The above letters can teach you how a business owner should communicate

with his or her fellow owners. A lesson in understanding a business.

The above letters can teach you how a business owner should communicate

with his or her fellow owners. A lesson in understanding a business.

—

Posted in History, Investor Psychology, Search Strategies

Tagged CCJ, cyclical markets, Gold, gold miners, Psychology, Uranium

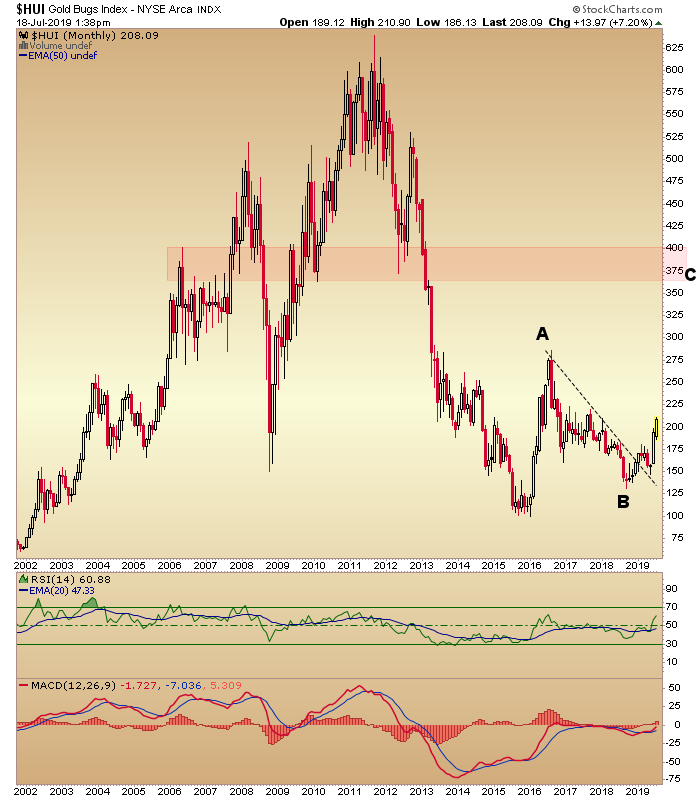

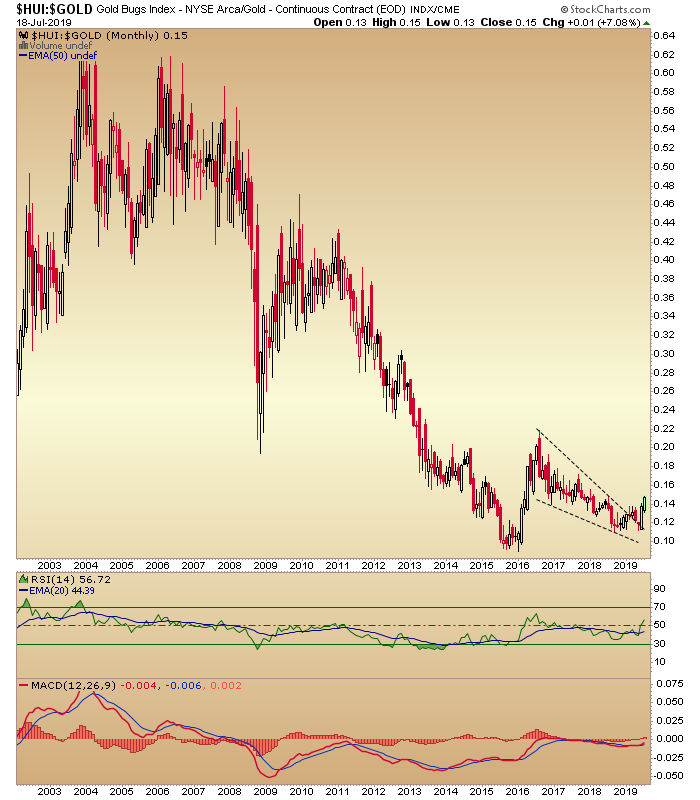

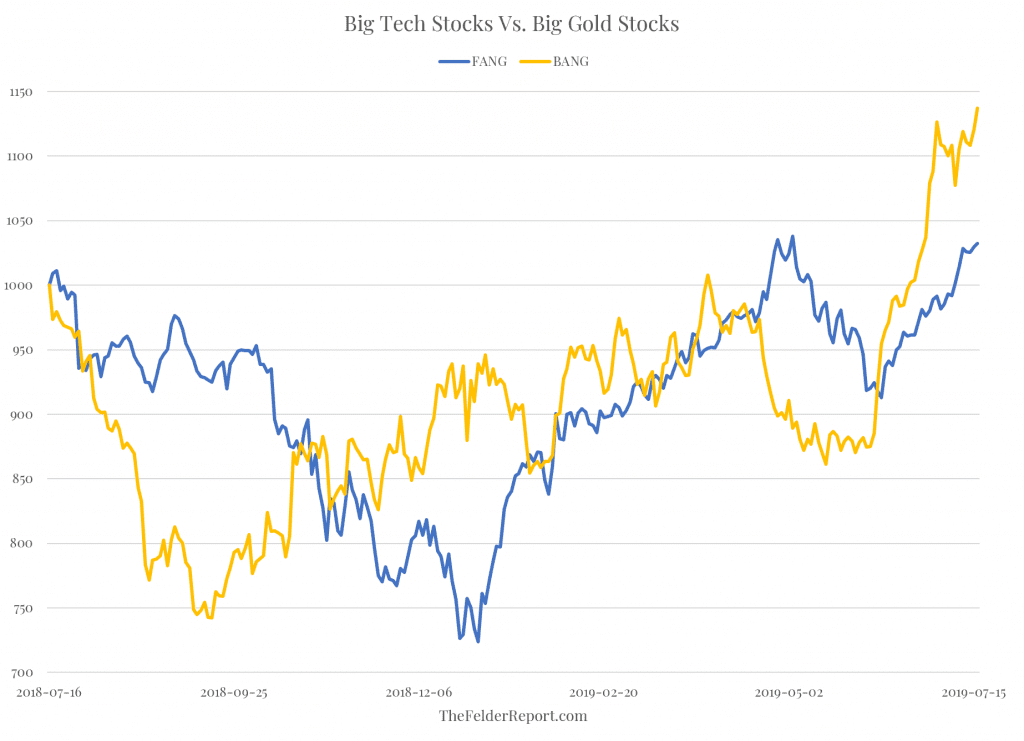

I am on my knees buying gold/silver/uranium miners with both hand this prior week (ouch!). Since the chart of the futures positions (COTS) is now more extreme–money managers are probably short now like back at end 2015/beginning 2016. I use the blog as a diary/bulletin board on occasion. I hate miners as a business but love the values. Note the vast underperformance of hard (read: miners) vs. financial assets (SPY). Not a recommendation, just a “diary” post.

Bob Moriarty Archives Jul 3, 2018

Entire article: http://www.321gold.com/editorials/moriarty/moriarty070318.html

Buying resource stocks has nearly nothing to do with the commodity. And near zero to do with management or country risk or interest rates or the dollar or what the DOW is doing. Those who are always wrong about markets spend a lot of time mumbling about all those things and they are just wasting ink.

Unbeknownst to GATA or the other PermaBulls who believe some munchkin at the Federal Reserve pulls the levers all of the time, markets go up and markets go down. They all do and they do it constantly. So if someone is telling you silver is the rarest mineral known to mankind and it should go up everyday of the week, forever, he’s lying to you in order to get you to pay for a subscription to his service. In short he’s like a bible thumping preacher or politician, he wants your support, and he specializes in telling you the lies you want to hear.

