Posted in Buffett, Investing Gurus, Investor Psychology, Risk Management

Tagged Humor, Momentum, Retail traders

Our goal at Project Punch Card is to foster long-term investment orientation amongst students underrepresented in the investment research and management business.

“We are delighted to announce that Alice Schroeder, the author of The Snowball: Warren Buffett and the Business of Life, the latest addition to the conference, will give a NEW keynote and share her insights on Mr. Buffett’s lesser-known investment secrets — built from thousands of hours spent with him and unique access to decades of Mr. Buffett’s archives.

Buffett_Case Study on Investment Filters Tabulating Company as an example of her work.

The Punch Card Conference has an incredible line-up of speakers and thought leaders including David Abrams (in a rare public appearance), John Rogers, Jonathan Levin, Murray Stahl and more.

We are offering a limited number of super-early-bird tickets for $145 until Nov-9 (TOMORROW-Friday), after which the price increases to $495 for early-bird tickets and $995 for full priced tickets.”

https://www.eventbrite.com/e/project-punch-card-value-investing-conference-tickets-50982639447

Who is it for?

We expect a blend of Portfolio Managers, Investment Advisors, Analysts and Allocators (i.e pension funds, Endowments, insurance, FOF etc). Ideally we would like people from the target communities — women, people of color, or graduates of underprivileged colleges in the investment industry. Marketing and strategic partners such as Smart Women Securities, Forte Foundation and SEO may also be a material component of the audience composition.

What is included?

Breakfast, Full Sit-down Lunch, Coffee Breaks, and Networking Opportunities.

When you go out in the world, look for the job you would take if you didn’t need the money. You really want to think about, what will make you feel good, when you get older, about your life, and you at least generally want to keep going in that direction. Don’t work for money . . . You’ll never be happy. You have to find the intersection of doing something you’re passionate about and at the same time something that is in the service of other people. I would argue that, if you don’t find that intersection, you’re not going to be very happy in life.

I could improve your ultimate financial welfare by giving you a ticket with only twenty slots in it so that you had twenty punches–representing all the investments that you got to make in a lifetime. And once you’d punched through the card, you couldn’t make any more investments at all. Under those rules, you’d really think carefully about what you did and you’d be forced to load up on what you’d really thought about. So you would do so much better.

Learn more about the investment competition: https://projectpunchcard.com/home/

John Chew: This seems like an EXCELLENT opportunity for students and emerging money managers at a CHEAP price. If you net out the lunch/food you are paying $100 to $120 for an incredible conference. I don’t know the other speakers but Murray Stahl is one of the most underrated stars (in my opinion) in the business. See for yourself: Murray Stahl The Skeptics Almanac-third-edition-volume-3

Also, Paul Isaac of Arbiter Partners, is another excellent investor who has been interviewed multiple times by Jim Grant of https://www.grantspub.com/

This New York-based investor has value investing in his blood. His father, Irving, an arbitrageur, was instrumental in finding Max Heine his first job on the Street. Heine went on to run the legendary Mutual Shares Fund, and Irving Isaac sat on its board for three decades. And Paul Isaac’s uncle, Walter Schloss, a student of Benjamin Graham, was praised by Warren Buffett and profiled in Barron’s. At his former position leading a fund of funds, Paul Isaac produced high single-digit returns annually. That fund was sold after the 2008-2009 financial crisis. He continues to manage Arbiter, a hedge fund that has returned 21%..

—

I have no association with the organizers of this event. I may be given a free ticket. However, I may not be able to attend. I hope to change my schedule to attend because just being able to meet Murray Stahl would be worth it for me.

Posted in Free Courses, Investing Careers, Investing Gurus

Perhaps you should differentiate yourself by focusing on management’s character and skill. However, you will need to focus and work hard to make a difference in understanding who is unique.

Find founder-led companies who are mission driven–one place to start your search.

Imagine putting the numbers of Berkshire Hathaway during the early days of Buffett’s takeover into a spreadsheet–would ANYONE have bought Berkshire. Who would have focused on Buffett’s integrity and skills?

Also: https://microcapclub.com/2018/05/invest-in-owner-management/

Interviewer: Are you unbiased?

John Chew: What a dumb question! Next.

Interviewer: No matter how you answered that question, how could you have an edge in researching companies?

John Chew: Well, I ……………..

and

Any suggestions? Is it possible to be unbiased? And based on your answer, how can you have an edge researching companies? Prize.

Posted in Investing Gurus, Search Strategies, Valuation Techniques, YOU

Tagged biased. Unbiased, Choosing Management, Managment, Robert Vinall, RV Capital

https://buffett.cnbc.com/warren-buffett-search-results/?query=inflation

A Reader kindly shared this: Warren Buffett Letters from 1957 to 2017! Now you can do a search through 60 + years of his writings on any subject. Use as a learning tool.

