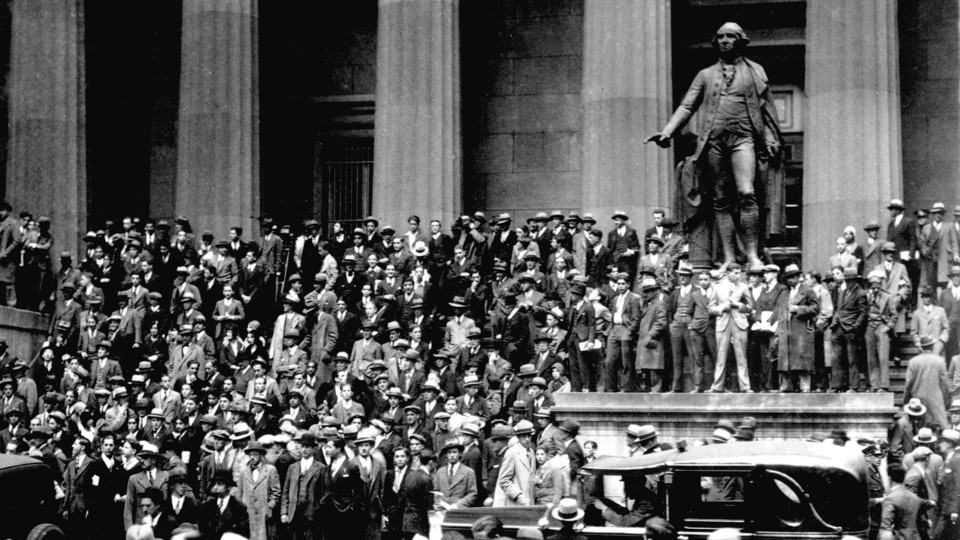

This 1931 article written in the aftermath of the Great Crash of October 1929 and in the teeth of the Great Depression illustrates the pattern of human emotions in the boom/bust cycle. This should be read alongside Murray Rothbard’s excellent work, America’s Great Depression which analyzes in detail the causes of the depression.

But can speculation be fettered? Are we dealing with human emotions which defy control? Certainly, we cannot fetter speculation by our naïve American tendency immediately to enact a law. Making short selling—a that bête noire of the amateur economist—a crime or attempting to forbid speculation in securities by imposing a heavy tax upon the resale of stock recently purchased, would obviously be impractical as well as futile in a democratic state. So, too, an effort to distort and distend the functions of the Federal Reserve System, by charging it with the power and duty to ration supplies of credit to the stock market, would be an unworkable and paternalistic venture.

2 responses to “Speculation during the Great Crash of 1929”