The Dao of the Austrian Investor

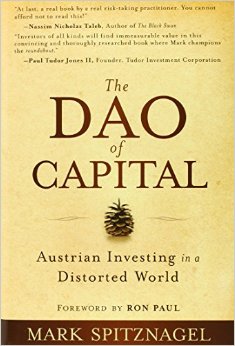

[The Dao of Capital: Austrian Investing in a Distorted World. By Mark Spitznagel. Wiley Press, 2013.]

The economy is extremely complex. As Leonard Read taught, no single individual in the world knows how to make something as simple as a pencil. The level of complexity has only increased over time with the expansion of knowledge, technology, transportation, and international trade. Our individual labor is increasingly focused on a narrower slice of the overall process of production.

Even the static picture, if it could be seen, is complicated by the fact that our world is a work in progress dating back thousands of years. Look around you and you will see the savings, investments, and work of individuals who are long dead. Previous generations made their choices, some of which have been maintained, repurposed, neglected, or destroyed. Ownership of all that capital is recognized in the form of stocks, bonds, titles, and deeds.

Austrian economics teaches that understanding the “economy” can only be undertaken with the aid of economic theory. There is no formula or equation for understanding the economy. It cannot be measured in any meaningful scientific way. Only the logical construction of cause and effect aid us. A simple example of this is when John trades his three apples to Mary for her three oranges because both John and Mary think they would be better off from doing so.

Mark Spitznagel, a hedge fund manager, tries to take economic theory, specifically Austrian economic theory, and breathe life into understanding how the economy works and why it sometimes doesn’t. In his book, The Dao of Capital: Austrian Investing in a Distorted World, he uses these insights to explain the process of investment that he uses.

The title refers to the paradoxical Chinese philosophy of Daoism. In this philosophy, in order to achieve your goal you must do the opposite, or Shi. For example: “turn right in order to go left.” This is used, ultimately, to underscore the roundaboutness of the market process, where production processes become increasingly more complex in order to become more productive. In investing, for Spitznagel, it means to step back and take small losses in preparation for making larger gains, a variation of “value investing,” where you must keep your vision of the future as one of a process that takes place over time.

As a young trader in the bond pit at the Chicago Board of Trade, the author was lucky enough to come across Hazlitt’s Economics in One Lesson and Mises’s Human Action. He found in these books a theoretical explanation for the otherwise perplexing world of primary markets at the Chicago Board of Trade. He later partnered with Nassim Taleb ofBlack Swan fame and later still opened his own firm to employ his concept of “Austrian Investing.”

- Synopsis of Economics in One Lesson by Henry Hazlitt

- Economics in One Lesson

- human_action_study_guide

- Human Action Abridgement

Spitznagel begins with the metaphor of the forest and the trees. Briefly put, conifers cannot compete with hardwood trees on the fertile plains so they retreat to higher ground that is less fertile and more intemperate where they can outcompete the hardwoods. Here they thrive under harsh conditions, even battling glaciers of various ice ages. This is an illustration of competition and comparative advantage in nature.

Fire plays a role in the competition between conifers and hardwoods, serving to clear small areas with dense underbrush free for new competitions among seedlings. This ebb and flow between conifers and hardwoods shows how apparent losses from fire can lead to strength and an overall growth in productivity. In the economy, firms go bankrupt, products are displaced, and new production processes emerge over time.

In a similar manner, he shows how fire-suppression policies of the government are like government intervention in the economy. Fire-suppression policy aims to put out most forest fires as soon as possible. This can lead to too much underbrush so that fires can become catastrophic is scope. This is an illustration from nature of the havoc caused by government intervention meddling in nature’s competition. In the economy, the government’s central bank can try to suppress recessions and deflation, but this can result in catastrophic depressions, like the Great Depression. As Rothbard showed in his America’s Great Depression, President Hoover’s interventions to suppress deflation and depression only made things worse.

In chapter 3, “Shi: The Intertemporal Strategy,” the insights of the famous military philosophers Sun Tzu and Carl von Clausewitz are discussed in support of the Daoist concept of Shi. This is the concept of strategic advantage in war where you do not hurl your troops headlong directly at enemy positions for an immediate victory. Rather, you conserve your troops and resources and take advantage of points with defensive and strategic advantages in a more roundabout approach to final victory. Military history has confirmed the wisdom of this approach from the battlefields of the American Civil War to the more recent guerilla wars fought against the modern empires of the United States and the Soviet Union. As applied to investment, this discussion is meant to make the reader prepared and even eager to take small losses in order to achieve the ultimate goal of growing your wealth into the future.