During the bull phase of the metals markets even the biggest piece of crap stocks go up. During the eventual bear phase of the metals markets even the best run with the most desired commodity in the safest jurisdiction goes down.

So investors in junior resource stocks need to keep two things in mind. You have to trade markets and take a profit when you can or the only alternative is to take a loss. I have had hundreds of investors tell me their biggest mistake was not taking a profit when they could. And given that something like 95% of investors in junior lottery tickets lose money, sell when you can, not when you have to.

You need to align yourself with the phase of the market you are in and let the wind be on your back. We had major lows in 2001 in gold and silver, again in 2008 and late in 2015. Don’t try to second-guess the market. If you were a buyer of anything from 2001 until 2008 you had a wonderful opportunity to profit. If you bought in 2009 or 2016, it was like shooting fish in a barrel. If you didn’t sell in March of 2008 or September of 2011, you got creamed regardless of the merits of the project or company. The phase of the market will either put money in your pocket or extract it regardless of what anyone says about a company.

Posted in Investor Psychology, Search Strategies, YOU

Tagged bob moriarty, gold miners, gold mining, market cycles

From Best to Worst. There are typically two ways to make 100 to 1 on your money. 1. The preferred way–in my view because the company has more control of its destiny–would be to invest early in a high ROIC company that can redeploy capital at high rates for MANY years.

From Best to Worst. There are typically two ways to make 100 to 1 on your money. 1. The preferred way–in my view because the company has more control of its destiny–would be to invest early in a high ROIC company that can redeploy capital at high rates for MANY years.

