Investing might be considered decision-making under uncertainty. Therefore the following exam.

You must answer BOTH questions correctly to be hired. You are now in the final pool of candidates to work for a big hedgie fund. Now comes

Question 1:

Imagine playing the following game, At a casino table is a brass urn containing 100 balls, 50 red and 50 black. You’re asked to choose a color. Your choice is recorded but not revealed to anyone, after which the casino attendant draws a ball randomly out of the urn. If the color you chose is the same as the color of the ball, you win $10,000. If it isn’t, you win nothing-$0.00.

You are only allowed to play once–which color would you prefer, and what is the maximum bid you would pay to play? Why?

—

Question 2:

Now imagine playing the same game, but with a second urn containing 100 balls in UNKNOWN proportions. There might be 100 black balls and no red balls, or 100 red balls and no black balls or ANY proportion in between those two extremes. Suppose we play the exact same game as game 1, but using this urn containing balls of unknown colors.

What is your bid to play this game IF you decide to play? How does the “risk” in this game (#2) compare to game (#1)?

Take no more than a minute. So are you hired?!

Answer posted this weekend.

ANSWER (9/10/2017)

A Reader provides a clearer distinction in Question2:

Your second problem is ill-specified for your desired effect . You write that all combinations of red/black balls within the 100 ball population ARE possible; you don’t say they are equally probable. You need to assume them to be equally probable in order for the reader to infer that the expectations are identical between problem 1 and problem 2.

The reason being is that without defined probabilities on the possible ratios the long run frequency of draws from the second bag isn’t calculable. Hence the expected value cannot be computed and therefore cannot be used in comparison to the EV of problem 1 (you need probabilities in a probability weighted average after all).

You could suggest that the offeree has a 50/50 chance of choosing the correct colour (even if the long run frequencies are not known). But this not an argument born from expected value. This is an argument of chance and it assumes the offeree has no additional information from which to make their decision (which is hardly ever the case).

—

There are 100 possible choices for the proportion of red/black: 100 red balls/0 black balls, 99 red balls/1 black ball etc., 98/2, 97/3 with 100%, 99%, 98%, 97% probability of choosing a black ball all the way………… to 2 black balls/98 red balls, 1/99, 0/100. Put equal weight on them since random. When computed, the average of the expected payoffs across all these alternative realities, one got an expected value of $5,000, the same as Game 1.

The two games describesthe Ellsberg Paradox, after the example in Ellsberg’s seminal paper. Thinking isn’t the same as feeling. You can think the two games have equal odds, but you just don’t feel the same about them. When there is any uncertainty about those risks, they immediately become more cautious and conservative. Fear of the unknown is one of the most potent kinds of fear there is, and the natural reaction is to get as far away from it as possible.

So, if you said the two games were exactly similar in probabilities, then A+. The price you would bid depends upon your margin of safety/comfort. You would be rational to bid $4,999.99 since that is less than the expected payoff of $5,000. But the loss of $4,999.99 might not be worth it despite the positive pay-off. A bid of $3,000 or $1,000 might be rational for you. The main point is to understand that the two games were similar but didn’t appear to be on the surface.

The Ellsberg paradox is a paradox in decision theory in which people’s choices violate the postulates of subjective expected utility. It is generally taken to be evidence for ambiguity aversion. The paradox was popularized by Daniel Ellsberg, although a version of it was noted considerably earlier by John Maynard Keynes. READ his paper: ellsberg

Who was fooled?

—

Anyone not answering correctly or NOT answering has to go on a date with my ex:

—

The Stock Market: Risk vs. Uncertainty

Life is risky. The future is uncertain. We’ve all heard these statements, but how well do we understand the concepts behind them? More specifically, what do risk and uncertainty imply for stock market investments? Is there any difference in these two terms?

