The fundamental problem facing the federal government (and for all the governments of Western Civilization), namely, that it has overextended its promises vastly beyond its ability to deliver on these promises.–Gary North

Ok, I have beaten this subject to death, but I will leave the subjects of debt, deficit and default–for now– with this important post for easy reference.

Hyperinflation Is Not Inevitable (Default Is)

Mises Daily: Monday, August 20, 2012 by Gary North

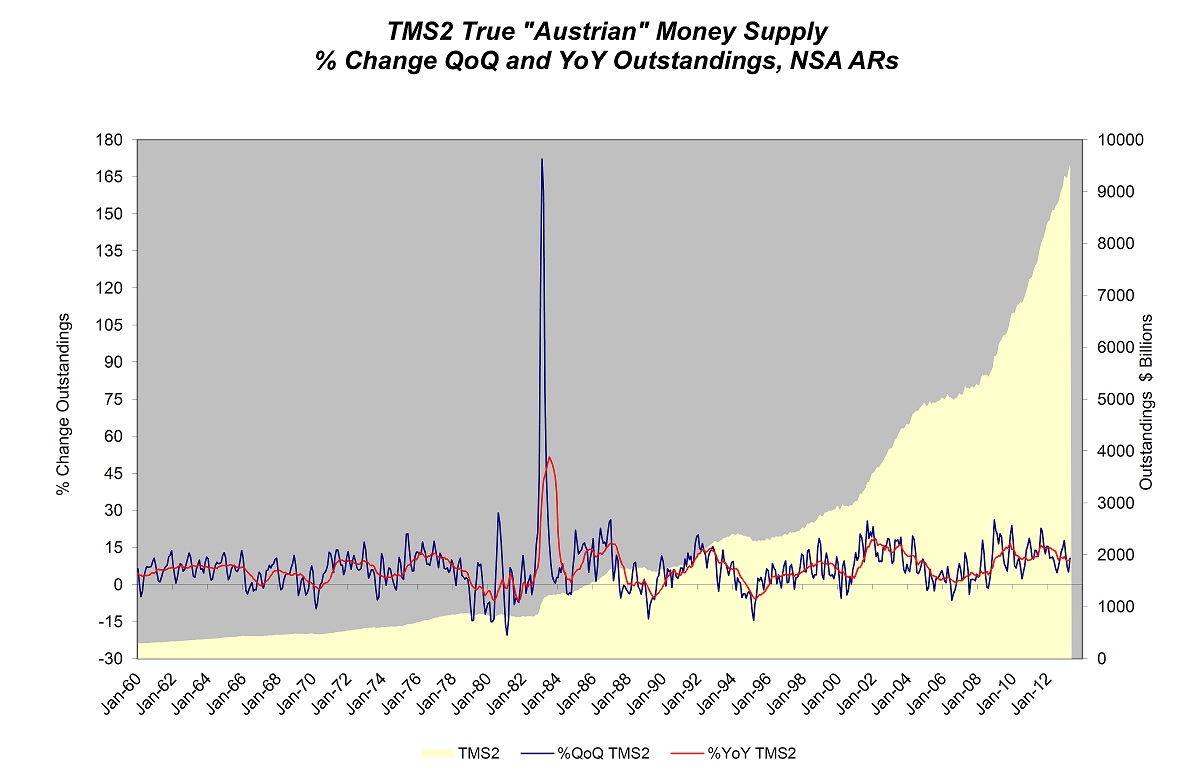

Hyperinflation is always a possibility for any national government or central bank. If a national government is running massive deficits, it can call on the central bank to buy treasury bills or treasury bonds with newly created money. This digital money is transferred to the treasury, which then spends the money into circulation.

There have been cases of hyperinflation in the past that have become legendary. The most famous of all of these hyperinflations is Germany from 1921 through 1923. Simultaneous with that hyperinflation was a hyperinflation in Austria. These were not the worst cases of hyperinflation in history, but they were the worst cases in industrial societies. The worst case was Hungary for two years immediately after World War II. The second-worst case took place a few years ago in Zimbabwe. Both were agricultural nations.

