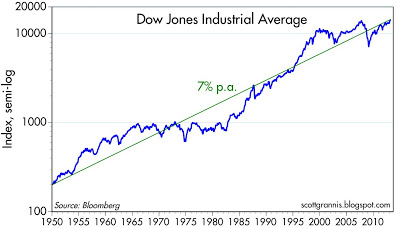

Happy Days,  my stocks are going up. Is it because of my astute valuation discipline? Perhaps this (Money Supply Growth) might be influencing conditions:

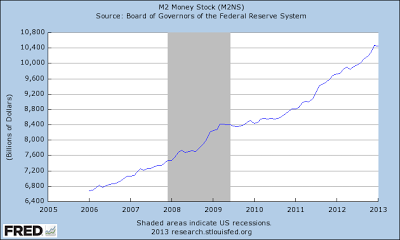

my stocks are going up. Is it because of my astute valuation discipline? Perhaps this (Money Supply Growth) might be influencing conditions:

Last week, Chairman Bernanke clearly stated his position: “In light of the moderate pace of the recovery and the continued high level of economic slack, dialing back accommodation with the goal of deterring excessive risk taking in some areas poses its own risks to growth, price stability, and ultimately, financial stability.”

So Bernanke is saying, let it rain:

How will this end? Last week in front of Congress Fed Chairman Bernanke spoke of the exit strategy once again, “We haven’t done a new review of the exit strategy yet.”

Well, we know how his EXIT STRATEGY will end:

See more: http://www.economicpolicyjournal.com/2013/03/bernanke-money-printing-disease-about.html

By the way, WHO benefits? http://mises.org/daily/6376/Who-Benefits-From-the-Fed No surprises here–the banks and the government. Guess who pays?

How do we know that?

Inflation Expectations

While important, however, the expectations component of the demand for money is speculative and reactive rather than an independent force. Generally, the public does not change its expectations suddenly or arbitrarily; they are usually based on the record of the immediate past. Generally, too, expectations are sluggish in revising themselves to adapt to new conditions; expectations, in short, tend to be conservative and dependent on the record of the recent past.

In Phase I of inflation, the government pumps a great deal of new money into the system, (Read pages 66 to 74 of this book, mystery of banking) so that Money supply increases sharply. Ordinarily, prices would have risen greatly but deflationary expectations by the public have intervened and have increased the demand for money, so that prices will rise much less substantially.

Unfortunately, the relatively small price rise often acts as heady wine to government. Suddenly, the government officials see a new Santa Claus, a cornucopia, a magic elixir. They can increase the money supply to a fare-thee-well, finance their deficits and subsidize favored political groups with cheap credit, and prices will rise only by a little bit! (Conditions as of today, March 5, 2013).

It is human nature that when you see something work well, you do more of it. If, in its ceaseless quest for revenue, government sees a seemingly harmless method of raising funds without causing much inflation, it will grab on to it. It will continue to pump new money into the system, and, given a high or increasing demand for money, prices, at first, might rise by only a little. But let the process continue for a length of time, and the public’s response will gradually, but inevitably, change.

Slowly, but surely, the public began to realize: “We have been waiting for a return to the good old days and a fall of prices, but prices have been steadily increasing. So it looks as if there will be no return to the good old days. Prices will not fall; in fact, they will probably keep going up.” As this psychology takes hold, the public’s thinking in Phase I changes into that of Phase II: “Prices inflation expectations will reverse from deflationary to inflationary.

The answer will differ from one country to another, and from one epoch to another, and will depend on many subtle cultural factors, such as trust in government, speed of communication, and many others. In Germany, this transition took four wartime years and one or two postwar years. In the United States, after World War II, it took about two decades for the message to slowly seep in that inflation was going to be a permanent fact of the American way of life.

When expectations tip decisively over from deflationary, or steady, to inflationary, the economy enters a danger zone. The crucial question is how the government and its monetary authorities are going to react to the new situation. When prices are going up faster than the money supply, the people begin to experience a severe shortage of money, for they now face a shortage of cash balances relative to the much higher price levels.

Phase 3 of inflationary expectations leads to a flight from fiat currency (Let’s hope this does not happen)