Also: https://buffett.cnbc.com/warren-buffett-archive/

Don’t forget Munger! http://latticeworkinvesting.com/

Ethan Wolff-Mann Senior Writer Yahoo FinanceMay 7, 2018

Value investing has changed over the years, but the fundamental way its disciples think about it hasn’t, according to Berkshire Hathaway (BRK.A, BRK.B) vice chair Charlie Munger.

“It’s gotten hard in the United States to find easy value investments because the world is so competitive,” Munger told Yahoo Finance editor-in-chief Andy Serwer after the Berkshire Hathaway 2018 Annual Shareholders Meeting.

“That accounts for a lot of what you see in Berkshire, where we buy securities like Apple that we wouldn’t have bought in the old days when we had more mundane things that were serving us very well,” said Munger.

For a company that operated for decades in the insurance business and other “mundane” areas, Munger and Warren Buffett’s moves at Berkshire Hathaway into tech appear to be a jarring change from the original value investing approach. Tech companies have historically been known to be the paths of “growth-oriented” investors. Value investors focus on a company’s price versus its value.

But Berkshire’s moves of late aren’t a deviation of value investing, Munger says, because rule number one is still the same.

“Now there are various ways to look for value investments, just as there are various places to fish. And the first rule of fishing is to fish where the fish are,” said Munger. “The first rule of value investing is to find some place to fish for value investments where there are a lot of them.“

Now, in a tougher environment, Berkshire has to fish in places it didn’t fish before. “So we’re just looking in different places, but we’re value investors,” said Munger.

In the end, Munger noted, value investing as a philosophy is tough to define precisely because, “All good investing is value investing by definition.”

“Some people, when they say ‘value investor,’ they mean somebody that emphasizes working capital or something,” said Munger. “Meaning, you should fish in that particular place, but I think that’s all a bad use of the language to think that the difference between value investing and other good investing.”

No formulas in value investing

During the Berkshire Hathaway Annual Shareholders Meeting, Munger and Buffett were asked about whether they use a formulaic approach to valuing companies and investing. Munger’s answer shed some light on why Berkshire’s business model is often-attempted-but-rarely-duplicated.

“I can’t give you a formulaic approach because I don’t use one,” Munger told a curious shareholder. “I just mix all the factors, and if the gap between value and price is not attractive, then I go on to something else. And sometimes, it’s just quantitative.”

Munger gave an example about Costco, (COST) noting that the stock was selling for 12 to 13 times earnings. (Berkshire Hathaway owns about a percent of the company.)

“I thought that was a ridiculously low value, just because the competitive strength of the business was so great, and it was so likely to keep doing better and better,” said Munger. “But I can’t reduce that to a formula for you.”

Some things Munger does like when he’s considering a company’s value, like Costco?

“I liked the cheap real estate. I liked the competitive position. I liked the way the personnel system worked. I liked everything about it,” said Munger. “And I thought, even though it’s three times book, or whatever it was then, that it’s worth more. But that’s not a formula.”

In fact, Munger has contempt for formulas.

“If you want a formula, you should go back to graduate school,” said Munger. “They’ll give you lots of formulas that won’t work.”

https://finance.yahoo.com/news/charlie-mungers-first-rule-value-investing-204323719.html

CS of Buffett Filter on Catastrophic Risk

The above is an example of how Buffett would approach a “start-up”. You can assume that he would almost 99.9999999999999999% pass on all opportunities.

Today the Fed reports it holds 8133 tonnes of gold, worth $349.4 billion at $1,330 an ounce, which equals 7.9$ of the Fed’s reported $4.4 TRILLION in liabilities. The current model suggest a 56% weighting of gold to 44% holding of S&P 500.

In an age when an algorithm is the main competitor for many fund managers, what can we know that they don’t? Algos understand the data trail of history, but this trail provides only limited insight into the key lessons of financial history for investors. In this talk, first provided at the 62nd Annual CFA Institute Financial Analysts Seminar, Russell Napier discusses those 21 most important lessons from financial history that allow human beings to profit at the expense of the machines. 1 Hour on-line seminar Feb. 1, 2018. Register (CSInvesting.org: I believe it is free: https://www.cfainstitute.org/learning/events/Pages/02012018_138012.aspx

Regardless of whether you can attend, read relentlessly about financial, economic, and common history. Note what Jim Grant of Grant’s Interest Rate Observer says:

But our main goal is to tell you the next important event in the markets. And sometimes we succeed.

– As with the tech bubble in 1999

– The 2008 mortgage crash

– The 2009 recovery in financials

– And the 2012-13 rise in house pricesHow have we been so prescient over the years?

We don’t have fancy, financial computer models or a team of MBAs and Ph.D.’s to help us make these predictions. And we don’t have access to any kind of special information.But we have been immersed in the markets for over 30 years. And we’ve studied the financial history of the past 200 years. None of which guarantees clairvoyance—nothing does. What we do claim is the capacity to see the present in the context of the helpful lessons of the past.

Like when we warned about the mortgage debt bubble in September 2006.

