Investing, when it looks the easiest, is at its hardest. When just about everyone heavily invested is doing well, it is hard for others to resist jumping in. But a market relentlessly rising in the face of challenging fundamentals–recession in Europe and Japan, slowdown in China, fiscal stalemate and high unemployment in the U.S.– is the riskiest environment of all.–Seth Klarman

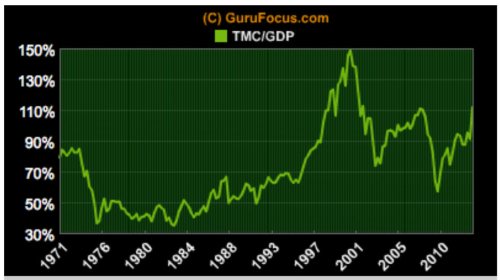

Read more on Buffett’s market indicator flashing red: http://greenbackd.com/2013/05/22/warren-buffetts-favored-measure-of-market-valuation-passes-unwelcome-milestone/?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+Greenbackd+%28Greenbackd%29

READERS’ QUESTIONS

Reader #1: To give you a bit of an introduction about myself, I am based in Singapore and a third year accountancy student. Have been researching Asian equities for quite a while and would like to seek your opinion on my analysis process.

I have read many books on value investing; Greenwald, Graham, Fisher and also accounting books like Financial Shenanigans. However, this is what I noticed whenever I am about to start working on a company.

Financial statements: I am able to pinpoint out the basic stuff like gross margin, ROA, ROIC, balance sheet ratios etc. But to be able to paint the full picture of a company, I am still not quite certain of my ability to do so yet. I have seen how some investors are able to tell a story using the financial statements (Have seen in newsletters of funds, books). Like picking out the nitty-gritty stuff.

Qualitative aspects: I start out first by reading the past few years of annual reports to get an idea of the corporate structure of the company and the business model. This step is generally OK. However, I am kinda unsure how to proceed on from here. What I usually do is that I just google the business model. Etc this company sells jewelry. I google jewelry business/how is jewelry manufactured and sold…you get my point.

But somehow, I still feel kinda lacking when I compare my analysis with the fund managers here. I read their newsletters, download conference calls transcript to see what questions they ask etc. And their level of understanding of the business simply astonishes me!

Not sure how you go about doing it but would like to hear from you!

My reply: You may need to learn more about analyzing an industry/business. As you first look at a company you want to answer several questions:

Does the company have a competitive advantage as shown by fairly high and consistent profitability and/or market share? If yes, then what is the source of competitive advantage? Patents/Copyrights (Disney), Unique Asset (Compass Minerals) , economies of scale coupled with customer captivity (Coke), etc. Is the moat weakening or strengthening? What price will you pay for growth?

You could draw up an industry map to understand the business better. Read Bruce Greenwald’s Competition Demystified or (Use search box on csinvesting.org and follow links to download cases on Coors, Coke, etc.).

Read: Strategic Logic by J. Carlos Jarillo and The Curse of the Mogul, What’s Wrong with the World’s Leading Media Companies by Jonathan Knee and Bruce C. Greenwald. Also, The Profit Zone: How Strategic Business Design Will Lead You to Tomorrow’s Profits by Adrian J. Slywotzsky.

If the business has no competitive advantage–95% of most businesses–then can management earn a fair return on the company’s assets? Does management allocate capital effectively; do they eat their own cooking?

Always try to find a thesis for a variant perception. Is there hidden value in this company like shutting down a losing subsidiary, NOLs, underutilized assets, etc. Where can I develop an understanding that will give me an edge?

Read with a purpose. Develop a checklist of your own. Try to determine the key metrics of the business. What are the risks in the business?

Try to read biographies of business leaders in a particular industry. You can find books about the cruise ship industry, steel, beverages, sports, media, and airlines. Also, try to speak to people in the business and industry once you have a basic understanding of the business. Read about the history of the industry–its booms and busts–what are the opportune times to buy and sell such a business?

But until you spend about ten years studying hard, it is difficult to develop proficiency in anything, so patience. Good luck.

Reader #2:

I have been dipping my toe into gold stocks having owned Yukon Nevada and Energold (EGDFF) over the last year or so. I am thinking along your lines that I need to diversify into ten or so names with a mix of producing and near producing. I wondered if you knew the current top 10 GSA recommendations and if there were any other stocks at the exploration or near producing end that you thought were worth further investigation. I see Weiss has a large position in Seabridge, but I don’t really know how to analyze the opportunity?