No other nations in western Europe have ever experienced anything like the hyperinflations of Germany and Austria in the early 1920s. Their currency systems were completely destroyed. Farmers were able to pay off debts that had been accumulated prior to World War I by selling one egg and handing the money over to the creditor. This of course destroyed the creditors. It is generally believed that the middle class in both Germany and Austria suffered enormous losses. They had been creditors.

There have been hyperinflations in Latin America after World War II. One of the worst was in Brazil in the 1980s and 1990s. The statistics of catastrophic inflation are available here. This went on for two decades. I know of no other case of hyperinflation that lasted more than three years. This is why I regard Brazil’s inflation as the worst hyperinflation in modern history. The political authorities did nothing to stop it, and the central bank inflated. The devastation to the middle class was almost total. If people did not get their money into gold and silver and foreign currencies, they were wiped out. The country went to barter.

If this form of hyperinflation ever comes to the United States or any other Western industrial nation, it will lead to the complete destruction of long-term creditors. Anyone who bought long-term bonds of any kind, anyone who invested in mortgages of any kind, anyone who is the recipient of a government pension, or anybody who is dependent on Social Security and Medicare could not survive this kind of hyperinflation. It would always be paid off in money that is worth far less than when the debt was contracted. When we think of the delay in payments that already exists with respect to Medicare reimbursements to physicians, we get some idea of what it would do to the healthcare industry. The delay of 90 days would basically eliminate the debt.

Destroying Creditors

When we think of the traditional arguments in favor of hyperinflation from the government’s point of view, we think about the ability of the government to pay off creditors. As I will show, this argument no longer is valid.

It is valid for private corporations. Some large business that has issued a 30-year bond is in a position to pay off those bonds with money that is essentially worthless. The person who extended credit to the company did so when the currency had far higher purchasing power. Then comes hyperinflation. Most bonds allow the debtor to pay off early. This will destroy the creditors.

Wherever creditors exist, debtors are happy to repay their loans with money that has depreciated ever since the time that the loan was established. This is especially true if the loan had a fixed interest rate. If the rate of interest cannot be hiked by the lender, he is trapped in his debt. Long-term interest rates begin to skyrocket because of the effect of hyperinflation on consumer prices. New creditors demand a higher rate of interest in order to compensate them for the expected decline of purchasing power. But when hyperinflation speeds up the process of depreciation even faster, creditors who demanded higher interest rates find that the interest rate was not sufficient to compensate them for the decline of purchasing power. So, the next time around, creditors demand even higher rates of interest.

Every time the rate of long-term interest rises, the market value of the existing bonds declines. So, the creditor class, which had faithfully extended credit to businesses, finds that it gave up money that was of considerable value, and now gets back money that is essentially worthless. This destroys the creditor class, which then proves unable to supply new rounds of credit to borrowers.

In the case of central banks that adopt policies that produce hyperinflation, there is no doubt that creditors are ruined if the lenders have the right to pay off the loan with the newly issued currency. If there are no gold contracts or silver contracts governing the payment of the loans, the creditor is helpless in the face of lenders who use the depreciated money to get out of their obligations.

Short Bursts of Hyperinflation

The important fact in all of this, with the exception of Brazil, is this: this possibility of escaping the burden of debt is available only on a relatively short-term basis, and it is available only where the borrower has the right to repay the loan at any time in the national currency. Whenever these two provisions do not exist, hyperinflation only marginally benefits borrowers at the expense of creditors.

Consider the biggest debtor of all: the US government. It has borrowed money out of the Medicare trust fund and the Social Security trust fund from the beginning. The government has issued nonmarketable IOUs to both of the trust funds. These IOUs are good for decades. They are not short-term IOUs.

The government is in a position to repay only short-term bonds bought by the public. It is not allowed to repay holders of long-term bonds before the date that the bond terminates and the monies are to be repaid.

