We continue our study of Herbalife’s saga with a recent post from www.brontecapital.com. There are lessons here on conducting research and on hubris.

What this story is really about

Herbalife is a company which combines a lot of good (think the life-saved diabetic above) with some pretty ugly features.

But this is not really a story about Herbalife – Herbalife will survive globally. Like all multi-level marketing schemes it will have its ups and downs. There will be all sorts of problems (such as tax compliance throughout the scheme, cash handling, perhaps even using Herbalife accounts to launder money).

What this has (deservedly) become is the story about how Bill Ackman can be so wrong. He spent (by his own admission) a year and a half analysing this company and his thesis can be falsified by visiting a few clubs in his home city. Bill Ackman’s thesis is the most easily falsified bear-thesis I have seen from a major hedge fund ever.

You have to wonder how this happened. So I am going to tell you:

Bill Ackman a Harvard educated (magna cum laude) billionaire New York hedge fund manager bet over a billion dollars on a short position (imperilling his fund and his reputation) without checking the facts.

And he did not check the facts because he was so rigid with a misplaced silver spoon that he could not stoop to sit on a subway for thirty minutes and talk with poor people for ninety minutes.

Read the entire article–an important read

http://brontecapital.blogspot.com/2013/01/notes-on-visiting-herbalife-nutrition.html

Also…..http://seekingalpha.com/article/1111331-implications-of-herbalife-s-soaring-short-interest-ratio

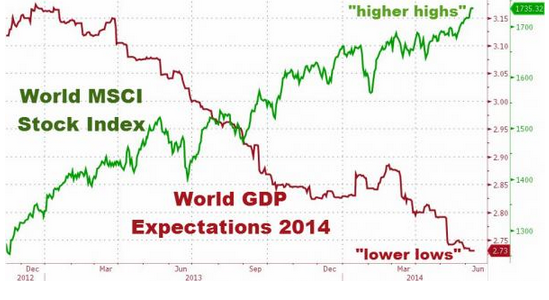

Expectations of Low Future Growth?

Market Review LMCM See Future Value (See page 5). Perhaps the market is discounting real growth vs. nominal growth? Don’t take that chart at face value.

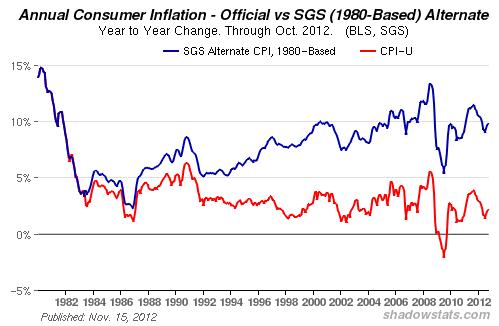

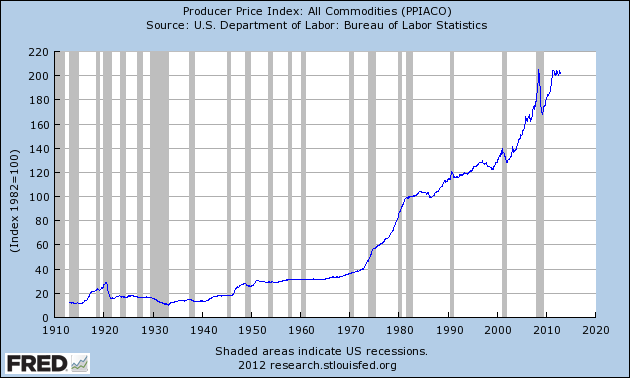

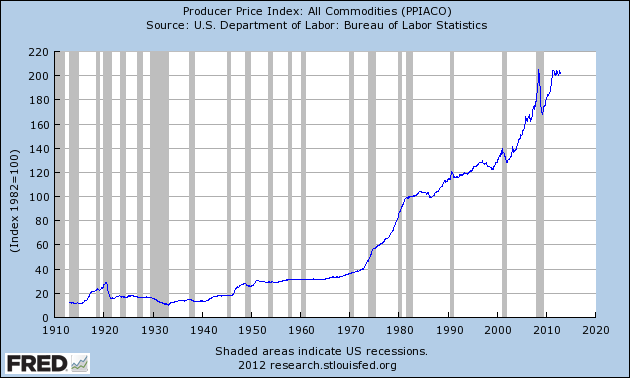

Where is the Inflation (CPI) ? Another lesson in why price aggregates are so misleading.