Normally, I do not like examples from nature and war to serve as illustrations of the benefits of roundaboutness of production, preservation of capital, and competition, but I will admit that in this case they are effective.

The book takes us on a trip through time to explore the character, history, and contributions of the Austrian economists. He begins with Frédéric Bastiat (the seen and unseen), and moves onto J. B. Say (entrepreneurship), Carl Menger (marginal utility and price formation), Eugen Böhm-Bawerk (roundabout production and interest), and even Henry Ford (the assembly line as an example of roundabout production). This is followed by a fascinating discussion of the critical role of time preference in life before he turns his attention to Ludwig von Mises (monetary and business cycle theories and the market as a process). According to Spitznagel, Mises was “perhaps the greatest economist of all time.”

Since I am not an investment expert, I will not comment on the chapters on investing or the author’s tweaks of Austrian economics that try to bring Austrian economic theory closer to the understanding of reality for the non-economist. However, I applaud the book as a look into the thinking process of a great investor, especially one that has a clear and consistent understanding of the market process, the dangers of government intervention, and the benefits of Austrian economics.

–

The roundabout path to profits: Mark Spitznagel on the Dao of Capital

How a hedge fund manager with floor trader roots embraces the Q Ratio, Austrian economics, tail hedging, libertarianism and Daoism to prepare for the next market crash.

Mark Spitznagel is an accomplished trader and hedge fund manager who has learned to take advantage of market distortions he blames on an overly involved Federal Reserve and government, while preparing for the consequences of those distortions. Instead of fighting what he knows is an illogical distorted market he has learned to ride those irrational markets while preparing for the inevitable snap back, where he then can profit in an exponential fashion through the perfecting of tail hedging strategies.

However, his book “The Dao of Capital: Austrian Investing in a Distorted World” is not an explanation of his trading strategy but an in-depth study of economics and human nature, the inevitable result of which is the philosophy of building a successful enterprise through the understanding of the roundabout, and learning to delay gratification to gain an advantage down the road. He does it through the study of Austrian economics and the application of the roundabout method of investing.

Spitznagel could have simply have written that investors need patience and must avoid the temptation of the quick profit; that building a successful strategy, and life, involves a longer-term approach foregoing instant gratification; that establishing a solid foundation while appearing not to create progress puts you in position for much greater success later on. He did not do that. Instead, he takes you on a tour of history and nature that illuminates these long held truths. Just as the technical trader delves into cycle analysis and Fibonacci numbers, Spitznagel illustrates how these truths are imbedded in history and nature and are not just platitudes to throw around. In the end his message is simple, but by providing the historical underpinnings he brings them to life in a much more vibrant way.

He travels a long way to come to a pretty simple message. It is through his vast research and study that he shows that this message, though simple, is essential. He has documented how it has been so throughout history.

Futures Magazine: Your book cites some of the most accomplished economists, military and historical figures as inspiration but at the top of your list is an old grain trader and family friend Everett Klipp. Why?

Mark Spitznagel: He was a close family friend, very close to my dad. I caught the [trading] bug from him early on and he said simply ‘to be successful you have to love to lose.’ Even at the[Chicago] Board of Trade, it is not like pit traders do this. But when I was 14 I thought that’s what trading was. This is the discipline of trading, loving to lose and nothing about winning.

I immersed myself in it and became obsessed with the grain markets. Through high school and even through college, I wanted to be a corn trader. I clerked for many summers in the grain [room] and ultimately the bond [room]. It slowly became obvious that is where someone’s got to be.

FM: It is no huge revelation that a lot of our recent economic problems can be blamed on short-term thinking; never looking beyond the next quarter. You take a circuitous route in your book to describe this. Is that on purpose?

MS: It is on purpose. The whole point is there is a lot you have to build up along the way. There is a path you have to follow to get somewhere and it is not the direct path. For instance, it is not enough to give someone an investment strategy, the key is what is underlying that investment strategy, why these things should work, what the thinking behind it is. It is very easy to say this is a strategy that works and it will continue to work. There are data mining issues with that. You need to approach trading in a much more deductive way. It was the point to build up the necessary tools to code to the strategy.

FM: It seems that we intuitively know some of these things but often don’t act on it.

