Thanks to www.acting-man.com

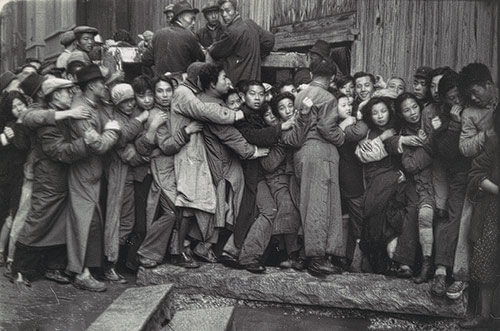

Chinese trying to exchange their currency into gold before the arrival of Mao’s triumph over Chiang Kai-Shek

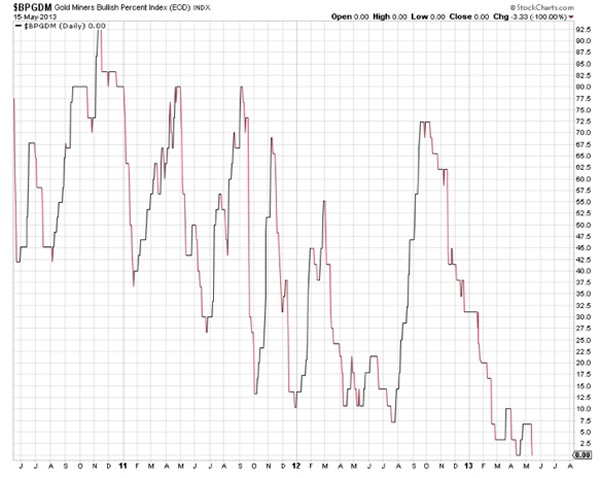

…and if you want to be a Contrarian, then miners is where you want to be…..0 percent recommendation to own miners by financial advisers (May 13). I guess they didn’t survey me.

Here is a case study question: what caused the past great bull and bear markets in gold and mining shares?

Money Managers

MoneyManagerInterviewArticle_Spring_2013

FYI:

June 13, 2013

London, England

[Editor’s note: Tim Price, Director of Investment at PFP Wealth Management in the UK and frequent Sovereign Man contributor, is filling in for Simon this morning.]

As Ben Graham, the father of value investing, observed, an investment operation “is one which, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.”

Challenged to distil the secret of sound investing into just three words, he advocated: “Margin of safety”. Unfortunately for all investors today, the margin of safety has all but disappeared.

To appreciate just how far away we are from normality or any remotely normal “margin of safety”, consider the chart below:

10-year US Treasury yields are at their lowest levels in more than two centuries. Even stranger is that these low yields exist when the US has never been deeper in debt (nearly $17 trillion for the on-balance sheet liabilities) and thus when the supply of Treasuries has never been as large.

Have the laws of supply and demand been repealed ?

If the US bond market is in a bizarre bubble, it is hardly alone. Consider the even longer data series below, a favourite of MoneyWeek’s Merryn Somerset-Webb, via Church House Investment Management.

In the more than three centuries’ history of the Bank of England, the base rate has never been this low.

Right now, these western government bond yields are so low because western governments and their central banks are rigging the market in their own debt.

Governments issue debt, only to have their central banks buy it right back. This creates liquidity for commercial banks that can put that money to more productive use– like artificially inflating their stock markets.

Because market manipulation is normally illegal, the monetary authorities have coined a phrase to give their market rigging an air of technical sophistication: quantitative easing, or QE.

Look back at that chart of US Treasury yields. From the austerity post-war years through the go-go years of the 1960s and the stagflationary disaster of the 1970s, T-bond yields rose from roughly 2% to a grotesque 16% in the early 1980s.

But we are now back to 1945 era yields. Do we think the future outlook is for higher yields, or lower ones ? What does the chart suggest ?

This is a nightmarish environment to be practising Ben Graham-style value investing – because the margin of safety has been destroyed by central bank market manipulation.

Western government bond yields are widely held as the ‘risk free rate’ against which other investments can be assessed. Now there is no longer a risk free rate, only the yield available on hopelessly rigged government bonds.

The manipulation of bond markets has inevitable effects upon stock market valuations too; everything is relative. Cash as a meaningful investment choice has also been destroyed by central bank action (see, again, that chart of the UK base rate).

This means that we – and in turn our clients – are forced to take more risk than we would prefer even if our intention is simply to keep our heads above water.

Investors are now obsessed about the prospect of the Fed “tapering” down its bond purchase programme.

Having painted itself into such a corner, having become the prime mover behind both bond and equity market momentum, the Fed may never be in a position to taper anything.

Nevertheless, this is the hand we’ve been dealt and which we must play. We think there is now a significant risk that QE ends (whenever it does end) in a currency crisis.

Since central banks can barely afford to let market interest rates rise any time soon, they will keep the printing presses rolling instead– and most fiat currencies will be printed toward destruction.

So the fundamental rationale for holding gold is as robust as ever in this hopelessly distorted world. But as Pimco’s Mohamed El-Erian now asks, are the markets now beginning to lose confidence in central bankers ? We certainly have.

Tim Price