Is the Market Expensive?

Where The Cheap Stocks Are—Come Hell Or High Water

Is “value investing” dead? Far from it, says Jon Shayne, whose bargain-hunting style will likely endure no matter who wins the presidential election or what horrors Mother Nature might whip up.

If you follow the stock market, Jon Shayne is worth a good, long listen. Especially now. (Also, check out his blog: http://www.jonshayne.com/2013_04_01_archive.html)

A disciplined buy-and-hold guy, Shayne manages $180 million for high-net-worth individuals, corporations and foundations, mainly in Tennessee. Like all value investors, he thrills at unearthing solid companies trading at below-average prices. The kind of companies that, as Warren Buffett said, would still be around if the market were to shut down for 10 years—let alone for two days after a devastating hurricane.

This game takes patience, and Shayne’s has served him well. Since his firm’s inception in March 1995, his stock picks have returned a smidgeon over 13% a year (net of a modest 1% annual management fee), versus 8.4% for the S&P 500 index. Including cash and Treasury bonds, Shayne has clocked a net 10.2% annualized return, with less than half the volatility of the broader stock market.

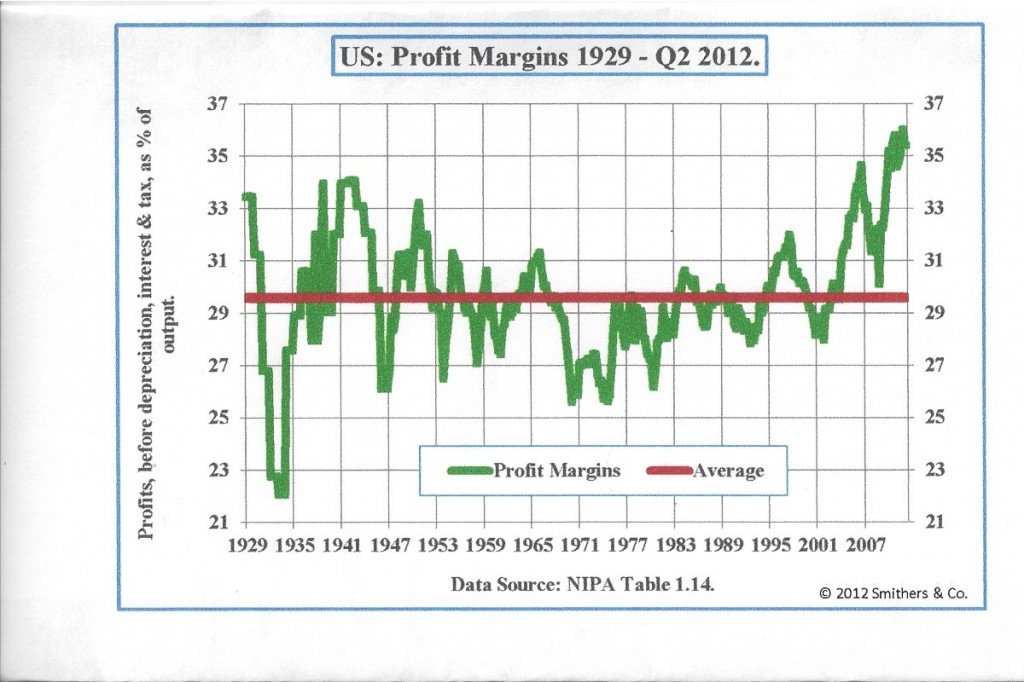

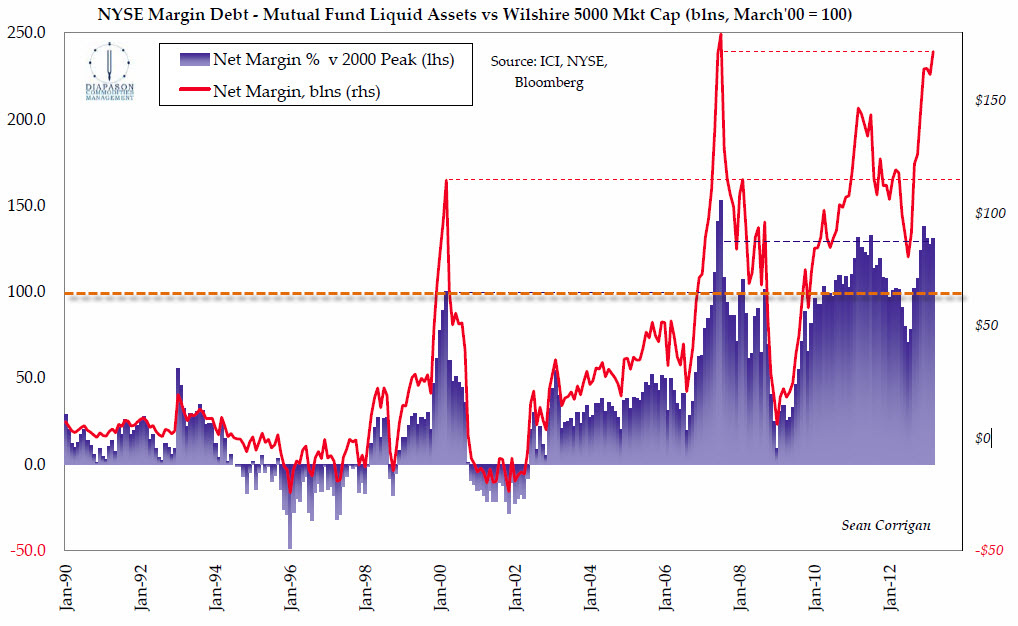

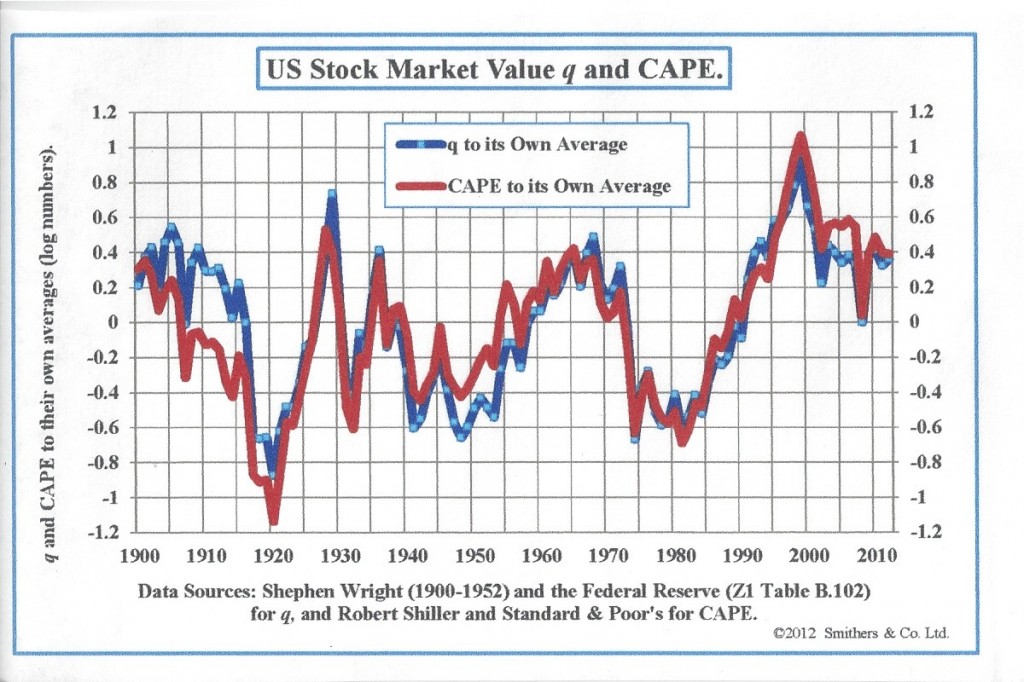

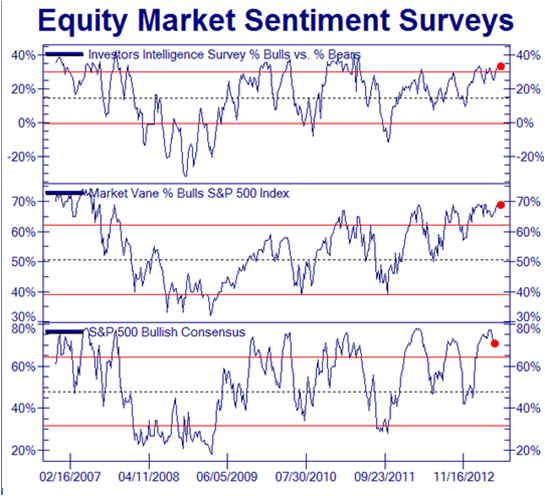

