Where are the Customer’s Yachts? (1940)

For one thing thing, customers have an unfortunate habit of asking about the financial future. Now if you do someone the signal honor of asking him a difficult question, you may be assured that you will get a detailed answer. Rarely will it be the most difficult of all answers–“I don’t know.”

—

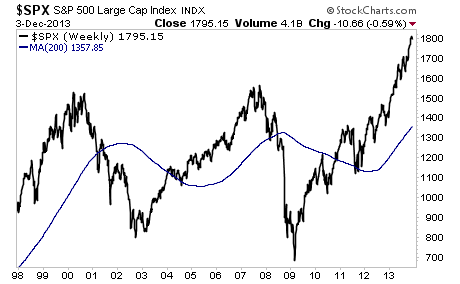

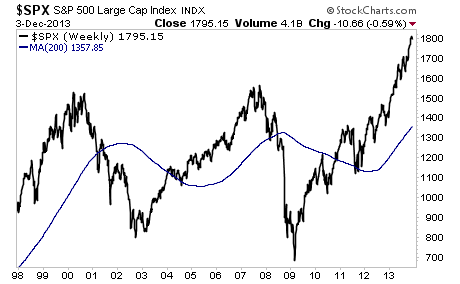

Today (Dec. 01, 2013) “As measured by the weekly Investors Intelligence survey of newsletter writers, the bullish boat is standing room only while the bear boat has the least amount of passengers dating back to the 1980’s. In today’s numbers, Bulls rose to 55.7 from 53.6 while the Bears fell to 14.4 from 15.5, an historic low in the history of this survey according to II. Combined with another record high in margin debt in October that puts its ratio to GDP at about 2.4%, near the high of 2.6% in July ’07 and 2.8% in March ’00 and it’s worth noting the historical limits in these two figures that we are pushing up against. That said, this says nothing about where markets go in the short term from here. This Fed hosted party can still have life left but I feel it’s always important to have perspective and these two data points should provide reason for an investing gut check in early 2014 in terms of how to be positioned.” www.hussmanfunds.com

“Being wrong on your own, as Keynes described so eloquently in Chapter 12 of the General Theory, is the cardinal crime of an investment manager. The management of career risk results in very destructive herding. Investors should be aware that the U.S. market is already badly overpriced – indeed, we believe it is priced to deliver negative real returns over seven years [GMO estimates fair value for the S&P 500 at 1100]. Be prudent and you’ll probably forego gains. Be risky and you’ll probably make some more money, but you may be bushwhacked and if you are, your excuses will look thin. My personal view is that the path of least resistance for the market will be up.”

– Value investor Jeremy Grantham, GMO, November 18, 2013

“I cannot look at myself in the mirror; everything I have believed in I have had to reject. This environment only makes sense through the prism of trends. You have got to be in things that are trending. Crashing is the least of my concerns. I can deal with that, but I cannot risk my reputation because we are in this virtuous loop where the market is trending. I may be providing a public utility here, as the last bear to capitulate.”

– Hedge fund manager Hugh Hendry, Eclectica, November 22, 2013

“I am out of justification to fight the uptrend. Up until now, I have had what I thought was compelling evidence to believe in the bearish case, but it has now been revealed to have been insufficient for the task. I am without ammunition to bet on the bears. I don’t like it, because I see the market as overly dependent upon the Fed’s largesse for its upward continuation. I see this as a bubble, but a bubble that is continuing higher even though it should not. I plan to ride the bubble for a while, and will hope to be able to succeed in reading the right [exit] signs.”

– Market technician Tom McClellan, November 26, 2013

In a classic case of not only locking the barn door after the horse is loose, but removing its best opportunity to return home, we’re seeing a capitulation by investment managers across every discipline, from technical, to value-conscious, to global macro. Historically extreme overvalued, overbought, overbullish conditions were in place even ten months ago, and my impression is that every further extension worsens the payback will inexorably follow.

Lesson: Don’t listen to gurus or “experts”. They are more apt to be wrong. Follow your own common-sense thinking. Right now RISKS ARE HIGH. BE CAREFUL.