This places the US government at a significant disadvantage with respect to creditors. While it is possible for issuers of corporate bonds to repay the creditors at any time, this is not possible for the US government. Furthermore, the largest of its debts are related to two programs: Social Security and especially Medicare. These debts cannot be repaid with fiat money, because to do so would involve paying off long-term debts early. This is not possible for the federal government, unless the federal government changes the law. If it does this, it would be an admission of total defeat. It will be open default.

When the Social Security trust fund administrators or the Medicare trust fund administrators estimate the obligations of each program, they use the figure of 75 years. They talk about what is owed over the entire 75 years. This means that any period of hyperinflation that is less than 75 years will be insufficient to abolish the political debts of the US government. It cannot escape the obligation by paying retired citizens whatever they are owed over the entire time period. Hyperinflation will enable private corporations to escape their obligations to creditors, but it will not enable the federal government to escape. The government will be able to escape the burden in the years of the worst time of hyperinflation, but when the hyperinflation ends, and the central bank issues a new currency, this does not solve the problem facing the government.

The hyperinflation ends when the money is worthless. At that point, the government cannot buy goods and services. Neither can its dependents.

The government today faces a political problem. It is not simply that it has issued nonmarketable IOUs to the Social Security trust fund and the Medicare trust fund. It has made specific promises to the entire working population. These promises have the force of law. They also cannot be escaped by means of short-term monetary expansion. It is possible for the government for a brief period of time to get its hands on money that is depreciating, but there are cost-of-living escalators built into Social Security payments.

Furthermore, if the government uses the fiat money to pay healthcare providers, and the money does not cover the cost of providing healthcare, healthcare providers will go out of business. It does no good to go to hyperinflation in order to reduce the costs to the government of healthcare. If the government attempts this, it will find that healthcare providers go into another line of work.

All those forecasters who say that hyperinflation is inevitable in the United States never discuss this problem of the 75-year obligations. They never spell out in detail how hyperinflation will enable the US government to escape its obligations. These obligations stretch out over 75 years. No hyperinflation has ever lasted longer than 20 years, and most of them have not lasted longer than about 3 years. So, the policy of hyperinflation wipes out the middle class, and it wipes out most of the creditors who transferred money to corporations in exchange for long-term bonds. The corporations will simply pay off the bonds early with depreciated money, and will then be the possessors of whatever productive assets they bought with the borrowed money. So, when the government comes to potential creditors and asks for another round of debt, it will find the creditors are too wise to provide this credit.

The on-budget debt of the United States that is owed to the general public has an average maturity of approximately eight years. The Federal Reserve System is using “operation twist” to buy larger quantities of 30-year Treasury bonds. This lowers the rate on these bonds and also mortgages issued by Fannie Mae and Freddie Mac. The private purchasers of these assets will find that, for any period of hyperinflation, the market value of these assets declines. The money, which is not much, that the government will pay to them as interest will not buy much of anything. The government cannot get rid of these debts by hyperinflation. It can pay interest on these debts cheaply only during the time of hyperinflation.

Kotlikoff’s Figures

This brings us back to the deficit in the most important category: off-budget debt. The general public is almost completely unaware of this debt. This debt comprises mainly the obligations of the government for Medicare, Social Security, and federal pensions. These debts extend out for 75 years, according to the calculations of the government. These are extremely long-term debts.

Professor Lawrence Kotlikoff of Boston University has been monitoring the growth of these debts for several years. He relies on the statistics published by the Congressional Budget Office. This is legally a nonpartisan organization that is set up to provide information on various aspects of the government’s budget.

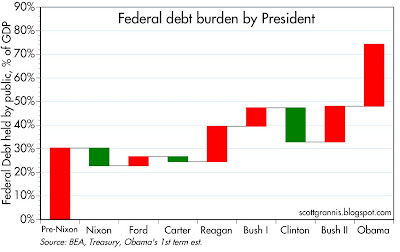

Early in August 2012, Kotlikoff and financial writer Scott Burns published an article on the increase of the unfunded liabilities of the US government. According to the figures issued by the Congressional Budget Office, Kotlikoff concluded that there had been an increase in unfunded liabilities over the past 12 months of $11 trillion.

