—

—

Posted in History, Investor Psychology, Search Strategies

Tagged CCJ, cyclical markets, Gold, gold miners, Psychology, Uranium

Bitcoin is not money. Gold IS money because its marginal utility does NOT decline. Read an excellent short article: https://monetary-metals.com/the-ultimate-stablecoin-report-18-nov-2018/

We have covered several times Warren Buffet’s pointed (and disingenuous) comment that gold has no utility. It just sits, and there is a cost for it to sit. And an opportunity cost.

So why do people buy something which has no utility and no return? One, which we discuss a lot, is speculation. They buy whatever’s going up, in an attempt to cash in on the rise. So let’s not dwell on this.

A second reason is fear of counterparty default. Third, is gold is a non-expiring hedge for monetary collapse and/or a currency regime change. This is a broader version of simple counterparty default.

Right now, General Electric is in the news. Its investment grade rated bonds are trading like junk bonds. This is like an echo from the past. Bear Sterns retained its investment-grade rating until just before its demise.

GE has about $115 billion in debt. If it defaults, that could put fear into a lot of investors. They will certainly buy Treasury bonds (which are defined as risk free). Will they buy gold, which is the only financial asset which is truly free of default risk? Maybe.

However, in addition to GE we know that a significant fraction of bonds out there are issued by so-called zombie corporations, whose profits are less than interest expense. Rising interest rates can only have increased the percentage, though the increased cost kicks in with a lag (as each bond matures and must roll). In addition to the problem of rising default risk from these companies, there is the risk if enough hits at once, that the credit market they depend on, goes no bid again as it did in 2008.

Of course, if their bonds are impaired then their equities are worthless. Stocks will be crashing in this scenario.

We raise the issue of price being set at the margin to make a point. In this scenario, the marginal buyer of gold will not be the speculator. It will be the mainstream investor who is desperate to protect himself from a financial system going mad again.

When will this happen? Watch for news of GE and other major debtors sinking deeper into trouble.

As to systemic default risk, i.e. monetary collapse, it’s early yet. There are some peripheral currencies like the bolivar and lira that could go away soon. But their troubles are widely known, and visible far in advance. We would not expect their demise to have much impact on the world’s monetary order (though of course it is horrific for the people who live in Venezuela and Turkey).

Other currencies are also in trouble—we have written a lot about the franc. It is impossible to predict the timing of such a thing, though our gut feeling is that it is still a ways out.

As to the de-dollarization, loss-of-reserve-status, end-of-petrodollar, gold-backed-yuan, SDR-to-replace-USD ideas, we say: rubbish. The dollar will get stronger from here, if not in terms of gold then as measured by other currencies. Panicky people in Istanbul do not think “let me buy Brazilian reals, Russian rubles, Indian rupees, and Chinese yuan” because someone coined the glib term “BRICs”. They do not think “I will buy me some Saudi riyal because, petro.”

They buy USD.

So we end on a conclusion we have reiterated many times. When gold goes to $10,000 it is not gold going up. It is the dollar going down.

It is inevitable that the dollar will go down. Keith just gave a talk at an Austrian economics conference in Madrid “There Is No Extinguisher of Debt” (paper to be published soon). The collapse of the dollar is baked into the mathematics.

People could buy gold today at an 88% discount from that price. But do yourself a favor. Watch any politician on TV. Watch a Republican promise to “grow our way out of the debt”. Or watch a Democrat promise a free university education to everyone. Watch even many libertarians promote a Universal Basic Income(!)

If you think they don’t understand, you are right. But the vast majority of voters support these politicians. The voters, too, don’t understand. And the investors too.

Buying gold is a non-expiring hedge. But only people who perceive a need to hedge, will buy the hedge. The rest may think that stocks are a bargain here, being down almost 7% from the high last month. So far in this incredible boom following the crisis, every time people who bought the dip were rewarded.

Are we getting close to the point where it won’t be? If GE is any indication, if GE will have a contagion effect (remember that word?) then the answer is likely yes.

Short then is the time which every man lives, and small the nook of the earth where he lives; and even this only continues by a succession of poor human beings, who will very soon die, and who know not even themselves, much less him who died long ago. — Marcus Aurelius.

What upsets people is not things in themselves but their judgments about the things. -Epictetus.

The goal is not to eliminate or repress the emotions to become devoid of feeling, the goal is to attach the right judgments to them. We can find happiness, love, and beauty without desiring more than is within our control. We can enjoy music so long as we do not wish for it never to end. We can enjoy a cold drink in the sun if we do not at the same time wish for it never to pass. –Seneca.

—

The end of cheap debt means more bankruptcies https://mises.org/wire/end-cheap-debt-will-bring-wave-bankruptcies

Actually, Fred is a V E R Y L O N G – T E R M Investor in gold.

