| Silver FeverEvidence of bubbles has accelerated since the [2007-2009 financial] crisis. ~ Robert Shiller (“Irrational Exuberance,” 2015).The celebrated author and humorist Samuel Clemens (pen name Mark Twain) documented his experiences in the Nevada mining stock bubble, and his writings are one of the earliest (and certainly the most humorous) firsthand accounts of involvement in a speculative mania. After a brief stint as a Confederate militiaman during the beginning of the U.S. Civil War, Clemens purchased stagecoach passage west, to Nevada, where his brother had been appointed Secretary of the Territory. In Nevada, Clemens began working as a reporter in Virginia City, in one of Nevada’s most productive silver- and gold-mining regions. He enviously watched prospecting parties departing into the wilderness, and he quickly became “smitten with the silver fever.” Clemens and two friends soon went out in search of silver veins in the mountains. As Clemens tells it, they rapidly discovered and laid claim to a rich vein of silver called the Wide West mine. The night after they established their ownership, they were restless and unable to sleep, visited by fantasies of extravagant wealth: “No one can be so thoughtless as to suppose that we slept, that night. Higbie and I went to bed at midnight, but it was only to lie broad awake and think, dream, scheme.” Clemens reported that in the excitement and confusion of the days following their discovery, he and his two partners failed to begin mining their claim. Under Nevada state law, a claim could be usurped if not worked within 10 days. As they scrambled, they didn’t start working, and they lost their claim to the mine. His dreams of sudden wealth were momentarily set back. But Clemens had a keen ear for rumors and new opportunities. Some prospectors who found rich ore veins were selling stock in New York City to raise capital for mining operations. In 1863, Clemens accumulated stocks in several such silver mines, sometimes as payment for working as a journalist. In order to lock in his anticipated gains from the stocks, he made a plan to sell his silver shares either when they reached $100,000 in total value or when Nevada voters approved a state constitution (which he thought would erode their long-term value). In 1863, funded by his substantial (paper) stock wealth, Clemens retired from journalism. He traveled west to San Francisco to live the high life. He watched his silver mine stock price quotes in the newspaper, and he felt rich: “I lived at the best hotel, exhibited my clothes in the most conspicuous places, infested the opera. . . . I had longed to be a butterfly, and I was one at last.” Yet after Nevada became a state, Clemens continued to hold on to his stocks, contrary to his plan. Suddenly, the gambling mania on silver stocks ended, and without warning, Clemens found himself virtually broke. “I, the cheerful idiot that had been squandering money like water, and thought myself beyond the reach of misfortune, had not now as much as fifty dollars when I gathered together my various debts and paid them.” Clemens was forced to return to journalism to pay his expenses. He lived on meager pay over the next several years. Even after his great literary and lecture-circuit success in the late nineteenth century, he continued to have difficulty investing wisely. In later life he had very public and large debts, and he was forced to work, often much harder than he wanted, to make ends meet for his family. Clemens had made a plan to sell his silver stock shares when Nevada became a state. His rapid and large gains stoked a sense of invincibility. Soon he deviated from his stock sales plan, stopped paying attention to the market fundamentals, and found himself virtually broke. Clemens was by no means the first or last person to succumb to mining stock excitement. The World’s Work, an investment periodical published decades later, in the early 1900s, was beset by letters from investors asking for advice on mining stocks. The magazine’s response to these letters was straightforward: “Emotion plays too large a part in the business of mining stocks. Enthusiasm, lust for gain, gullibility are the real bases of this trading. The sober common sense of the intelligent businessman has no part in such investment.” (from Meir Statman) While the focus of market manias changes – mining, biotech, Chinese stocks, housing, etc… – the outline of a speculative bubbles remains remarkably similar over the centuries. Today’s newsletter examines the latest research into speculative bubbles and looks at how we can apply that knowledge, with examples of the recent booms (bubbles?) in Chinese stocks and Biotech. This newsletter is much longer than usual letter, in part because the topic is both complex and important. Skip ahead to the end for the Chinese and Biotech conclusions. Speculative bubbles_2 |

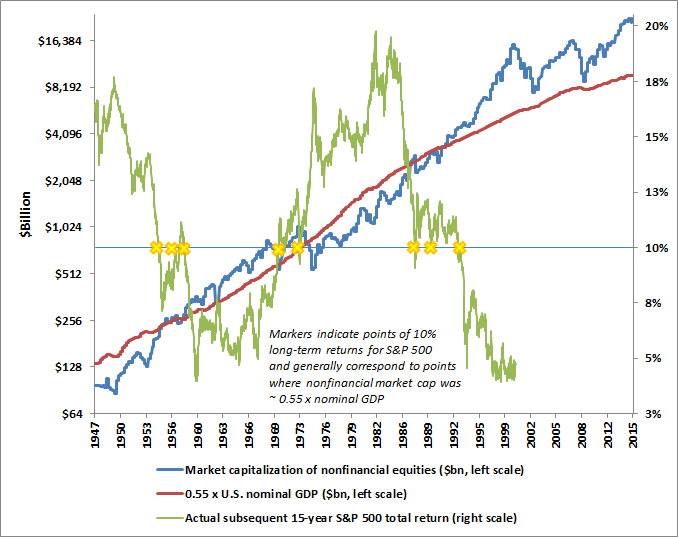

Source: http://hussmanfunds.com/wmc/wmc150504.htm