAAP earning don’t always equal owner’s earnings. Study online for free or attend a class or grind through a textbook but do ALL the problem-sets.

If you know your portfolio is doing well, keep good records that you can show to potential investors or employers. Do you have a clear investment process that you can follow?

Ask further questions in the comment section.

Good luck!