While at all times Wall Street analysts try to justify the valuations, here is a fun quote (via Bloomberg) from 2002 looking back from Scott McNeely, the CEO of Sun Microsystems, one of the darlings of the 2000 tech bubble:

“At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes.

What were you thinking?”

An educational, savagely satirical view of our current market conditions and lessons on valuation. I read about 40 investment letters a quarter and this is about the best I have read in five years. Hilarious! Mark McKinney – Its Like Deja Vu All Over Again – Final and his prior letter: I Dont Get It – Mark McKinney – Final 8292017 New

—

An excellent interview by Tobias Carlisle. CHEAPNESS not quality wins! Yes, I was somewhat shocked. Why?

http://www.valuewalk.com/2018/01/tobias-carlisle-talks-acquirers-multiple-valuetalks/

Ackman’s embattled Pershing Square hedge fund laid off 18 percent of its staff on Friday — a total of 10 pink slips that brought head count down to 46.

Investors have suffered in Pershing Square (PSHZF) vs. S&P 500:

He wants to hire an analyst who can THINK INDEPENDENTLY. You walk into his office and he asks you, “Can you think independently as an analyst?”

How do you reply. Be careful…………think for awhile before you reply. What proof can you give?

If you are struggling to answer, then https://www.newyorker.com/magazine/2015/11/23/conversion-via-twitter-westboro-baptist-church-megan-phelps-roper

will provide clues.

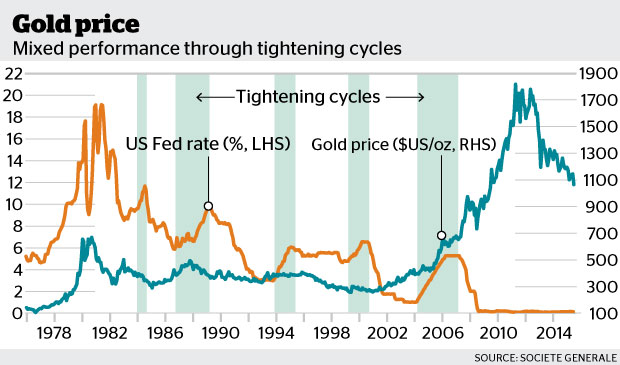

Bloomberg December 2015: But Societe Generale predicts gold will be a casualty of the rate hike, falling below $US1000 an ounce, to $US955 by the end of next year.

Head of global asset allocation Alain Bokobza says looking at the 2016 panorama, in which US interest rates tighten and the economy fares reasonably well, “that does not argue for a higher gold price.”

“Gold will be a casualty.”

CSInvesting: The purpose of this post is to remind you of ignoring expert advice and to do your own analysis. The above comment by Bokobza is meaningless blather. He is simply spouting the consensus view that rising rates mean a declining gold price since gold has no yield. Beware of simple narratives.

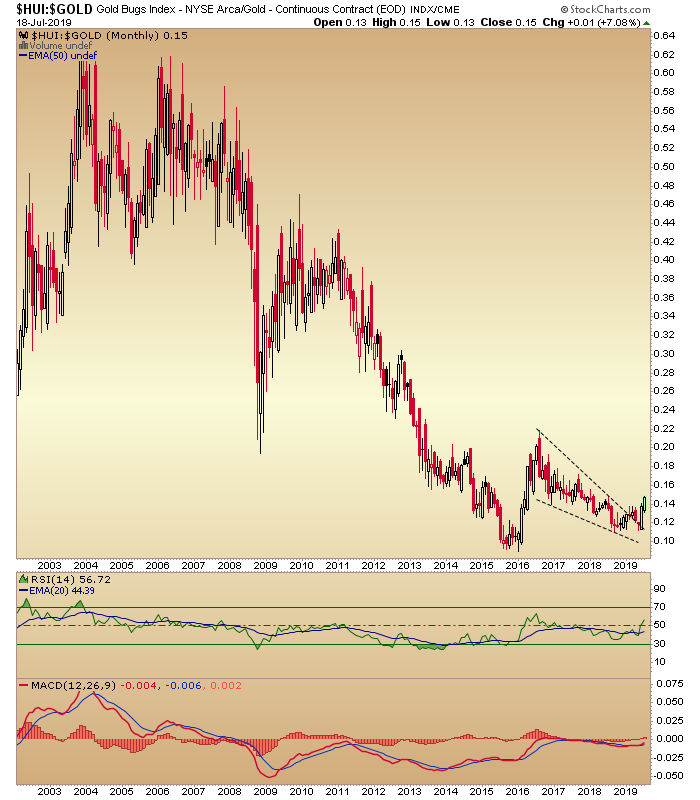

The assumption “Fed rate hikes equal a falling gold price” is not supported by a shred of empirical evidence. On the contrary, all that is revealed by the empirical record in this context is that there seems to be absolutely no discernible correlation between gold and FF rate. If anything, gold and the FF rate exhibit a positive correlation rather more frequently than a negative one! Source: www.acting-man.com