The total obligation of the federal government to voters that is not funded at the present time is now $222 trillion. This does not mean that, over the entire life of the program, the government will be short $220 trillion. It means that the present value of the unfunded liability is $220 trillion. This means that the government would have to set aside $220 trillion immediately, invest this money in nongovernment projects that will pay a positive rate of return, and will therefore fund the amortization of this debt. I have written about the estimate here.

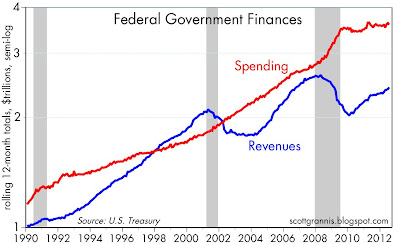

The federal government at the present time is running annual on-budget deficits of about $1.2 trillion. It spends something in the range of $3.7 trillion. But it needs to have $222 trillion immediately to invest in private markets. It of course does not have this money. There is also the question of which markets could absorb a total of $222 trillion overnight and be able to gain a constant rate of return of, say, 5 percent per annum? It simply is not possible.

Kotlikoff’s figures indicate that the federal government at some point will have to default on large portions of the long-term debt. The numbers do not lie. Kotlikoff’s numbers are larger than most estimates, but other economists have estimated the total unfunded liability in the range of $90 trillion. This number is as unmanageable as $222 trillion.

The Congress of the United States could not come to an agreement in 2011 on how to solve an official deficit of $1.2 trillion per year. Congress kicked the can down the road until January 1, 2013. At that point, the government will have to slash spending, according to the agreement made in 2011. The Bush tax cuts of 2002 will expire unless Congress extends them.

It is obvious that Congress cannot come to an agreement to solve the problem of $1.2 trillion annual deficits. What Kotlikoff and Burns reveal is something far more extraordinary. They indicate that the actual increase of the federal deficit over the last 12 months is in the range of 10 times greater than the increase in the official government deficit. This means that the compounding process that is taking place in the area of unfunded liabilities dwarfs the compounding process that we see in the on-budget statistics.

If Kotlikoff’s figures are incorrect, then some government economist or other expert should publish a detailed study of the correct methodology to examine the figures issued by the Congressional Budget Office. If he has made a mistake, the public deserves to know what this mistake was, and what the correct answer is. I am aware of no such study as yet, but perhaps it will be issued soon. The question will then be this: to what extent did Kotlikoff exaggerate the figures? If it turns out that he is wrong by, say, $50 trillion, the critic will have a point, but the point will be essentially irrelevant to the future crisis of the US government.

Even if Kotlikoff is wrong by $100 trillion, it becomes clear that Congress is completely incapable of dealing politically with this problem. It could not possibly raise the funds to balance the budget if the budget really is increasing by, say, $5 trillion per year. The difference between $5 trillion and $11 trillion is huge, but irrelevant in relationship to the ability of the government to deal with it. The government does not have the money, nor does the free market provide sufficient investment opportunities to enable the US government and all of the other Western governments, including Japan, to solve the problem.

This is not simply an American problem. This is the problem of Western civilization. This is a problem created by every group of politicians in the world who have overpromised what each national government is going to be able to deliver in the future.

If Kotlikoff’s figures are wrong, there should be a hue and cry in Congress over the magnitude of his misrepresentation. There is no hue and cry. We hear the silence of the Congressional Budget Office and also the silence of Congress in general. This persuades me that Kotlikoff’s figures are sufficiently accurate, so that we can make judgments about what is likely to happen to the solvency of the US government and its ability to send out checks every month to its recipients.

Kotlikoff and Burns do not estimate the year in which the crisis will become obvious. I don’t blame them. We cannot be certain about this date, because we cannot be certain about Federal Reserve policy. We can be certain about this: there is no way to repay the obligations that the federal government has negotiated with the voters. It has pretended that it can continue to make its payments on time, but it has not shown how this is going to be possible over the long haul. Meanwhile, millions of baby boomers have started to retire.

