RISK: My grandfather invested his fortune in Russian bonds. This was before the Russian Revolution. At the time, he was told he couldn’t lose money. Because the bonds were pegged to gold. So there was no currency risk. And these were bonds of Russian railways, which were the most solid businesses in the world, and they were guaranteed by the Tsarist government. No currency risk. No default risk. No business risk. They were as close to risk-free as you can get. But when the Bolsheviks took over they seized the railways. They stopped paying the bonds. And they executed the Tsar and his family.”

It didn’t make any difference if the bonds were pegged to gold or not. They were worthless. It just reminds you of how things can go very bad in a way you don’t expect. Who would have imagined a communist revolution in Russia? (Could a Dictator take over the U.S.A.?) www.acting-man.com

The 1975 Buffett memo that saved WaPo’s pension

Found here:Warren-Buffett-Katharine-Graham-Letter on Pensions 1975

The letter alone is quite amazing. In it, Buffett identifies the pension problems that others would key in on only a decade or so later. But he also lays out perhaps for the first time — Buffett was 45 when he wrote it and years away from attaining the investment fame he has today — his philosophy behind what it takes to be a successful investor. His main pieces of advice: Think like an owner, look for a discount, and be patient. Full article: http://finance.fortune.cnn.com/2013/08/15/warren-buffett-katharine-graham-letter/?iid=EL

Gold and Gold Stock Capitulation (GLD represents gold while GDX represents an index of major gold producers and GDXJ represents junior gold miners). Note the date of the low prices in End June/Early July. We last mentioned capitulation here: http://wp.me/p2OaYY-25W

Paulson’s Investors help form a bottom in Gold: http://www.acting-man.com/?p=25354#more-25354 (a suggested read)

Paulson & Co. – a Victim of Redemptions?

Today news hit that John Paulson has finally sold a big chunk of his position in GLD. It is not terribly surprising that this happened in the quarter when gold made its low. After Paulson sold his holdings in bank stocks, the group soared, with many of the stocks he had sold at the lows rising by 200% and more thereafter. However, this time it has probably less to do with his bad timing, but very likely more with the bad timing of investors in his funds. As the Bloomberg article mentions:

“Paulson & Co., the largest investor in the SPDR Gold Trust, the biggest exchange-traded product for the metal, pared its stake to 10.2 million shares in the three months ended June 30 from 21.8 million at the end of the first quarter, according to a government filing yesterday. The New York-based firm, which manages $18 billion, cut its ownership for the first time since 2011 “due to a reduced need for hedging,”according to an e-mailed response to questions.”

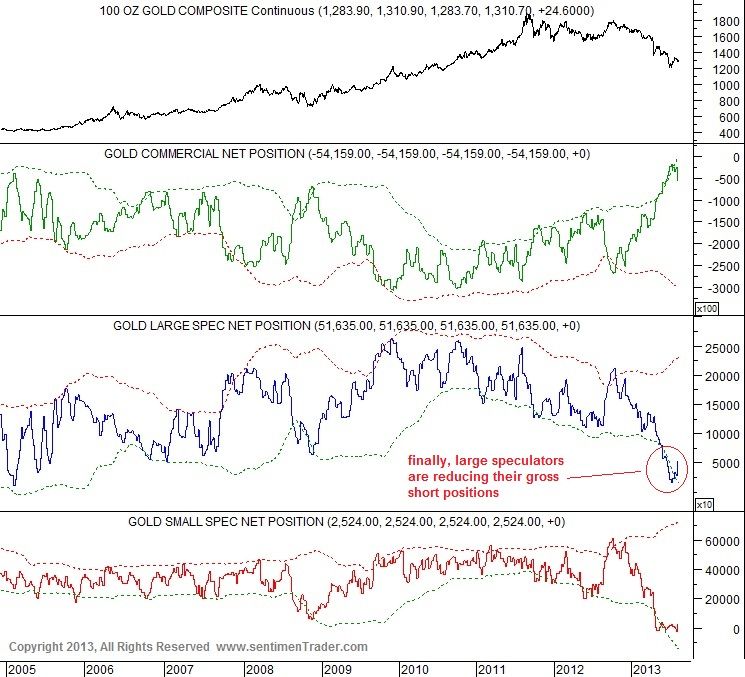

CSInvesting Editor: As mentioned before, I have been unable to find attractively priced franchises so in the past four months I have bought “quality” miners and related companies like RGLD, SLW, FNV, AUY, AEM, NGD, EGO, etc. I place the word, QUALITY in quotes because those companies are not franchises and each struggles with the cyclical risks of their product–metals. So beware, I am biased to seeking out information that bolsters my bullish outlook like Commercial Hedgers having a low short position:

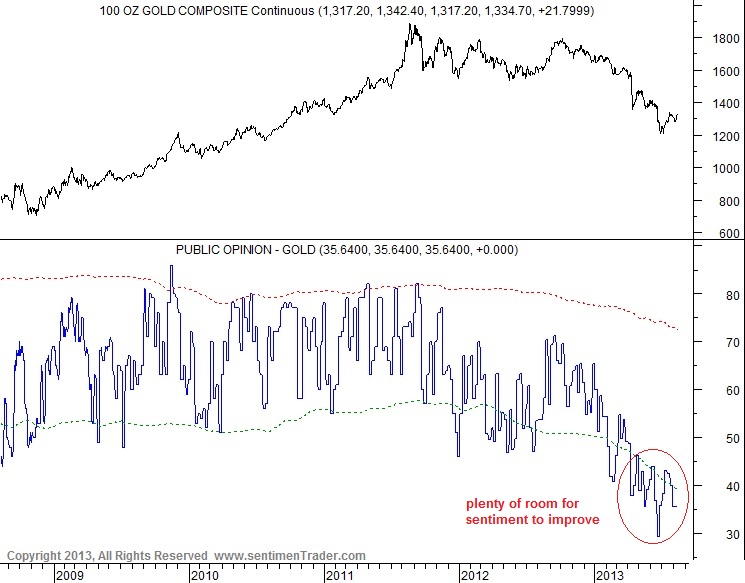

and extremely negative speculative sentiment–a contrary signal.

And….

- A very seasoned mining executive I’ve known for years (www.grandich.com) sent me the following email, along with the latest World Gold Council report. He made a very keen observation is his email. Here it is:

“As an aside FYI, attached is the WGC’s first ½ 2013 report – skip to page 14 and look at the highlight yellow I put in. Of ~2000 supply and demand tonnes , ~578 tonnes are sold by ETF’s. If ETF’s sales were zero there would be a 29% supply shortfall. Total mine production is 1377 tonnes, ETF’s sold 42% of all mine production first ½ this year. My math is that if the ETF’s get cleaned up and go to 0 sales, we are looking at quite a gold supply problem. Old fashioned thinking I know, but alas, I am just a simple guy.”

We have a very serious mine production shortfall that has been masked during the gold raids and sell-offs. I think it will get exposed going forward.

—

I need evidence against my thesis, so please send any negative information against owning precious metals miners and gold. I am reading:

Next week, I will post a valuation on Royal Gold (RGLD) so get a head start and visit the websites of Franco-Nevada (FNV), Silver Wheaton (SLW) and Sandstrom Gold (SAND) to learn about this business.

HAVE A GREAT WEEKEND!

10 responses to “Buffett Investment Lesson; Gold Capitulation Part 2”