The source and root of all monetary evil is the government monopoly on the issue and control of money. –Friedrich Hayek

An interesting discussion

Pivotal to the investment process is interest rates. For entrepreneurs to control capital, interest rates must reflect its real cost rather than merely the cost of printing money. Otherwise the money printers will dominate investment.

Zero interest rates rob future generations by bidding up the value of current government assets and privileges. A bubble of current assets inflated by near-zero –interest loans does nothing to fund the future. Retirees face a prospect of shriveled pensions and support and watching their children and grandchildren live slow motion lives. –George Gilder from The Scandal of Money: Why Wall Street Recovers But The Economy Never Does

—

I’d come to Wall Street for validation. I believed my value was in achievement, that achievement was conferred by instituions and rendered in money. I’d joined an army of bright young men and women dressed in business-casual uniforms, streaming into the service of massive corporation without any sense of why we’d chosen to dedicate our lives to further enriching the already rich, except that we needed proof that we were valuable, because at heart we didn’t really believe we were. –Sam Polk from The Love of Money

—

Moving towards a solution

https://monetary-metals.com/arizona-considers-issuing-a-gold-bond/

Deep Value Investor: 2016-05_conference_transcript

HAVE A GREAT WEEKEND!

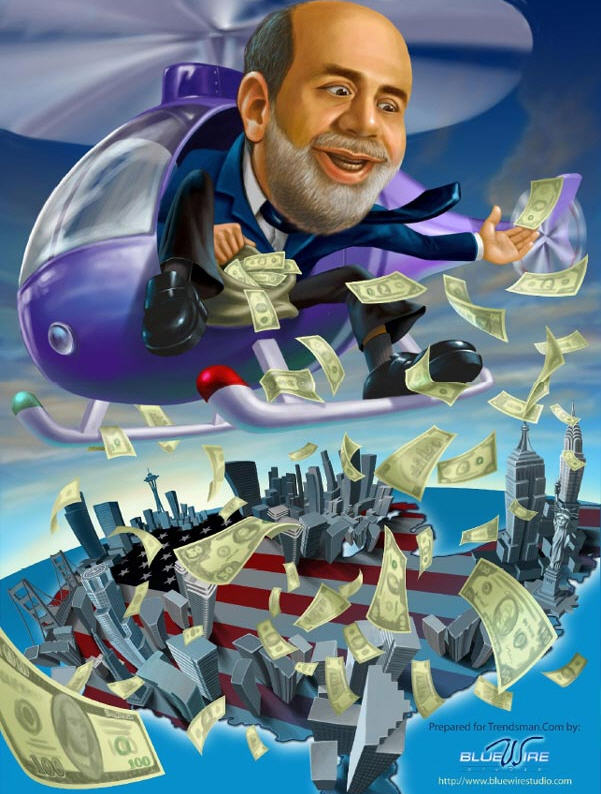

2 responses to “Helicopter Money?”