Trouble is, truly good values have been increasingly hard to find. While the market retreated a tad after a rash of weak corporate earnings reports and ominous pronouncements by the International Monetary Fund, stocks are still very expensive by historical measures. And as for finding safety on the sidelines, the Federal Reserve’s tireless printing presses have done to Treasury yields what Hurricane Sandy just did to the northeastern coastline.

Shayne’s dilemma and ours: Get in the game—even if you have to pay up for the privilege—or watch your capital get gnawed by inflation. “There are periods when it’s easy to find stuff, and periods when it gets pretty hard,” says Shayne. “The environment is more difficult than it has been because it is more uncomfortable to hold cash.”

Read More…….Where the Cheap Stocks Are

Top 5 Videos on Warren Buffett

4. Warren Buffett – Going Global This video is more about an applied look at how Warren Buffett operates, the CNBC show follows Warren on one of his rare trips overseas, including a look at one of his first offshore acquisitions – ISCAR. This video shows how folksy, old fashioned, and down to earth the billionaire investor is, but it also shows how he is quick to realise a good deal and his talent for allocating capital. It also shows his brilliance for identifying great companies and strong capable management teams and letting them get on with the business for him.

Thanks to www.financedocumentaries.com for finding all these documentaries (and others!) Source: http://www.alleconomists.com/2012/10/top-5-videos-on-warren-buffett.html