MS: People say it is a long term thing. It is almost a cliché to say that. They use it as an excuse for what is not working at the moment. What I am talking about is not just about waiting, it is about working in the present to gain an advantage in the future as opposed to just putting something on and twiddling your thumbs and watching it work. Yes, we are all very short-term minded. Corporate managers are thinking about the next quarter. This is all very rational for them to do. There is the [Stanford professor Walter] Mischel study (an experiment to determine whether kids would be willing to wait to get more marshmallows or take one immediately). It turns out that the reason they don’t wait is not because of impatience, it is that they don’t believe you are going to come back with more. Any investment manager is right to think that if I don’t get my marshmallow now, do well now, you are not going to give me an opportunity to do better later. And they are right about that. It is a structural problem. These people are acting very rationally based on the structure of these industries. I firmly believe the big problem here is one of being trapped in the present and all that matters is that next slice of time. It is both a structural problem in history and our psychology.

FM: You successfully called the market turns of 2000 and 2008. Was your tail hedging strategy perfected or was it just forming?

MS: I was on the floor from 1993-97. In ’98 I was a swaption trader at Credit bank primary dealer arm. In 1999 I started a hedge fund with Nassim Taleb, who was at the [Chicago Mercantile Exchange] when I was at the CBOT; 2000 was our big play there. In 2005 I went to Morgan Stanley within its stat arb group. In 2007 I left to start Universa [Investments] and we all know what happened in 2008.

FM: A lot of people saw the 2000 crash coming as the market appeared overbought throughout the late 1990s but lost money by being wrong on the timing. Is your strategy a fix for that problem?

MS: Absolutely. You can’t short markets that are running like that. You are going to blow yourself up. It goes back to Everett. That’s the reason I approach market this way: the idea of taking a one tick loss. If you want to trade that market with S&Ps you would short it, but when you are wrong you will have a tight stop. And throughout the ’90s you would have taken a lot of losses. Eventually you would have been right, whether you would make up all your losses, I can’t say.

What I do with options is nothing more than a fancier way to do that. Right now I would say the market is massively distorted, we are going to see a huge sell-off but I would never advise someone to be short this market. You would blow yourself up. The market will balance itself; as it has in all the other bull moves caused by distortions in the last 100 years. It managed to right itself but the path there is difficult and there is no telling how far it can go.

In the late ’90s clearly [Fed Chair Alan] Greenspan was the driver of that boom. There was a nice believable theme behind it that we were in a new economy. The market went further than it ever had in recorded history. Here we are again on the cusp. If the market rallies much from here, now we are back in this territory like 1999. It is possible the market could double from here or triple from here. I happen to think it is not the likely path.

FM: Isn’t it different now. In the ’90s we had a booming economy. No one would confuse the last six years with a booming economy, we know it is struggling and the Fed is trying to keep us above water waiting for stronger growth to happen.

MS: Agreed. But I would argue in both situations ultimately there were delusions. The booming economy of the ’90s was happening but it was not based on anything real. At some point monetary distortion can easily lift asset prices but it also could make it look like there is activity in the economy that is artificial. They both had similar sources. The late ’90s look very different than today and for that reason it will probably be very difficult for us to go too much higher.

FM: What was the misallocation in the ’90s? It seem that they were constantly raising interest rates anytime growth went beyond 3.5%.

MS: It was the Fed keeping interest rates too low. Rates were too low in the ’90s. We don’t understand why Greenspan kept rates as low as he did in 1996. The general argument was rates were too low for too long. I know by today’s standards it seems benign. They were artificially low in the ’90s (see “Way to busy,” below).

FM: In 2002 when GDP was growing by more than 4% two quarters in a row, the Fed went from 1.75% down to 1%. Is that the seed of the current problem?

MS: Yes. The same thing happened. How people can’t see how that for instance created the real-estate boom is inconceivable. The question is how much do we bring Fed Funds back up again. In 1996, why didn’t you let rates go up more quickly than you did? And rates were lowered in ’02 all for the same reason. You change the structure of the economy when you artificially move them in the first place. When the government sets the price of things typically our culture is such that we don’t like it.

If the government set the price of LCD TVs we would think there is something weird about that, and yet we don’t think it is weird for them to set the price for the most important price in the economy, which is interest rates. We don’t have a free market in interest rates. When you do that, complex distortions happen.

FM: How patient would you have been if you developed this strategy in 1990 and had to wait a long time for the market to correct?