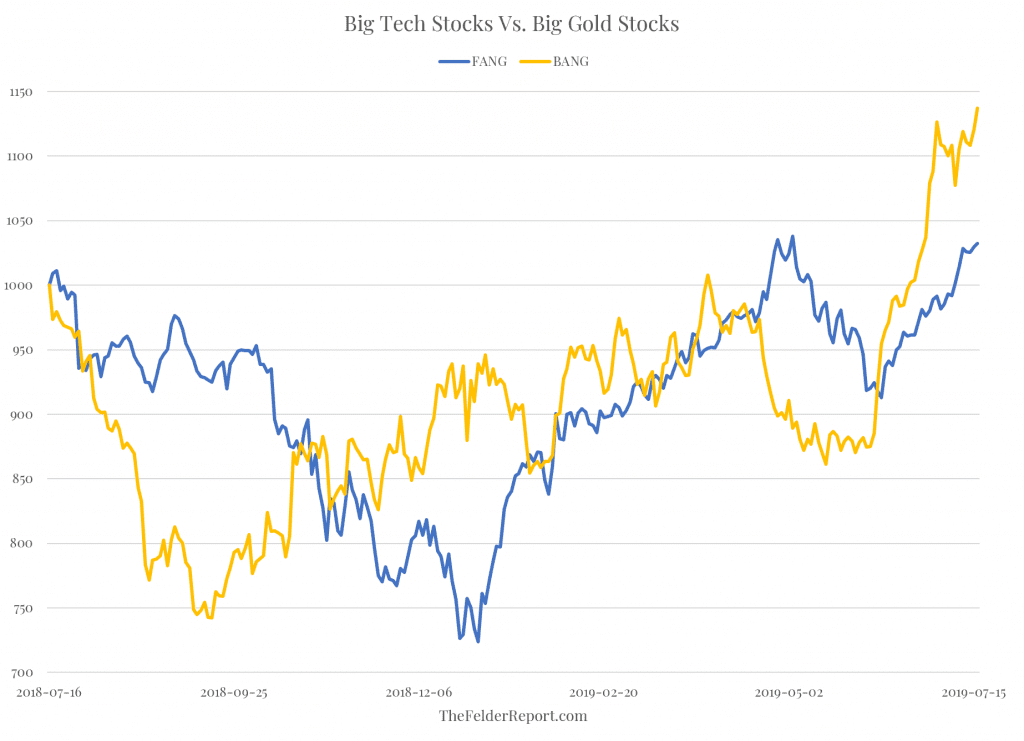

And today:

More here: Gold and the Federal Funds Rate and Gold and gold stocks Dec 26 2017

UPDATE: Interesting Read

Interview of David Collum: https://youtu.be/Vlr7_vDwg_M

in-gold-we-trust-2017-extended-version-english

“Doubt is not a pleasant condition, but certainty is absurd.” Voltaire

Absolute return small cap investing https://www.thefelderreport.com/2017/05/30/podcast-eric-cinnamond-on-the-value-of-absolute-return-investing/

GOLD

Buffett comments on the shiny metal in his discussion on investors’ choices: The Basic Choices for Investors and the One We Strongly Prefer

This type of investment requires an expanding pool of buyers, who, in turn, are enticed because they believe the buying pool will expand still further. Owners are not inspired by what the asset itself can produce – it will remain lifeless forever – but rather by the belief that others will desire it even more avidly in the future.

The major asset in this category is gold, currently a huge favorite of investors who fear almost all other assets, especially paper money (of whose value, as noted, they are right to be fearful). Gold, however, has two significant shortcomings, being neither of much use nor procreative. True, gold has some industrial and decorative utility, but the demand for these purposes is both limited and incapable of soaking up new production. Meanwhile, if you own one ounce of gold for an eternity, you will still own one ounce at its end.

What motivates most gold purchasers is their belief that the ranks of the fearful will grow. During the past decade that belief has proved correct. Beyond that, the rising price has on its own generated additional buying enthusiasm, attracting purchasers who see the rise as validating an investment thesis. As “bandwagon” investors join any party, they create their own truth – for a while.

Over the past 15 years, both Internet stocks and houses have demonstrated the extraordinary excesses that can be created by combining an initially sensible thesis with well-publicized rising prices. In these bubbles, an army of originally skeptical investors succumbed to the “proof” delivered by the market, and the pool of buyers – for a time – expanded sufficiently to keep the bandwagon rolling. But bubbles blown large enough inevitably pop. And then the old proverb is confirmed once again: “What the wise man does in the beginning, the fool does in the end.”

Today the world’s gold stock is about 170,000 metric tons. If all of this gold were melded together, it would form a cube of about 68 feet per side. (Picture it fitting comfortably within a baseball infield.) At $1,750 per ounce – gold’s price as I write this – its value would be $9.6 trillion. Call this cube pile A.