Lessons in Entrepreneurship (Gary Hoover) http://www.today.mccombs.utexas.edu/gary-hoover-video-library/

My break

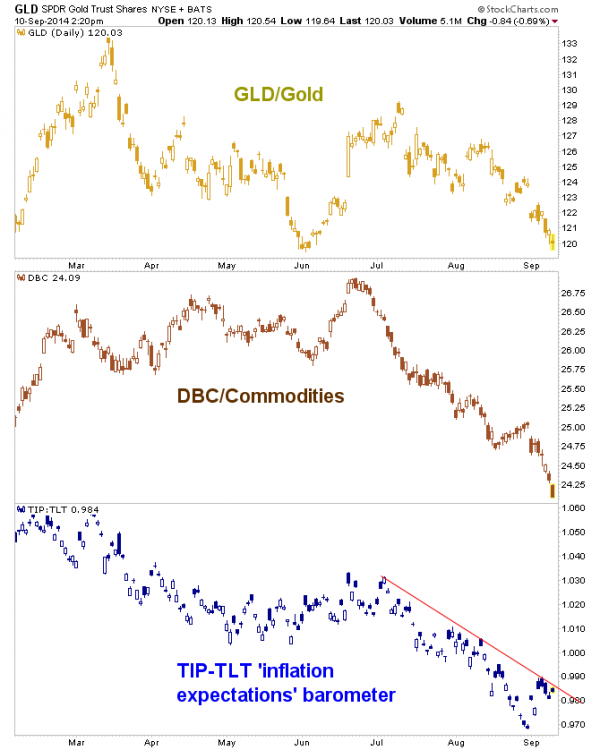

I have been so busy buying gold and miners that I haven’t had much chance to post, but I do plan to resume once things settle down (I hope).