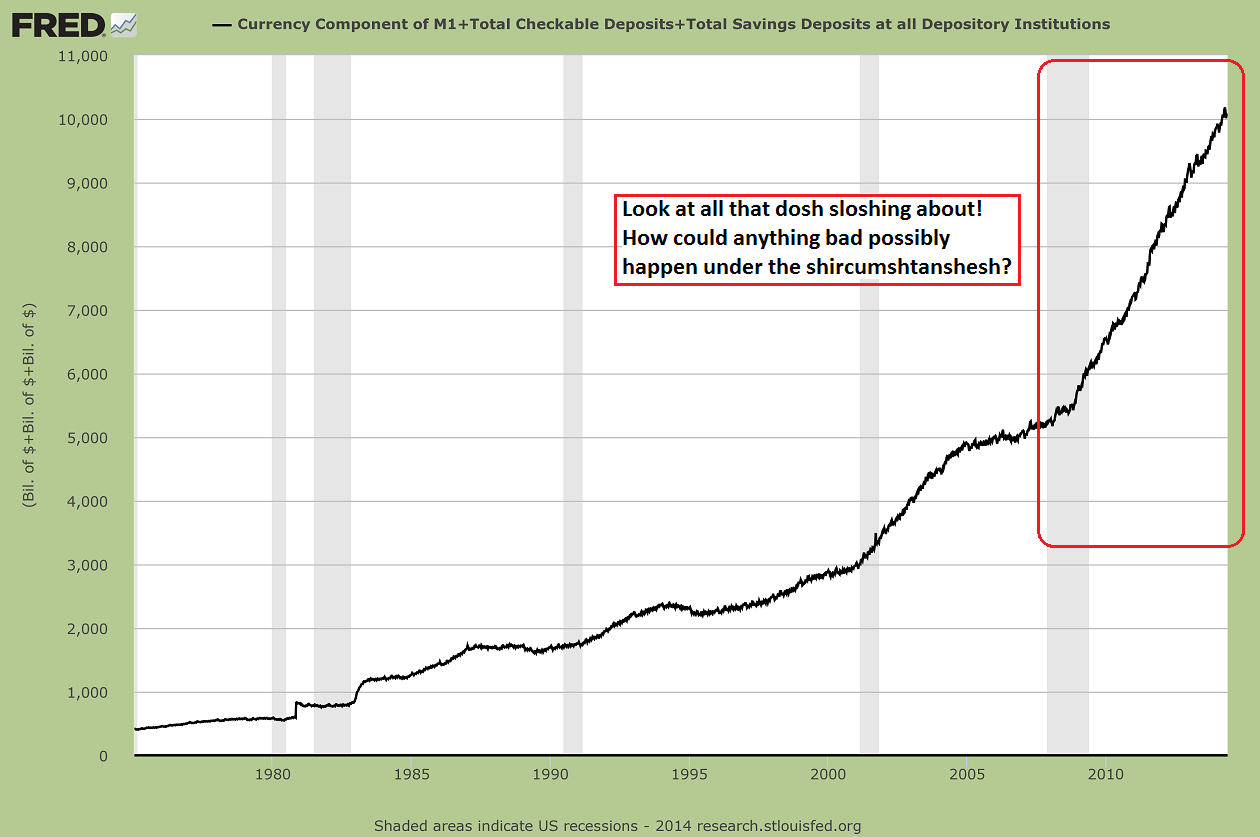

Critics of the Austrian School of economics have been throwing barbs at Austrians like Robert Murphy because there is very little inflation in the economy. Of course, these critics are speaking about the mainstream concept of the price level as measured by the Consumer Price Index (i.e., CPI).

….

High prices seem to be the norm. The US stock and bond markets are at, or near, all-time highs. Agricultural land in the US is at all time highs. The Contemporary Art market in New York is booming with record sales and high prices. The real estate markets in Manhattan and Washington, DC, are both at all-time highs as the Austrians would predict. That is, after all, where the money is being created, and the place where much of it is injected into the economy.

This doesn’t even consider what prices would be like if the Fed and world central banks had not acted as they did. Housing prices would be lower, commodity prices would be lower, CPI and PPI would be running negative. Low-income families would have seen a surge in their standard of living. Savers would get a decent return on their savings.

