We last posted the Case Study of Cisco (CSCO) here: http://wp.me/p2OaYY-1YL

My analysis: This case forces you to compare the year-over-year change between sales and accounts receivable. The reason why you should focus on it is because the market was happy that Cisco “met” its 5% growth target for sales.

Cisco’s revenues were up 5.4% year-over-year and met management’s guidance, but accounts receivable jumped 25.2% year-over-year ($4.9 billion versus 3.9 billion–you need to look at Cisco’s prior year’s 2012 quarterly announcement to find the comparable figure for account receivable).

A small yellow flag should fly in front of you. Normally the discrepancy would indicate potential “channel stuffing,” in order to meet quarterly revenue and earnings estimates. However, if you listened to competitors of Cisco, you knew that the market for Cisco’s products were quite weak. Another explanation might be that Cisco gave generous credit terms to generate sales. Either way, there are slight concerns for future growth. In other words, the quality of Cisco’s growth may not be as high as it appears.

Of course, you need to be aware of Cisco’s valuation and take other information into consideration. If Cisco’s price is near full value (and I think it is) then this accounting information adds to my inclination NOT to own Cisco any longer.

Chapter 8: Two Key Ratios : Accounts Receivable and Inventories by Thornton L. OGlove in The Quality of Earnings

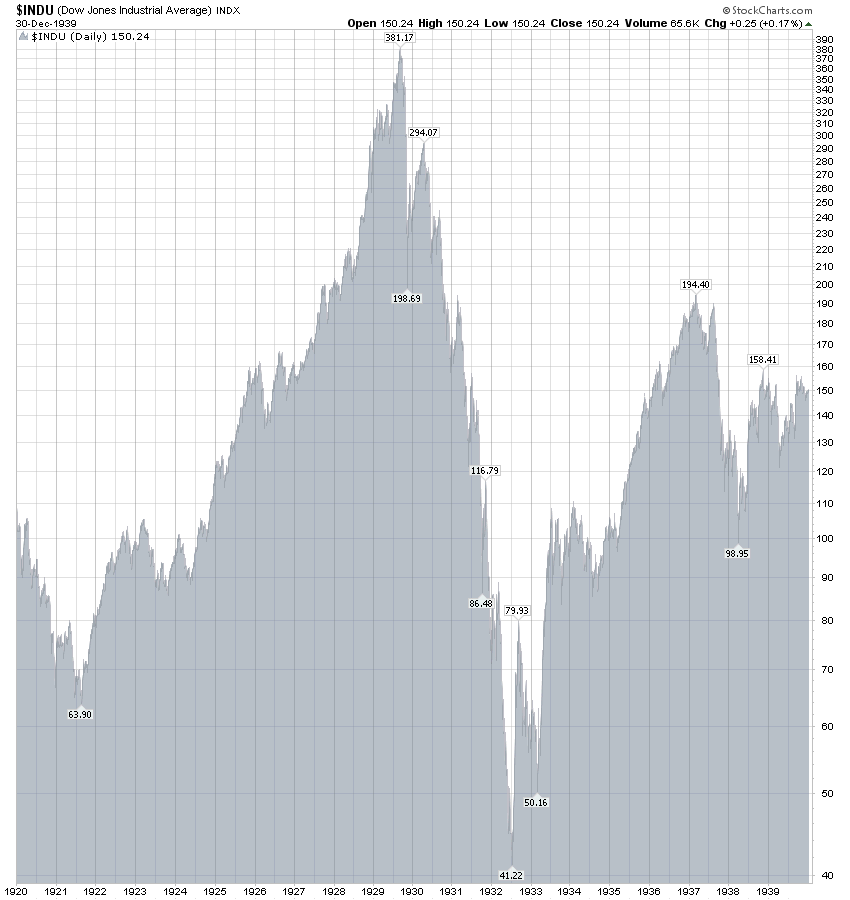

In 1931, when stocks continued their dizzying plunge during the nation’s most spectacular bear market, Bernard E. Smith, better known as “Sell ‘Em Ben,” was the king of the district. As the sobriquet indicates, Smith was a short seller who, as legend had it, ran from brokerage to brokerage on Black Tuesday, 1929, screaming, “Sell ‘Em All! They’re not worth anything!” Two years later, this former longshoreman out of Hell’s Kitchen was taking in more than $1 million a month, scorching the few remaining bulls.

According to one of many sources about him, Smith was monitoring the stock of a medium—sized industrial company which supposedly was bucking the trend and doing quite nicely. Because of this the stock was setting new highs almost daily, while the rest of the list was hitting bottom. Smith was puzzled, and one day motored to the factory where he asked to see management, only to be turned away at the gate. Undeterred, he walked around the plant, and noticed that only one of its five smokestacks was belching forth smoke. Smith took this to mean the other furnaces were not operating, and so business was bad. Rushing to a telephone, he shorted the stock which plunged several weeks later when poor earnings were reported. This was how Sell’Em Ben made part of that Month’s $1 million.

The investment world is far more sophisticated today, but such simple ploys still work better than the most baroque equations cooked up in the business schools for use on computers.

One of the these simple ploys—the best method I have every discovered to predict future downwards earnings revisions by Wall Street security analysts—is a careful analysis of accounts receivable and inventories. Learn how to interpret these, and you will have today’s equivalent of Smith’s smokeless smokestacks. In fact, had old Ben been able to go through that company’s books, he probably would have found two things: a larger than average account receivable situation, and /or a bloated inventory. When I see these, bells go off in my head telling me to analyze that particular stock in a devil’s advocate manner.

END

PS: Low future returns for stocks: http://www.hussmanfunds.com/wmc/wmc130610.htm

The Best is yet to come? http://www.gold-eagle.com/editorials_12/lundeen060913.html