My reply: Like this gentleman, http://truecontrarian-sjk.blogspot.com/, I am drawn to cheap assets. Precious metals miners (GDX and GDXJ) certainly qualify. The more I study mining, the more I dislike the business. These businesses are highly capital intensive, they are price takers and subject to many operational risks. Right off the bat, you HAVE to buy these assets cheaply to reduce your risks and you must diversify (8 to 12) names to take advantage of the insurance concept of GENERAL cheapness. One of your companies could get swamped but overall your other companies will flourish. I bought Energold last week once it went 15% below $2.00 per share because then you were buying the company for less than its working capital of which 40% of that was cash. I don’t buy the thesis that Energold has a competitive advantage. I am buying cheap assets.

The mining industry has four tiers: Senior Producers like Yumana, Newmont, Agnico-Eagle, Goldcorp, Barrick. Then you have mid Tier Producers like EGO, GORO, and NGD, then you have developmental companies like Seabridge, Pretium and others which may be years until production. Finally, the lottery tickets like explorers found in GLDX.

If you want exposure to bullion, I recommend CEF at a 2% discount or more. Avoid GDXJ because of some of the low quality names in that index. You might want TOCQUEVILLE. John Hathaway, the fund’s manager, has a long experience and good reputation. Read his letters for several years. See his fund below:

Above, is GROW (US Global Investors) this may be a cheap way to participate in the rebound in precious metals and commodities. The current price seems to be at a discount to its cash and AUM of $1.3 billion using 2% of AUM (pay less than $3 per share).

Another way to reduce your risk through diversification and avoiding operational mining risk is to look at the royalty/streamer companies like SLW, RGLD, SAND, FNV. Though they are not as statistically cheap, they have huge free cash flows. I think those companies will be needed more and more to finance future exploration and development. Put your hat in the ring with experts. Now is a better time to be buying than in the past five years based on valuations.

The safer strategy would be to go with Tocqueville because you get broad diversification with a manager who knows his companies. The downside is the annual fee. However, You can make decent returns when this sector rebounds and be ready to sell when his fund become popular again. Look at Fairholme last year with its heavy investments in financials–a formerly out of favor sector:

The downside in gold and gold stocks may not be over. My thinking is that the current events are VERY bullish for gold long-term but bearish short-term. Japan’s insane policy of currency debasement is forcing down interest rates (for now) and leading to a reach for yield (return) so gold might be under pressure as investors leave gold to pursue stocks. Eventually, Japan’s currency will implode, leading to massive unintended consequences and a rush back to safety. But, gold miners don’t necessarily need gold to go up, they need their inputs to decline more than gold, so their margins widen/stabilize.

Also, gold should just be part, not all, of your portfolio.

P.S: ENERGOLD (EGDFF): Down and Dirty Analysis

Someone sent me this……sometimes the best ideas are the simplest.

Or even better, Energold. I am a proud shareowner. But emotions and will aside. Here you have a biz with 3 operations. Earnings power is the best way to look at it and most valuable, but let’s imagine we just sold for parts:

Dando (worth 3mm or so – bought for 300k or so plus put in working capital)

Bertram (paid 18mm for it. But EBITDA now back up in the low/mid teens – worth at least 30mm today)

Mining Biz (133 rigs, let’s be super conservative and say 250k per rig – so worth floor of 33.25mm)

Impact Silver Stake (3.8mm at today’s prices)

In addition, 91.2mm of working capital (incl. cash and inventories)

Minus the 43mm in total liabilities = $3+30+33.25+3.8+(91.2-43)= 118.7mm ($2.59 per share) vs today’s EV of 68.15 mm.

I am no genius – but that seems silly cheap to me. What’s more, earnings power is substantially higher, and the company is growing, and it has amazing operational leverage. Sure, results may not look amazing until they are back towards 5000k meters per drill annually. But even if they were to only get 3500 meters per drill @ 180 per meter (assuming cost per meter is ~138 per meter) the minimg biz is still FCF positive and earnings positive. And these are bad times. Bertram still doing fine, as is Dando.

Another good blog: http://brooklyninvestor.blogspot.com/

4 responses to “Readers’ Questions: Studying a Company; Gold Stocks; Down and Dirty on EGD.V”