MS: You had to wait until the mid-1990s before the MS Index or Tobin’s Q ratio, put you at the levels where it is today (see “The Mises Index,” below). Let’s remember 1982 was a generational buy and then the market ripped. It wasn’t until 1995 or 1996 where it reached that level where every market topped in the last 100 years: 1917, 1929, 1937, (1973) and 1996. It wasn’t until 1996 if you were following this MS Index that you would have stated maybe it is different this time because the market screamed from there but throughout the first part of the 1990s, it was not terribly overvalued.

FM: Your philosophy is based on non-intervention but 2008 was pretty extreme crisis. Do you think the Fed needed to do anything?

MS: People who are Libertarian are always put in this unenviable position where we look like people who don’t care because we are saying you shouldn’t do anything; you should let the forest burn; let people suffer. It is unfair to start with the tragedy, you have to start with the build-up. It is interventionism that got us there in the first place. Go to my forest analogy that is central to my book. If you don’t allow any forest fires for many many years and then all of a sudden a little fire starts at that point you get painted in a corner where you have to put out every fire. And now if you step aside at that point now the whole forest could get destroyed. The mistake you made was not letting the little fires burn in the first place.

FM: To continue with your analogy; now there are houses built in the path and we can’t just let people’s homes burn down. Right?

MS: In the economy—and I have a 100 years of evidence to show this—if people are going to build homes in this parkland where we don’t let fires go, those homes are doomed regardless. We can continue to put out fires but that is only going to make a bigger fire later. It is inevitable that this thing is going to blow. The question is how long are we going to let it go and how many people are we going to let get trapped into building more homes in this tinderbox, to extend your analogy.

Should we have done nothing in 2008? I strongly believe that we should have let the market correct itself. I strongly believe that TARP (Troubled Asset Relief Program) was a terrible thing to do. I strongly believe that the auto companies should have gone through bankruptcy.

FM: So you are saying we need to go cold turkey on intervention? Haven’t we gone beyond the point of no return in Keynesian economics? This was not started in this administration or this Fed. It is a process that has taken decades. How would you get to where you want to go from where we are right now?

MS: To start off, what Bernanke has done is unprecedented. We haven’t manipulated the yield curve like this ever. While there have been monetary manipulation that has caused booms and busts—and I strongly believe that booms and busts are caused by monetary interventions and it is not a natural feature of capitalism—but what Bernanke has done has been an experiment the likes of which we have never seen. Look at the history of rates. The last four years will stand out. It is very extreme and it is scary and the move down will be worse.

Are we past the point of no return? I think we are. If this is the way the Federal Reserve Chairman will have to look at it. [New Fed Chair Janet] Yellen is going to have to deal with the consequences. All this talk of tapering. I don’t think it is going to be an option for the Fed. I don’t think the Fed can taper. If you saw a headline; ‘Yellen decides to let all interest rates float, free market in interest rates.’ Then you would see the market down 50%. Most people agree with me on that. I don’t know what the yield curve would look like but the market would crash. What they are doing now is waiting and hoping that something happens in the economy that allows them to taper. They are going to be waiting for a long time. You will end up with a situation that the Fed’s hand is forced or with what the Fed’s is doing stops mattering and that will come when more leverage in the system is not possible and we are probably not far from that.

FM: But the Fed is tapering.

MS: Those expectations keep on getting pushed back. I agree with your statement that we are passed the point of no return. I don’t think the Fed can taper without crashing the market. The market is only at where it is at because of the Fed. I don’t want to predict what the Fed will do but one way or another it won’t matter what they want to do. Unless the Fed is willing to crash the market, which I don’t think it is, I don’t see this big taper happening willingly.

FM: Jim Sinclair said to us two years ago that quantitative easing was the only tool Bernanke had to avoid a catastrophe and the only measure of success is that when the economy begins to grow more robustly whether or not he can drain the excess liquidity safely. Do you agree?

MS: I think you will be waiting a while for it. When companies start borrowing not to buy back their own stock, not just to raise their dividend but instead borrow in order to do more capital expenditures, then we will start seeing some growth but don’t hold your breath for it. I see his point: Will the Fed be able to drain the liquidity fast enough to avoid inflation?

FM: Was QE not necessary?

MS: It depends on what you are trying to do. If you are trying to prop up the stock market, if you are trying to save people who own risk assets like banks, it was absolutely necessary, in the short-term. There is no doubt that the Fed is capable of pushing risk assets. We shouldn’t be surprised that the market has gone up and continues to go up but it can’t go on forever. It is an artificial world we are living in. If we were able to manipulate it like this permanently than obviously this would be a formula that would work everywhere.