Let’s now create a pile B costing an equal amount. For that, we could buy all U.S. cropland (400 million acres with output of about $200 billion annually), plus 16 Exxon Mobils (the world’s most profitable company, one earning more than $40 billion annually). After these purchases, we would have about $1 trillion left over for walking-around money (no sense feeling strapped after this buying binge). Can you imagine an investor with $9.6 trillion selecting pile A over pile B?

Beyond the staggering valuation given the existing stock of gold, current prices (In 2011, gold traded at an average price of $1,700 in $US) make today’s annual production of gold command about $160 billion. Buyers – whether jewelry and industrial users, frightened individuals, or speculators – must continually absorb this additional supply to merely maintain an equilibrium at present prices.

A century from now the 400 million acres of farmland will have produced staggering amounts of corn, wheat, cotton, and other crops – and will continue to produce that valuable bounty, whatever the currency may be. Exxon Mobil will probably have delivered trillions of dollars in dividends to its owners and will also hold assets worth many more trillions (and, remember, you get 16 Exxons). The 170,000 tons of gold will be unchanged in size and still incapable of producing anything. You can fondle the cube, but it will not respond.

Admittedly, when people a century from now are fearful, it’s likely many will still rush to gold. I’m confident, however, that the $9.6 trillion current valuation of pile A will compound over the century at a rate far inferior to that achieved by pile B.

My own preference – and you knew this was coming – is our third category: investment in productive assets, whether businesses, farms, or real estate. Ideally, these assets should have the ability in inflationary times to deliver output that will retain its purchasing-power value while requiring a minimum of new capital investment. Farms, real estate, and many businesses such as Coca-Cola, IBM and our own See’s Candy meet that double-barreled test. Certain other companies – think of our regulated utilities, for example – fail it because inflation places heavy capital requirements on them. To earn more, their owners must invest more. Even so, these investments will remain superior to nonproductive or currency-based assets.

Whether the currency a century from now is based on gold, seashells, shark teeth, or a piece of paper (as today), people will be willing to exchange a couple of minutes of their daily labor for a Coca-Cola or some See’s peanut brittle. In the future the U.S. population will move more goods, consume more food, and require more living space than it does now. People will forever exchange what they produce for what others produce.

Our country’s businesses will continue to efficiently deliver goods and services wanted by our citizens. Metaphorically, these commercial “cows” will live for centuries and give ever greater quantities of “milk” to boot. Their value will be determined not by the medium of exchange but rather by their capacity to deliver milk. Proceeds from the sale of the milk will compound for the owners of the cows, just as they did during the 20th century when the Dow increased from 66 to 11,497 (and paid loads of dividends as well). Berkshire’s goal will be to increase its ownership of first-class businesses. Our first choice will be to own them in their entirety – but we will also be owners by way of holding sizable amounts of marketable stocks. I believe that over any extended period of time this category of investing will prove to be the runaway winner among the three we’ve examined. More important, it will be by far the safest.

CSInvesting: I agree with all the above except that comparing gold as an investment to productive companies is not comparing like-with-like. Of course, owning a highly productive company or business that can compound over time will beat a sterile asset like cash or gold, but even Buffett will hold cash if he can’t buy great businesses at a good price. Gold is “money” that can’t be created by governments—by fiat.

An excellent article: Inflation Swindles the Equity Investor by Buffett.

QUESTIONS? Gold as money has far out-performed currencies over the past decades

What are your alternatives? Quality ain’t cheap………..(source: seekingalpha.com)

and….assets to fin assets

| Ticker | Industry Group | Price/ Earnings Forward | % Free Cash Flow/ Market Cap | % Forward Dividend Yield | Debt to Equity Latest Qtr | Financial Health Grade | Economic Moat | Stewardship | |

| 3M Co | MMM | Industrial Products | 21.6 | 4.7 | 2.51 | 1.04 | A | Wide | E |

| BlackRock Inc | BLK | Asset Management | 18.25 | 3.06 | 2.56 | 0.17 | B | Wide | E |

| Coca-Cola Co | KO | Beverages – Non-Alcoholic | 22.17 | 3.57 | 3.55 | 1.21 | A | Wide | E |

| Colgate-Palmolive Co | CL | Consumer Packaged Goods | 25.25 | 3.83 | 2.1 | — | A | Wide | E |

| CSX Corp | CSX | Transportation & Logistics | 23.7 | 1.45 | 1.5 | 0.94 | B | Wide | S |

| CVS Health Corp | CVS | Health Care Plans | 13.81 | 9.46 | 2.47 | 0.7 | B | Wide | S |

| Emerson Electric Co | EMR | Industrial Products | 23.98 | 5.65 | 3.17 | 0.49 | A | Wide | S |

| Exxon Mobil Corp | XOM | Oil & Gas – Integrated | 19.76 | 1.75 | 3.67 | 0.17 | A | Narrow | E |

