Life is my college. May I graduate well, and earn some honors.” –Louisa May Alcott, American writer

I will be posting almost exclusively on strategic logic as we study Competition Demystified by Bruce Greenwald (in the Value Vault, see ABOUT, http://csinvesting.org/about/) in early 2012. Now is the time to voice a complaint, comment or suggestion if you have reservations about our impending trek. Understanding financial statement analysis, studying market history and other great investors are all part of your investment journey. The gap, I see, in the education of many is in understanding competitive advantages. There is no way around studying case studies and thinking hard about the subject.

The most profound effect studying competitive analysis, franchises, and barriers to entry as an investor has been to understand how rare structural competitive advantages really are. And the great businesses that can grow and redeploy capital at high rates are precious and difficult to find. Companies are often non-franchise, asset-type investments that an investor should buy only when there is a huge discount (read: massive disappointment, despair and disgust with the business) between reproduction and earnings power value (See Greenwald Lecture Notes here: http://wp.me/p1PgpH-23). If you are similarly influenced, you will be much more discerning in your investments. You may even invest as Buffett suggests, with a 20-hole punch-card. Much of your investment life will be spent reading while waiting for the perfect pitch.

BUFFETT

Back to why our study of Competition Demystified is critical. Buffett is a keen student of business franchises as he was tutored by Charlie Munger when they bought See’s Candy.

(Source 1983 Berkshire Annual Report and Letter to Shareholders). Despite the volume problem, See’s strengths are many and important. In our primary marketing area, the West, our candy is preferred by an enormous margin to that of any competitor (Regional/Local Economies of Scale).

You also alluded to getting a return on the amount of capital invested in the business.

How do you determine what is the proper price to pay for the business?

Buffett: It is a tough thing to decide but I don’t want to buy into any business I am not terribly sure of. So if I am terribly sure of it, it probably won’t offer incredible returns. Why should something that is essentially a cinch to do well, offer you 40% a year? We don’t have huge returns in mind, but we do have in mind not losing anything. We bought See’s Candy in 1972, See’s Candy was then selling 16 m. pounds of candy at a $1.95 a pound and it was making 2 bits a pound or $4 million pre-tax. We paid $25 million for it—6.25 x pretax or about 10x after tax. It took no capital to speak of. When we looked at that business—basically, my partner, Charlie, and I—we needed to decide if there was some untapped pricing power there. Where that $1.95 box of candy could sell for $2 to $2.25. If it could sell for $2.25 or another $0.30 per pound that was $4.8 on 16 million pounds. Which on a $25 million purchase price was fine. We never hired a consultant in our lives; our idea of consulting was to go out and buy a box of candy and eat it.

See’s Candy

What we did know was that they had share of mind in California. There was something special. Every person in Ca. has something in mind about See’s Candy and overwhelmingly it was favorable. They had taken a box on Valentine’s Day to some girl and she had kissed him. If she slapped him, we would have no business. As long as she kisses him, that is what we want in their minds. See’s Candy means getting kissed. If we can get that in the minds of people, we can raise prices. I bought it in 1972, and every year I have raised prices on Dec. 26th, the day after Christmas, because we sell a lot on Christmas. In fact, we will make $60 million this year. We will make $2 per pound on 30 million pounds. Same business, same formulas, same everything–$60 million bucks and it still doesn’t take any capital.

And we make more money 10 years from now. But of that $60 million, we make $55 million in the three weeks before Christmas. And our company song is: “What a friend we have in Jesus.” (Laughter). It is a good business. Think about it a little. Most people do not buy boxed chocolate to consume themselves, they buy them as gifts—somebody’s birthday or more likely it is a holiday. Valentine’s Day is the single biggest day of the year. Christmas is the biggest season by far. Women buy for Christmas and they plan ahead and buy over a two or three-week period. Men buy on Valentine’s Day. They are driving home; we run ads on the Radio. Guilt, guilt, guilt—guys are veering off the highway right and left. They won’t dare go home without a box of Chocolates by the time we get through with them on our radio ads. So that Valentine’s Day is the biggest day.

