An interesting blog:http://alephblog.com/ The writer seems to approach investing through the different lens of actuarial risk–another approach to help you broaden your perspective on investing.

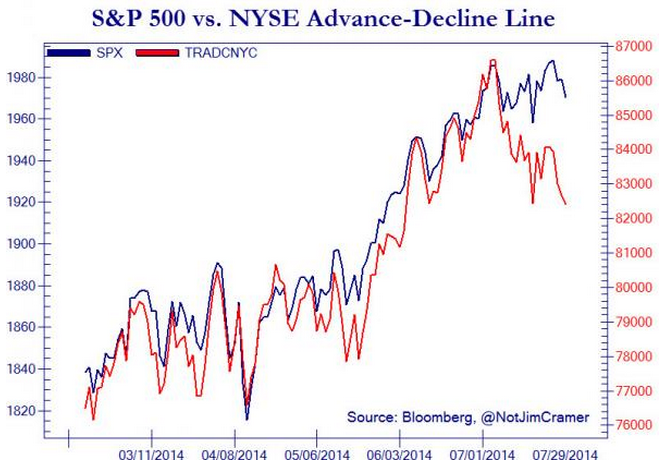

Classic the fundamentals of market-tops

Advice to students of investing (that’s us!)

But if I had control over what Finance students were taught, I would do the following:

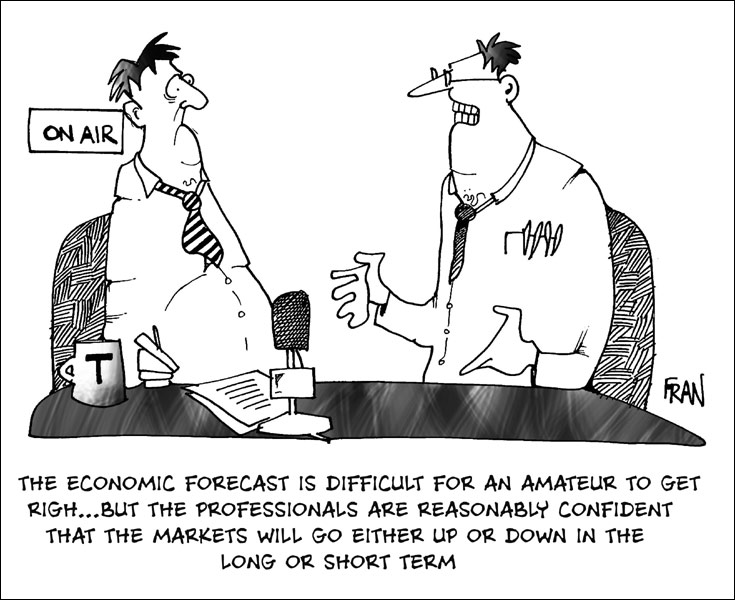

1) I would reduce the math content for finance students and increase the qualitative understanding of markets. No more MPT.

2) I would increase the level of understanding on how to relate with people, because that makes a big difference in negotiating trades.

3) I would want them to work in a simple business, like a hot-dog cart, or mowing lawns, so that they could begin to get an idea of how tough it is to earn a profit. My best boss in my life grew up watching his parents’ delicatessen, and it shaped his view of how to make a profit.

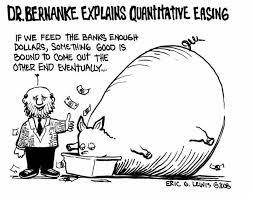

4) I would revise the concept of the cost of capital to make it credit-centric. All the efforts to calculate the cost of equity capital from equity market correlations are bogus. They don’t make any economic sense. In most cases, the cost of equity should not exceed the yield on an average CCC bond.

5) I would tell them that changes in inflation and real GDP don’t have as large of an impact on corporate profits as is commonly thought, both positively and negatively. I would tell them to focus on the stock, and drop the complex model. Few in the investment business work off a complex model, and if you need one, you can buy Value Line, which I like, which tries to use a single macroeconomic model for 1700 popular stocks.

—

Mostly, I would teach them to think broadly, and realize the most of the complex investment math is easy to get wrong.

The article:

What I Would & Would Not Teach College Students About Finance

Have a Good Weekend!

HY credit is where the fun may begin. I would be terrified to buy the dip–unless I knew the company cold.

One response to “Another Investing Blog”