-

-

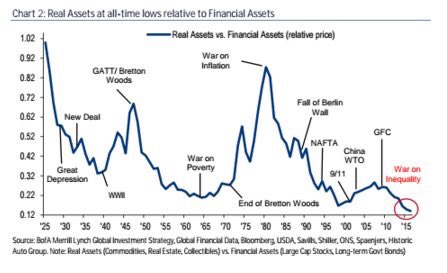

How very odd concerning the recent increase of property prices.

-

And collectibles. Just tells you how bad commodities have been.

-

-

-

couple that graph with the one of financial wealth to gdp and you have quite the story.

-

Yes indeed. This chart gave me quite the pause to think

-

-

No, no... financial assets at all-time high relative to real assets. That´s the point.

-

-

@J0nathanDavis Good time to buy real assets then? -

and here was me thinking you followed my tweets.

@jessefelder@Macronomics1 -

Yes U been saying 4 while but property out, gold volatile, So how best to hold other real assets?

-

lots of ways but that wasn't your question. ETFs, Inv Trusts, Unit Trusts (OEICs), shares, bullion etc etc

-

Thought we are talking about owning physical asset (gold coins, piece of land) not a paper iou? jim rickards et alt

-

there are a number of bullion funds

-

-

From an inverse view: Financial (intangible) assets are at all-time highs relative to real (physical) assets.

-

Jesse, real, "Real Assets" Real Estate, Art, Collectables are flying.

-

Interesting if you adjusted to secular trends of PPE being replaced with intangible assets in the economy

-

Hey! maybe bc we have electronic money & a tech banking system we have other options to cash or hard assets?!

-

-

Nice chart! In 1970 Gold closed at $38.90 and closed at $1980 in 1980 a 15x return. Silver actually outperformed.

-

sorry typo. Closed at $594 in 1980 my bad.

-

-

Yes. "Stuff" is cheap. A compelling valuation when an alternative to financial assets is needed.

-

Great chart!

Loading seems to be taking a while.

Twitter may be over capacity or experiencing a momentary hiccup. Try again or visit Twitter Status for more information.