Can you imagine going home on Valentine’s Day—our See’s Candy is now $11 a pound thanks to my brilliance. And let’s say there is candy available at $6 a pound. Do you really want to walk in on Valentine’s Day and hand—she has all these positive images of See’s Candy over the years—and say, “Honey, this year I took the low bid.” And hand her a box of candy. It just isn’t going to work. So in a sense, there is untapped pricing power—it is not price dependent. (Source: Buffett’s 1998 Speech to Univ. of FL Business School Students)

Charlie Munger on the Mental Model of Microeconomics

Strategic logic or microeconomics is one of the mental models that Charlie Munger suggests you know cold.

http://www.tilsonfunds.com/MungerUCSBspeech.pdf

Too Much Emphasis on Macroeconomics

My fourth criticism is that there’s too much emphasis on macroeconomics and not enough on microeconomics. I think this is wrong. It’s like trying to master medicine without knowing anatomy and chemistry. Also, the discipline of microeconomics is a lot of fun. It helps you correctly understand macroeconomics. And it’s a perfect circus to do. In contrast, I don’t think macroeconomics people have all that much fun. For one thing they are often wrong because of extreme complexity in the system they wish to understand.

Case study: Nebraska Furniture Mart’s new store in Kansas City

Let me demonstrate the power of microeconomics by solving a microeconomic problem. One simple problem is this: Berkshire Hathaway just opened a furniture and appliance store in Kansas City [www.nfm.com/store_kansascity.asp]. At the time Berkshire opened it, the largest selling furniture and appliance store in the world was another Berkshire Hathaway store, selling $350 million worth of goods per year. The new store in a strange city opened up selling at the rate of more than $500 million a year. From the day it opened, the 3,200 spaces in the parking lot were full. The women had to wait outside the ladies restroom because the architects didn’t understand biology. (Laughter). It’s hugely successful.

Well, I’ve given you the problem. Now, tell me what explains the runaway success of this new furniture and appliance store, which is outselling everything else in the world? (Pause). Well, let me do it for you. Is this a low-priced store or a high-priced store? (Laughter). It’s not going to have a runaway success in a strange city as a high-priced store. That would take time. Number two, if it’s moving $500 million worth of furniture through it, it’s one hell of a big store, furniture being as bulky as it is. And what does a big store do? It provides a big selection. So what could this possibly be except a low-priced store with a big selection?

But, you may wonder, why wasn’t it done before, preventing its being done first now? Again, the answer just pops into your head: it costs a fortune to open a store this big. So, nobody’s done it before. So, you quickly know the answer. With a few basic concepts, these microeconomic problems that seem hard can be solved much as you put a hot knife through butter. I like such easy ways of thought that are very remunerative. And I suggest that you people should also learn to do microeconomics better. END.

—

You should read the first three chapters of Competition Demystified to explain how Mrs. Bee developed Nebraska Furniture Market’s advantage. We will review those chapters in the next several posts while delving deeply into minimum efficient scale and economies of scale.

Whether you learn about microeconomics here or elsewhere, it is critical to apply these mental models in your business analysis.

HAPPY NEW YEAR!

