When I’m bearish and I sell a stock, each sale must be at a lower level than the previous sale. When I am buying, the reverse is true. I must buy on a rising scale. I don’t buy long stocks on a scale down, I buy on a scale up.

The average man doesn’t wish to be told that it is a bull or a bear market. What he desires is to be told specifically which particular stock to buy or sell. He wants to get something for nothing. He does not wish to work. He doesn’t even wish to have to think.I never hesitate to tell a man that I am bullish or bearish. But I do not tell people to buy or sell any particular stock. In a bear market all stocks go down and in a bull market they go up. –Jesse Livermore

You get recessions, you have stock market declines. If you don’t understand that’s going to happen, then you’re not ready, you won’t do well in the markets.–Peter Lynch

I’ve found that when the market’s going down and you buy funds wisely, at some point in the future you will be happy. You won’t get there by reading ‘Now is the time to buy. –Peter Lynch

An Impending Recession?

http://www.hussmanfunds.com/wmc/wmc120625.htm

Or hope for the future?

http://www.ftportfolios.com/Commentary/EconomicResearch/2012/6/25/the-second-step-supreme-court

and http://scottgrannis.blogspot.com/2012/06/housing-update-significant-improvement.html

I prefer to focus bottom up. How about going where a depression is ALREADY occuring rather than fearing something bad WILL happen.

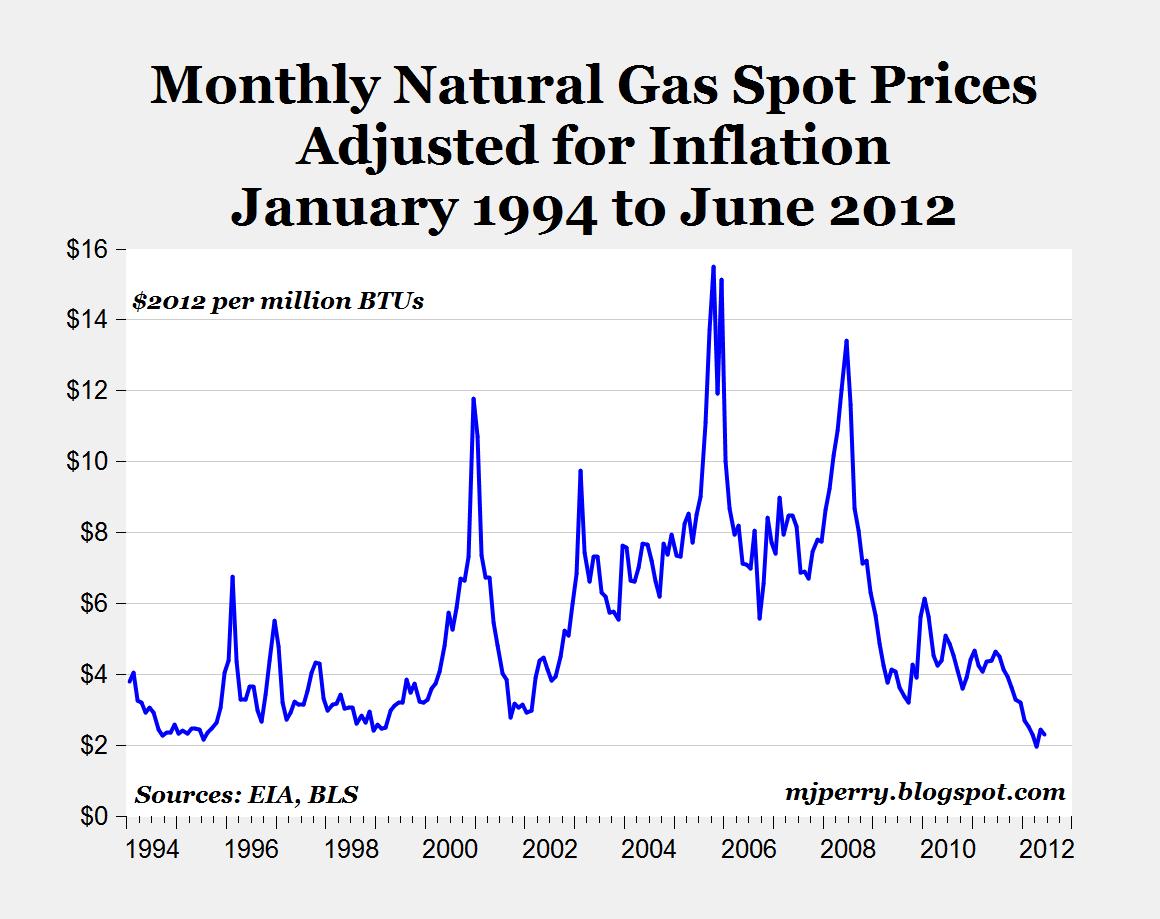

The Natural Gas MArket

Natural Gas is currently trading under its true marginal cost of production due to a law known as “Hold by Production” where an exploration company must have a producing well operating in order to hold their leases in perpetuity. Oil is trading at 20 times the BTU equivalent of natural gas. Also, storage facilities can’t hold as much nat. gas as is being produced, so production has to be sold at any price. The main point is that the cure for low prices is low prices or, in other words, the laws of supply and demand are inevitable given TIME.

The Arithmetic of Shale Gas: Consumer Benefits from Technology of Shale Gas Exceed $100 Billion

“The Henry Hub spot price in 2008 was $7.97 per mcf and in 2011 was $3.95 per mcf (see chart above) so that the difference in price over three successive years was $4.02 per mcf. Gas production in 2008 was 25.6 tcf so that the surplus to consumers by the price reduction from shale gas equaled $102.9 billion.

This very large amount of consumer gain—over $100 billion—from the new technology induced price reduction in gas is the elephant in the room. It comprised a substantial majority of total expenditures on this fuel nationwide. In past years those expenditures were limited by the higher costs of production of gas produced from vertical wells. These were in part producer surplus but most were the costs of sustaining well operations in the old technology. Even so it is startling to acknowledge that consumer benefits from the technology of shale gas drilling and new gas production can be expected to exceed $100 billion per year, year in and year out as long as present production rates are maintained.”

The authors then account for the possible environmental costs to society and compare that to the consumer-savings of $100 billion per year:

“How then do we extrapolate individual disaster scenarios across an entire industry to determine the social cost of possible contamination from fracking in order to deduct it from the consumer surplus of $100 billion for each year? We consider that the reported instances of contamination from fracking relate, at most, to an extremely limited minority over hundreds of thousands of wells. Assuming the worst—that the accidents occur in one year; that the cleanup requires a new water well at $5,000; and that one hundred spills occur at $2.5 million per spill given then that the industry drills 10,000 new wells per year. The cost of frackwater contamination is $250 million. Economic benefits, as estimated in as limited methodology as is reasonable, exceed costs to the community by 400-to-1.”

And they also estimate the consumer benefits of switching from oil to natural gas:

Replacing 1.0 million bbls per day of crude oil with the 6 billion cubic feet (bcf”) equivalent of natural gas, would generate approximately $25.6 billion ($70/bbl*1 million bbls*365 days) of consumer surplus for the US economy over one year.”

Here’s a Forbes articlethat summarizes some of the key findings of the Yale study.

More here:http://www.creditbubblestocks.com/2012/05/natural-gasoil-btu-spread-in.html

Companies

The glut of natural gas has depressed natural gas and oil companies like Devon Energy (DVN) and Chesapeake (CHK). Of course, price may decline further, but lets check back on these two companies in early 2014.

See you in 2014!