A Strategy for investing in highly volatile, cyclical stocks

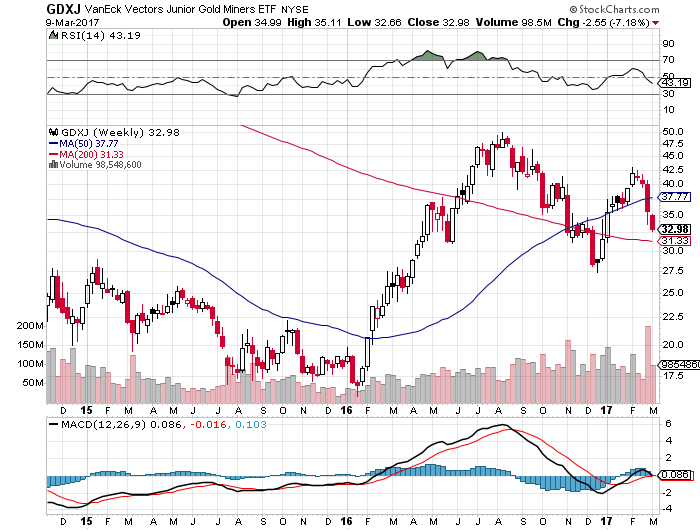

Once again, gold, silver and their mining stocks are selling off for whatever reason: risk-on as money floods into the stock market, rising nominal yields, 95% certainty of a (meaningless) 0.25% interest rate hike, momentum–take your excuse. The main point is to know your companies (valuation) and wait for sales like you do at the grocery store. This week we are having a sale on some miners.

As Sprott’s Rick Rule often says, “If you are not a contrarian in the resource sector, you are a victim. The above video is provided to show a particular investing strategy when your quality miners are selling off to prices where you estimate a margin of safety. However, it doesn’t mean you predict THE exact bottom. If your holding period is three-to-five years, you can occasionally pick up cheaper merchandise. Use prices to your advantage, not disadvantage. I also wouldn’t be surprised to see the miners sell-off further because of their highly volatile nature–huge operational and asset-based leverage–when gold or silver goes up or down, both the price of their product goes up or down and the value of their reserves. Never expect exact timing–a fool’s game. Also, miners are impacted by the cost of their inputs, so a rising gold/oil ratio is a positive, for example.

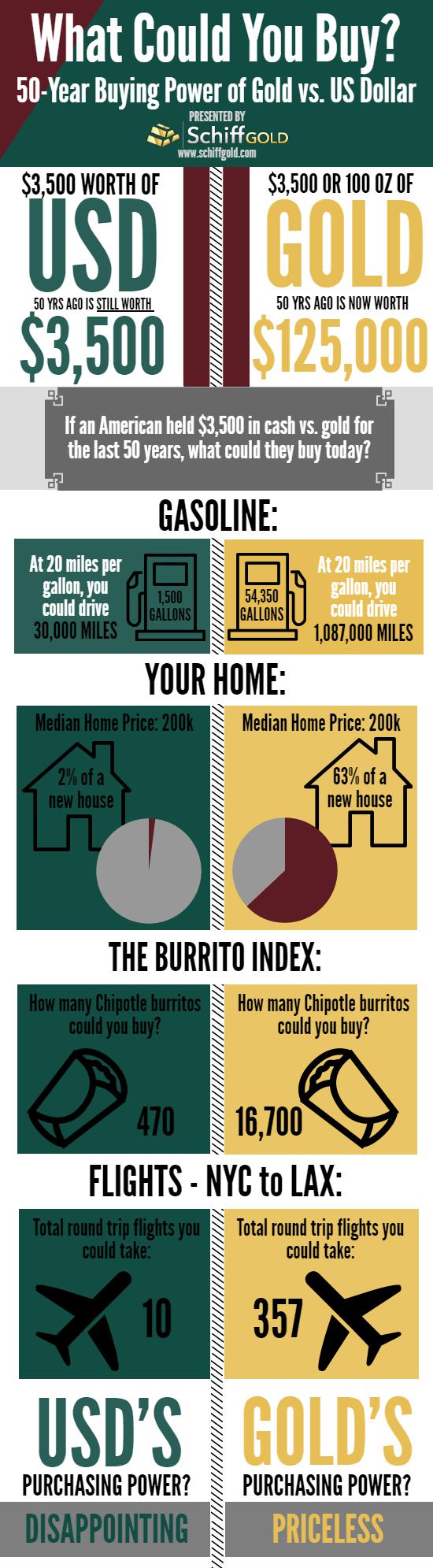

What about the gold price in my assumptions? I am assuming gold is money (“All else is credit”–JP Morgan) and thus I can benchmark it against world currencies. Gold has been THE strongest money relative to all other currencies for the past 20 years, 30 years, 40 years, 50 years, 100 years. Gold is THE only money and store of value that can’t be created out of electronic bits like FIAT MONEY. The stability of available supple is what makes gold the premier money. Of course, due to LEGAL TENDER LAWS, gold is not a currency in the U.S., except that may be changing in some states like Arizona: http://planetfreewill.com/2017/03/09/Ron-paul-testifies-support-arizona-bill-treat-gold-silver-money-remove-capital-gains-taxes/.

In fact, gold (originally silver) is the only Constitutional money allowed–http://www.heritage.org/constitution/#!/articles/1/essays/42/coinage-clause

You can get a historical overview of gold’s‘ price history below. Notice a trend?

http://www.macrotrends.net/1440/hui-to-gold-ratio Now view the miners in perspective.

P.S. Let me know if anyone wants to see a NPV case study on a miner.

—

Designing an analyst course

My goal is to organize a comprehensive analyst course using the best investors’ teachings and lectures. For example, Buffett, Munger, Graham, Fisher, Tweedy Browne, Walter Schloss, Klarman, and many others etc. Why not use original sources of the best practitioners? This is the course I wish I had twenty years ago. It will be Buffett and Munger teaching not me.

The course would cover search, valuation, portfolio management, and you (how to improve decision-making). There would be different modules continuing articles, case studies, videos from Columbia Business School and others. We would go from DEEP VALUE to FRANCHISE INVESTING. Valuing assets to assessing franchises. Understanding reversion to the mean and slow reversion to the mean. You need to understand that when a moat is breached-watch out! Note Nokia in cell phones.

I would have to make it a private web-site because of copy-right. This would be more of like a private study place, library, and discussion area for learning. There could be a in-person value class in some convenient location depending upon interest once folks have had a chance to go through the modules.

For example, putting ebitda into perspective might be a mini-module on a sub-set of cash-flow: http://csinvesting.org/placing-ev-and-ebitda-into-perspective-case-studies/ Now, if you scroll down to the last link, you can see that it was taken down. With a private web-site, you would see this: http://csinvesting.org/wp-content/uploads/2012/09/placing-ebitda-into-perspective.pdf

Let me know your thoughts because this would be a huge project to complete. What focus do YOU want? How would YOU design and make the course.

Have a great weekend!