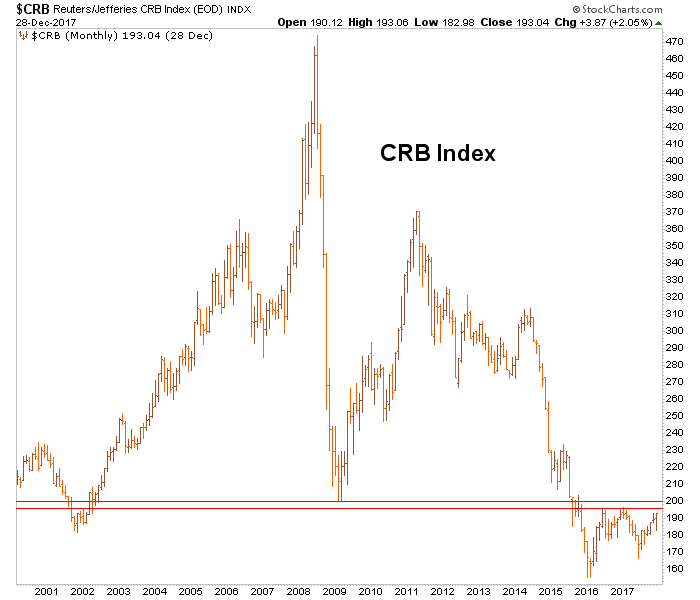

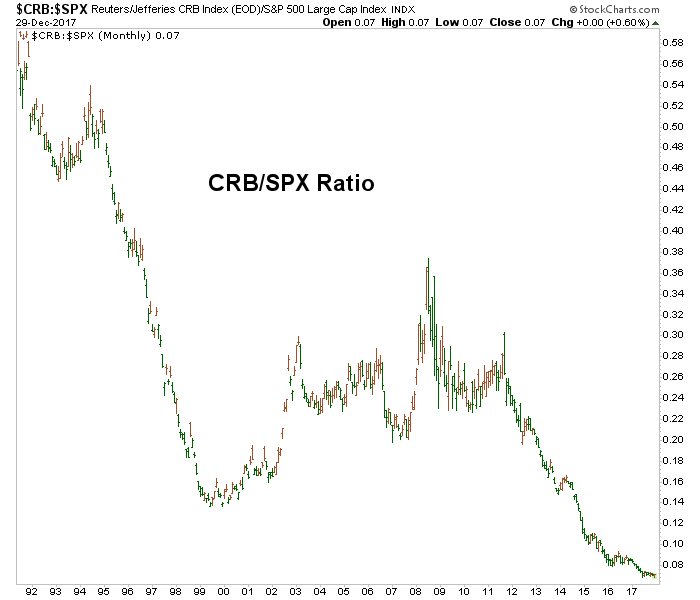

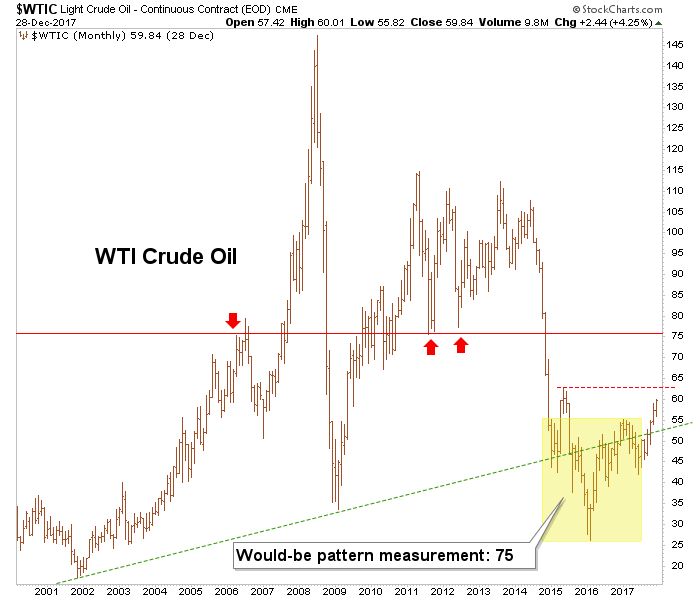

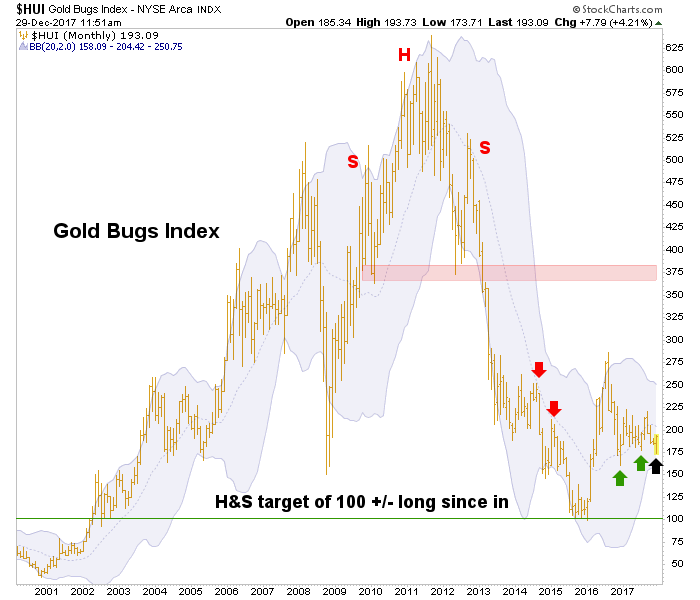

Note the date Dec 2016

Note the date Dec 2016