“Fullness of knowledge always and necessarily means some understanding of the depths of our ignorance, and that is always conducive to both humility and reverence.” — Robert A. Millikan

Do you wish to be great? Then begin by being. Do you desire to construct a vast and lofty fabric? Think first about the foundations of humility. The higher your structure is to be, the deeper must be its foundation. –Saint Augustine

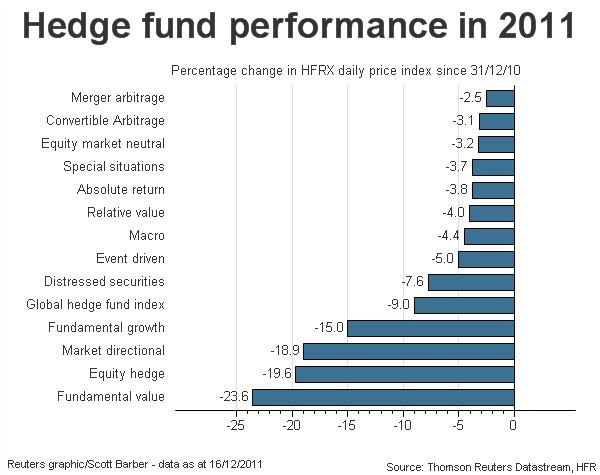

Fundamental Value Investors Struggle This Year

http://www.frankvoisin.com/2011/12/21/hedge-fund-performance-by-strategy/

I am puzzled by the performance graph as compared to the S&P 500; the Index, not including dividends, is flat for the year. How can the performance of so many money managers be so negative? Fundamental investors (whoever they are?) are down 20% or more! Thoughts? My guess is that managers had to liquidate on the violent sell-offs throughout the year due to client redemptions.

Are there any lessons here? If a money manager had simply held stocks and done nothing all year, clients’ accounts would be in the black with dividends included.

More on Central Banks in Europe:

http://www.thefreemanonline.org/in-brief/european-central-bank-turns-to-credit-expansion/

Lessons in Economics

Interest rates in a gold coin standard: http://lewrockwell.com/north/north1075.html An article on understanding interest rates. What would interest rates be under an expanding economy with no currency debasement?

A lecture on Keynes and Social credit. This lecture is really about how Central Banks “pay off” government debts through inflation. A lesson on how production creates demand. Productivity (Says Law) drives wealth creation and economic growth not consumption. http://www.garynorth.com/public/8874.cfm

Interesting Charts and Graphs this Past Year

http://mjperry.blogspot.com/2011/12/atlantic-most-important-graphs-of-2011.html Click on the links within this article. Remember correlation is not causation.

Health

With all the spiked eggnog you will be drinking over the holidays, you will need to know How to Interpret Cholesterol Test Results

Can I hear your Primal Scream?

4 responses to “Fundamental Investors Struggle in 2011, Central Banks and Europe, Cholesterol”