A Reader posted his struggle here:http://wp.me/p1PgpH-FF

Other readers generously shared their wisdom below (slight editing for brevity and my comments in Italics)

19 Responses to A Reader Seeks Advice

I, too, am trying to teach myself how to properly value a business. I feel lost as well. I have more finance/investing books than I know what to do with and my time studying may be spread too thin and that I would be better off focusing on the few materials that are really worth it.

So far, the few books that I have found helpful (and always come back to) in determining how to value a company and what drives value are:

“Valuation” (McKinsey), “Accounting for Value” (Penman), and “Financial Statement Analysis and Security Valuation” (Penman). I’ve heard a good intro into accounting and financial statement analysis is “Financial Statement Analysis” (Thomas Ittelson), although I have not read this book.

One thing that I have noticed (learned?) as I read more and more (particularly from this blog), is that valuation may be the easy part. It’s not too hard to find a company that has a high ROIC and good earnings. I think the more important question, is whether the high ROIC and earnings are sustainable and what they will look like 10-20 years down the road. Don’t miss the forest for the trees (I think that is how the quote goes). That said, I think books that help frame this question and focus the analysis are: “Competition Demystified” (Greenwald), “The Little Book that Builds Wealth” (Dorsey), and “Hidden Champions” (Simon), help show what makes a business superior to others (the moat) and how wide/long a competitive advantage may be.

I would love feedback from others, as I am also looking for the few books to know “cold” and so that can get more “value” out of my time reading and studying.

Hope this helps. It certainly does–good suggestions. I second spending time on focusing on what is a good business. On this blog are valuation case studies from Greenblatt and Greenwald but they are scattered over 300 posts and the lectures are on video in the vault folders. If you want me to group the cases with the videos in a valuation case study folder, I will. For example, (type in word in blog search box: Munsingwear, Duff & Phelps, Hudson General, Moody’s, etc. for valuation case studies)

Buffett said he would only teach two things: How to think about prices and how to value. I believed he said he would teach about valuing a farm first. How many acres, yields, cost of fertilizer, variability of crops, range of prices, cost to borrow and what cash is left over then discount back to the present. He mentioned to Bernstein the Reporter from the Washington Post, that valuation is like reporting on a story–What’s it worth?

Warren | April 26, 2012 at 12:41 pm | Reply | Edit

Your reader sounds like a smart guy, but doesn’t have a firm foundation on basics of finance. He could always elect to take NYU’s Damodaran’s free course on Corporate Finance and learn about WACC etc.

I have spoken to other great investors too, and they will tell you that going to Columbia or Harvard will not make you a great analyst/investor – if that was the case that CBS tuition would not be affordable, because all the graduates would eventual be billionaires. Insert Ben Graham quote here: “courage becomes the supreme virtue after adequate knowledge and a tested judgment are at hand”. They don’t teach judgement or courage at business school.

CBS lets in roughly 40 people into their AVI program out of about 150 who apply. So the odds are against you and I heard there is no rhyme or reason to how individuals get selected. As an anecdote, there is always only one person of African descendant in the program! BUT, if you are student at CBS and not in the program, professor will allow you access to their classes as an auditor.

Building a network and finding a mentor are very difficult. Finding a mentor is hard even if you go to CBS, most people who find a mentor are lucky in my opinion. I work in the same building as a famous investor who is an alumnus CBS and asked to met with him. He wrote back and said, I find meeting with people a waste of my time!

I do find business school, great in terms of building a network, but you can go to any of the top MBA programs, join the investment clubs and build from their. Another piece of advice, CBS is not very strong in terms of the intimacy of their network, you are better off at HBS or Stanford IMO.

4 years ago, I was accepted into CBS’s MBA program, I could not attend because that was the year the financial crisis destroyed the international student loan program. CBS was the only Ivy League school they did not backstop its International Students that were admitted in those years. With no American cosigner, I was unable to get financing despite trying for 3 years and a Value Investing Need Based Scholarship.

Fortunately and unfortunately, I am on the buy-side, but not at the fund I would aspire to work for. What I am finding out now is that and MBA from a top school is a good option, if you want to want to move into a better firm.

Ironically, I am still saving up for CBS’s MBA program and plan to attend one day, so I can move to a place with a mentor and build a network. I am not looking elsewhere, because I recently moved my family to NYC and my daughter loves it here.

