Closed-End Funds at a Discount is another Asset Class to Study.

A decent review of CEFs: CEFA_Brochure

I have found 15% discounts in relatively “cheap” markets can be attractive. Look at the history of premiums and discounts. http://www.cefa.com/FundSelector/fundcompare.fs?Search=jof

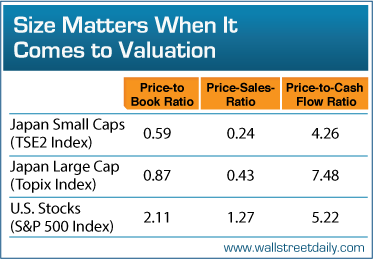

Of course, there is no hope for Japan, but now Japan’s Central Bank will be under pressure to join the reflation party. There are plenty of reasons why Japan’s stocks will languish–poor corporate governance, declining population, massive inefficiencies in the domestic market due to protectionism, etc.

Brandes Believes (research)

Japan A New Dawn in the Land of the Rising Sun

http://seekingalpha.com/article/671141-the-number-1-reason-that-i-m-still-bullish-on-japan

This is probably a very cheap value trap. You won’t get killed, but can you make your required return?

Perhaps…………

3 responses to “Primer on Closed-End Funds (JOF)”