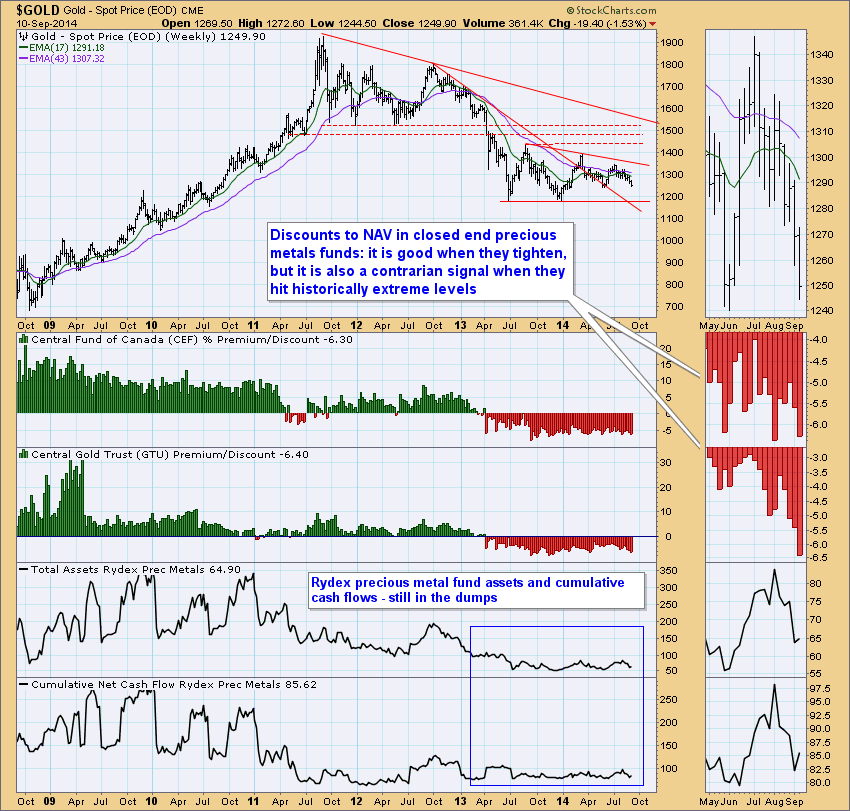

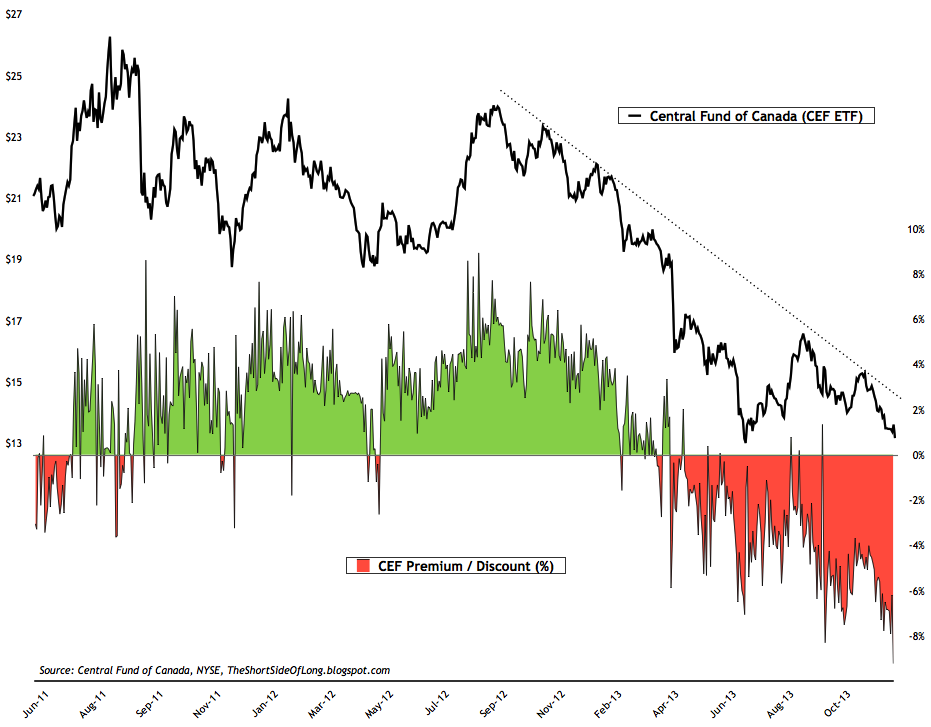

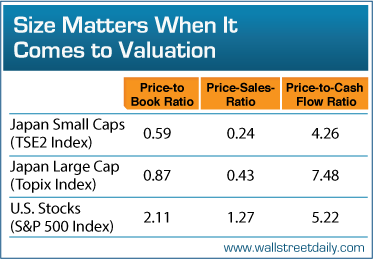

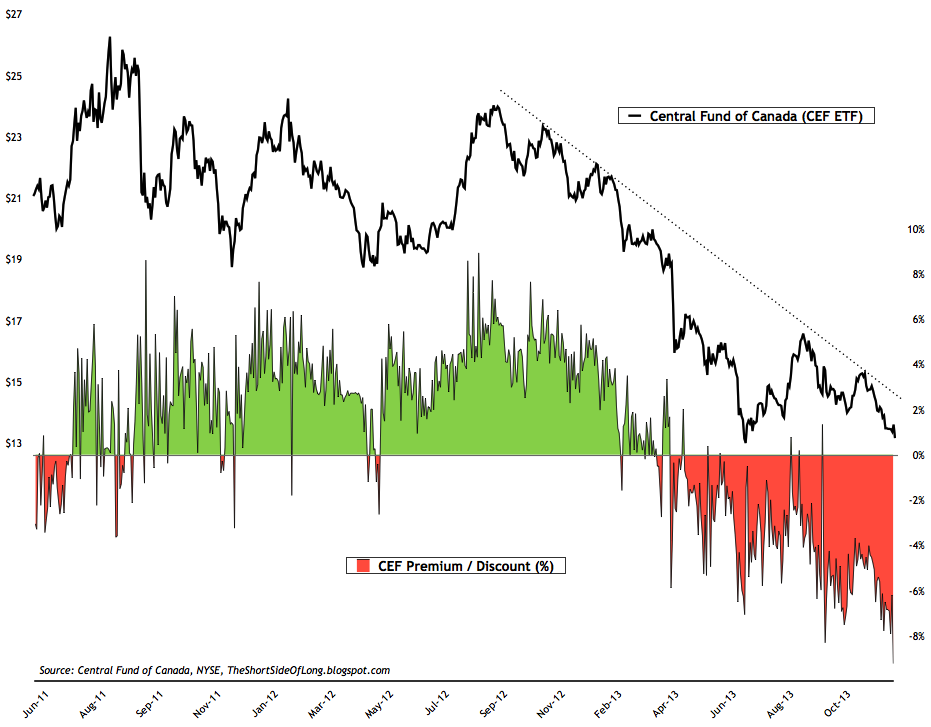

I like this: buying bullion (gold/silver) at a 10% discount. Last time was 2001.