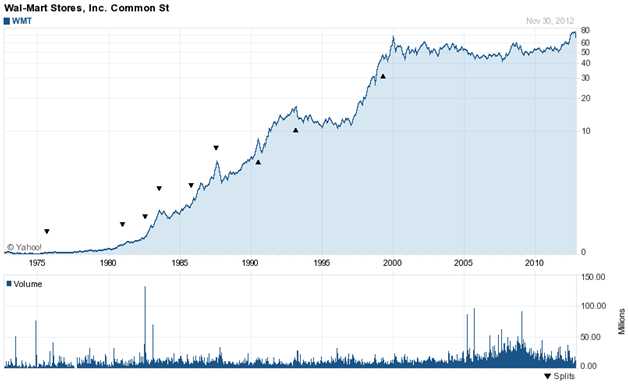

Note how the chart has gone sideways for 18 years as the ability to redeploy at high rates has declined. WMT can’t grow with regional economies of scale in Germany as it could in Arkansas back in 1965. You have to hold on through the inevitable 50% price plunges which you are able to do because of your understanding of the company’s competitive edge in the market.

Note how the chart has gone sideways for 18 years as the ability to redeploy at high rates has declined. WMT can’t grow with regional economies of scale in Germany as it could in Arkansas back in 1965. You have to hold on through the inevitable 50% price plunges which you are able to do because of your understanding of the company’s competitive edge in the market.

2. Or, you find an extremely cheap, beaten-up cyclical company (TECK) in an industry that has had low capital investment, then hold on for the boom which you then sell out at the top–harder and more nerve-wracking than the example above.

The worst performing sectors are where you want to look, but realize that some industries like phone companies may be under structural change.

Why is EBITDA so different than operating cash flow? Is that a problem or an opportunity. See: WTTR Mar 31 2018

A good research report on WTTR: Permian WDDC

<

Posted in Accounting, Humor & Entertainment, Search Strategies

Tagged 199 to 1, OCF vs. EBITDA, Selling, WTTR

I know nothing about this but to let you know: https://cyprusvalueinvestor.com/

Why Everyone Hates Finance and What to Do about It

By Paul McCaffrey

Finance can be a noble profession, yet too many people don’t see it that way.

Mihir A. Desai, the Mizuho Financial Group Professor of Finance at Harvard Business School and professor of law at Harvard Law School, explained why finance has a trust problem and offered a simple strategy to address it at the 71st CFA Institute Annual Conference.

“Finance is being demonized, and it’s being demonized because people don’t understand it,” he said. “If we want to stop demonization, we have to make it accessible . . . And it turns out stories and the humanities are a really powerful way to do that.”

Though he says much of the criticism of finance is unfair, Desai, the author of The Wisdom of Finance: Discovering Humanity in the World of Risk and Return, acknowledged that some of the industry’s reputational wounds are self inflicted.

“Why do we have more than our share of Martin Shkrelis?” he asked. Largely because of attribution error. What sets finance apart from most other disciplines is that performance feedback is clear and constant. And that can breed arrogance.

“If you’re an investor,” Desai explained, “you get feedback all the time about how you’re doing every day. And it’s super precise and inflated by leverage. What happens in those settings? Human beings do what human beings do everywhere. Every good outcome is because of me. Every bad outcome is because of the world.”

As that process continues through the years and the outcomes are mostly good, people come to believe in their skill, that they earned and deserve their returns.

But in finance and investing, skill is difficult to assess and practically impossible to prove.

“The greatest lesson in finance, of course, is it’s very hard to tell the difference between luck and skill,” Desai said. “It’s better to operate as if it’s luck.” He also pointed to the emphasis on value extraction over value creation in recent decades as another culprit behind finance’s lackluster standing among the public.

These criticisms aside, Desai believes that finance does much more good than harm and that finance professionals need to highlight the benefits that it creates.

Rehabilitating Finance

“If we re-aim the practice of finance and the underlying ideas that are incredibly noble, we can make finance into something aspirational, which is what it should be,” he explained. That requires thinking about the big ideas, the first principles of finance, and explaining them to people in ways that resonate.

“And frankly equations and graphs don’t work for many people,” he said. “It turns out there’s a whole section of the population that just doesn’t get that.”

That’s where literature and the humanities come into play.

Inspired by the structure of The Wisdom of Finance, Desai broke finance down into seven concepts during his presentation, what he calls “the biggest ideas in finance,” which are

As Desai explains it, when reduced to its essence, finance comes down to insurance. “Insurance is underneath all of finance in a remarkable way,” he said. “Once we think about risk and insurance, we have to think about risk management. That’s going to be about options and diversification. Instead of doing it with fancy calculus, we’re going to do it with stories.”

