I intend to live forever. So far, so good–Steven Wright

—

We will tackle Chapter 4 in Deep Value next week and I will find out the status of the forum for advanced students this weekend. I am swamped.

—

POP QUIZ

If a company is increasing its Return on Equity (“ROE”) over time, is that an attribute of a good business?

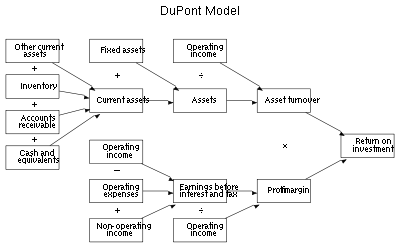

Since you are skeptical, you whip out your ROE diagrams:

Even better, you are hired as the investment banker to help advise the CEO how to enhance ROE (bonuses are based on rising ROE and increasing earnings per share).

Today, the company receives 0.00000000000001% on its money market accounts, while the CEO’s company stock trades at 34 times earnings and earns its cost of capital, 10%. Remember, you work for JP Morgan and you have student (MBA) loans to pay off. You sharpen your pencil and……………….?

My thoughts posted this weekend after I pass out grades.

—

Post: Feb. 16, 2015

Damn! I am unable to flunk anyone. There was a good discussion looking at the question from many sides because I didn’t give you much detail. The key point is: “It depends.” Context is key. You could have a situation like Microsoft’s where its core businesses (Office, etc.) generate so much cash without incremental investment that cash builds up and in turn drags down ROE (equity grows without a high return on the cash). Then the issue becomes what will Microsoft do with its excess cash? Squander on new ventures and acquisitions or return it to shareholders? Microsoft over the past six years has done a little bit of both. Perhaps low ROE means the company has no debt and thus a buffer during cyclical down turns?

Maybe this company’s ROE is suppressed by last year’s investment into new stores and more time is needed before the stores earn their expected return. Perhaps, like Costco or Philip Morris, future growth will be so profitable and persistent that buying in shares means reducing shares below intrinsic value–a long shot, how many emerging Wal-Marts, Costcos or Whole Foods are there?

The popular move which I, as a JP Morgan banker, would advise the CEO to buy back his stock with his low yielding cash (about a 0%) return and lather on low cost debt to buy stock back to earn an approximate 3% return (1 divided by 34) despite being a mundane business (10% ROE). Even at inflated prices. You shrink share count and equity to drive up EPS and ROE. The CEO collects another bonus and you can chirp about your value enhancement strategies. But when you buy an average company at 34 times earnings, you are paying over intrinsic value (let’s assume). Earnings and ROE rise but book value drops. Long-term wealth is reduced. Look at tech and consumer good companies today where managements are buying in their stock near all-time highs after a six year run-up. Few bought shares in the depths of the 2008/09 crisis. Borrow money today at 3.5% to buy-in your stock at a 5% earnings yield. Brilliant–until the next economic downturn.

This is another lesson in incentives. CEOs are incentivized to get a short-term bump in their stock prices, long-term value be damned.

GOOD JOB to all who commented.

15 responses to “POP Quiz: Is a Rising ROE Good?”