Time-out: How to Think and How to read a book Worth reviewing.

As a supplement to Chapter 2, Contrarians at the Gate in DEEP VALUE, please read the highlighted paragraphs on liquidation value in Seth Klarman’s chapter on Valuation (Chapter 8 in Margin of Safety and emailed to the Deep Value Group at Google).

You will understand

- how wide the range of valuations can become

- how uncertain valuation is.

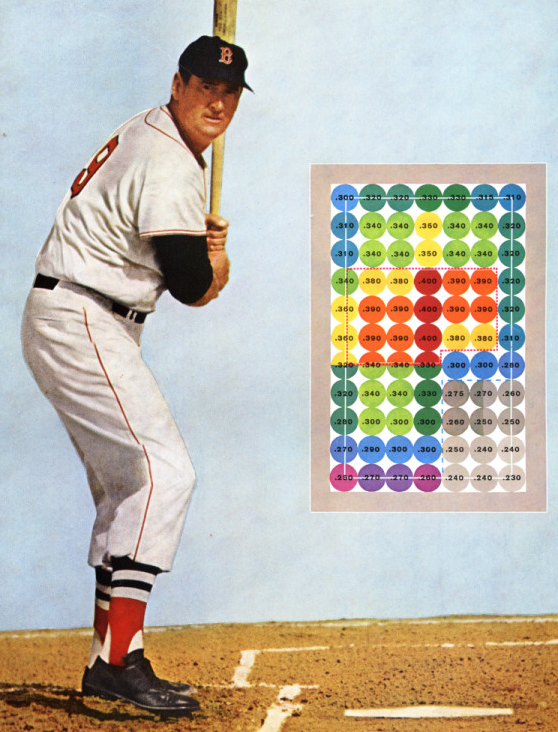

Therefore, a value investor passes on what he or she can’t understand or uses CONSERVATIVE assumptions to build-in a margin of safety.

Take your time and read the above chapter carefully, especially his case study on Esco Electronics. He makes a compelling case. The difference between price and intrinsic value (determined several ways) is ASTOUNDING. A great investment should slap you in the face–it should be obvious, but then you might say what am I missing? You can’t believe the opportunity.

To reveal one of the secrets of this course (shh..) by the time we have journeyed through the readings, examples, videos, and cases, you will realize that if you are buying assets like net/nets, then you must buy them VERY cheaply to allow REVERSION to the MEAN to work.

Or if you go the Munger/Buffett (in his later years) route and buy franchises with moats around them (the companies have high returns on invested capital and they either grow profitability or return excess cash to shareholders) those companies are RARELY on sale. The franchise moat (barrier to entry) slows the reversion to the mean process while high profitability allows for compounding of capital–an investor’s nirvana.

Great investments are FEW and FAR BETWEEN unless markets are in a huge dislocation. Keep waiting and waiting until the money is just lying there for you to safely pick it up. In other words wait for:

Can any pretty women taking this course teach the others:

Certainly we need to do better than this:

I will be posting a lesson index shortly. We will tackle Chapter 1, The Paradox of Dumb Money, of Quantitative Value next before we move back to Chapter 3 in Deep Value and read Buffett’s Partnership letters (to be posted).

7 responses to “Liquidation Valuation (Ch. 2 Deep Value)”