Are conditions deflationary or inflationary? Do bonds have lower to go? If I wanted to short long-term bonds, I would choose corporate bonds over U.S. treasuries because you are fighting a subsidized market of central banks buying government debt.

WHAT IS AN INTEREST RATE?

An interest rate is the discount that individuals place on the value of future goods compared to present goods. This discount applies to money and everything else. Mises said, “Originary interest is a category of human action. It is operative in any valuation of external things and can never disappear” (Human Action, page 524).

This discount “is a ratio of commodity prices (note contango between June Gold and Dec. Gold), not a price in itself” (p.523. “Originary interest is not ‘the price paid for the services of capital’….It is, on the contrary, the phenomenon of originary interest that explains why less time-consuming methods of production are resorted to in spite of the fact that more time-consuming methods would render a higher output per unit of input” (p. 523). Interest is not profit. Profit is the difference between the purchase price of a good and its sale price, after having deducted the income that would have been earned by placing the money at interest. Profit originates in the entrepreneur’s perception –his guess–that his competitors have underbid the price of some resource, and that future consumers will bid more than his competitors think (p. 532).

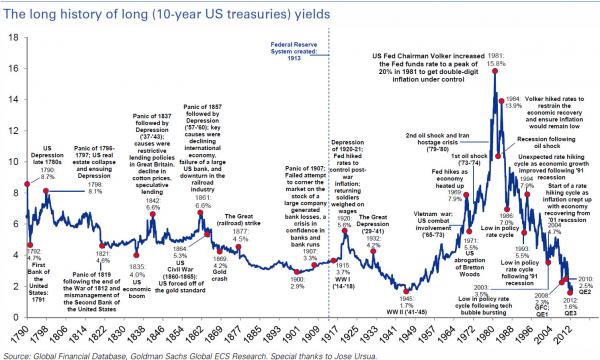

Pingback: History of 10 Year USTs | Photogenic Thoughts