Dan Oliver of Myrmikan Capital (Video must watch!)

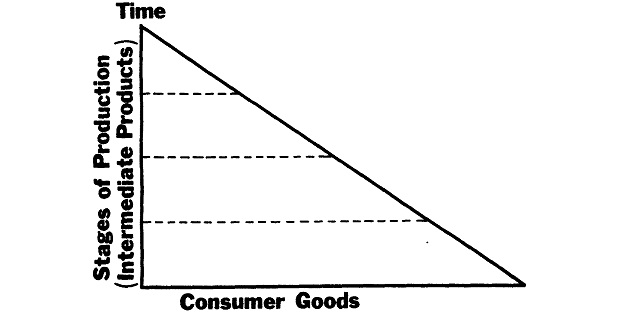

So as EBITDA for companies begins to flatten out and/or decline while corporate interest burdens rise as high yields rise, then the cash to service debt declines. The capital investments made while interest rates were low draw on capital that is NOT there since credit is not based on real savings. Mal-investment shown in massive overcapacity and declining demand (consumer demand was never at the appropriate level due to central bank intervention and distortion of interest rates) in commodities causes equity holders to be wiped out and banks to teeter. The Fed will respond reflexively as it has over the past 101 years.

More here: Liftoff_Myrmikan Capital Dec 17 2015

Unambiguously Good_Myrmikan Jan 22 206

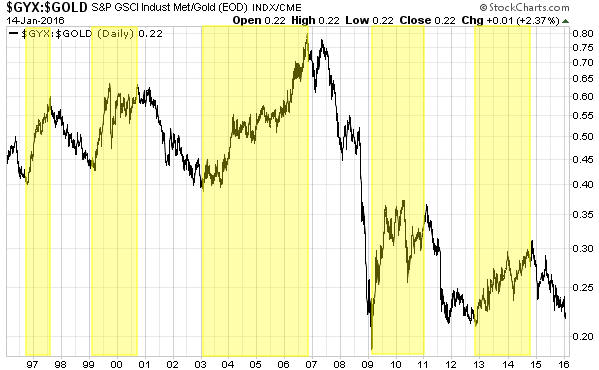

Gold senses the danger as it rises relative to commodities (commodities are sold to raise money). Gold is not rising (yet) in terms of dollars because fiat dollars are in an epic short squeeze–there are only $4 trillion of base money with which to service $90 trillion of debt–tightened by recent Fed action. When defaults occur and/or the Fed creates the dollars to try to stop the collapse of banks and borrowers, gold will rise against the dollar. This has been the pattern over the past 4,000 years.

The ancient Greeks discovered that debt could magnify wealth. The debtor feels richer from the use of the borrowed property, while the lender feels richer from the compounding interest yielded by his claim. Both indulge in consumption more freely. As long as the accumulating claims remain contingent, the bubble grows. But, eventually, someone asks to be paid, and the expanding claims on wealth must be reconciled to tangible wealth, much of which has been consumed.

The first recorded credit bubble popped in 594 B.C. Athens. Threatened with a civil war of creditor versus debtor, the Athenian ruler Solon pulled down the mortgage stones to free the debtors and devalued the drachma by 27% to relieve the bankers. Every credit collapse since – from the Panic of A.D. 33 to John Law’s Mississippi Bubble to the Great Depression and many others besides – has followed Solon’s template of debt default and currency devaluation.

“The natural remedies, if the credit-sickness be far advanced, will always include a redistribution of wealth: the further it is postponed, the more violent it will be. Every collapse of a credit expansion is a bankruptcy, and the magnitude of the bankruptcy will be proportionate to the magnitude of the debt debauch. In bankruptcies, creditors must suffer.” – Freeman Tilden, 1936

And against what is currency and debt devalued? Carl Menger, founder of the Austrian School of economics, was the first to explain that money is liquidity and that gold is the most liquid asset. Thus, gold has served as the reference point of value since the origins of money and is that against which currency must be devalued to relieve debts. Paper promises depreciate.

“The faith is lost. All with one impulse people rush to seize the gold itself as the only reality left—not only people as individuals; banks, also, and the great banking systems and governments do it, in competition with people. This is the financial crisis.”

– Garet Garrett, 1932

Source: http://www.myrmikan.com/port/

The sequence repeats: a boom based on ponzi finance (fractional reserve banking, fiat currency, etc.) causing a distortion in the production structure, and then bringing on the inevitable bust.

Does anyone see ANY OTHER outcome besides either a credit or currency collapse? Reward!

Revaluation: Gold Revaluation

How tough it is to pick stocks

P.S.: I will be sending out value vault keys soon. I usually wait for a que to develop. Thanks for your patience.