Risk and The Maltese Falcon

To explain risk, Desai recommends the Dashiell Hammett novel, The Maltese Falcon, which was made into a motion picture starring Humphrey Bogart as the hard-bitten San Francisco private detective Sam Spade. In the novel, Spade recounts a story about a man named Flitcraft, who disappears one day, leaving a wife, family, and career behind. Some years later, the wife receives word from an acquaintance that Flitcraft has been spotted in Spokane, Washington. She calls Spade to investigate.

Spade learns after traveling to Spokane, that the man is Flitcraft, as it turns out, only he’s changed his name to Charles Pierce. Spade confronts him and Flitcraft admits his ruse and explains why he abandoned his family.

“‘I was walking along, and a huge iron beam fell right next to me, and a piece of sidewalk jumped up and hit me in the face,’” Desai said, quoting Flitcraft’s words. “‘And at that moment, I realized that life was totally random. And I’d been living my life as if the universe was well ordered so my life had to be well ordered. But, in fact, the universe is random. So I’m going to change my life at random.”

So Flitcraft left to build an entirely new identity. “But then,” Desai continued, “Sam says, ‘The best part of the story is, when I found him in Spokane, he had recreated the same life he had . . . He had the same kind of wife and house and job and kids and everything was exactly the same.’” The names Flitcraft and Charles Pierce were not chosen by chance. Allen J. Flitcraft was a leading actuary and author of a life insurance manual. Charles Sanders Peirce was a philosopher dubbed the “father of pragmatism.”

What Hammett and Spade were getting at was that what looked chaotic and haphazard was not entirely unpredictable. There was an underlying order to it.

“The fundamental thing in life is randomness,” Desai explained. “And what do finance and insurance understand? They understand that we can navigate it by looking for patterns. Things that look totally random are not. . . That’s what the foundation of finance is: Seemingly random outcomes actually behave along patterns.”

Pride, Prejudice, and Risk Management

So how does Desai explain the concept of risk management?

“We could talk about options and diversification with modern portfolio theory and stochastic calculus,” he said. “Or we could use Jane Austen.”

It turns out her 19th-century English romantic novel Pride and Prejudice, describing the courtship rituals of the day and how the heroine, Elizabeth Bennet, and other young women respond to their various suitors, has a lot to teach on the subject.

“So what’s the risk management problem?” Desai said. “Potential suitors come by and you don’t know which one to take. And there’s always a problem. Some of them are rich, some are drunk, some of them are nice, some of them are ugly.”

Indeed, the novel features one of the worst marriage proposals ever. A Mr. Collins asks Bennet for her hand rather bluntly: “You’re not that pretty. You’re not that rich. Here’s an offer. I suggest you take it,” Desai recalled. “And of course, what’s he doing? He’s playing off her risk aversion.”

Bennet rejects the offer, but soon after, Collins shifts his attention to her friend Charlotte, to whom he makes a similarly mercenary proposal, one that that she excitedly accepts.

“The neat part about that story is the risk management problem is solved with options and diversification,” Desai said. “These characters give voice to what we think of as modern financial institutions.” “Finance needs some humanization.”

Desai’s message was simple: The best way to reclaim finance’s reputation is to demystify it and to do it through literature and the humanities, through storytelling.

“If it becomes all about spreadsheets and screens, then we detach ourselves from humanity,” he said. “We should think about the human consequences of what we do. And these stories are a wonderful way to get reattached to what the moral content of our ideas are.”

The above video is a decent book review of the book, The Art of Contrary Thinking found in this link: http://csinvesting.org/2017/12/01/the-art-of-contrary-thinking/

and http://csinvesting.org/2015/12/16/contrarian-investing-part-ii/

You are neither right nor wrong because people agree or disagree with you but because you have your facts and reasoning correct.

Emotionally, going against the crowd will subject you to ridicule.

Posted in Risk Management, Search Strategies, YOU

Perhaps you should differentiate yourself by focusing on management’s character and skill. However, you will need to focus and work hard to make a difference in understanding who is unique.

Find founder-led companies who are mission driven–one place to start your search.

Imagine putting the numbers of Berkshire Hathaway during the early days of Buffett’s takeover into a spreadsheet–would ANYONE have bought Berkshire. Who would have focused on Buffett’s integrity and skills?

Also: https://microcapclub.com/2018/05/invest-in-owner-management/

Interviewer: Are you unbiased?

John Chew: What a dumb question! Next.

Interviewer: No matter how you answered that question, how could you have an edge in researching companies?