Of course, the stock market and the bond market would also see significantly lower prices. Bank stocks would collapse and the bad banks would close. Finance, hedge funds, and investment banks would have collapsed. Manhattan real estate would be in the tank. The market for fund managers, hedge fund operators, and bankers would evaporate.

In other words, what the Fed chose to do ended up making the rich, richer and the poor, poorer. If they had not embarked on the most extreme and unorthodox monetary policy in memory, the poor would have experienced a relative rise in their standard of living and the rich would have experienced a collective decrease in their standard of living.

http://mises.org/daily/6340/Where-Is-the-Inflation

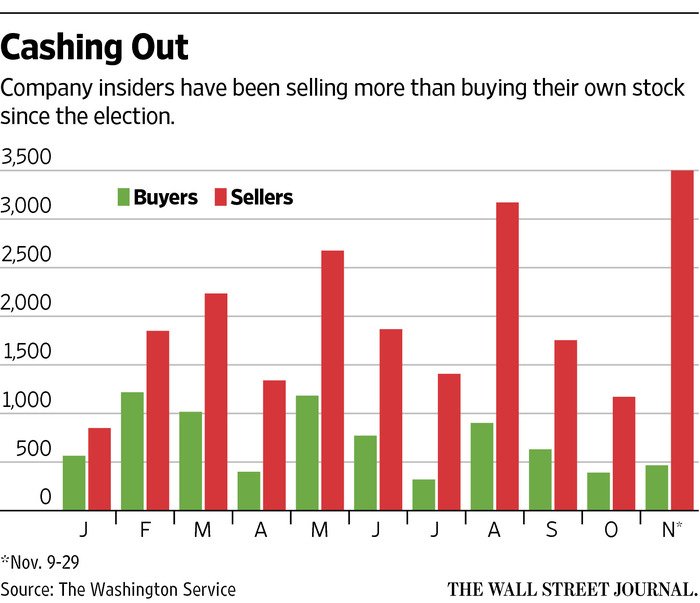

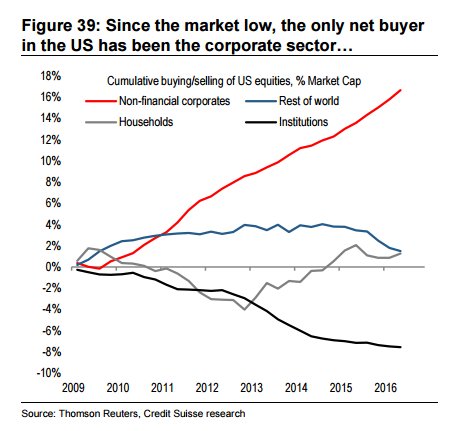

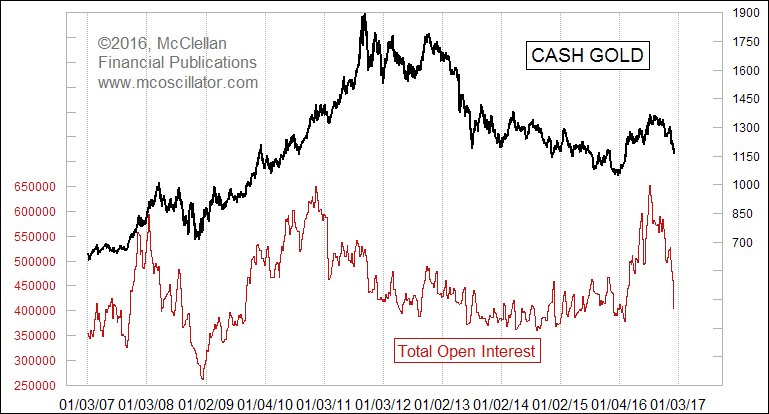

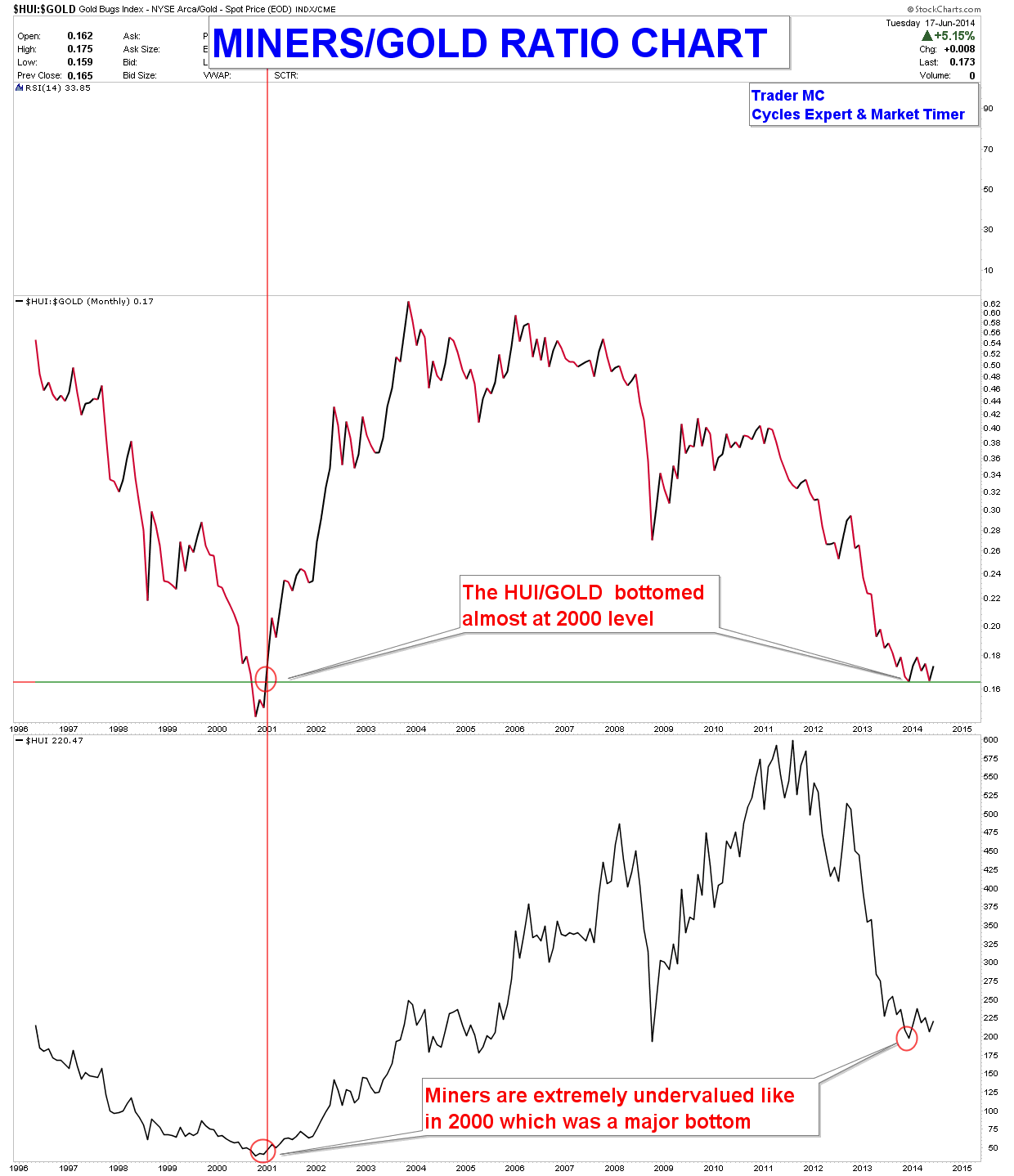

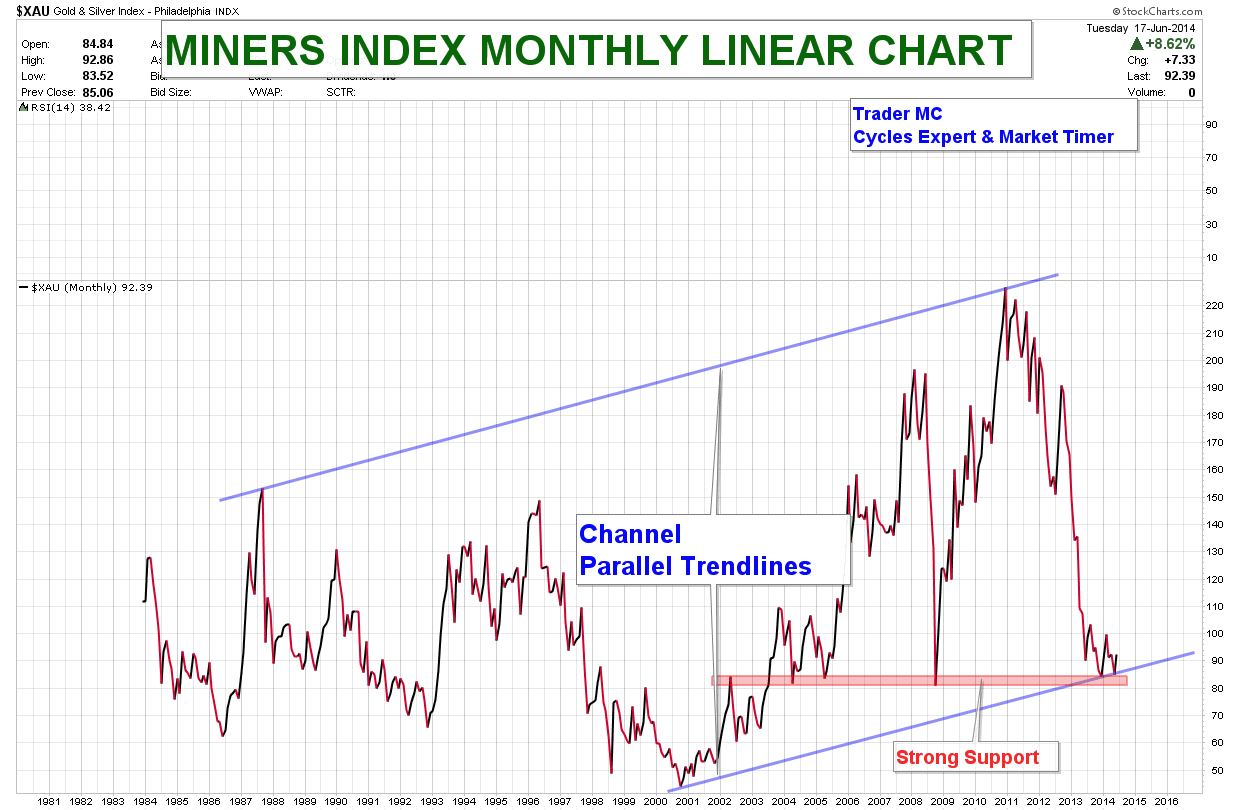

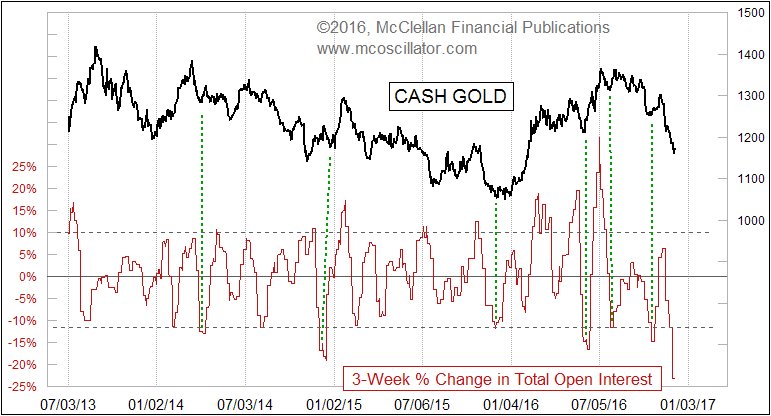

Specs liquidating at a furious pace in gold. US Dollar on the cover of the Economist, insider selling in stocks–all lend support to real asset undervaluation.

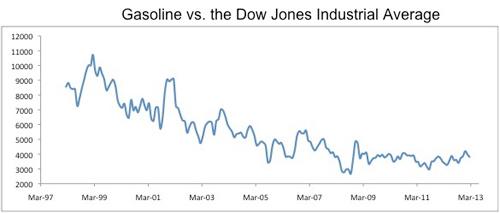

Specs liquidating at a furious pace in gold. US Dollar on the cover of the Economist, insider selling in stocks–all lend support to real asset undervaluation. The Dow in dollar terms (yellow) and the Dow in gold terms.

The Dow in dollar terms (yellow) and the Dow in gold terms.