The Federal Reserve System

The Federal Reserve cannot solve the problem of the 75-year debt which has unfunded liabilities in the present of $222 trillion. There is no way that the government of United States can solve this problem without simply going into default. So, it does not pay the Federal Reserve to adopt a policy of hyperinflation, which is necessary to destroy the debts of the various levels of civil government in the United States.

The Federal Reserve may go to mass inflation. By mass inflation, I have in mind rates of consumer price increases of 25 percent or thereabouts. We have never seen this in peacetime America, but it is possible. It will enable Congress to sell some of its rollover debt as this debt matures. The average maturity of the federal debt now is about eight years.

This does not solve the major problem, which is the unfunded liability of the federal government for long-term old-age retirement programs. The central bank could hyperinflate for a few years and enable Congress to kick the can down the road for another three or four years. But this does not solve the fundamental problem facing the federal government, namely, that it has overextended its promises vastly beyond its ability to deliver on these promises.

Economists at the Federal Reserve understand this as well as I do. I ask this: What possible incentive is there for the Federal Reserve System to hyperinflate the money to zero value, when the political obligations of the old-age retirement system will survive the time of hyperinflation? What is the advantage of the Federal Reserve to hyperinflate the money supply?

Maybe it would do this in order to intervene to save specific large New York banks, but their obligations are minimal compared to the total obligations of the US government.

I am convinced that, unless Congress nationalizes the Federal Reserve, the Federal Reserve will not adopt a policy of hyperinflation. That would be to the detriment of the banking system in general.

Conclusion

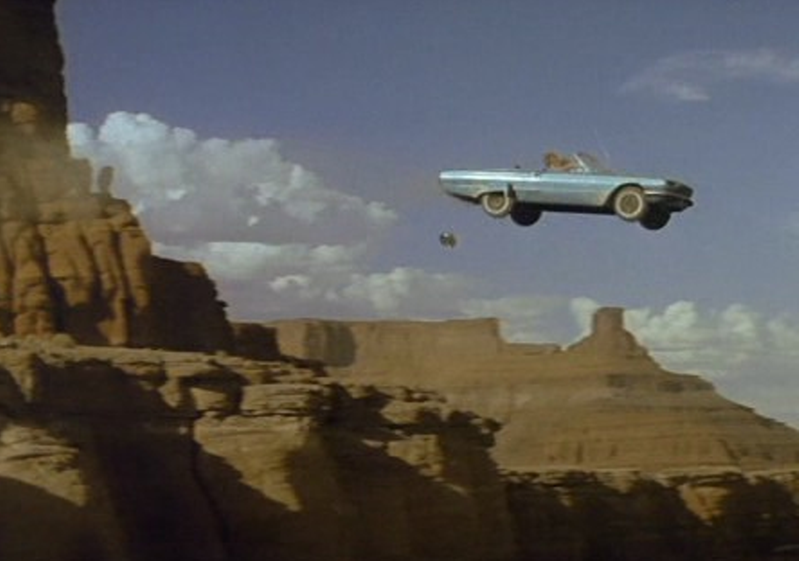

This is why I am not persuaded by those people who say that hyperinflation in the United States is inevitable. I don’t think it is. I think default is inevitable, but I don’t think it needs to be default by hyperinflation. That is because the government cannot get out of its obligations by fiat money. It cannot default by using hyperinflation, because hyperinflation will only last a few years, but the obligations last for the next 75 years.

In other words, the default will be much more open. The government is going to have to renege on promises made to the vast majority of people who are now dependent on the federal government for their retirement income, and it will also default on the workers who are still in the workforce, who are paying each payday into Social Security and Medicare.

Anyone who makes the case for inevitable hyperinflation needs to present evidence on how hyperinflation will enable the US government to escape the political obligations of the promises that it has made to retirees.

If Congress nationalizes the Fed, then we could get hyperinflation, just to meet present bills. But this will not solve the long-term problem: government unfunded liabilities. After the currency dies, the debt will still be there.

Blink! U.S. Debt Just Grew by $11 Trillion

By Laurence Kotlikoff and Scott Burns – Aug 8, 2012

Republicans and Democrats spent last summer battling how best to save $2.1 trillion over the next decade. They are spending this summer battling how best to not save $2.1 trillion over the next decade.