While being wary of this (in general). Go here: www.hussmanfunds.com

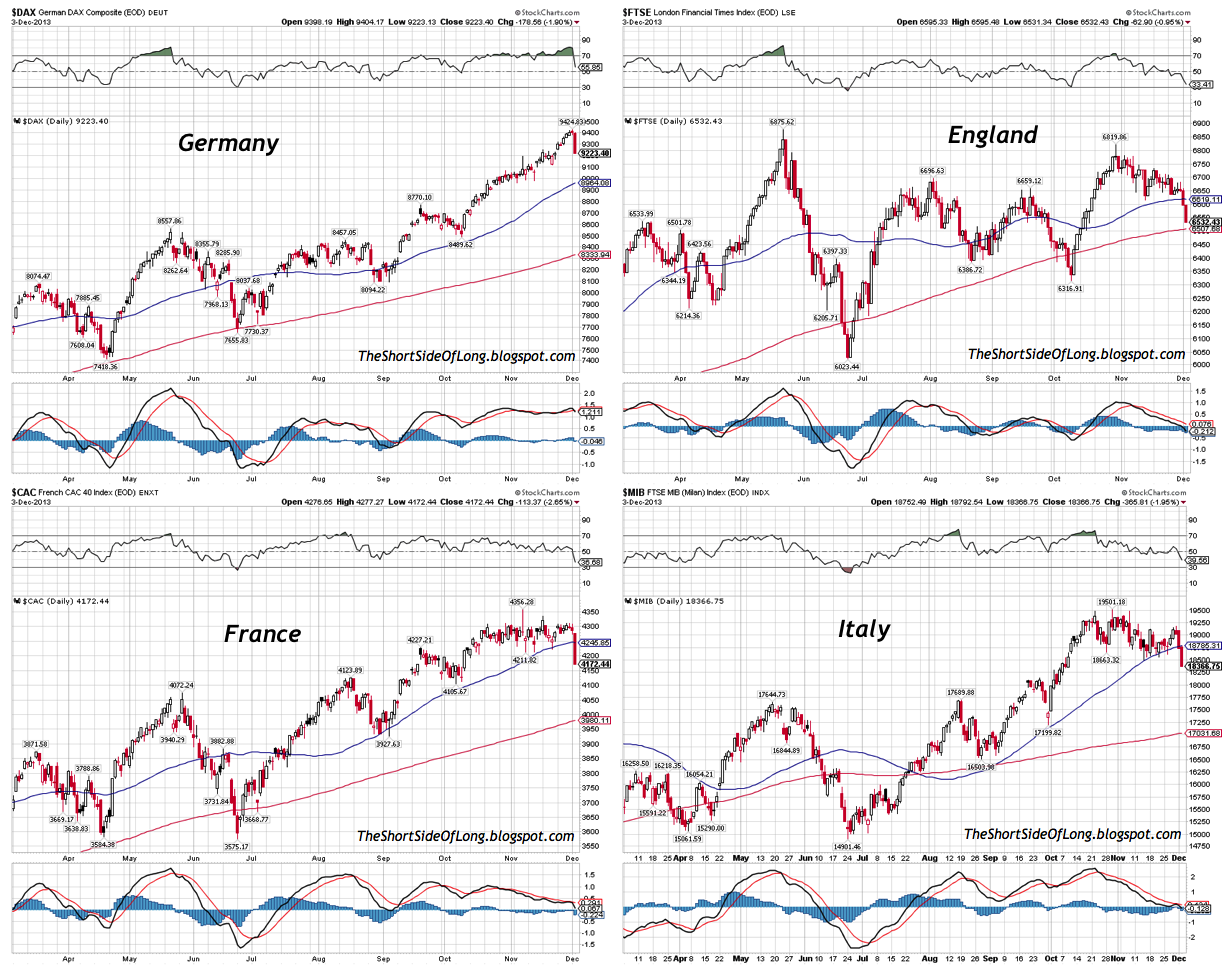

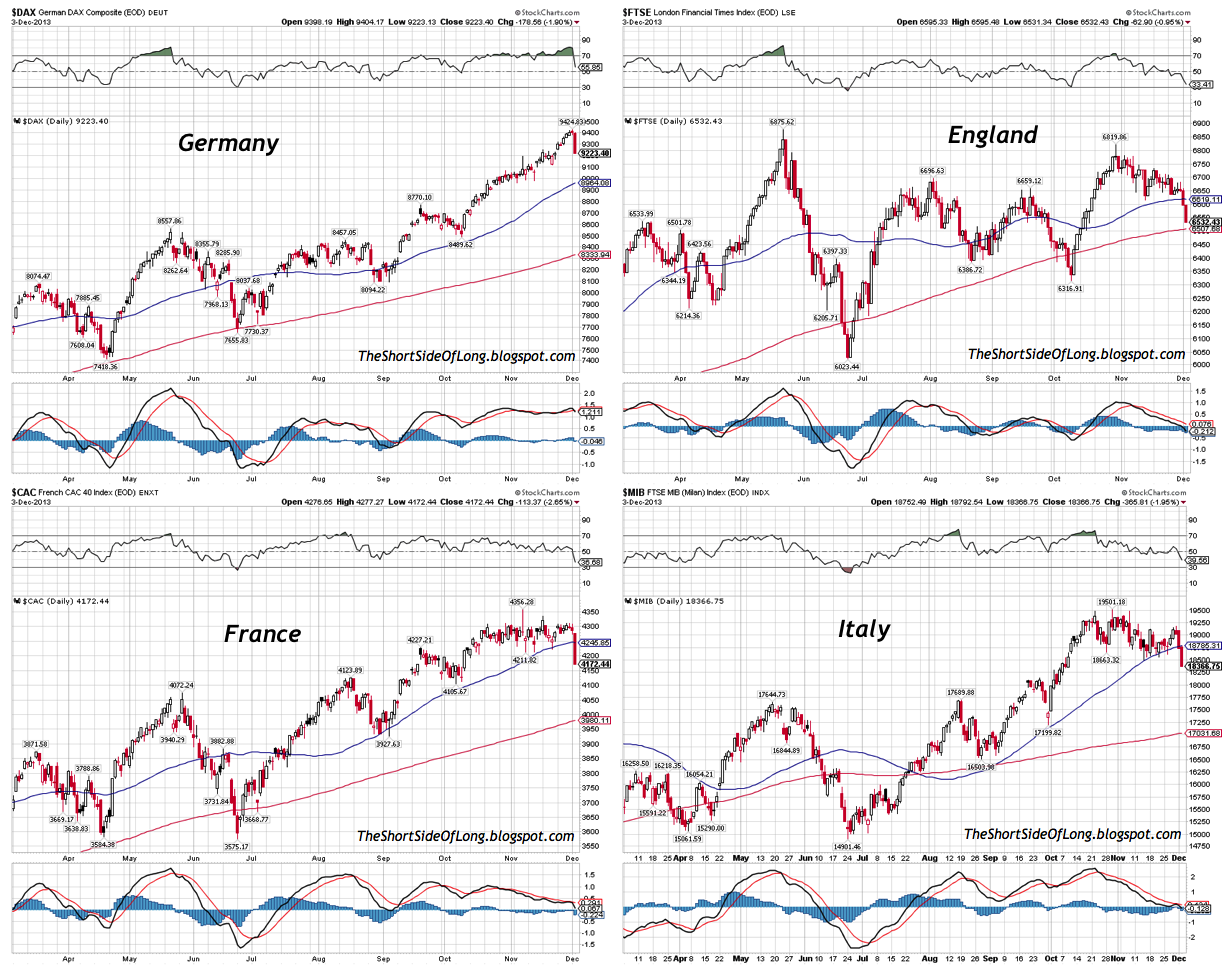

Note the early warnings signs—not all is well in Europe.

Jean-Marie Eveillard: “I just returned from Europe, where I was mostly in France, and the mood was not good there because the economy is not doing well. And since the economy is not doing well, there are political developments on the far-right and on the far-left….

“Some people, and I cannot blame them, believe that the establishment has failed them in the sense that the economy continues to do poorly.”

Eric King: “Jean-Marie, it sounds like there is a polarization happening in Europe where people are jumping on both sides and the middle-ground is being lost.”

Eveillard: “Yes, and usually it’s the middle-ground that governs. That has been the case in France where both the socialist party, which is currently in power, and the center-right party, both of them have historically been close to the center. That’s not the case any more.

