The History of the Markets through the lens of socionomics

So does social mood CAUSE events or vice-versa? I found the video below interesting but socionomics seems too general for useful application.

VIDEO: http://www.socionomics.net/hhe-part-1/#axzz2uM3BV7in

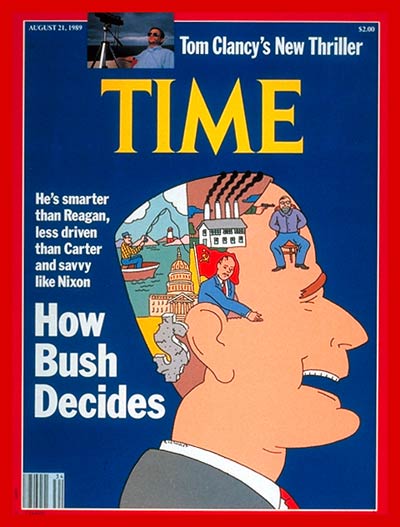

Note the date on the above Time cover–August 21, 1999. America was at its height of exuberance. The NASDAQ peaked in March of 2000 seven months later.

Social Mood and the Stock Market and Presidential Elections

Sex and the Stock Market: http://www.socionomics.net/1999/09/stocks-and-sex-a-socionomic-view-of-demographic-trends/#ixzz2uM4DB7aq

Talk about social mood? How about a bubble in social media? Do they ring a bell at the top? (Remember the AOL/Time Warner merger).

Facebook’s $19 billion takeover of WhatsApp (largely financed by issuing more of FB’s inflated stock, hence the price tag is in a way actually an illusion) has predictably produced a very wide range of reactions. Jeff Macke at Yahoo’s Daily Ticker was describing it as a ‘brilliant deal‘, heaping scorn on critics who in his opinion just don’t understand the value of a business employing metrics other than the money it actually makes (or stands to make in the future even under very generous assumptions, since a major attraction of the service is that it is actually free for one year, and thereafter costs a pittance). “They’ll eventually figure out how to make money from it”, according to Macke. Perhaps; Facebook’s shareholders were no doubt relieved to hear it.

On the other end of the spectrum of reactions, Peter Schiff is criticizing it as just another outgrowth of the latest Fed-induced credit and asset bubble, noting that such pricey takeovers are typically only seen when oodles of money from thin air have flooded the system.

A great post: http://www.acting-man.com/?p=28860

Don’t forget to improve your investing by STUDYING the whole movie–ROUNDERS.