Investing is a continual learning process, business school can only accelerate that so much.

Krishnasinha1 | April 26, 2012 at 12:54 pm | I’d be very interested in any useful advice that readers have here, as i am in a similar boat (although i’m only 26). I’m also struggling with learning effective techniques to do valuations and develop a strong understanding of financial statements and accounting. I tossed Damodaran’s book after he started talking about Beta, and unfortunately i didn’t really get much from Greenwald’s book on the topic either (is it just me or does this guy talk the talk but then not really walk the walk? Everytime i see a pro like Einhorn or Michael Price talk about a valuation i’m thoroughly impressed and they never talk about reproduction values etc. that Greenwald always emphasizes). Editor: Greenblatt does not believe in using reproduction value since it is hard to do accurately. Also, Prof. Greenwald wants to be the smartest person in the room, not the best investor. You have to read what he says with your own independent mind. I think his book, Comp. Demystified is good, but even there, you need to not take everything on blind faith. Do the concepts make sense to YOU. What a great value investor (hired by Buffett 30 years ago) told me, “Sit down with a Value Line and segment the great, normal and bad businesses, then choose an industry that you might enjoy learning about to read the 10-Ks of the major companies in that industry. Have your accounting texts alongside to answer your questions of the financial statements, read about the industry and how managers think about the business. Get a sense of good businesses and what you would pay. Try always to apply your knowledge to the real world of businesses–theory to application–it is more fun that way. If you apply yourself every day intensely on the right things, then within ten years, you will gain a sense of mastery (somewhat). See books on the steps to mastery on any difficult subject–race car driving, chess, martial arts, etc.

On that note, The only advice i can give you as someone who is completely self-taught and basically only started reading about value investing 3 years ago is the following:

READ EVERYTHING: When i first started, i read a lot of the books that talked about the psychology and theory of value investing. I started with “The Little Book of Value Investing” by Chris Browne. That is an excellent primer, and then i built from there, reading Margin of Safety by Klarman (Free in the VALUE Vault–just email aldridge56@aol.com with Margin of Safety in Headline, and interviews with a lot of top hedge fund guys. Even if i didn’t understand everything they were talking about in terms of specific financial jargon, having the main theory hammered into me for a few years really prepares you for the turbulence in the market. Now, when one of my stocks goes down, i always have enough confidence to double down on it if i truly understand the stock. (Side note here, i still haven’t actually read Security Analysis or Intelligent Investor all the way through, everyone hypes those books but they are not for a novice and i always found myself in over my head when trying to read them, start with other more recent books, the same concepts are covered but are often explained more clearly and concisely).

In addition, look for articles where respectable hedge fund managers discuss their thesis on an investment (Einhorn, Ackman, michael price, etc.) Read the Graham and Doddsville Newsletter from Columbia business school (free on their website) where these managers get interviewed and read their “Letters to the Investors” when you get the chance. You’ll notice that they don’t necessarily spend a lot of time talking about specific accounting numbers, they have a lot of understanding of the businesses themselves and the business models. You’ll rarely see them get into an esoteric conversation on how accurate the GAAP Earnings figure is, but you will see them discuss why they think earnings are depressed or why they will rebound and why the market is overreacting. That is far more fundamental to value investing than knowing a lot about accounting in my experience. When you read Buffetts letters (i highly recommend reading his partnership letters), you’ll see that even then, he doesn’t talk about the specifics of the balance sheet, but rather, the few simple reasons about why the stock is cheap. It is MUCH easier for me to grasp those principles than to learn the minutiae of financial statements, and you can even successfully pick stocks by applying simple techniques.

Speaking of simple techniques, there are 2 books that really stand out (besides Greenblatt’s magic formula, which is a good book but i can sense you want more than that). The first book is Why Do Stocks Go Up (and Down)? It was recommended by Michael Burry and i recommend it whole heartedly to you, it’s very very simple and illuminates most of what you need to know in terms of financial statements. The second book is the 5 Keys to Value Investing (found out about it from this site actually!), The reason this book turned me on was because Michael Price is my biggest influence (my goal is to work for him at MFP Investors) and the author of this book worked for him when he was at Mutual Series. He sets out very clear and basic criteria for investing in stocks and shows you exactly how he does it, there is no guesswork involved, and the explanations are very clear and detailed. I highly recommend that book. Again, it doesn’t require that much in terms of financial statement knowledge to grasp the concepts, and you’ll learn all you need to know from the Why Do Stocks Go Up book anyways.