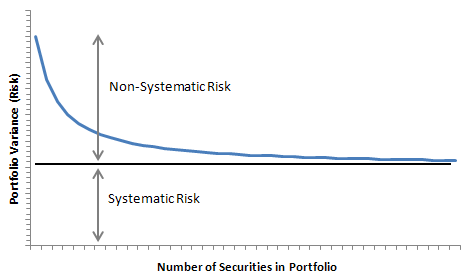

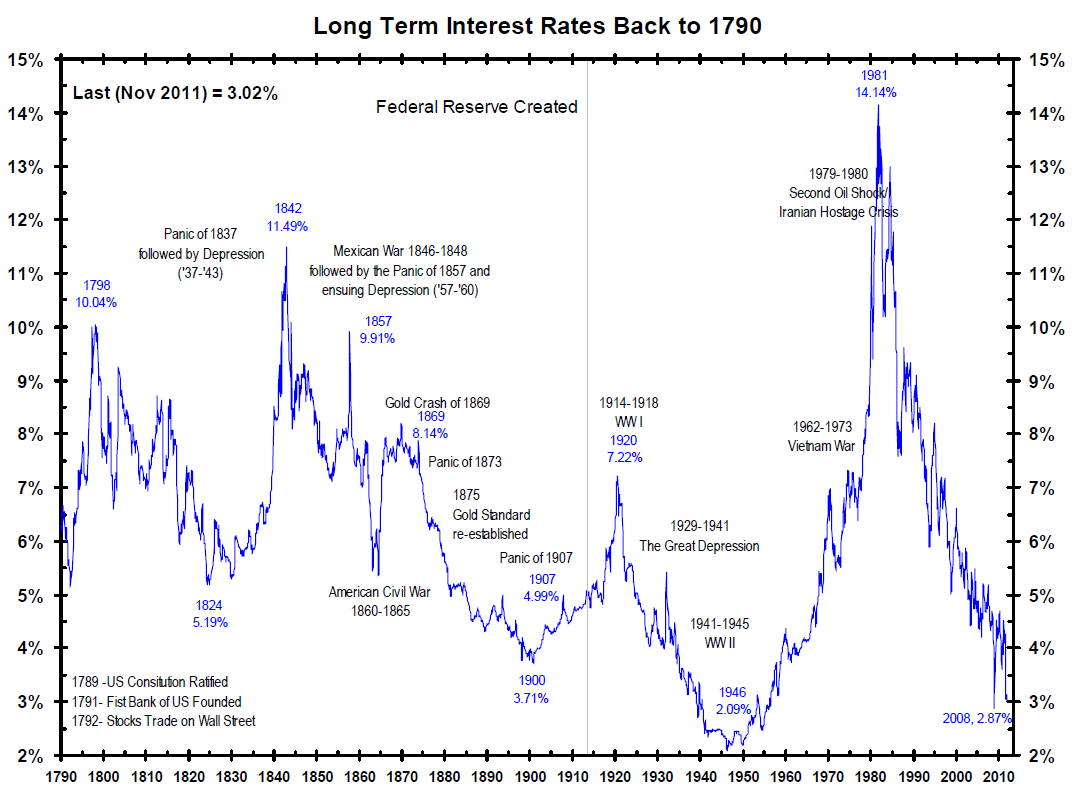

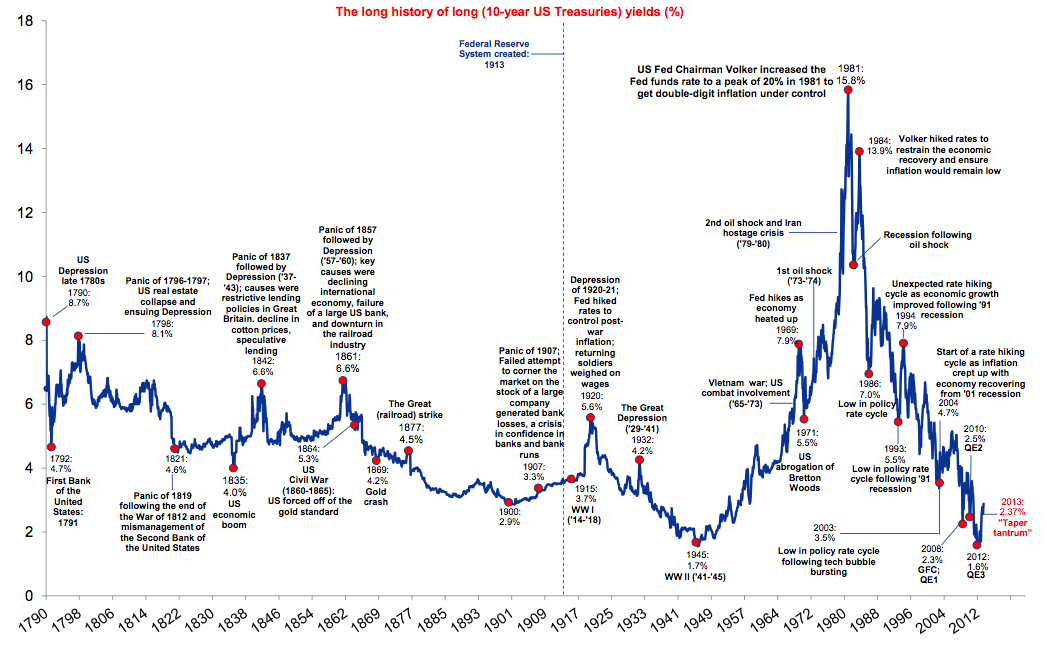

Risk and uncertainty both relate to the same underlying concept—randomness. Risk is randomness in which events have measurable probabilities, wrote economist Frank Knight in 1921 in Meaning of Risk and Uncertainty.1 Probabilities may be attained either by deduction (using theoretical models) or induction (using the observed frequency of events). For example, we can easily deduce the probabilities of the possible outcomes of a game of dice. Similarly, economists can deduce probability distributions for stock market returns based on theoretical models of investor behavior.

On the other hand, induction allows us to calculate probabilities from past observations where theoretical models are unavailable, possibly because of a lack of knowledge about the underlying relation between cause and effect. For instance, we can induce the probability of suffering a head injury when riding a bicycle by observing how frequently it has happened in the past. In a like manner, economists estimate probability distributions for stock market returns from the history of past returns.

