Photo by Sergei Tokmakov on Pixabay

The crypto world has experienced a boom over the last decade, with more investors seeing its potential. The assurance of financial stability and wealth growth quickly makes a crypto investment worthwhile. As a newcomer in this space of digital assets, your chances of reaping huge profits will be influenced by your capacity to navigate the pitfalls. Despite the market’s volatility, it will inject strength and consistency into your portfolio. This article equips you with insights on how to start your crypto journey on the right foot.

1. Failing to Do Thorough Research

Before entering the crypto world, familiarize yourself with the fundamental details of different coin categories and investment strategies. Spend time on each asset, concentrating on the use case, technology, dynamism, and the team behind the project.

Get these insights from reliable sources like whitepapers and crypto news platforms. By doing your research, you’ll understand how the various cryptocurrencies work. Investing without sufficient knowledge can lead to poor decision-making. For example, not understanding the difference between proof of work and proof of stake can impact your investment choices.

2. Choosing Incompetent Exchanges

The best way to start an investment mission is to find a credible exchange that is performing well. Even after seeing flashy adverts and promises of low fees on different platforms, do your homework first. Be specific about the security standards, experience of other users, and regulatory compliance. Ascertain the user-friendliness of exchange, which will influence how easy your time will be as a beginner.

Evaluate its functionality, including the minimum amount you can spend and diversity in the crypto assets. It should allow you to buy Bitcoin using your preferred method and fast with transaction processing. The best will even come with excellent customer support to assure you quick assistance when need be.

3. Investing More Than You Can Avoid to Lose

As a new investor on a mission to enjoy high returns, it’s tempting to commit more funds to the investment. The important thing is training yourself to commit more as your financial resilience increases. This is the best way to survive in the volatile market while getting more exposure to things that work.

Start by creating a budget to help you manage your finances. Allocate an amount that you’ll be comfortable with, even in case of a loss. After crafting the budget, remain dedicated and committed to it, which will safeguard your long-term financial health.

4. Neglecting Security Practices

The promising prospects and high profits make crypto spaces attractive to cyber criminals who may want to lure unsuspecting investors. It’s crucial to be vigilant to easily detect scammers from afar. Adopt the best practices, from utilizing two-factor authentication to targeting secure wallets.

You must keep your personal details confidential and avoid sharing the recovery phrases and private keys. Before making any deals, confirm the credibility of all the investors you’re dealing with.

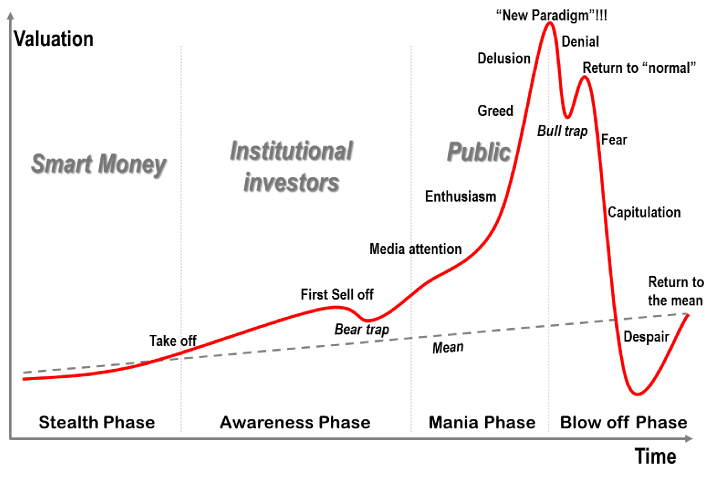

5. Falling for Hype and FOMO

One way to avoid impulsive decisions is to refrain from following the hype with the hope of enjoying huge gains fast. The fear of missing out (FOMO) may sometimes risk buying high and selling low, mainly when the market corrects itself. The right approach is to base your decisions on real-time market analysis.

Focus on the market trends, which will help you identify the best timing for your trade and increase your chances of making profits. Adopt a habit of regularly researching while refining all your entry and exit strategies.

Endnote

Investing in cryptocurrency as a beginner may feel confusing at first, but there are critical considerations for a successful investment. You need to know more about the principles that will help you succeed in this journey, such as working with a budget, researching different cryptos, and picking the correct exchange. These efforts will increase your chances of making profits in this volatile market.