By the way, i highly recommend reading up about successful value investors and picking a few whose style you admire, for me that’s michael price, for you it may be someone else. Read their 13-F’s, read their explanations, and then go to EDGAR online and try to put together the same stories that they tell using your own intuition, it will be slow and painful the first few times but you will learn exponentially.

I think the most important advice that i can give though is to remember that it is a marathon, not a sprint, i struggle with this a lot myself because i always think i should be learning faster and that i’m so far behind other people. True! True! The fact of the matter is if you keep reading and keep doing your own research you will soon find that your brain starts making a lot of connections and things slowly become clear to you. Like i said, i’ve only been studying investing for 3 years, and i still haven’t learned even a fraction of what i could know, but i get up every day and read SOMETHING investing related, every single day.

So again, i hope that advice helps, and i’d be interested to hear what people recommend to learn about accounting and financial statement analysis.

Regards, Krishna

Editor: Let me mention two books for helping you start your journey:

Logan James | April 26, 2012 at 2:11 pm | Reply | Edit

Perhaps it would be instructive to work on a more comprehensive valuation case study as a group. I would be willing to participate. Anyone else?

We’ve briefly covered valuation a few posts back when we were going through a few Value Line case studies. That could serve as a good starting point. Editor: Dear Logan, please see comment at top of this post.

I have a question. How much do each of you rely on gathering data/information in spreadsheets on companies? Does it depend on the complexity of the investment? For example, David Einhorn, Ackman, etc. usually have 50+ slide deck presentations for the investments they present to the public. Do you think that much work is necessary? I know some private investors that deeply analyze complex investment situations (i.e. Sears Holdings), These guys go through and essentially look at everything. For a person working on their own, this task seems very cumbersome. Other investors think more about the businesses they are analyzing, so their spreadsheets and models are less complex.

Would appreciate feedback.

Thanks.

Ankit Gupta | April 26, 2012 at 3:45 pm | Reply | Edit

I think the reader who emailed you will be *far more* successful than most value investors, simply because he is cognizant of the existence of things he doesn’t know about. I tell people that the less they know about finance, the better, because calculating numbers is just a very small portion of it, in my opinion.

I don’t know that I can recommend how to get started, but I would consider the length of what you’re doing. For example, let’s say that you’re writing auto loans. If you write a 1 year loan, then you’ll know how you did after just 1 year. If you write a 5 year loan, then it will take a little longer, and it’ll be 5 years before you know how you really performed.

Stocks? Buffett has called these “100 year bonds” in a 1977 Fortune article that he wrote. It takes a much longer time.

I still have a ton of work to do, but I will say that I started out with the shorter-term views by focusing on things like liquidation value. As I’ve progressed, I’m now looking around trying to find companies that I would be comfortable owning in their entirety and never selling them. The finance aspect can be handled, but the tougher part is just finding businesses that I really like and am willing to own for 20-30 years. (Editor: OK, if you hold a business for 25 years, you will receive the return on equity over that time. If you can find companies that can compound their capital at high rates–not easy to do–then hold them!)

Today, I start with understanding business and business strategy before valuations. Using historical data has many benefits, however requires a lot of discretion and judgement when projecting anything out into the future, and so I let that almost be a secondary aspect of what I’m doing. ASTUTE!

I could be wrong too though – we won’t know for a long time.

PT | April 26, 2012 at 3:58 pm

I would also like to make a humble contrarian comment, within the frame of the transformation from a trader to a value investor.

I do know most people who are reading this blog are interested in ‘value investing’ so it is natural to only consider this path of investing on this blog. In my opinion however, I think investing is about allocating money to get a certain (ex-ante) return versus risk award. How you define return and risk is of course subject to the personal interpretation of you as a capital allocator.

In a broad sense this capital allocation can take any form. You can work with ETFs, you can trade commodities, you can invest in bonds, you can have your own start-up in whatever business, you can invest à la Buffet, etc. As long as your investment approach satisfies your needs and you stick to it, you should be fine.

By this I mean…I don’t think you should consider value investing as the only possible investment approach. For me it makes sense since I always want to understand situations and a big part of value investing for me is to understand the business you are investing in. I think this should be the starting point why you pursue a ‘value investing’ approach. So first I believe you should write your goals and beliefs on a piece of paper, and then you could see this type of investing fits you.