John Chew: Well, I ……………..

and

Any suggestions? Is it possible to be unbiased? And based on your answer, how can you have an edge researching companies? Prize.

Posted in Investing Gurus, Search Strategies, Valuation Techniques, YOU

Tagged biased. Unbiased, Choosing Management, Managment, Robert Vinall, RV Capital

Mark Twain once said: “A gold mine is a hole in the ground with a liar standing on top of it.” I think mining is more like a rusty, leaky bucket that you need to pour capital so as to keep the bucket filled.

A better description: mining is a capital intensive business that must be constantly replenishing its depleting reserves which are hard to find much less extract economically.

However, if you buy Primero Mining (PPPMF) say this morning 9:40 AM at 18 cents you will receive 0.03325 shares of First Majestic Silver (AG) that you short at $6.00, for example. For each share of Primero bought at 18 cents allows you to own ($0.18/.03325) a proportional share of First Majestic at $5.41. The difference between your short sale of First Majestic at $6 and 5.41 is ($6 – 5.41)/5.41 is about 10.9%.

Or the short sale of $6 of First Majestic converts at 0.0335 into a share price of Primero Mining of ($6 x 0.03325) or $0.1995. The difference between the 18 cents that you paid for Primero and 19.95 cents received upon the closing of the transaction is (1.95 cents/ 18 cents) or 10.8%. The deal should close within the next twenty days. The annual return if the deal closes in the next 10 to 20 days is over 100%. March 13th is Primero’s shareholder meeting to approve the deal.

I believe there is a 98% chance of the deal going through thanks to all three parties benefiting. Wheaton precious metals’ (WPM) stream was restructured so there is now an economic mine and opportunity for WPM to receive cash flow. Primero shareholders are no longer faced with bankruptcy, and First Majestic has the money and the expertise to handle underground mining to expand their reserves and cash flows. https://www.gurufocus.com/forum/read.php?10,622803,622803,report=1

Also, the proxy advisor has given the go ahead for the MARCH 13th meeting. http://www.primeromining.com/English/investors/news/press-release-details/2018/Leading-Independent-Proxy-Advisory-Firms-Recommend-Primero-Shareholders-Vote-in-Favour-of-Proposed-Arrangement/default.aspx

If the deal would fall through, then let’s imagine your 18 cents is now worth $0 (PPPMF probably drops to 5 cents, but let’s be cruel) and AG spikes up 50 cents. On the deal announcement, AG fell 30 cents. Every dollar in PPPMF goes to $0 and every short dollar in AG loses about 10%. A 2% chance of the deal not closing causes a loss of $1.10 for every dollar invested–which means an expected loss of 2.2 cents vs. making about 10 cents to 11 cents on each dollar invested in the arbitrage. I have an expected value of about 8 to 9 cents on each dollar invested in this arbitrage within the next month. Not bad considering my alternatives today.

See below

Mexico-focused company First Majestic Silver has signed a definitive arrangement agreement to acquire all of the issued and outstanding common shares of Primero Mining for $320m.

Under the agreement, every Primero shareholder will receive 0.03325 First Majestic common shares in exchange for one Primero common unit.

Primero owns the San Dimas silver-gold mine in the Mexican state of Durango.

Primero has identified more than 120 epithermal veins with exploration potentiality throughout its production history.

In parallel with the deal, First Majestic has entered separate agreements with Wheaton Precious Metals International (WPM) to terminate the existing silver streaming interest at the San Dimas mine.

You can use Google Alerts to send to your email notices of buyouts, mergers, etc. Then do your homework. These tiny, obscure deals are out there.

Posted in Risk Management, Search Strategies

Tagged Arbitrage, First Majestic, Primero Mining

Here is an example of uneconomic selling–the price decline has nothing to do with the underlying operations or the price of the product the firm is selling (precious metals and aggregates). The marginal seller sets the price no matter how unintelligent. Seth Klarman always sought out these types of situations.

If you have an understanding of the company’s fair value, then you perhaps get a gift. I heard from the grapevine that John Doody of The Gold Stock Analyst put out a sell recommendation because Golden Queen would defer paying dividends once the company reached full production so as to explore and expand the existing mine. His newsletter does NOT cover explorers, so he recommended selling. The decision was correct for him, but his subscribers all tried to leave the room through the same exit. GQMNF traded over 6 million shares or about 100 times the normal daily volume of 60,000 shares. There is more selling likely over this week and next.

“If the massive sell-off today was due to a newsletter writer’s recommendation and you are a subscriber, ask yourself if you really should follow his or her advice on small cap stocks with limited liquidity. You’ll overpay to establish the position and you’ll get crushed when the herd heads for the exit, which may explain the action today.”