FM: I don’t think anyone believes that this is good policy in general just that it was necessary to avoid a disaster. We kick the can down the road to a point that growth improves and we can better handle the excess. Can it work?

MS: You certainly are looking for a precise, perfect scenario. I am not necessarily calling for hyperinflation but with the money being printed it is [possible]. Be careful what you wish for. If you start getting growth I totally recognize how we could get very high inflation, but first you have to have growth, you have to have people investing capital.

Interest rates are the most important economic variable out there. Entrepreneurs base their activities on that, whether you engage in production what is your return over your cost of capital. When interest rates are very low in a free natural market that means that there is a lot of savings, people aren’t consuming but they are saving. They call that a consumer recession, it is a very nice homeostatic system. Entrepreneurs respond to that. It incentivizes them to extend their period of production. Austrians call that more roundabout. They create more efficient production. The civilization and economy progresses and that production completes around the time that consumers are ready to consume again and save less. Remember we save to consume more later. There is a nice temporal structure that goes on in the economy. But what happens when interest rates are low for artificial reasons; actually the opposite happens.

The whole point of low interest rates is not only do central bankers want to goose asset prices but they are trying to get entrepreneurs to invest more and when they invest more, progress comes from them. But when interest rates are lower than what we natural want it to be based on our time preferences, it is now this weird thing where people are trying to chase yield just to make a little carry. Zero rates are unacceptable to people. So we are looking for dividend yielding stocks. At the end of the day investors are not looking for more roundabout production but instead are looking for companies with high dividends.

This is considered a puzzle by Keynesian Economists. [Paul] Krugman himself called it a puzzle. When Tobin’s Q is high and rates are low why don’t companies invest more? It makes perfect sense because it is a distorted environment. They are not low for natural reasons. This is why we shouldn’t expect the economy to progress just because rates are low. The opposite is happening now. Many government programs create the opposite affect [of its design].

[Economist Ludvig von] Mises says when a person gets run over by a car, the last thing he needs is for that car to then back over him. And that is the cycle that we are in. Each time the government intervenes, it is making things worse. We are worse off now than when we were in 2006-07, for no other reason than there is no more back stop.

FM: But these misallocations have been going on for a long time. Is there a way to do this gradually or does it have to happen all at once?

MS: I would be perfectly happy with a taper that ends over a period with a free market in interest rates. It doesn’t have to be that we close the Eccles (Federal Reserve) building over night. It could be gradual. [But] if the market caught wind of what they were doing it would crash. A taper [with a goal] of a market determined interest rate would force discipline on our fiscal policy. So much of the debt that we are running up right now is because our rates are artificially low. I would be all for that.

FM: Many experts suggested that regulations and policy needs to be countercyclical. Do you agree?

MS: They look the other way when everything is going well. I totally agree. But it shouldn’t be so much about them in the first place.

FM: Discuss your trading philosophy and how it can be used.

MS: You simply step aside when markets get distorted. What does that mean? You have to watch all your friends making money when you are sitting aside making nothing. You are no longer focusing on your returns today but the return opportunities you will have later when markets reset. I am thinking about the advantage that you will have with dry powder when the markets crash and not about return today. By doing nothing I am doing something real big. I am allowing myself opportunities later.

A higher level example of that is what I do, which is instead of doing nothing you actually have positions that will [create] a tremendous amount of cash. What is the hardest position to have right now? It is cash. The Fed knows what it is doing. It is pushing you out of something it doesn’t want you in. It is not an accident. If your focus is only on that next slice of time like all the professionals, then it is not an option. If you can plan for those other slices of time, they should be far more important to you than the current one.

If you had followed the strategy you would be far ahead of the market. You would have been out of the market since 1996, which is a very hard thing to do.

FM: In your strategy do you constantly have the same hedge on or do you increase and decrease it based on the MS Index?

MS: You can increase it or decrease it. I showed an example in the book that it is the most affective when there is a high MS index; when it is low there is not a lot of room for a systemic crash. When that is low a tail hedge is not critical. The great thing about what I do is that the more distorted the market gets, the cheaper my trade is and the better the risk/reward looks. It is a very convenient property. For instance the VIX tends to go down when the S&P rallies.

FM: How much do you underperform the market when things go well?