Just some random comments of course:)

Excellent comments. There are successful momentum traders/investors, etc. Value investing (search for bargains, paying a discount, etc.) is just one method that has to fit YOUR personality. Also, do not just think of equities; there are debt markets, tax liens, burial plots, art, etc. where value can be found.

I would agree with you – sometimes value investing takes form in many places, like the startup world, commodities, bankruptcies, etc. That said, I think you can take the same thing, even Coca Cola stock, and it can be speculative to one person while a value investment to another. I’m not sure what we invest in matters nearly as much as how well we know the item we’re investing in… and, of course, price

(Sometimes… I think the price we pay is actually going to modify the actual business outcome. If we invest in a startup at a very low price and management ends up with a miniscule ownership in the business, they may be demotivated, so price alone isn’t the only thing I personally look at, just as an example)

PT | April 26, 2012 at 4:02 pm

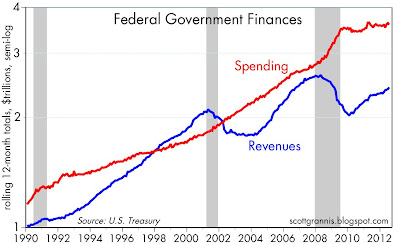

Something else that helps me (I’m still at the beginning of my investment path so) is to look at history in terms of inflation, bond yields, equity returns, bankruptcies, etc. And by history I don’t mean the history of bond yields as available in Bloomberg as of 1962…go for example to Shiller’s website and look at data from 1900.

PT | April 26, 2012 at 4:04 pm | Reply | Edit

Btw, if you would go in the fund industry…also read the latest GMO and Research Puzzle article.

valueprax | April 26, 2012 at 6:55 pm | Reply | Edit

The best advice we can give others is usually the best advice we can give ourselves, so, in that vein, I offer this:

Spend more time looking at actual companies and their actual financial statements and historical data, and less time reading theory. The theory all backs up and becomes gobbeldy-gook if you’re not continually applying it in a practical manner to REAL companies. (Well said and great advice–your goal is to apply what you have learned and then learn from what you have applied.)

There are THOUSANDS of companies with financial data out there, waiting to be examined. You will not find a bargain every time you look at one. You WILL learn something each time, however, and that’s invaluable.

Part of Buffett’s humongous advantage is the great VOLUME of companies, deals, trades, etc., he’s considered and actually looked at. When you do so, patterns and one-offs start to jump out at you. You scratch your head less and go “a-ha!” more.

How is business school going to do that work for you? It won’t. If you’re going to be a great value investor, you’ll find a way to do it on your own, as you must. Business school, generally, is for people who want to go work for others, not for themselves.

Summed up, “Put down your value investing books, pick up your Value Line tearsheets. Start digging.”

Man, if I just could learn to take my own advice, Buffett himself might have to look out!

I am im the same boat as op, in that i am trying to teach myself and i find it all very confusing.

I also find it that having only a high school edu. Makes learning that much slower. Thats why i respected walter schloss so much.he found and applied a system and it worked very well.

The best advice i can give anyone in a situation like mine is to rewrite the concepts and simplify them so that they make sense to you.

Editor: One of the best investors I have ever known dropped out of high school, worked odd jobs while spending all night in the public library; he skimped and he saved $5,000 dollars and over 9 or 10 years took his account to about 2 million $ (yes, he used options and leverage, but he was very selective, and he didn’t put everything on just one bet. He would admit he was lucky in part, but he stayed humble too. Anyway he lives with his wife like a king on $800 a month in Central America near the mountains and beach. Retired at 32.

Roy | April 26, 2012 at 9:43 pm |

+1 for valueprax. If you have already read The Intelligent Investor, Margin of Safety etc. Spend your time on reading financial statements and not more books. When you go over a statement and you are not clear about something simply search it on the net. Editor: That is the exact same advice I gave. And don’t be intimidated by lack of MBA, CFA, ZZA, etc. Just start and humbly move forward step by step each day.

—

As you can see excellent thoughts, suggestions and wisdom shared!

Rent the movie, Other People’s Money with Danny Devito (an early post on this blog) and see how he values NE Wire and Cable.