| General Dynamics Corp | GD | Aerospace & Defense | 19.27 | 3.17 | 1.61 | 0.27 | A | Wide | E |

| Honeywell International Inc | HON | Industrial Products | 17.73 | 4.63 | 2.13 | 0.63 | A | Wide | S |

| International Business Machines Corp | IBM | Application Software | 13.14 | 8.38 | 3.08 | 2.09 | A | Narrow | S |

| Johnson & Johnson | JNJ | Drug Manufacturers | 17.15 | 4.05 | 2.63 | 0.32 | A | Wide | S |

| McDonald’s Corp | MCD | Restaurants | 20.7 | 4.65 | 2.93 | — | A | Wide | S |

| Nike Inc B | NKE | Manufacturing – Apparel & Furniture | 22.22 | 2.85 | 1.25 | 0.28 | A | Wide | E |

| PepsiCo Inc | PEP | Beverages – Non-Alcoholic | 21.41 | 4.71 | 2.75 | 2.67 | A | Wide | S |

| Procter & Gamble Co | PG | Consumer Packaged Goods | 23.81 | 4.26 | 2.94 | 0.32 | A | Wide | S |

| The Hershey Co | HSY | Consumer Packaged Goods | 22.88 | 3.09 | 2.28 | 2.99 | A | Wide | S |

| The Home Depot Inc | HD | Retail – Apparel & Specialty | 20.24 | 4.74 | 2.46 | 3.97 | A | Wide | E |

| United Technologies Corp | UTX | Aerospace & Defense | 17.15 | 1.98 | 2.36 | 0.79 | A | Wide | S |

| Wal-Mart Stores Inc | WMT | Retail – Defensive | 16.47 | 9.73 | 2.86 | 0.54 | A | Wide | S |

| Walt Disney Co | DIS | Entertainment | 18.45 | 4.39 | 1.42 | 0.34 | A | Wide | S |

| 19.38 | 4.48 | 2.48 | 1.08 |

Data source: Morningstar

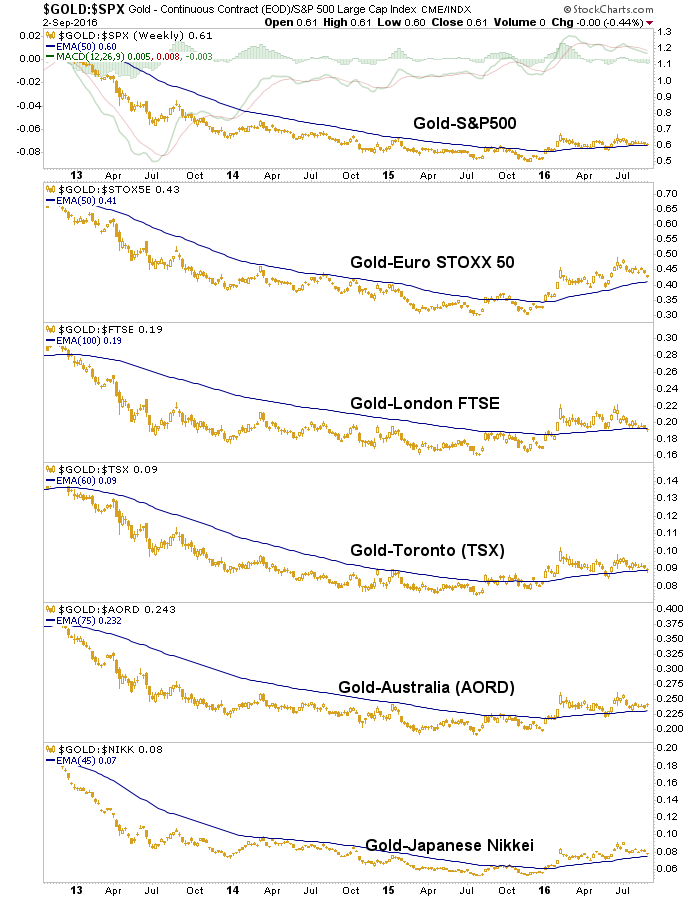

I like to have a reference to refer back to a year or five years from now capturing certain points in time. The market seems to be placing peak confidence in financial assets (stocks) vs. gold.

This post continues from a prior post: http://csinvesting.org/2016/11/17/when-no-one-wants-em-search-strategy/

The Bearish Gold Articles keep on coming: http://www.businessinsider.com/heres-why-you-should-never-buy-and-hold-gold-2016-12

http://seekingalpha.com/article/4032167-gold-miners-perfect-bear-case

http://bloom.bg/2hWukKn Running out of metal.

Even bullish mining investors expect “waterfall declines” and gold going below $1,100. Momentum creates the news: http://www.kitco.com/news/video/show/Gold–Silver-Outlook-2017/1456/2016-12-22/Mining-Stocks-Could-See-Waterfall-Declines—David-Erfle To be fair, he is long-term bullish, but note the “certainty, inevitability” of gold falling in USD below $1,100 or even to $1,000. Since he is probably considered strong hands (better capitalized with more experience in precious metals miners) his view indicates VERY bearish near-term (1 day to two/three months sentiment). As I interprete this news.