In the course of that year, the U.S. government’s fiscal gap — the true measure of the nation’s indebtedness — rose by $11 trillion.

The fiscal gap is the present value difference between projected future spending and revenue. It captures all government liabilities, whether they are official obligations to service Treasury bonds or unofficial commitments, such as paying for food stamps or buying drones.

Some question whether “official” and “unofficial” spending commitments can be added together. But calling particular obligations “official” doesn’t make them economically more important. Indeed, the government would sooner renege on Chinese holding U.S. Treasuries than on Americans collecting Social Security, especially because the U.S. can print money and service its bonds with watered-down dollars.

For its part, economic theory sees through labels and views a country’s official debt for what it is — a linguistic construct devoid of real economic content. In contrast, the fiscal gap is theoretically well-defined and invariant to the choice of labels. Each labeling choice changes the mix of obligations between official and unofficial, but leaves the total unchanged.

Dangerous Growth

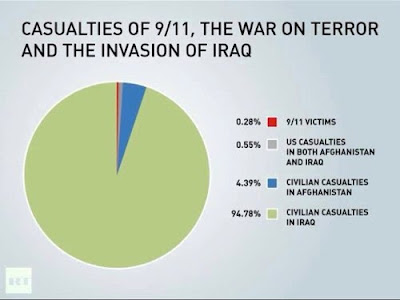

The U.S. fiscal gap, calculated (by us) using the Congressional Budget Office’s realistic long-term budget forecast — the Alternative Fiscal Scenario — is now $222 trillion. Last year, it was $211 trillion. The $11 trillion difference — this year’s true federal deficit — is 10 times larger than the official deficit and roughly as large as the entire stock of official debt in public hands.

This fantastic and dangerous growth in the fiscal gap is not new. In 2003 and 2004, the economists Alan Auerbach and William Gale extended the CBO’s short-term forecast and measured fiscal gaps of $60 trillion and $86 trillion, respectively. In 2007, the first year the CBO produced the Alternative Fiscal Scenario, the gap, by our reckoning, stood at $175 trillion. By 2009, when the CBO began reporting the AFS annually, the gap was $184 trillion. In 2010, it was $202 trillion, followed by $211 trillion in 2011 and $222 trillion in 2012.

Part of the fiscal gap’s growth reflects changes in policy, such as the Bush and Obama tax cuts, the introduction of Medicare Part D, and the expansion of defense spending. Part reflects “natural” growth of existing programs, including growth in Medicare and Medicaid reimbursement rates. And part reflects the demographic time bomb U.S. politicians are blithely ignoring.

When fully retired, 78 million baby boomers will collect, on average, more than 85 percent of per-capita gross domestic product ($40,000 in today’s dollars) in Social Security, Medicare and Medicaid benefits. Each passing year brings these outlays one year closer, which raises their present value.

Governments, like households, can’t indefinitely spend beyond their means. They have to satisfy what economists call their “intertemporal budget constraint.” The fiscal gap simply measures the extent to which this constraint is violated and tells us what is needed to balance the government’s intertemporal budget.

The answer for the U.S. isn’t pretty. Closing the gap using taxes requires an immediate and permanent 64 percent increase in all federal taxes. Alternatively, the U.S. needs to cut, immediately and permanently, all federal purchases and transfer payments, including Social Security and Medicare benefits, by 40 percent. Or it can mix these terrible fiscal medicines with honey, namely radical fiscal reforms that make the economy much fairer and far stronger. What the government can’t do is pay its bills by spending more and taxing less. America’s children, whose futures are being rapidly destroyed, are smart enough to tell us this.

(Laurence Kotlikoff, an economist at Boston University, andScott Burns, a syndicated columnist, are co-authors of “The Clash of Generations.” The opinions expressed are their own.)

To contact the writers of this article: Laurence Kotlikoff at kotlikoff@gmail.com.

To contact the editor responsible for this article: Katy Roberts at kroberts29@bloomberg.net.