Whereas risk is quantifiable randomness, uncertainty isn’t. It applies to situations in which the world is not well-charted. First, our world view might be insufficient from the start. Second, the way the world operates might change so that past observations offer little guidance for the future. Once bicyclists were encouraged to wear helmets, the relation between riding the bicycle—the cause—and the probability of suffering a head injury—the effect—changed. You might simply think that the introduction of helmets would have reduced the number of head injuries. Rather, the opposite happened. The number of head injuries actually increased, possibly because helmet wearing bikers started riding in a more risky manner due to a false perception of safety.2

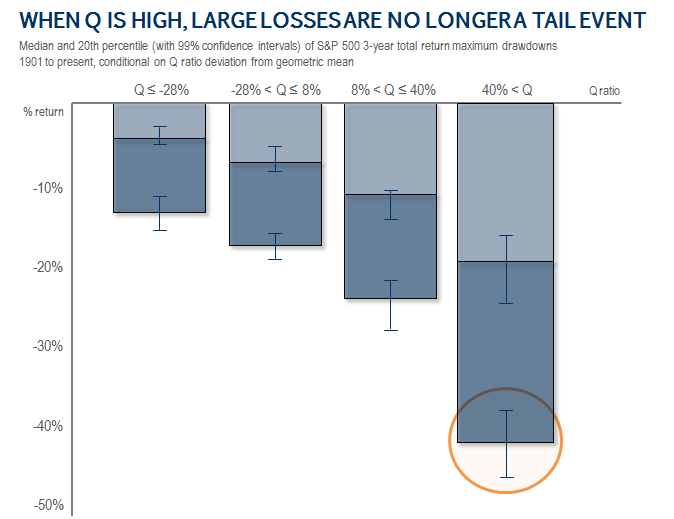

Typically, in situations of choice, risk and uncertainty both apply. Many situations of choice are unprecedented, and uncertainty about the underlying relation between cause and effect is often present. Given that risk is quantifiable, it is not surprising that academic literature on stock market randomness deals exclusively with stock market risk. On the other hand, ignorance of uncertainty may be hazardous to the investor’s financial health.

Stock market uncertainty relates to imperfect information about how the world behaves. First, how well do we understand the process that generated historical stock market returns? Second, even if we had perfect information about past processes, can we assume that the same relation between cause and effect will apply in the future?