Financial risk is increasing on US company balance sheets, but then who cares while confidence is high?

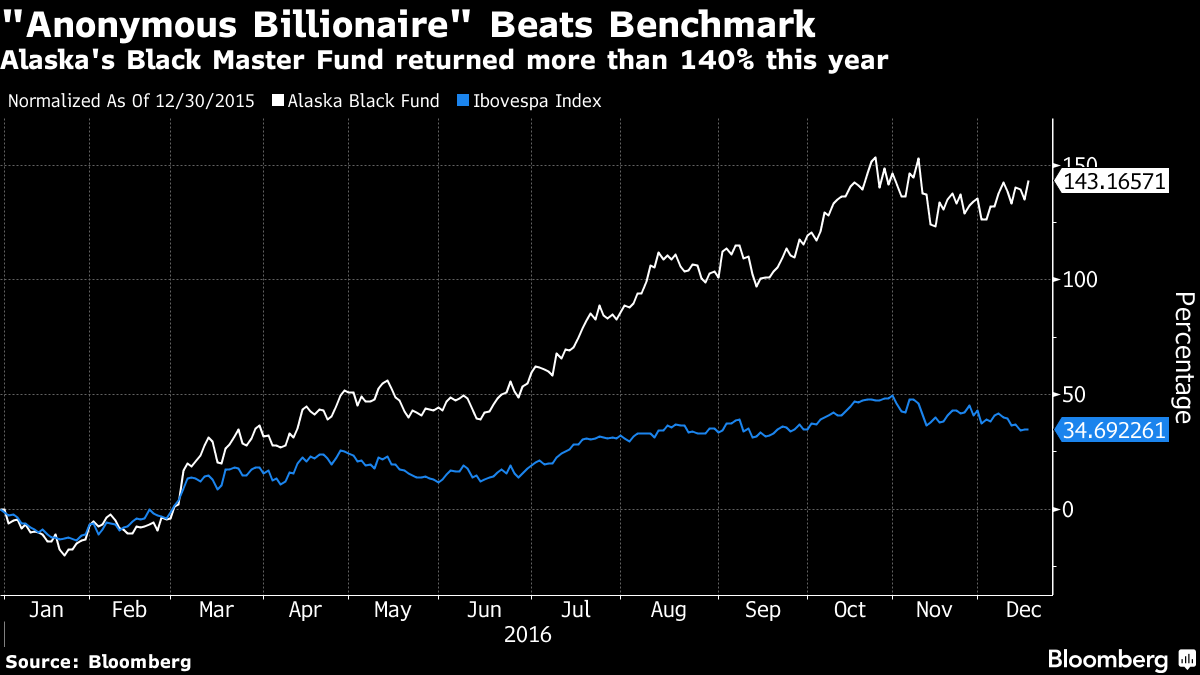

Luiz Alves Paes de Barros is something of an enigma in Sao Paulo’s financial circles. At 69, he’s known around town as the “anonymous billionaire” for quietly amassing a fortune by wagering on stocks almost no one else seemed to want.

In Magazine Luiza SA, Barros may have made one of his best bets yet.

Starting in late 2015, Barros’s Alaska Investimentos Ltda. made the battered retailer one of its biggest holdings, a brazen move in a nation stuck in the middle of its worst recession in a century. It paid off. Magazine Luiza has surged more than 1,000 percent since reaching a record low about a year ago, making it the top stock in one of the world’s top-performing markets. That turned Alaska’s Black Master, which Barros co-manages with Henrique Bredda and Ney Miyamoto, into the No. 2 fund among 569 peers focused on Brazilian equities, according to data compiled by Bloomberg.

Barros’s latest success only adds to the intrigue surrounding one of Brazil’s most storied, but media-shy, individual investors. Early in his career, he traded commodities and was a partner of star fund manager Luis Stuhlberger at what is now Credit Suisse Hedging-Griffo. Barros then spent the next half century investing only his own cash, almost exclusively in Brazilian stocks, and regulatory filings show he personally holds 1.2 billion reais in equities.

When it comes to managing other people’s money, Barros is a rookie, having co-founded Alaska in July 2015. But his investing method remains the same. He only holds a handful of stocks, favors companies with bottom-of-the-barrel valuations and usually jumps in as everyone else is bailing.

“Perfecting patience is all I’ve done over the past 50 years,” Barros says. “I love when things get bad. When it’s bad, I buy.”

During two interviews, first in Alaska’s shoebox office in the heart of Sao Paulo’s financial district and then at his personal office on the city’s oldest business thoroughfare, the silver-haired asset manager explained what drew him to Magazine Luiza and went over the stocks he likes now: Fibria Celulose SA, Braskem SA, Marcopolo SA and Vale SA.