MS: It is complicated because I do some complex hedges and spreads. What I talk about in the book is a very simplistic naïve representation where you are just buying out-of-the-money puts. But it costs you a low single digit percentage a year—in that naïve case. I could be short premium meaning if the market shuts down I am earning premium but if the market crashes I am long gamma.

FM: There has been a lot of criticism of alternatives. Is this dangerous given that it will push people to long equity strategies?

MS: All bets are interconnected. There is one big systemic bet that everyone is taking right now. Diversification is hard to come by. It is a shame. We are very good extrapolators.

FM: How will the current distorted market be resolved?

MS: At some point whether it is quickly or not [there is so much leverage a system can take] markets will crash. In classical economic perspective they say that when interest rate get lower we have higher liquidity preferences, people don’t want to lend anymore, they don’t want to borrow anymore. That is why balance sheets at banks get so bloated. It will probably happen quickly when it happens but at the end of the day when markets are this distorted you will find your way back.

FM: What is your goal with the book? It includes concepts that are very easy to understand but difficult to execute in investing and in life.

MS: That’s kind of my thinking. It sounds like a cliché. These are the tools of what got us here in the first place. The idea of a roundabout. Focusing on the means and not the ends. It is so obvious but it helps to understand the role it has played. You can’t just focus on outcomes, you have to have something else to lean on. It is not empiricism that you should lean on because it can guide you down the wrong way so you need these concepts and in order to understand them and believe them [you have to see how they came about].

Half of it was good introspection for me. It is a travesty what the smaller investors go through so to me it was important to try and get people to understand this perspective. So much of Austrian theory is difficult to get through. Though I went about it in a roundabout way, my goal was to make it somewhat approachable.

FM: For people to adopt this is it just going to take pain? Another crash or event to reorganize ourselves?

MS: I think it will. And capitalism will be blamed again when it happens. All the scary stories that we heard when they jammed through TARP, a lot of it was overstated. I can’t prove it and I don’t think others can prove the other side of it. But this idea of the end of the world scenario is entirely wrong. We should look at this as a healthy process, as a cleansing process. We would be on the road to very healthy real growth today if we just let it cleanse itself. My ultimate message is one of great optimism. Seeing optimism in a crisis or a tragedy. It is a means to a much greater end. We need to recognize that. Politicians can’t because politicians will not get reelected during a crisis. They are rational to try and stop all pain. …We should have had more banks fail.

Review

“Investors of all kinds will find immeasurable value in this convincing and thoroughly researched book where Mark champions the roundabout. Using thought-provoking examples from both the natural world and the historical world, The Dao of Capital shows how a seemingly difficult immediate loss becomes an advantageous intermediate step for greater future gain, and thus why we must become ‘patient now and strategically impatient later.’”—Paul Tudor Jones II, Founder, Tudor Investment Corporation

“At last, a real book by a real risk-taking practitioner. The Dao of Capital mixes (rather, unifies) personal risk-taking with explanations of global phenomena. You cannot afford not to read this!”—Nassim Nicholas Taleb, Author of The Black Swan

“You really should read Spitznagel’s book because you will learn a lot whether you agree with everything he says or not.”—Jim Rogers, Author of Street Smarts—Adventures on the Road and in the Markets

“Wall Street gamblers who believe the Fed has their back need to read this book. Mark Spitznagel provides a brilliant demonstration that the gang of money printers currently resident in the Eccles Building have not repealed the laws of sound money nor have they rescinded the historical lessons on which they are based.”—David Stockman, Former U.S. Congressman, Budget Director under Ronald Reagan, and Author of The Great Deformation

“A timely, original, right-economic principles and history-based approach to investing. Drawing on impressive philosophical building blocks, The Dao of Capital illuminates the wellsprings of capital creation, innovation and economic progress. Dazzling!”—Steve Forbes, Chairman and Editor-in-Chief, Forbes Media

“This is a magnificent, scintillating book that I will read over and over again. Every page is eye-opening, with numerous areas for testing and profits in every chapter. Here’s an unqualified, total, heartfelt recommendation, which coming from me is a rarity, and possibly unique.”—Victor Niederhoffer, Author of The Education of a Speculator

“The Dao of Capital is an impressive work. Spitznagel’s approach is refreshing—scholarly without being tedious. What a broad look at economic history it provides!”—Byron Wien, Vice Chairman, Blackstone Advisory Partners LP

“Spitznagel has written an essential new book. Indeed, The Dao of Capital: Austrian Investing in a Distorted World might be one of the most important books of the year, or any year for that matter.”—Forbes