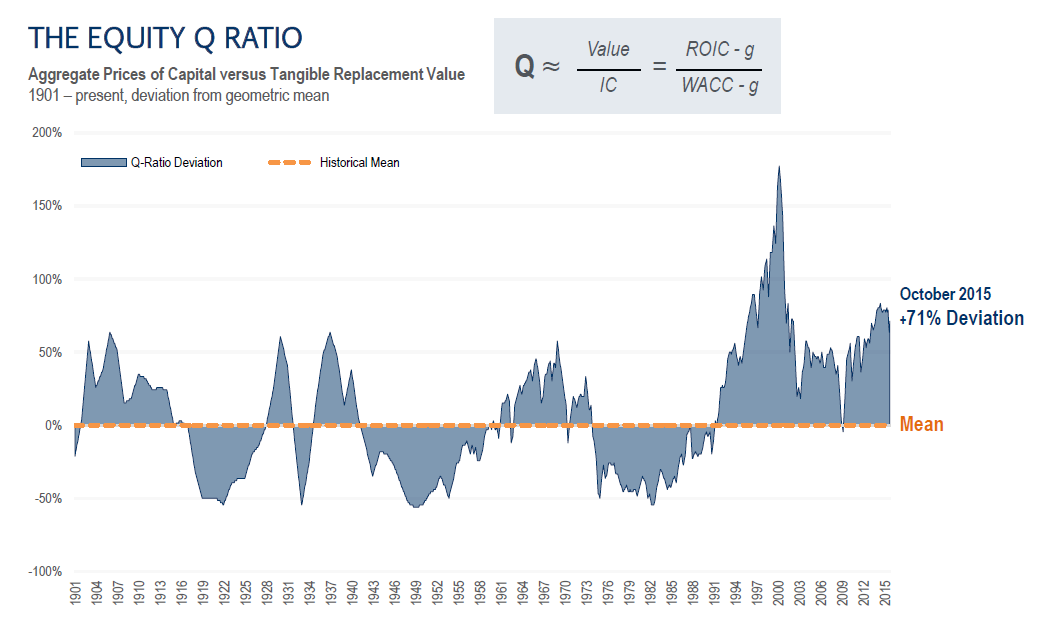

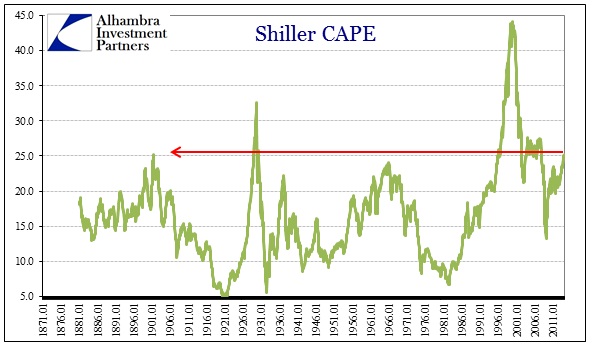

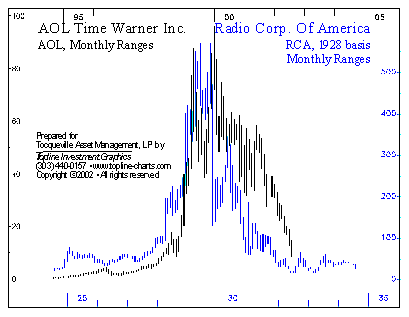

The Highs and Lows of the Market

Warren Buffett, the world’s second-richest man, distinguishes between periods of comparatively high and low stock market valuation. In the early 1920s, stock market valuation was comparatively low, as measured by the inflation-adjusted present value of future dividends. The attractive valuation of stocks relative to bonds became a widely held belief after Edgar Lawrence Smith published a book in 1924 on stock market valuation, Common Stocks as Long Term Investments. Smith argued that stocks not only offer dividends, but also capital appreciation through retained earnings. The book, which was reviewed by John Maynard Keynes in 1925, gave cause to an unprecedented stock market appreciation. The inflation-adjusted annual average growth rate of a buy-and-hold investment in large-company stocks established at the end of 1925 amounted to a staggering 32.13 percent at the end of 1928.

On the other hand, over the next four years, this portfolio depreciated at an average annual rate of 17.28 percent, inflation-adjusted. Taken together, over the entire seven-year period, the inflation-adjusted average annual growth rate of this portfolio came to a meager 1.11 percent. Buy-and-hold portfolios in allegedly unattractive long-term corporate and government bonds, on the other hand, grew at inflation-adjusted average annual rates of 10.18 and 9.83 percent, respectively. This proves Buffett’s point: “What the few bought for the right reason in 1925, the many bought for the wrong reason in 1929.” One conclusion from this episode is that learning about the stock market may feed back into the market and, by changing the behavior of the market, render our “learning” useless or—if we don’t recognize the feedback effect—hazardous.

Is Tomorrow Another Day?

Risk and uncertainty are two concepts that stem from randomness. Neither is fully understood. Although risk is quantifiable, uncertainty is not. Rather, uncertainty arises from imperfect knowledge about the way the world behaves. Most importantly, uncertainty relates to the questions of how to deal with the unprecedented, and whether the world will behave tomorrow in the way as it behaved in the past.

This article was adapted from “The Stock Market: Beyond Risk Lies Uncertainty,” which was written by Frank A. Schmid and appeared in the July 2002 issue of The Regional Economist, a St. Louis Fed publication.

(Source: St Louis Federal Reserve)