Readings: Munger-Talk-at-Harvard-Westlake and don’t forget to subscribe to kessler@robotti.com and www.santangelsreview.com to be up to date on all news related to investing.

How the Market Really Works

Editor: The author argues that GDP growth, as measured in money and stock market values as reflected by broad indices like the S&P 500 and the DJIA, rises as a result of the increase in money caused by the expansion of bank credit. Note that the DJIA went from 809 on Jan 2, 1970 to 12,800.18 on January 4, 2008, a gain of 1,582 percent, even greater than the increase in the (m-2) money supply in that period.

If money supply was held constant or grew slowly (as would be typical under a classical gold standard), then capital gains could be made only by stock picking–by investing in companies that are expanding market share, bringing to market new products, etc., thus truly gaining proportionately more revenues and profits at the expense of these companies that are less innovative and efficient.

The stock prices of the gaining companies would rise while others fell. Since the average stock would not actually increase in value, most of the gains made by investors from stocks would be in the form of dividend payments. By contrast, in our world today, most stocks–good and bad ones–rise during inflationary bull markets and decline during bear markets. The good companies simply rise faster than the bad.

An interesting, important read: http://mises.org/daily/4654

In fact, the only real force that ultimately makes the stock market or any market rise (and, to a large extent, fall) over the longer term is simply changes in the quantity of money and the volume of spending in the economy. Stocks rise when there is inflation of the money supply (i.e., more money in the economy and in the markets). This truth has many consequences that should be considered.

Since stock markets can fall — and fall often — to various degrees for numerous reasons (including a decline in the quantity of money and spending), our focus here will be only on why they are able to rise in a sustained fashion over the longer term.

Since stock markets can fall — and fall often — to various degrees for numerous reasons (including a decline in the quantity of money and spending), our focus here will be only on why they are able to rise in a sustained fashion over the longer term.

The Fundamental Source of All Rising Prices

For perspective, let’s put stock prices aside for a moment and make sure first to understand how aggregate consumer prices rise. In short, overall prices can rise only if the quantity of money in the economy increases faster than the quantity of goods and services. (In economically retrogressing countries, prices can rise when the supply of goods diminishes while the supply of money remains the same, or even rises.)

When the supply of goods and services rises faster than the supply of money — as happened during most of the 1800s — the unit price of each good or service falls, since a given supply of money has to buy, or “cover,” an increasing supply of goods or services. George Reisman offers us the critical formula for the derivation of economy-wide prices: [1]

In this formula, price (P) is determined by demand (D) divided by supply (S). The formula shows us that it is mathematically impossible for aggregate prices to rise by any means other than (1) increasing demand, or (2) decreasing supply; i.e., by either more money being spent to buy goods, or fewer goods being sold in the economy.

In our developed economy, the supply of goods is not decreasing, or at least not at enough of a pace to raise prices at the usual rate of 3–4 percent per year; prices are rising due to more money entering the marketplace.

The same price formula noted above can equally be applied to asset prices — stocks, bonds, commodities, houses, oil, fine art, etc. It also pertains to corporate revenues and profits. As Fritz Machlup states:

It is impossible for the profits of all or of the majority of enterprises to rise without an increase in the effective monetary circulation (through the creation of new credit or dishoarding).[2]

…….

The Link between the Economy and the Stock Market

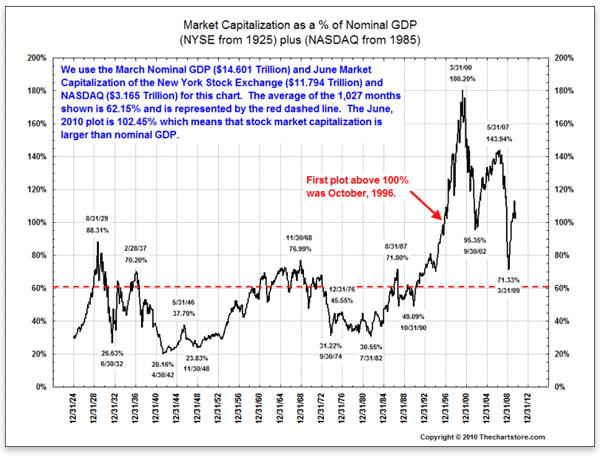

The primary link between the stock market and the economy — in the aggregate — is that an increase in money and credit pushes up both GDP and the stock market simultaneously.

A progressing economy is one in which more goods are being produced over time. It is real “stuff,” not money per se, which represents real wealth. The more cars, refrigerators, food, clothes, medicines, and hammocks we have, the better off our lives. We saw above that, if goods are produced at a faster rate than money, prices will fall. With a constant supply of money, wages would remain the same while prices fell, because the supply of goods would increase while the supply of workers would not. But even when prices rise due to money being created faster than goods, prices still fall in real terms, because wages rise faster than prices. In either scenario, if productivity and output are increasing, goods get cheaper in real terms.

Obviously, then, a growing economy consists of prices falling, not rising. No matter how many goods are produced, if the quantity of money remains constant, the only money that can be spent in an economy is the particular amount of money existing in it (and velocity, or the number of times each dollar is spent, could not change very much if the money supply remained unchanged).

This alone reveals that GDP does not necessarily tell us much about the number of actual goods and services being produced; it only tells us that if (even real) GDP is rising, the money supply must be increasing, since a rise in GDP is mathematically possible only if the money price of individual goods produced is increasing to some degree. Otherwise, with a constant supply of money and spending, the total amount of money companies earn — the total selling prices of all goods produced — and thus GDP itself would all necessarily remain constant year after year.

—