From the Sept. 8, 2006 Grant’s:

“Overvalued,” we, in fact, judge trillions of dollars of asset-backed securities and collateralized debt obligations to be, and we are bearish on them. Housing-related stocks may or may not be prospectively cheap; they at least look historically cheap. But housing-related debt is cheap by no standard of value. For institutional investors equipped to deal in credit default swaps, there’s an opportunity to lay down a low-cost bearish bet.

368353935-GMOMeltUp J. Grantham says that the current market does not YET show the characteristics of a bubble despite being highly valued.

Referenced study in the article: Bubbles for Fama 2017 and gmo-quarterly-letter

and more of interest: faang-schmaang-don-t-blame-the-over-valuation-of-the-s-p-solely-on-information-technology

Update (1/10/2018) Runaway Train – Dec 2018

—

12/06/2017 Mises Institute

Arguably one of the greatest thinkers of the twentieth century, Ludwig von Mises created a framework for all of economic science beginning with the simple axiom that individuals act. In his magnum opus, Human Action, he described economics as a branch of the theory of human action and stressed how broadly it spans, far beyond a discussion of mere money and prices. Mises said, “Economics must not be relegated to classrooms and statistical offices and must not be left to esoteric circles. It is the philosophy of human life and action and concerns everybody and everything. It is the pith of civilization and of man’s human existence.” For Mises, it was imperative that everyone learns economics, calling it “the main and proper study of every citizen.”

Human Action is a challenging read. With over 800 pages of dense material, study tools are very helpful. The course, Advanced Seminar in Human Action, is a useful addition to other materials like the Human Action Study Guide.

In this course, leading Austrian economists walk the student through Human Action a chapter at a time.

If you’ve ever wanted a push to help you get through the book or if you’ve wondered about your own reading of the material, here is your opportunity to study Human Action with David Gordon, Joe Salerno, Jeffery Herbener, Peter Klein, Guido Hülsmann, and Mark Thornton.

Human Action by Ludwig von Mises is available for free on Mises.org and for purchase as a paperback and hardcover in the Mises Bookstore.

Register: https://mises.org/library/advanced-seminar-human-action

The teachers are excellent and Human Action is the Magnum Opus of Ludwig von Mises. The book is a DIFFICULT read but there is a study guide, lecture videos, and lecture slides for all the chapters of the book. You will have a strong grounding in economics and improve your reading and critical thinking skills, but if you are a beginner, I would opt for https://www.mises.org/library/economics-one-lesson

Posted in Free Courses, History, Investing Gurus

Tagged Bubbles, Financial History, Free Course, Human Action

An agnostic interpreter of what the markets are telling us.

CSInvesting: Note how he understands the cycles in commodity prices (oil)

Explore extensively here: http://13d.com/news.html#kiril-interview

I recommend listening to the interviews several times over the next few days. Note how you can apply what he says. His understanding of European history (many centuries of horrific wars) will probably mean that many European states will want to remain in the European Union–thus, a weaker dollar than expected.

Funny!

Munger rips bitcoin

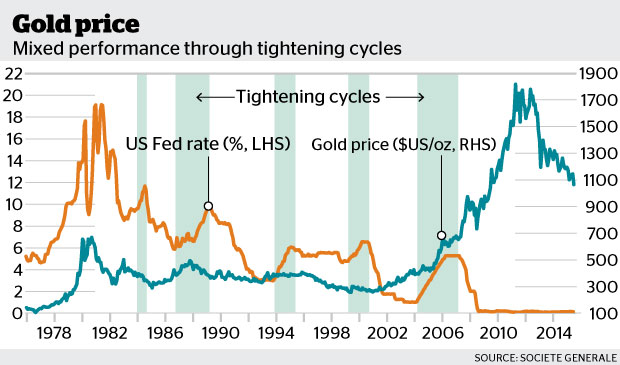

Bloomberg December 2015: But Societe Generale predicts gold will be a casualty of the rate hike, falling below $US1000 an ounce, to $US955 by the end of next year.

Head of global asset allocation Alain Bokobza says looking at the 2016 panorama, in which US interest rates tighten and the economy fares reasonably well, “that does not argue for a higher gold price.”

“Gold will be a casualty.”

CSInvesting: The purpose of this post is to remind you of ignoring expert advice and to do your own analysis. The above comment by Bokobza is meaningless blather. He is simply spouting the consensus view that rising rates mean a declining gold price since gold has no yield. Beware of simple narratives.

The assumption “Fed rate hikes equal a falling gold price” is not supported by a shred of empirical evidence. On the contrary, all that is revealed by the empirical record in this context is that there seems to be absolutely no discernible correlation between gold and FF rate. If anything, gold and the FF rate exhibit a positive correlation rather more frequently than a negative one! Source: www.acting-man.com

And today:

More here: Gold and the Federal Funds Rate and Gold and gold stocks Dec 26 2017

UPDATE: Interesting Read

Interview of David Collum: https://youtu.be/Vlr7_vDwg_M