“The market has forgotten these stocks,” he says.

Alaska started building a stake in petrochemicals maker Braskem about four months ago (the stock has surged 48 percent since mid-August after tumbling 20 percent this year before then) and pulpmaker Fibria a few months later. Barros likes both companies because they’re fundamentally sound — and valuations are low. Braskem’s price-to-earnings ratio is 8.3, less than half the level three years ago. Fibria’s valuation is less than half the average of the past two years.Marcopolo, a maker of trucks and buses, is a play on Brazil’s rebound from recession, while miner Vale will benefit as global investors start seeking value again over safety. There’s no economic expansion in Brazil without infrastructure investments, he says.

“Vale won’t be a disaster for anyone. When iron-ore prices rise again, Vale will fly,” he said.

If those stocks return just a fraction of what Magazine Luiza did, they’d count as stellar investments. In all, Alaska acquired almost 40 percent of Magazine Luiza’s free-floating shares, regulatory filings show. In 2016’s third quarter, Alaska unloaded half its stake. What’s left of Alaska’s holdings in Magazine Luiza is now worth about 111 million reais ($33 million).

Asked how he knew Magazine Luiza would do as well as it did, he says he didn’t. “I just knew it was cheap.” The fact that the retailer of appliances and electronics had a market value of 180 million reais even though a bank had offered to pay 300 million reais for the right to offer extended guarantees on Magazine Luiza products made that clear.

“Either the bank was crazy or there was value there,” Barros says.

Alaska’s Black Master fund has returned 143 percent in 2016, compared with a 33 percent gain for Brazil’s benchmark Ibovespa stock index. The gains were also driven by a stake in Cia. de Saneamento do Parana, the water utility known as Sanepar that’s almost tripled this year.

Alaska is still a relatively small player in Brazil’s 2.38 trillion-real stock market. The asset manager employs 11 people (“That includes the lady who serves the coffee,” Barros says). While Alaska oversees about 1.6 billion reais, three-quarters of that is Barros’s own cash. But the fund is actively seeking new clients.

Why now, after 50 years of going it alone?

“Because I’m positive that the market is going to rise,” he says.

Posted in Economics & Politics, Investing Gurus

Tagged Bonds, Brazilian Deep Contrarian, Gold, Sentiment, stocks

50-slides-for-the-gold-bulls-incrementum-chartbook

I post these charts for a historical reference point. I do not use them to predict where prices will go. Note though that rising CinC (currency in circulation) doesn’t always correlate to rising asset prices.

Update: Oct 6th: A contrarian: http://energyandgold.com/2016/10/04/bob-moriarty-i-am-ready-to-buy-silver-at-16/

