…When men live by trade–with reason not force, as their final arbiter–it is the best product that wins, the best performance, the man of best judgment and high ability and the degree of a man’s productiveness is the degree of his reward. (Atlas Shrugged)

Seth Klarman

Below are links to Seth Klarman’s investor letters and appearances. I would try to study his philosophy, attitude, and approach to investing–see if you can integrate some of his approach to YOUR OWN methods.

New material from a reader (generous!) KLARMAN Response to Lowensteins Rational Investors found here:Graham Dodd Revisted by Lowenstein

Seth-Klarmanm-Interview-Financial-Analyst-Journal

klarman-value-investors-different

Klarman_on_running_a_fund_interview

Seth_Klarman-Why_Most_Investment_Managers_Have_It_Backwards

A BLOG DEVOTED TO Klarman http://www.rbcpa.com/klarman.html

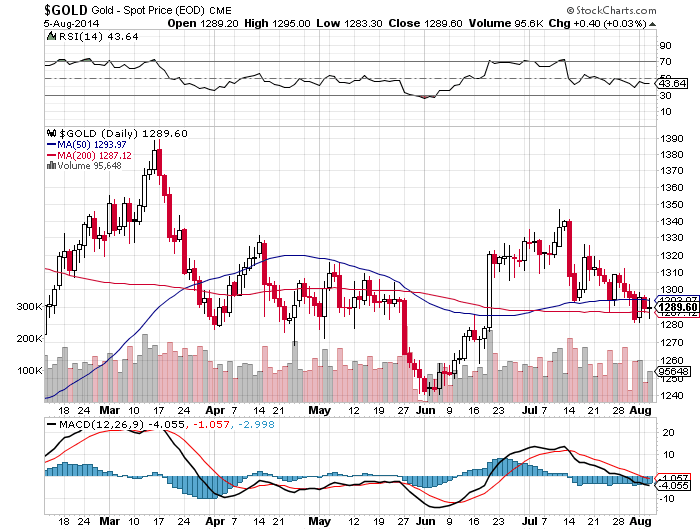

Yamana Valuation

Upon returning from vacation, I have put off updating my valuation of Yamana. When there are fish, you must fish. I promise to have it posted by this weekend. I do recommend anyone who wants to hear a good management team explain their strategy for managing assets to listen to Yamana’s second quarter’s conference call:

http://www.gowebcasting.com/events/yamana-gold-inc/2014/07/31/second-quarter-financial-results/play

Yamana Gold Inc_ Q2 2014 MDA Final (SEDAR)_v001_t1ii3h

Presentation: Q2 2014 – Conference Call Final

—

Asking a girl for her phone number

Pingback: Seth Klarman | Seneca Drive

Pingback: Esco Electronics: An Exercise in Securities Valuation With Seth Klarman | Hurricane Capital

Pingback: jerseyfhlfkl