Effective money managers do not go with the flow. They are loners, by and large. They are not joiners; they’re skeptics, cynics even. Whatever label you want to put on them, they trait they all share is that they don ‘t automatically trust that what the majority of people–especially the experts–are doing is necessarily correct or wise. If anything, they move in the opposite direction of the majority, or they at least seek out their own course.

Warren Buffett is the best example of this contrarian impulse. In the 1960s, when Buffett started out (An excellent recounting of that era is The Go-Go Years, The Drama and Crashing Finale of Wall Street’s Bullish 1960s by John Brookes, Good review of the book, the Go-Go Years) most money managers were investing in highly cyclical, heavily indebted and capital-intensive industrial giants like U.S. Steel (X). As a consequence, stock in those kinds of companies were overpriced in Buffett’s view, especially when compared to their earnings. Instead of following the majority and buying into that mini-bubble, he consciously sought out companies on the other end of the spectrum–businesses with lower capital expenditures and higher profit margins–and he wound up buying relatively cheap stocks in ad agencies and regional media companies like Capital Cities, Gannett, and the Washington Post. This was a complete departure from the consensus of the time, and it made Buffett a ridiculous amount of money. (Scott Rearon, Dead Companies Walking, 2015)

most money managers were investing in highly cyclical, heavily indebted and capital-intensive industrial giants like U.S. Steel (X). As a consequence, stock in those kinds of companies were overpriced in Buffett’s view, especially when compared to their earnings. Instead of following the majority and buying into that mini-bubble, he consciously sought out companies on the other end of the spectrum–businesses with lower capital expenditures and higher profit margins–and he wound up buying relatively cheap stocks in ad agencies and regional media companies like Capital Cities, Gannett, and the Washington Post. This was a complete departure from the consensus of the time, and it made Buffett a ridiculous amount of money. (Scott Rearon, Dead Companies Walking, 2015)

—

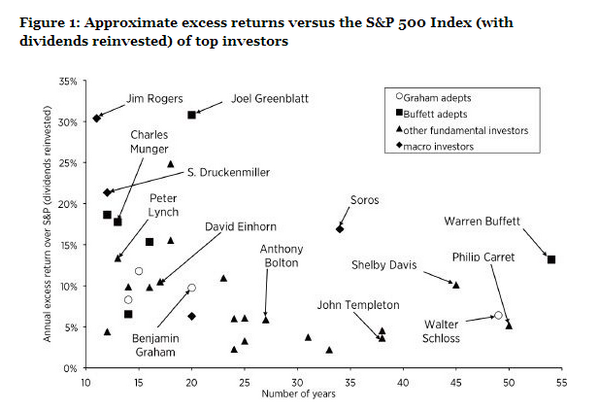

As we study Chapter 3 in Deep Value and Buffett’s early career, we should learn more about this tribe called value investors. Have they had success and why?

Below are four (4) articles you should read in sequence. Watch for what these investors do differently than the majority of institutional investors. Lessons we can use?

- The Superinvestors of Graham and Doddsville by Warren Buffett

- Graham Dodd Revisted by Lowenstein

- Searching for rational investors in a perfect storm

- KLARMAN in response to Lwenstein Article on Rational Investors

This Friday/Weekend I will review our readings. By the way, I don’t know if the graph above is accurate, but it might stimulate our reading of the articles.

How to join Deep-Value group at Google I ask enrollees to join to make communication and emailings easier.