Ganging up on Gold

Because I hold gold related investments, I always seek out the opposing views to test my thesis. On the recent 5% fall in gold, a chorus of bears came out.

Natixis offers three main arguments for this call, only one of which makes sense, at least “technically”, if you will:

“For 2017 and 2018, we think that the biggest factor influencing the price of gold is the expected path of U.S. interest rate hikes,” the analysts said. “Also, we do not expect further rate cuts by the [European Central Bank] or [Bank of Japan] as this is likely to damage their banking system especially in the case of Europe.”

Natixis economists are expecting to see the Federal Reserve raise interest rates by 25 basis points three times next year: June, September and December.

Not only will higher bond yields raise gold’s opportunity costs but they will also boost the U.S. dollar, providing another headwind for the precious metals, the analysts explained.”

So when you read the above, always ask for theoretical and empirical evidence of the authors claims. Is there any long-term correlation between US interest rates and the dollar price of gold? And why? More here: Ganging up on gold

Some negative comments on gold is spot-on like

http://tsi-blog.com/2016/10/the-gold-manipulation-silliness-continues/

More perspective……………..

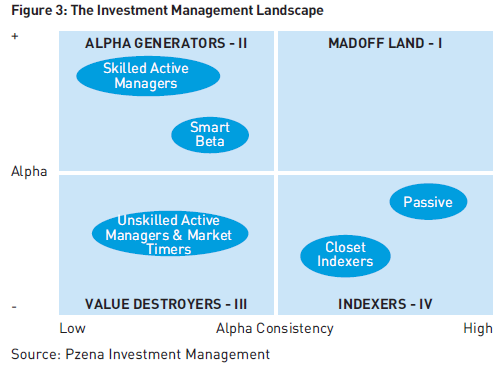

Passive Investing

……The most successful professional investors like Warren Buffett, Paul Tudor Jones, John Templeton, George Soros and Jim Rogers, know this well. Their methodologies are even built upon the idea that an intelligent investor can get ahead by taking advantage of those times the crowd becomes irrational, the antithesis of the EMH and MPT.

https://www.thefelderreport.com/2015/02/11/the-wisdom-of-insecurity-in-the-stock-market/

Pingback: What we are reading on 10/19/2016 - UNDERVALUED STOCKS