They both have their own extreme wings, but it has been the center that has always governed. Now people believe that the ‘center’ has governed poorly enough that you have more people who are being seduced by the far-right, and the far-left.”

Eric King: “Does that worry you?”

Eveillard: “Yes, but, again, it’s a result of the establishment and it’s happening in the US as well. You have the center disappearing in the US, which means that both extremes on the left and the right will keep gaining additional audiences.”

Eric King: “This trend obviously has you worried.”

Eveillard: “It worries me particularly because in the US, France, and elsewhere, it’s Neo-Keynesian policies that are being followed because it’s the fashion of the day. Even though the Neo-Keynesians didn’t see the financial crisis coming, nevertheless they are still in power in academia, the political world, and in the world of corporate economists.

I ask myself, ‘If Keynes were alive today, would he be a Neo-Keynesian?’ I don’t think so. But the Neo-Keynesians believe, as Keynes did, that every now and then private sector demand is weak and has to be supplemented by public sector demand.

What we’ve had in the US over the past 5 years , both from a monetary and from a fiscal point of view, is the most stimulative economic policies ever — completely unprecedented. The printing of money, QE, etc, the budget deficit, the tremendous increase in government debt, and yet the economic recovery continues to be weak.

Now, the stock market is up sharply because some of the excess liquidity being created by the Fed is going into stocks. Some of it has also gone into things such as the real estate and fine art markets. But the money goes particularly into the stock market.

And the stock market is strong not just because of the excess liquidity, but because the vast majority of investors seem to believe, they are wrong, but they believe that, ‘Yes, we had a financial crisis 5 years ago, but that’s all over. We are going back to normal, and within a few months the economy in the US will grow at more than an annual rate of 2%.’

It hasn’t happened yet. How come it hasn’t happened yet? Nobody seems to be asking the question. It hasn’t happened yet because the medicine being prescribed by the Neo-Keynesians is not working. Incidentally, I don’t think anything will work because there no steps which can be taken by the politicians that would, almost overnight, result in a non-inflationary economy growing at 3% or 4% a year.

The reality is the steps which have been taken over the past 5 years will cause tremendous chaos and problems in the future, but we haven’t seen that yet.”

Eveillard also spoke about gold: “I believe that if I’m right, and the Neo-Keynesian medicine continues not to work, although they can continue with their QE, even at the Fed they know that quantitative easing cannot go on forever. So at some point something will have to give. That’s the point where investors will change their attitudes and move to gold. But it isn’t happening right now in the West because investors continue to believe the Neo-Keynesian medicine will succeed any day now.”

Eric King: “If there is this move you just described back to gold in the West, Jean-Marie, do you see new all-time highs in gold?”

Eveillard: “Yes, because gold will become the substitute currency. People will say, ‘I don’t want the yen, dollar, or the euro because they are all engaged in a race to the bottom.’ Yes, then gold will become the substitute currency. Gold will be money again. In a sense it never stopped, but 40 years ago the politicians decided that we were going to operate on the basis of a pure paper money system. But I can assure you that the history of pure paper money systems is not inspiring.” (www.kingworldnews.com)

CSInvesting: I don’t agree with everything said. Will gold become a substitute “currency?” Perhaps, more people will understand that Gold is the best money in the world (despite the raving over bitcoin or “token” money).

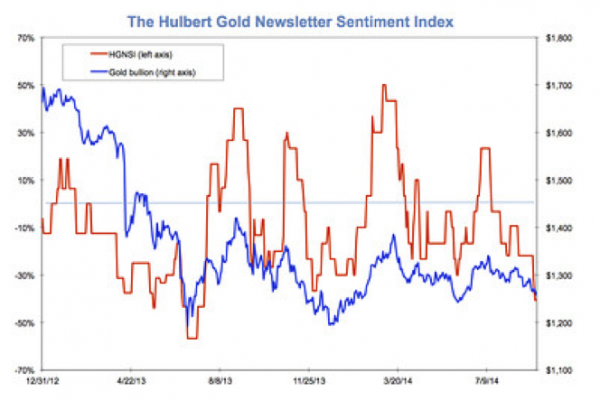

Selling today in the pits-gold and silver

Selling today in the pits-gold and silver