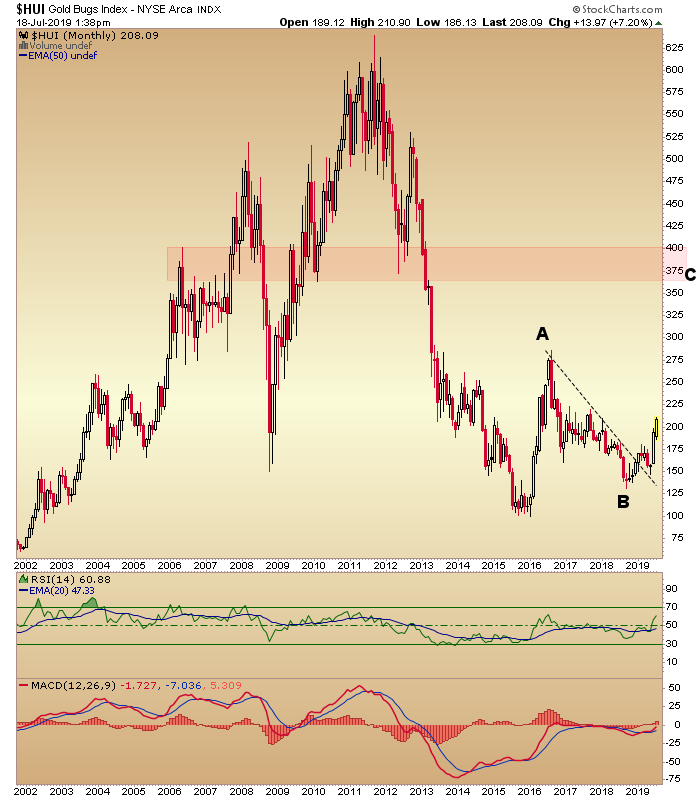

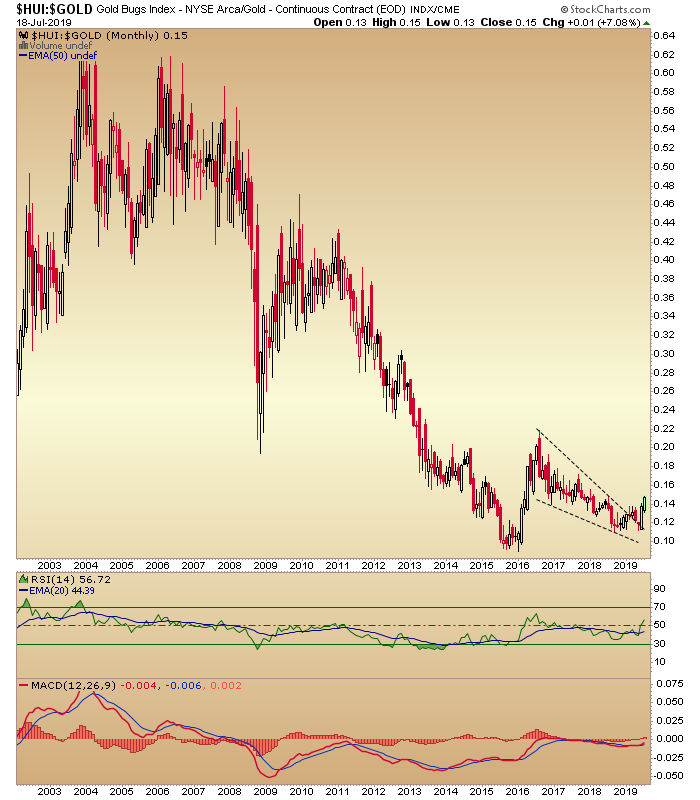

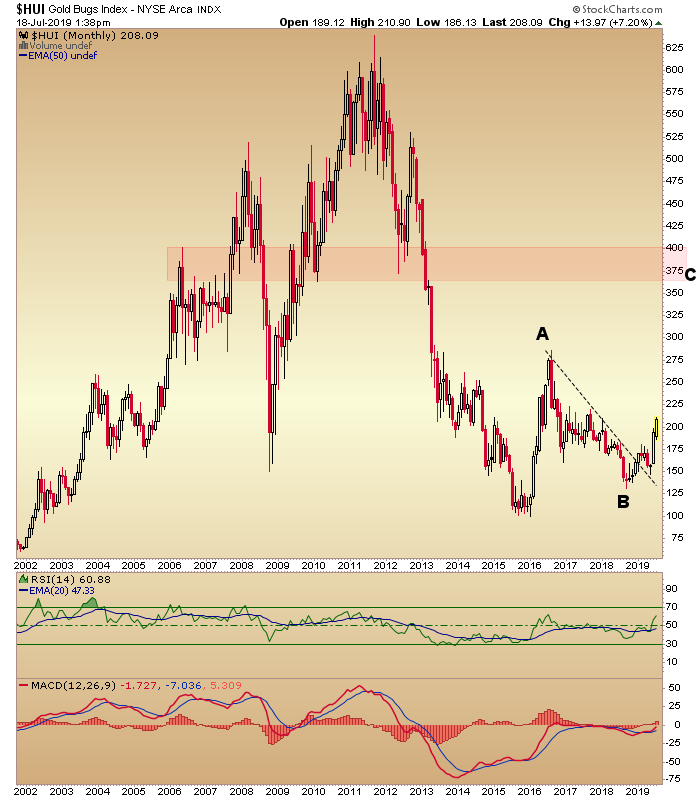

Using Technical Analysis for a Fundamental View: https://nftrh.com/2016/09/03/gold-the-good-and-the-not-yet-good/

Using Technical Analysis for a Fundamental View: https://nftrh.com/2016/09/03/gold-the-good-and-the-not-yet-good/

The Trend is not your friend

There’s an old saying in the financial markets that the trend is your friend, meaning that you will do well as long as you position your trades in line with the current price trend. This sounds good. The only problem is that you can never know what the current trend is; you can only know what the trend was during some prior period. How is it possible for something you can never know to be your friend?

Market ‘technicians’ often make comments such as “the trend for Market X is up” and “Market Y is in a downward trend” as if they were stating facts. They are not stating facts, they are stating assumptions that have as much chance of being wrong as being right.

A statement such as “Market X’s trend is up” would more correctly be worded as “I’m going to assume that Market X’s trend is up unless proven otherwise”. The proving otherwise will generally involve the price moving above or below a certain level, but the selection of this level is yet another assumption and the price moving above/below any particular level will provide no factual information about the current trend.

More http://tsi-blog.com/2016/09/sorry-the-trend-is-not-your-friend/

Mea Culpa: sequoia-may-2016-transcript Not much to glean.

However, a question for you: Is it better to buy franchises or net/nets?

If you could choose between a fair coin that was gold or a rusty tin coin that each paid off 4 to 1 on choosing heads or tails, which one would you prefer?

In October those near Philly Microcap Conference http://microcapconf.com/conferences/philadelphia-2016/

HAVE A GOOD WEEKEND!